Bulls Need Decisive Breakout

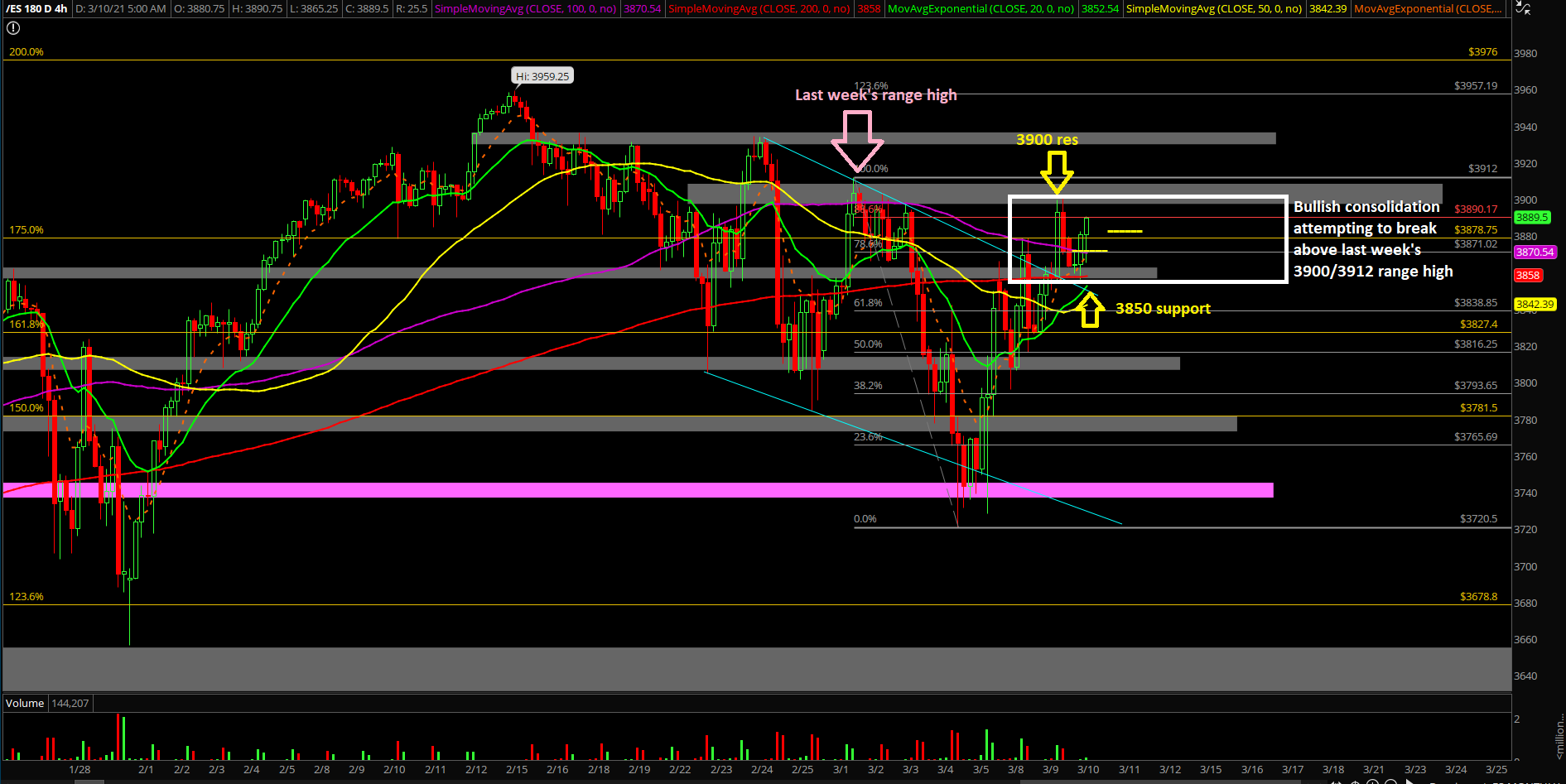

Tuesday’s session was another range day within the inside week context as price action is still figuring out what to do. First attempt at the weekly range high resistance was rejected yesterday at 3900 on the Emini S&P 500 (ES) per typical standards, so the second attempt today could be the real deal. The structure remains higher lows and higher highs into midweek thus far, so there are indications of gummy bears across the board on ES and NQ.

