Bulls Looking For Break Through High-Level Consolidation

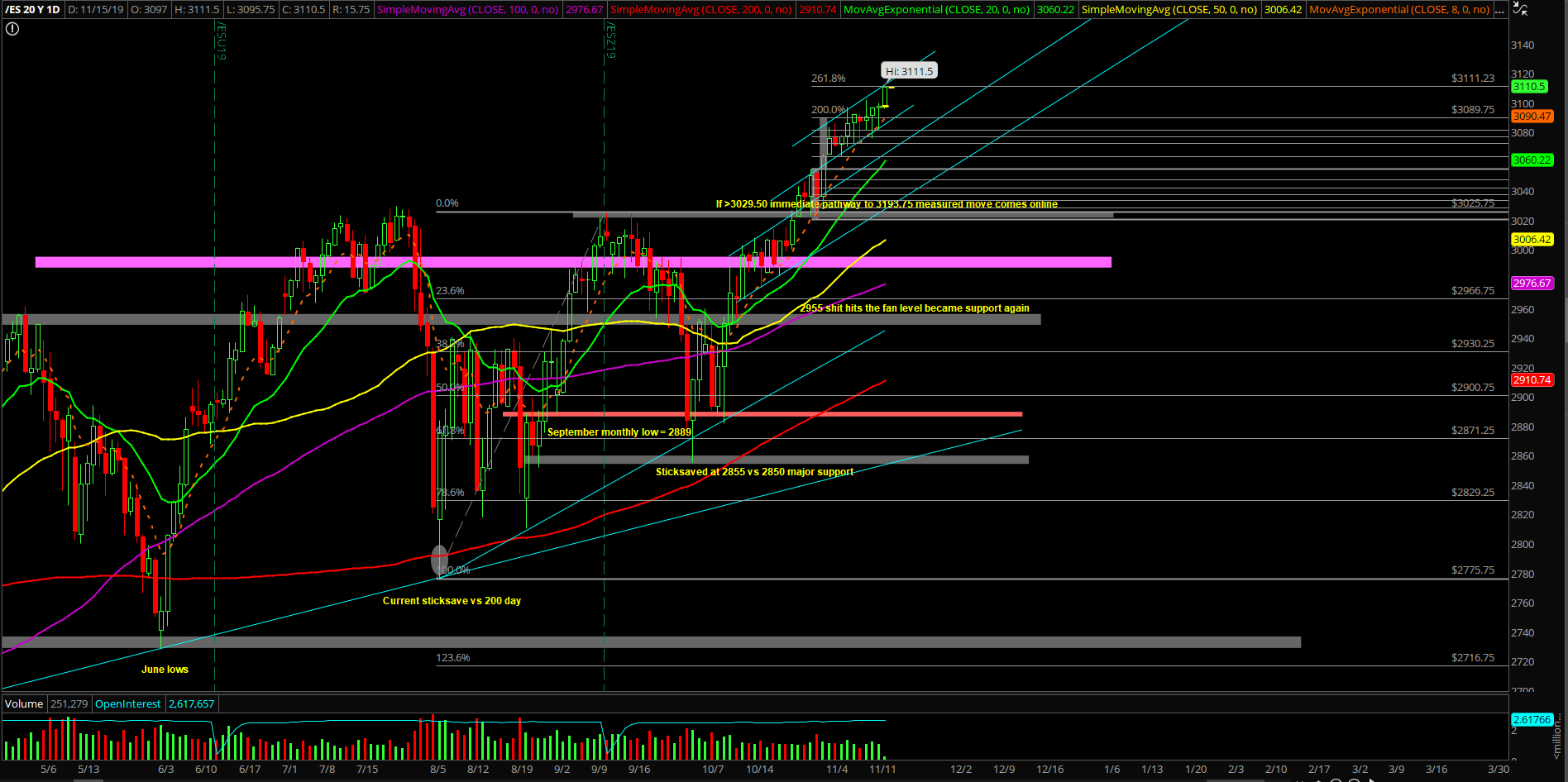

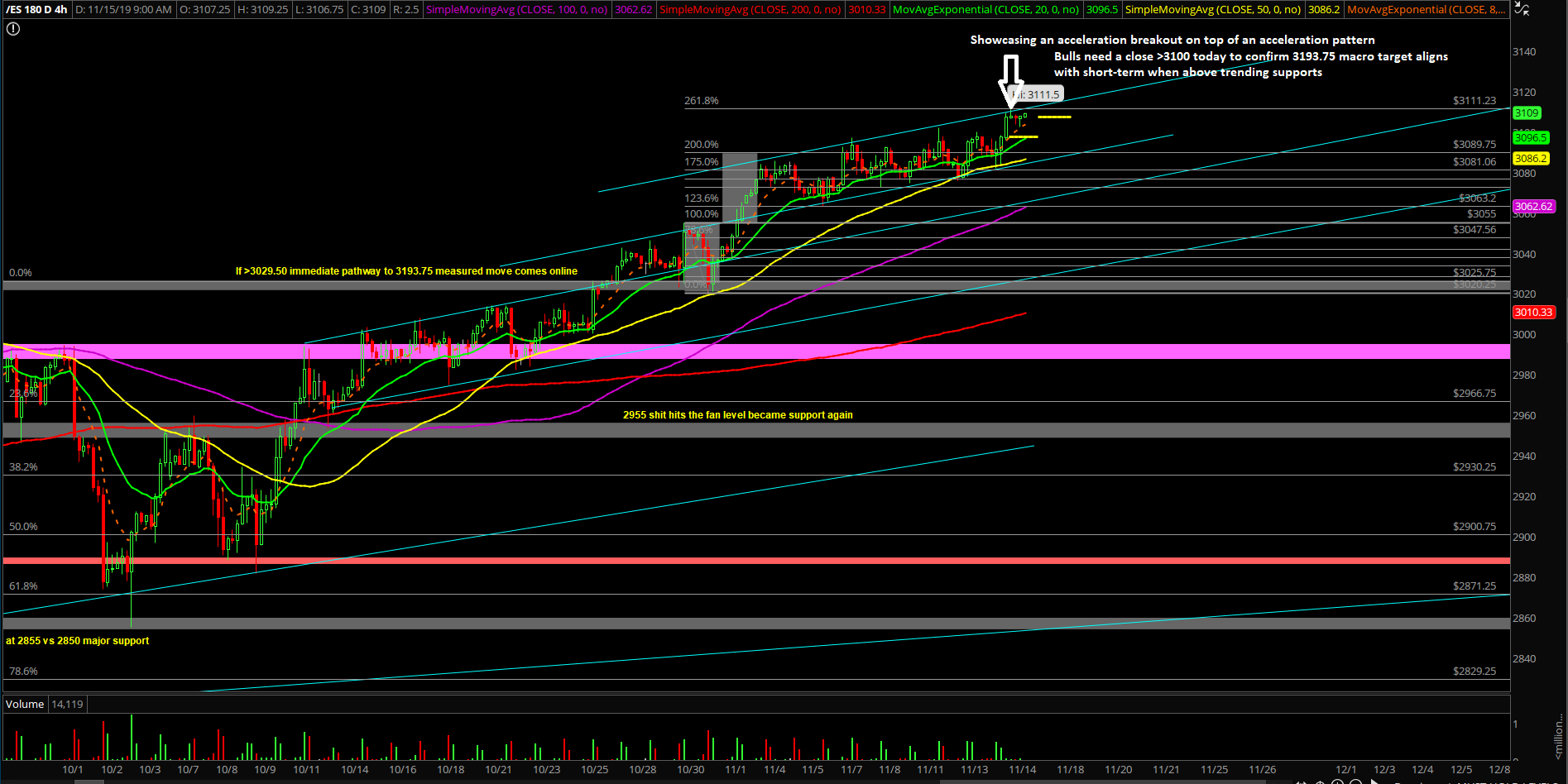

Thursday’s session was another range day that held the 8 day once again and the most significant things occurred during the overnight period after the RTH session ended. The globex showcased a strong break above 3100 after 2 weeks of the high level consolidation here.

The main takeaway from this is that the market is attempting the vertical buying climax/massive feedback loop squeeze that we discussed was a rare scenario when price action is at top of BB alongside with stats. However, price is king and if price action continues to hold the 8 day and keep grinding up then it is what it is. Today is monthly opex and the goal line for both sides is very simple: bulls are trying to close above 3100 to confirm momentum heading into next week, and the mythical creatures are trying to deter the acceleration setup that is on top of an existing acceleration setup. (Market is grinding above the 8 day moving average for 1 month now, so a mean reversion back to the 20 day could be swift if they resurrect themselves)

What’s next?

Thursday closed at 3097.5 on the Emini S&P 500 (ES) and all eyes are on today’s monthly opex close. We took off our hedges vs overall portfolio last night as we were forced out with the decisive break above last week’s 3102 high. Now, we’re waiting to see if bulls can confirm a close above 3100 in order to play the aggressive mode next week if price proves itself decisively. Pretty key because now everything is at BB/Keltner bands high again, so price action needs to prove itself to expand the range significantly to get us to 3193.75 directly here with the grind up and relentless sticksaves of the 8 day moving average.

