Bulls In Full Control

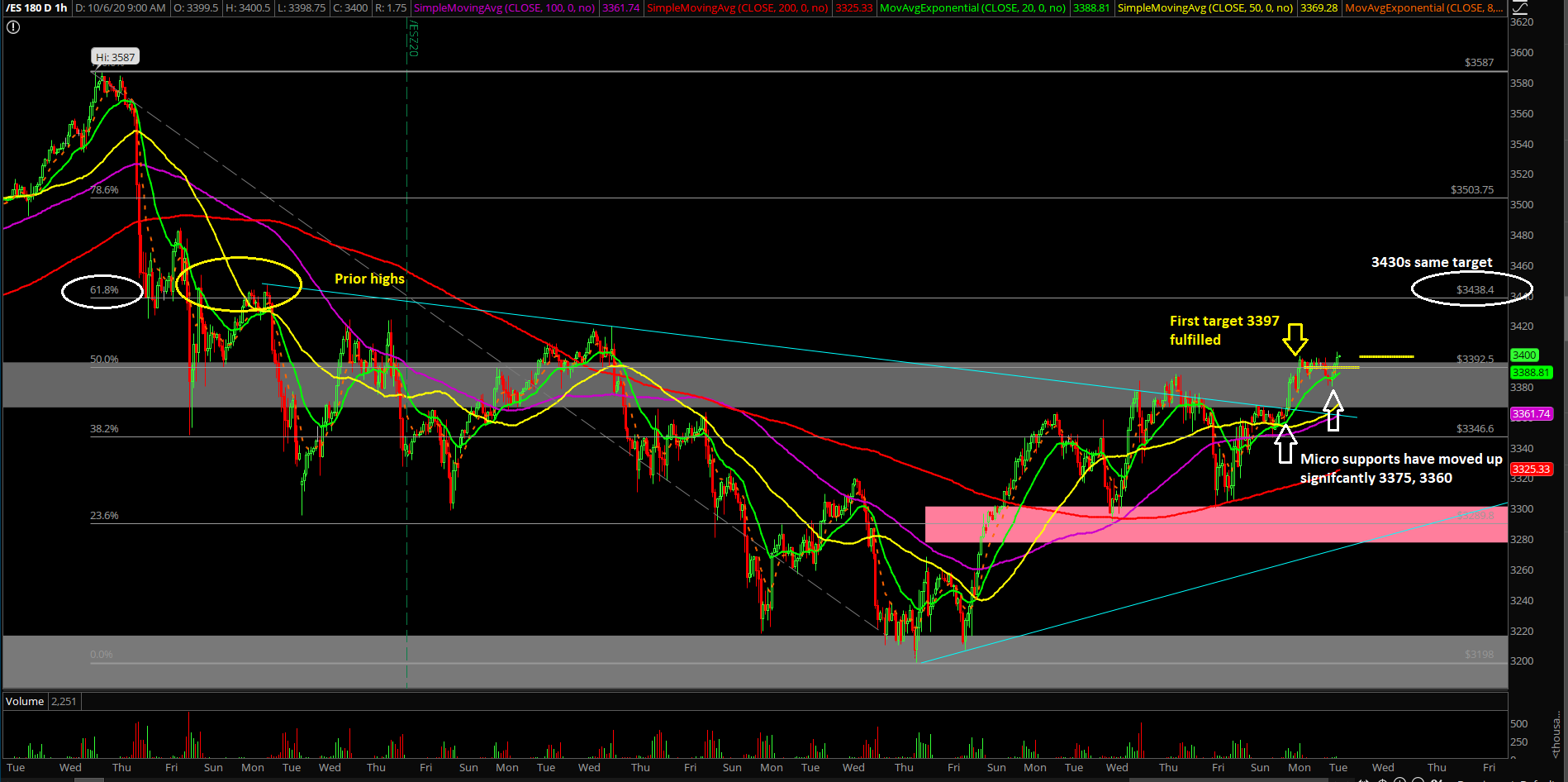

Monday’s session played out as a gap up and go/trend day where the market formed higher lows and higher highs for the entire day. Essentially, the market played out the path of least resistance and the bull train fulfilled the first target at 3397 on the Emini S&P 500 (ES) per expectations.