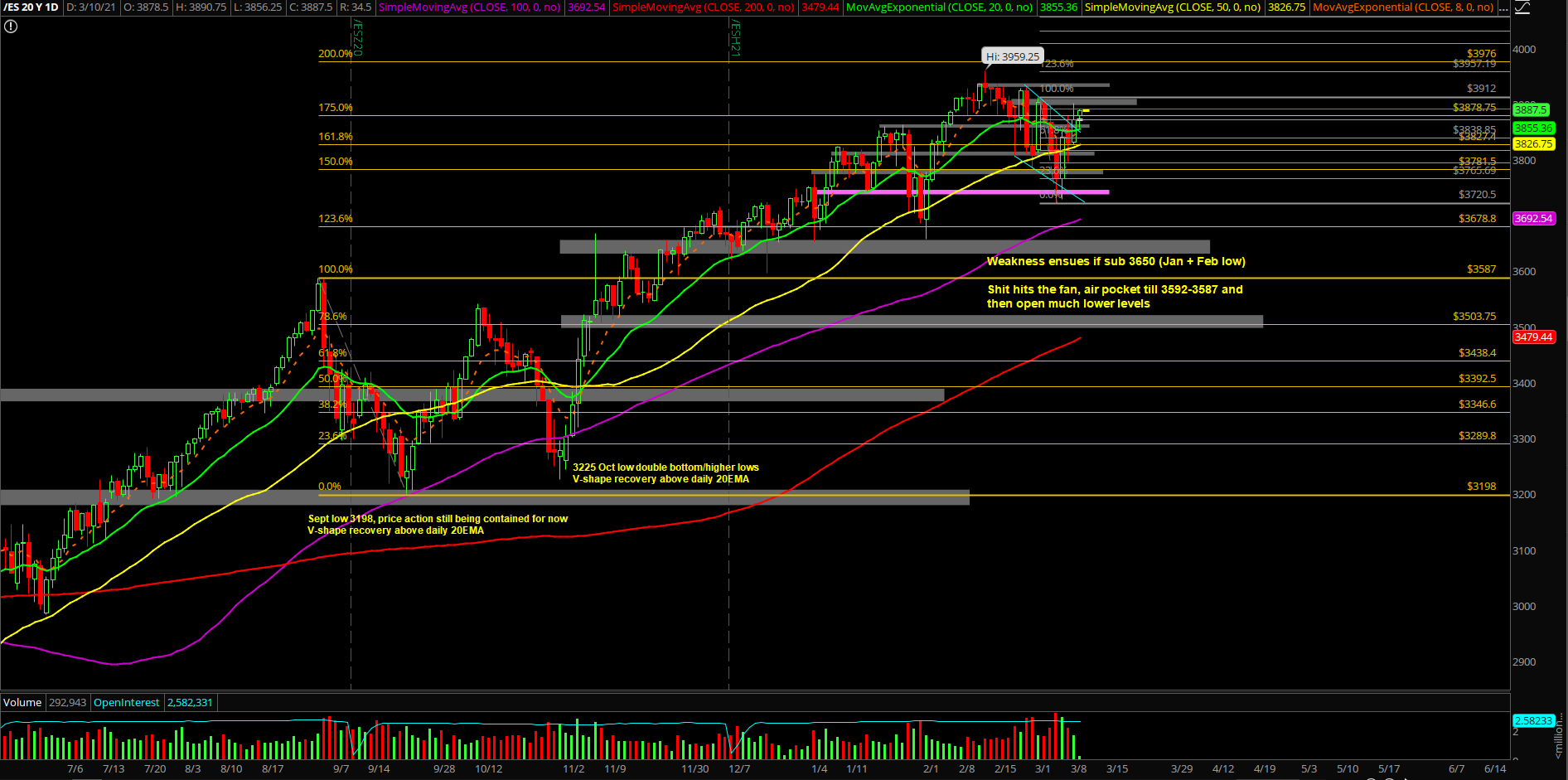

The main takeaway is the ongoing feedback loop squeeze setup from last week’s 3720 vs 3728 low. If you recall, bulls made a temporary low and they are building higher lows and higher highs in order to confirm that it was the low so the market could get back towards the ATHs setup again like a few weeks ago.

What’s next?

Tuesday closed at 3871.75 as the high level consolidation continues waiting for another attempt at the prior week’s resistance zone. Today is an important day to judge momentum because NQ stabilized yesterday with its +3.5% massive upside day, and bulls would need to demonstrate a decisive follow through to gobble up all the gummy bears. Otherwise, it’s still an inside week shaking both sides.

A summary of our game plan:

- Immediate key levels today are 3850 support and 3900 resistance.

- Bears were not able to follow through to the downside last night indicating gummy bears (yesterday’s white/red line projections) so must be aware of continued grind up pressure after RTH open.

- Bulls must break above 3900 to get outside this immediate box range with HLs+HHs.

