Bulls Looking To Close Month at Dead Highs After 2-Day Breather

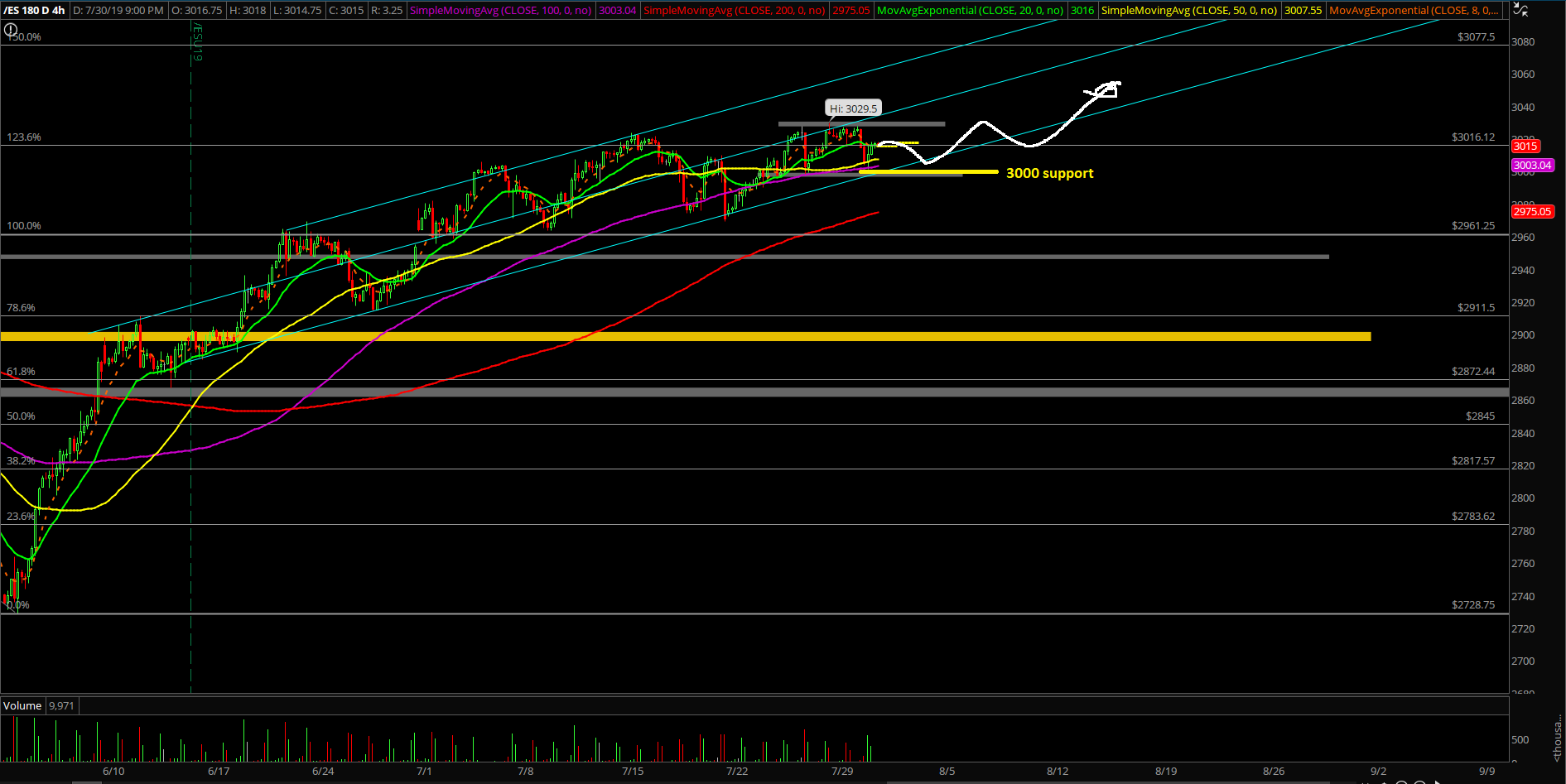

Tuesday was a textbook range day that went according to our game plan. It was essentially a carbon copy of Monday’s structure with slightly different levels. The market gifted us the dip-buying setup by backtesting against the trending support levels 3006/3006 at the regular trading hours (RTH) open.

As demonstrated in real-time within our ES trading room, we obviously loaded up our long positions at the lows and sold at the highs again. We were done by 10AM, so we didn’t overstay our welcome. This way we escaped the likely afternoon "shakefest" as it’s just a waste of time ahead of month end closing and Fed day. You never want to overstay your welcome on a pre-determined range day when you already nail the highest probability setup for the day. It’s better to prepare the mentality for Wednesday’s month-end/FOMC wrap up.