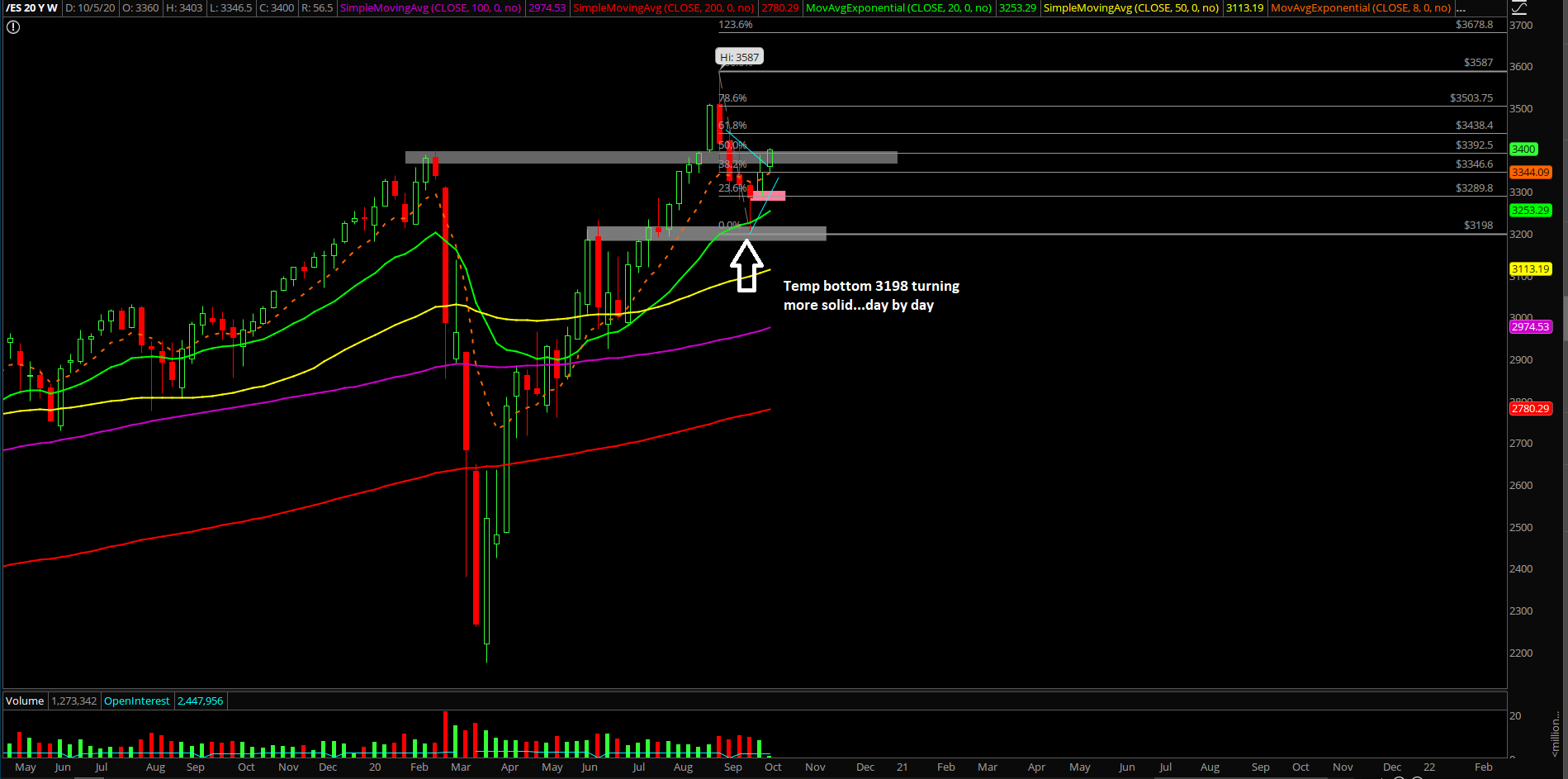

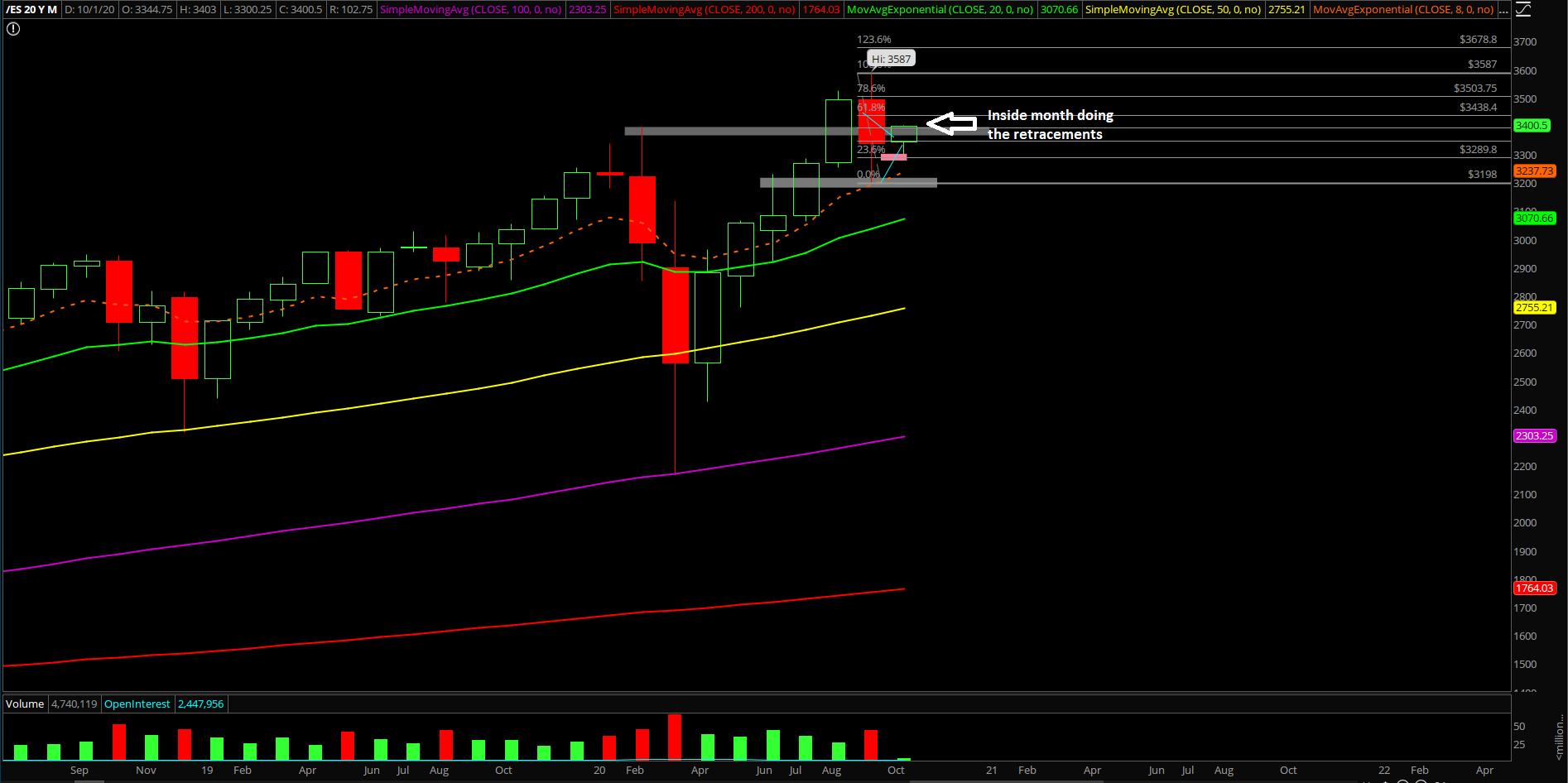

The main takeaway remains the same: It’s a clear inverted H&S or a rounding bottom pattern that has been playing out for the past 2 weeks. The 3198 temporary bottom is acting more like a bigger concrete bottom as every day passes without making a decisive lower low by the countertrend parties. This means that the 3198 low could be the low for the foreseeable future as price makes its way back into the 3430s 61.8% retracement area and also where the prior tops were from early September.

What’s next?

Monday closed at 3392.25 on the ES, around the dead highs of the session indicating that bulls are in full control. Overnight retraced back into the 1hr 20ema and formed a bull flag indicating that bulls are still in full control in regards to our immediate momentum levels. Note: holding 1hr 20ema and grinding out higher lows and higher highs is a big clue in terms of the micro. Know your timeframes.

Key points of our game plan:

- Our short-term bull bias has not changed much from the Oct 5 report: support levels just moved up because first target of 3397 was fulfilled during Oct 5’s gap up and go/trend day.