- Bears must break below 3850 to get outside this immediate box range and LHs+LLs.

- NQ made a huge decisive temporary bottom yesterday; bulls need follow through above 12800 to begin confirming more of a solid bottom. Traders should keep an eye on NQ as it backtests the resistance confluence at 13000~.

- Daily timeframe remains unchanged/neutral as price action chopping around daily 8/20EMA, temporary low was confirmed last Friday with the 3720 vs 3728 higher lows into a feedback loop squeeze back into 3850 resistance. Then, price action held the 50% retracement during Sunday night and continued higher into Tuesday with continuous higher lows and higher highs on the lower timeframes.

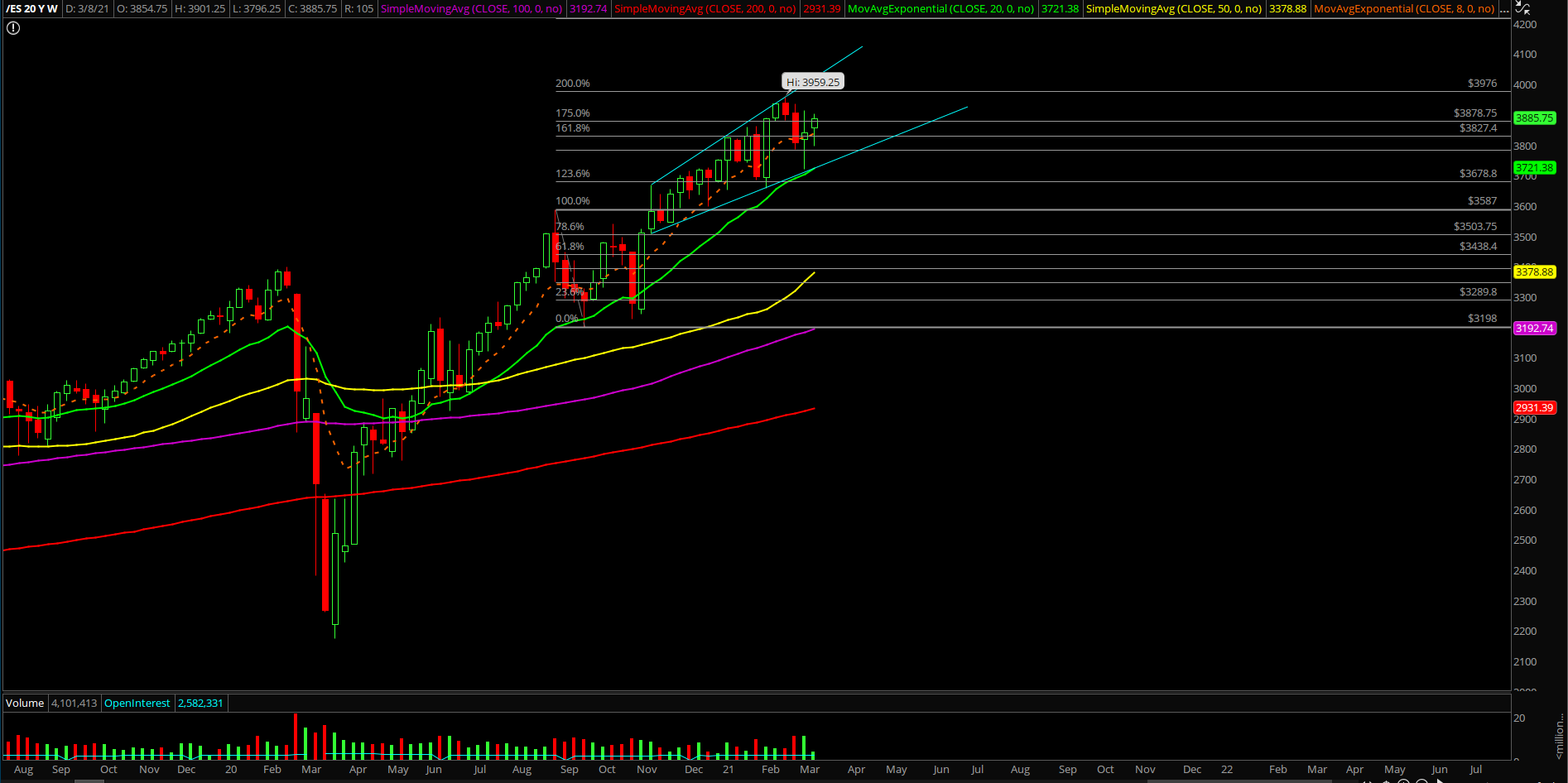

- Weekly timeframe still trending within an established bull trend setting by holding the weekly 20EMA and grinding higher for the past few months. Be aware of an inside week range 3912-3720, meaning that this week is all about rangebound trading strategies vs the extremes until price proves otherwise.