In summary:

- For now, bulls are gearing for a daily closing print above 3100 that they’ve been battling against for 2 weeks now in terms of the high-level consolidation.

- A close above 3100 opens up the rare scenario of a buying climax/feedback loop squeeze that could take us towards the 3193.75 macro target immediately.

- The immediate trending supports have now moved up to 3095 and 3082 where bulls remain favorable when price action trends above it.

- A break below these levels would indicate immediate momentum failing and this week’s low of 3074.5 would be the key pivot.

- We took off our ES leveraged hedges vs. portfolio approach and now can actively look go aggressive when applicable vs trending support levels or intraday pivots going forward assuming the acceleration breakout succeeds by today’s close.

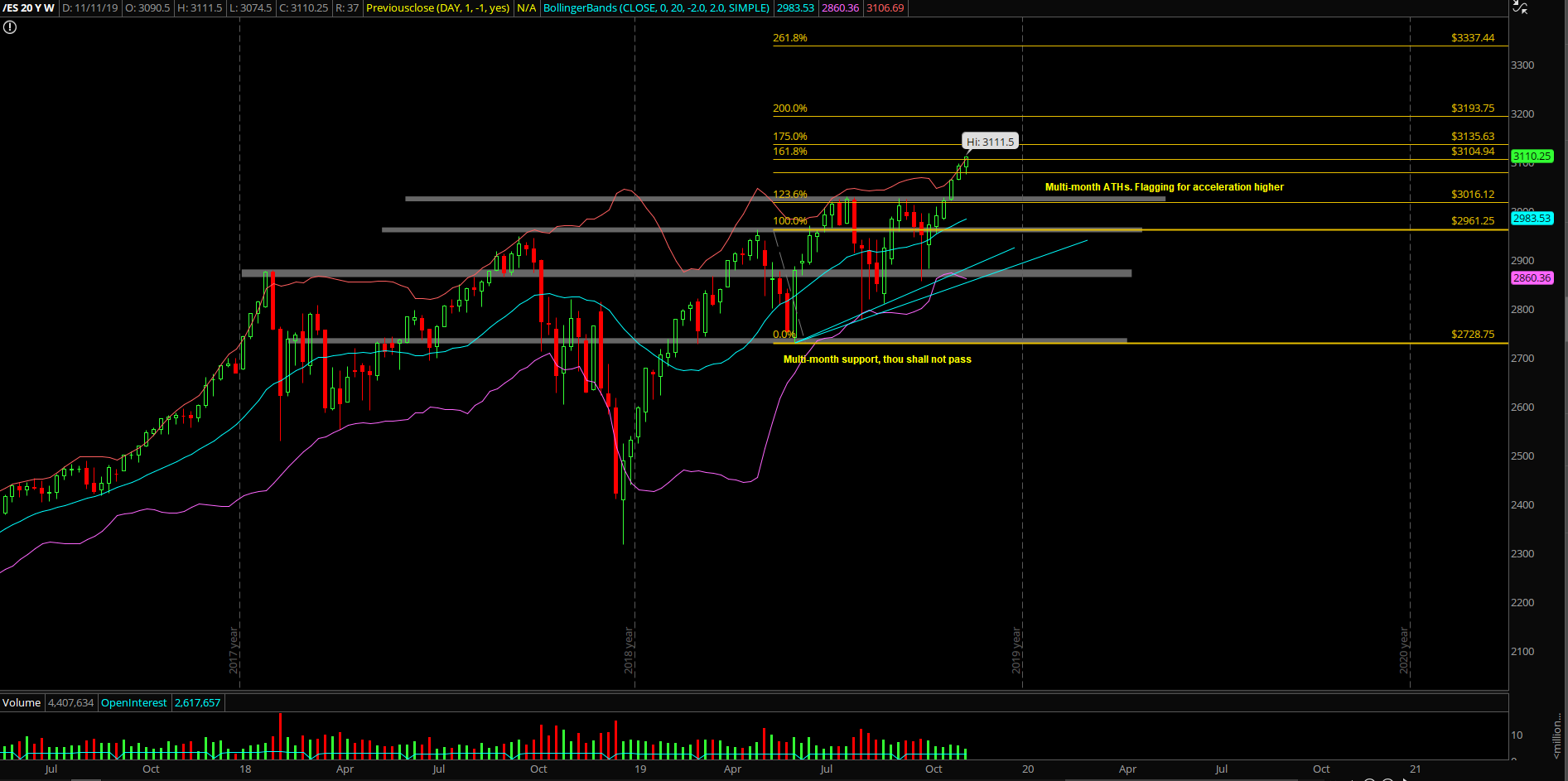