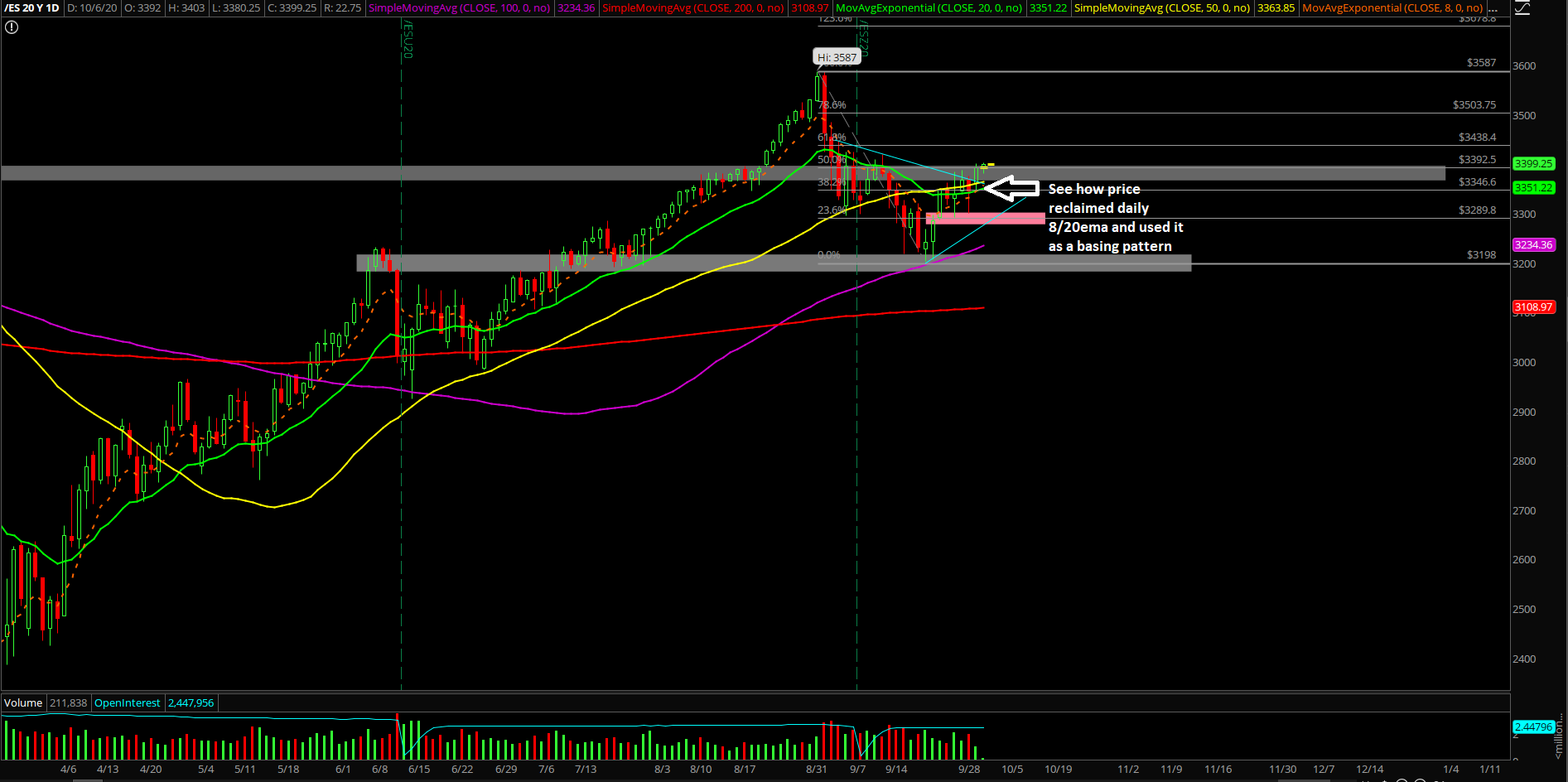

- Look at how price action is now utilizing the daily 8/20EMA as supports now given the market formed a solid basing pattern and reclaimed them a couple sessions ago.

- Weekly plan: when above 3285, target 3430s minimum as we’re short-term bull biased because of the past two week’s context from the temporary bottom into a basing pattern.

- Daily plan: when above 3300, target 3397 which represents the 50% retracement area and last week’s high.

- Micro wise, utilize some of the most immediate support levels from overnight 3380s and yesterday’s RTH low of 3360s .

- At this point, a break below 3345 (Sunday Oct 4 low) would be the first warning sign that immediate momentum is switching sides or turning into a backtest of bigger supports. If followed by a decisive break of 3300, then it opens up the downside risk of prior week’s low of 3285.

- If that key level of 3285 breaks, then it opens up targets of 3250/3198 again because at that point it would be some sort of a huge daily/weekly reversal candle into the downside.