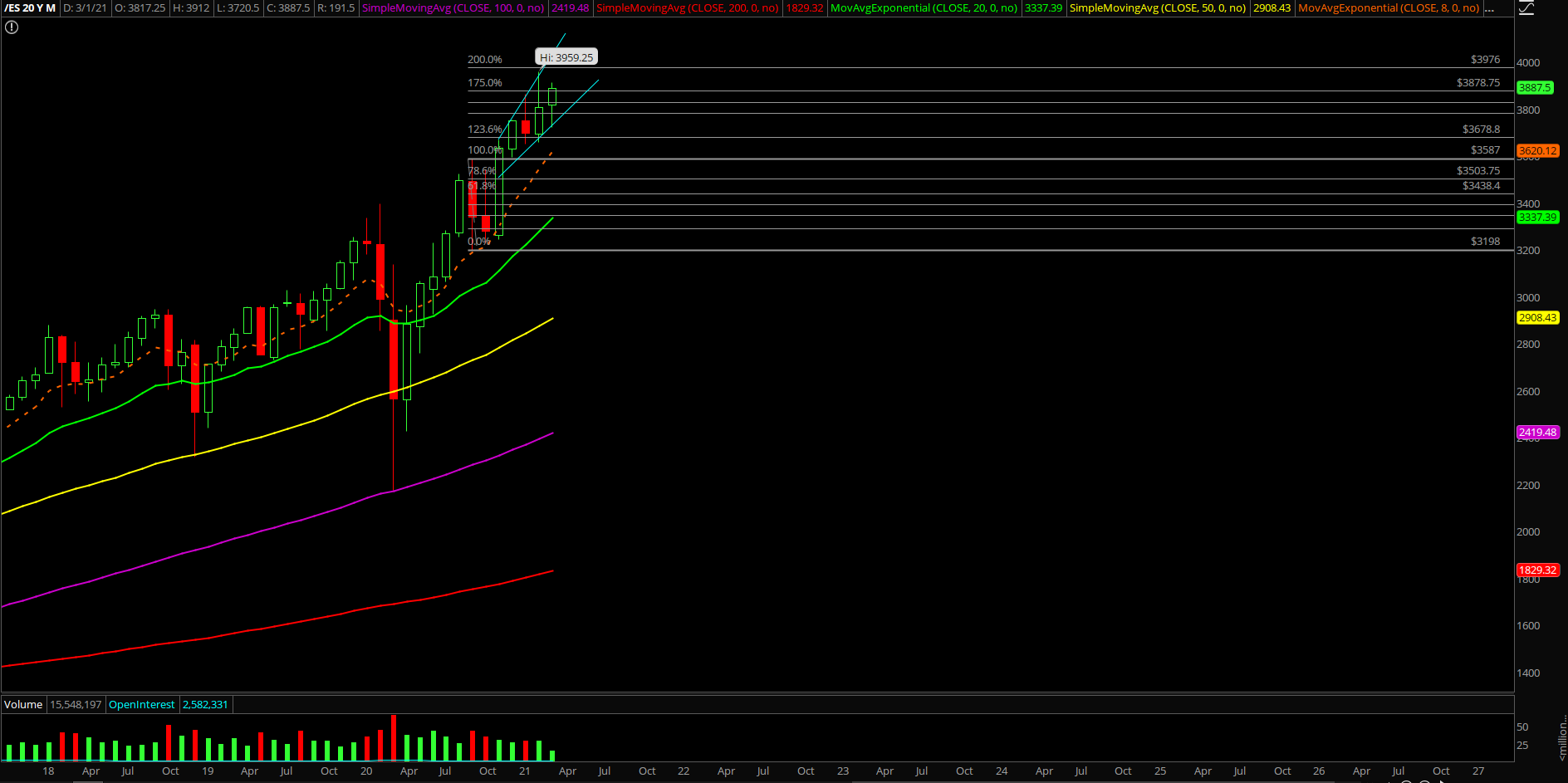

- Monthly timeframe remains very bullish given the past couple months stabilizing with 3650 lows and attempting higher highs. Any dip is buyable opportunity for longer term if 3650 area holds.

- Our mission this week is to figure out whether 3720 low from last week was the low already for this month or we need to redo the overall bottoming process again.

- Bulls need at least 1 daily close above 3900 followed by last week’s high of 3912 to open up 3976/4000+ again based on trend.

- Bears need to get back at least below 3780 followed by a breakdown of 3720.