The main takeaway from Tuesday’s session is that it’s finally show time as the bull train has consolidated for two days and took a little breather and shook out some weak hands. This also means that the bulls will likely attempt the month-end closing at the dead highs again based on the structure and the stats. Let’s see if the market gifts us another easy money setup tomorrow morning or finally forces us to adapt with a sneaky bear attack.

What’s next?

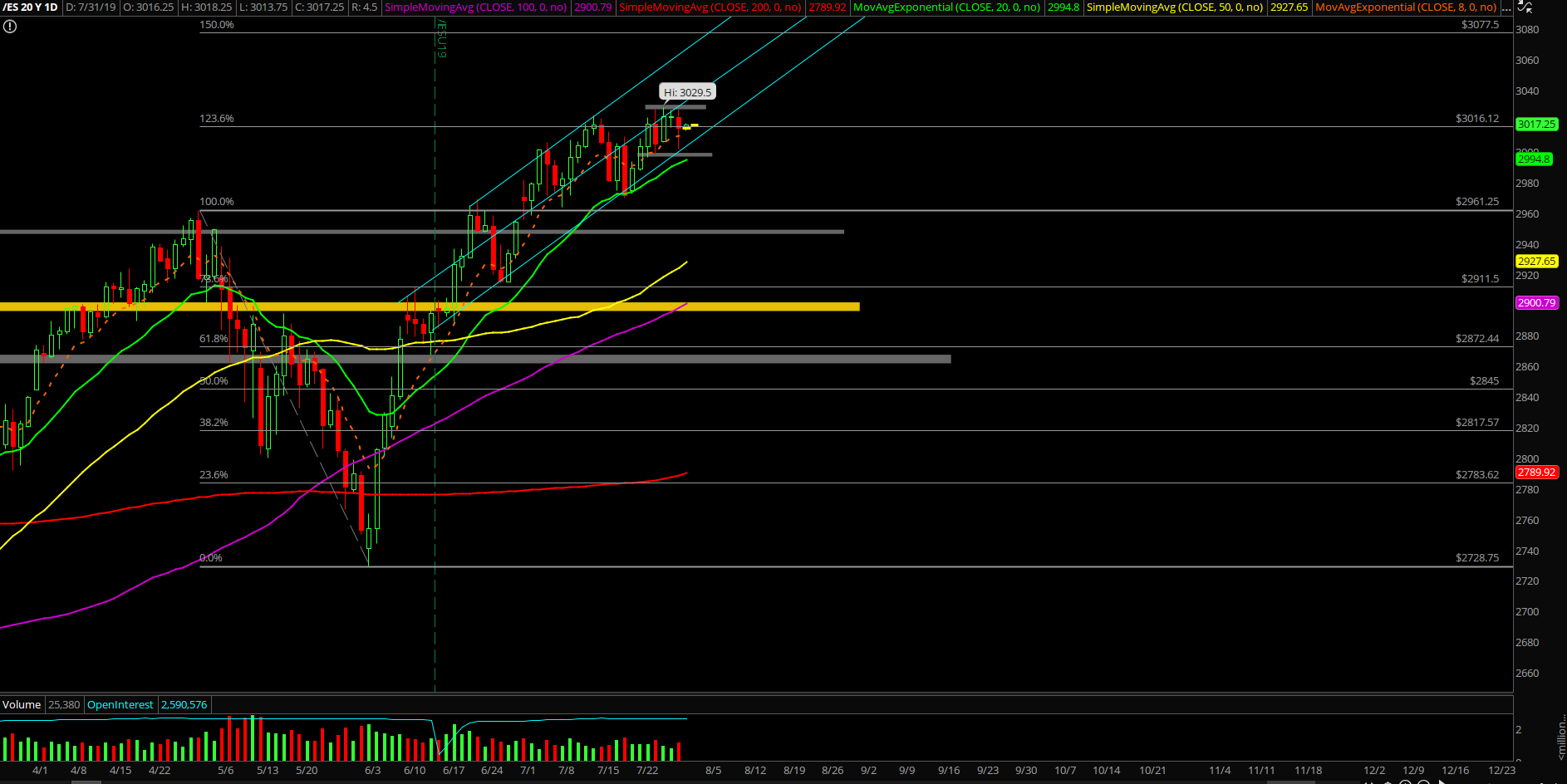

The Emini S&P 500 (ES) closed at 3015.25 on Tuesday with a bottom wick candlestick signifying the 3001.50 sticksave. If you recall from the previous KISS report or the ES trading room premarket game plan: When price action is above 3006/3000, any dip is an opportunity and not a risk. We are buying all dips until it stops printing us money and price action tells us to adapt.