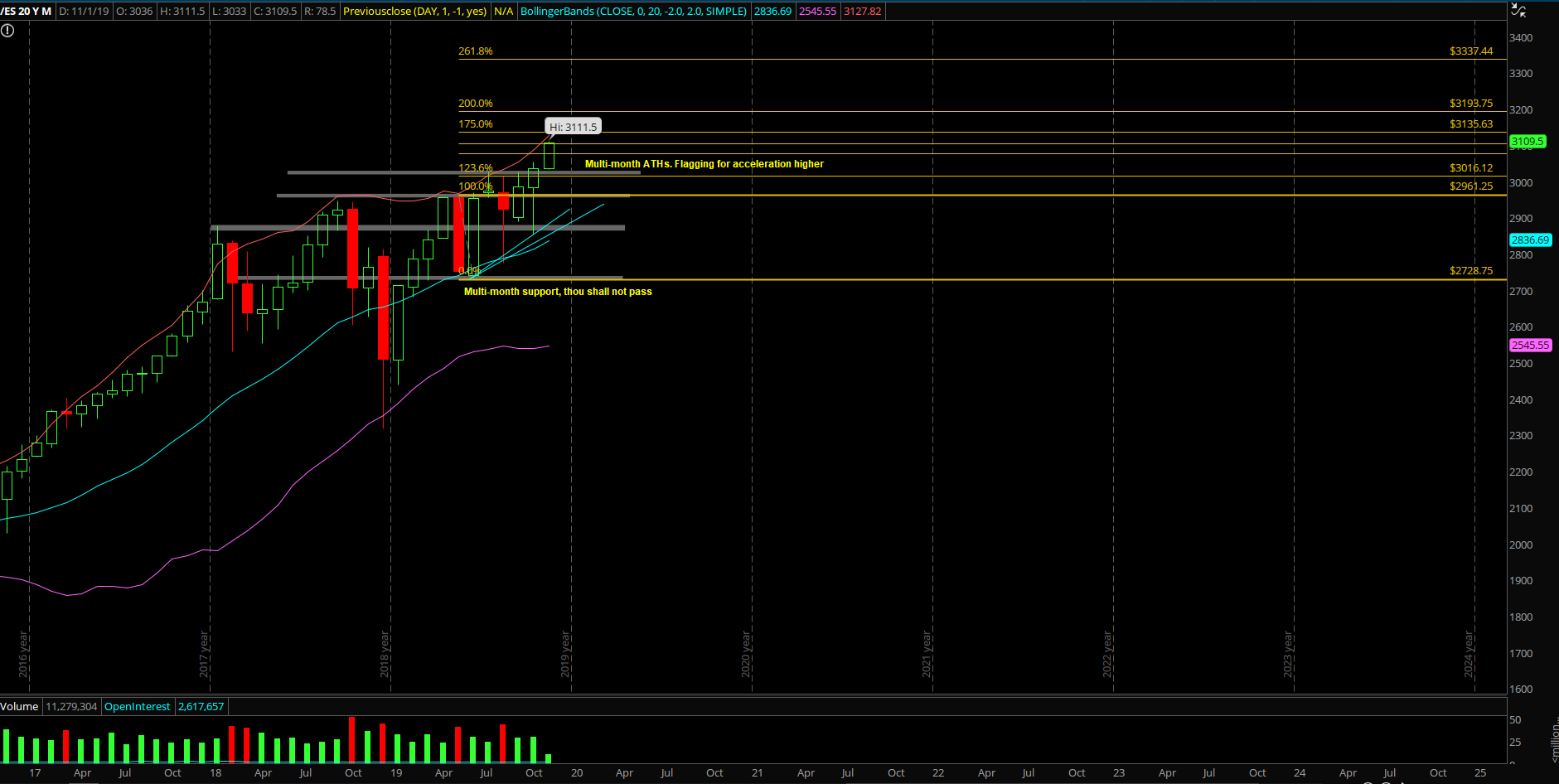

Macro Weekly/monthly chart timeframe:

For these timeframes, when above 2955 and 2984, all dips are considered buyable going towards 3193.75 into year-end closing print or year 2020. This is especially true when price remains immediately above 3000 for the short-term trend. Also, the trend remains strong this year given the +20% YTD performance thus far and it’s likely has more left in the tank given the multi-month bullish consolidation that has been established since the Dec 2018 lows and then subsequent range of 3029.5-2726 since March 2019. For immediate/aggressive trend followers, whenever price action is trending above or below the daily 8/20EMA with an established macro trend on the weekly/monthly charts, then you have the golden goose setup of aligning the micro with the macro.