The market managed to once again sticksave at our key intraday support levels so nothing of significance has changed in terms of our overall perspective. Given the two days worth of range day consolidations, we’ve added a couple main points below to guide traders heading into month end/rest of week.

Current parameters/bias:

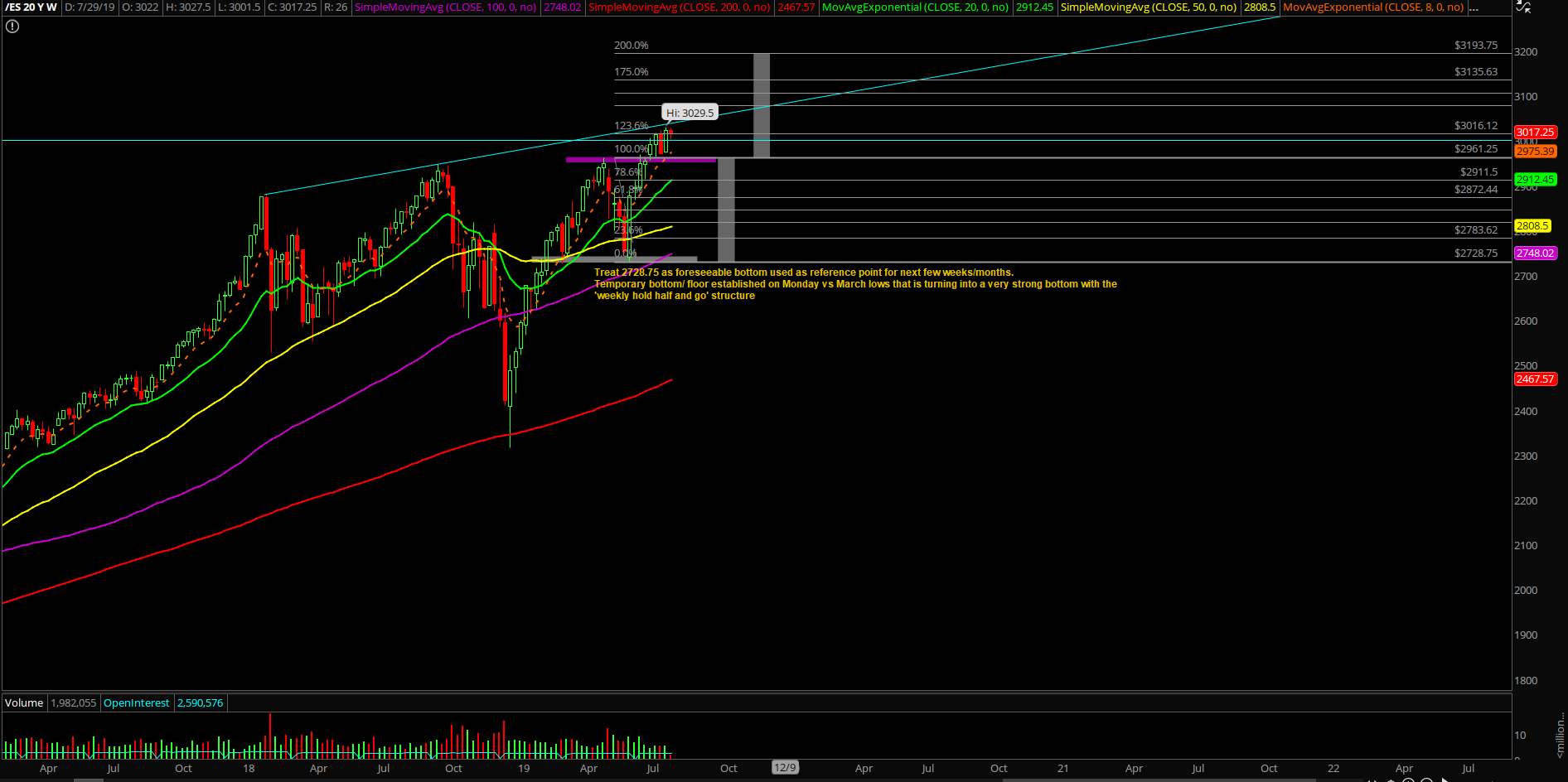

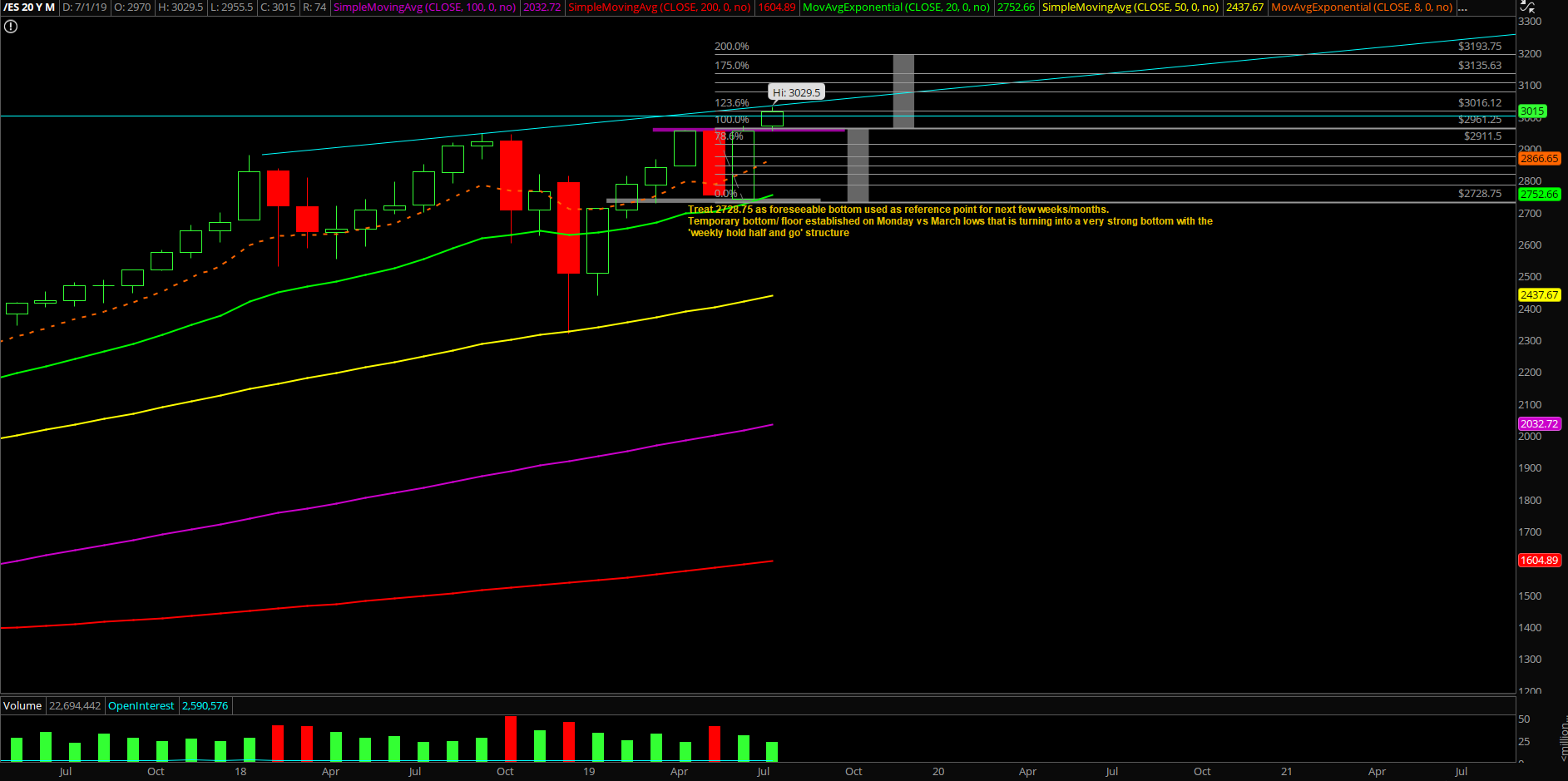

- The bulls are obviously trying to wrap it up at the dead highs tomorrow for the month end closing print, they’ve spent so much time grinding it up for the past few weeks so it’s déjà vu again. It’s been a decent immediate upside continuation from the June sticksave bottom.

- When above 3000, the bull train is looking to continue towards as 3048-3055 next target. It’s been two days worth of consolidation so let’s see if we get the acceleration upside tomorrow with the help of the FOMC timing catalyst alongside with month end dead highs closing setup.

- When below 3000, look for daily 20EMA as the next key trending support for another reaction/sticksave opportunity.

- When price action is above 3006/3000, any dip is an opportunity and not a risk. We are buying all dips until it stops printing us money and price action tells us to adapt.

- Continue to nail the higher lows/LOD setup as that’s what we do best in this trending market environment.

- Another ongoing feedback loop squeeze from last week’s daily 20EMA sticksave.

- Ongoing "sh*t hits the fan" level located at 2955. This is the first warning sign of a weekly/monthly bear engulf that we must be preparing ourselves if price action ever gets a repeat of the Oct 2018 mean reversion structure or similar.