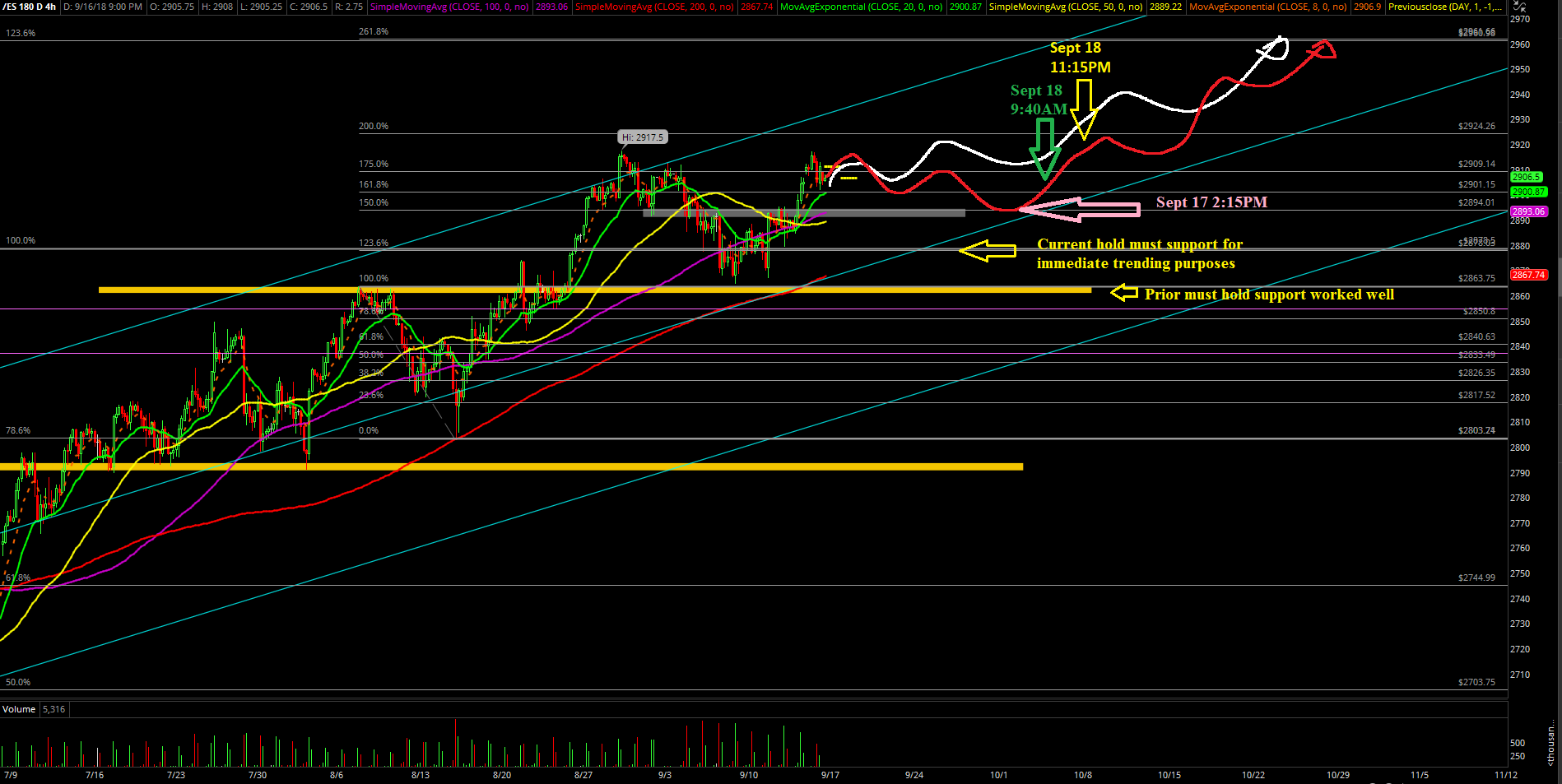

Bulls Back in Control as Market "Sticksaves" Above Must-Hold Support

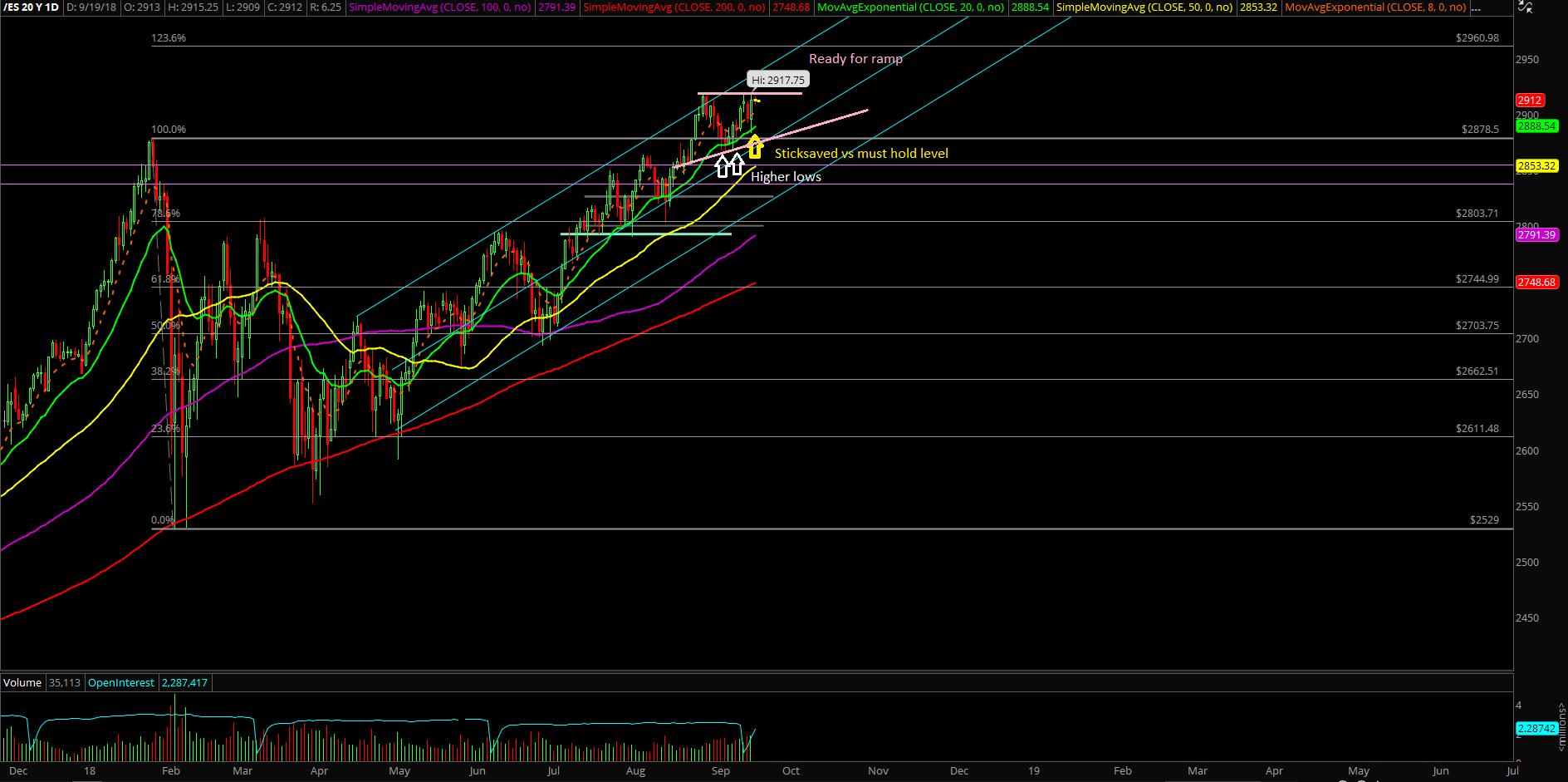

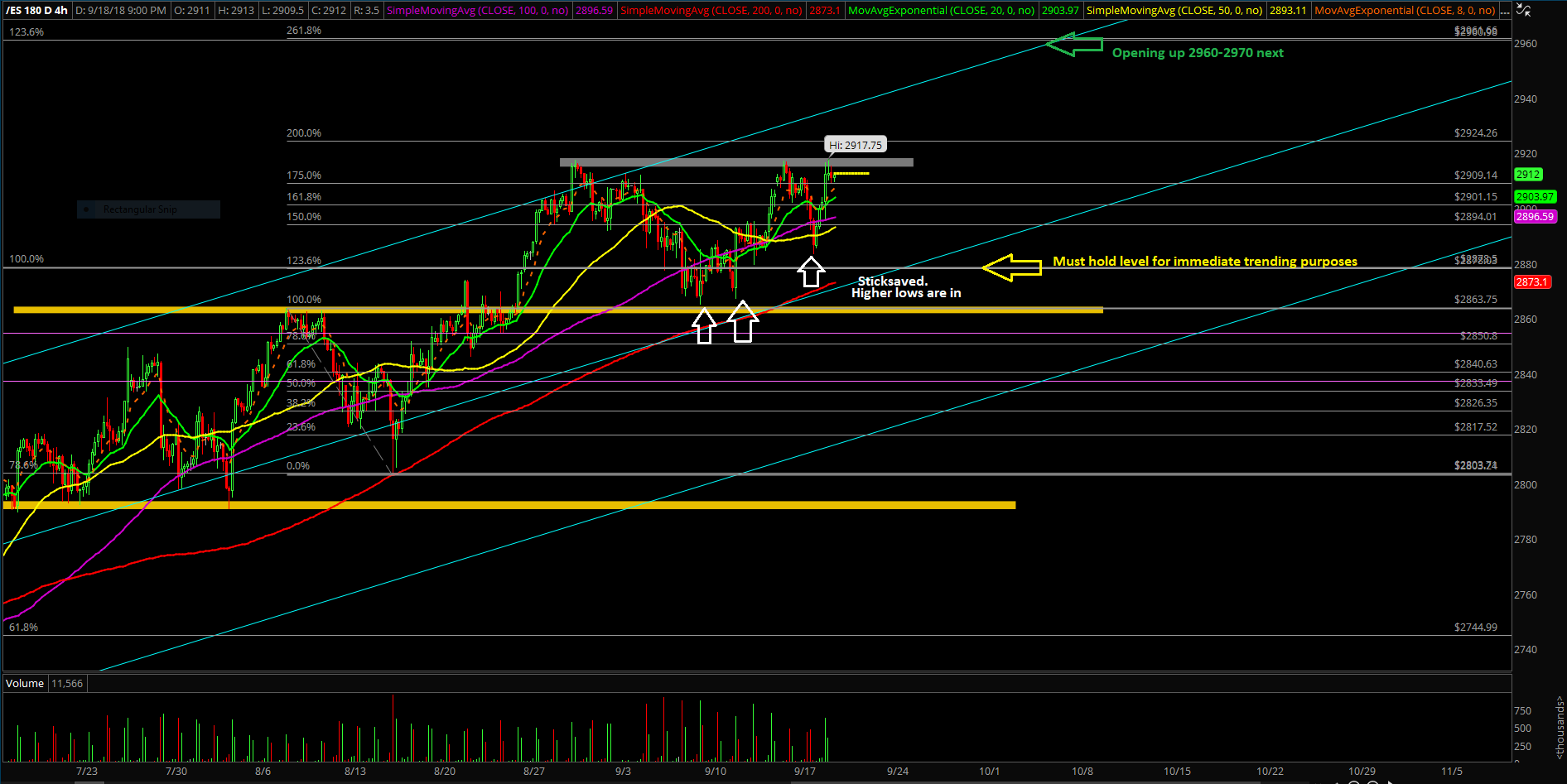

Tuesday’s session was a large bull bar reversal that is very similar to the Tuesday Sept 11 pattern. The action really started with overnight trading catching a bid at 2883.50 in the Emini S&P 500 (ES), remaining above must-hold 2880 support from the weekend report thesis. Then the bulls managed to formulate a V-shape reversal up-pattern throughout the night and open up with a small gap-up. Essentially, it became a gap-up and go pattern as the market ground higher towards the 2917 month high level for the rest of the session.

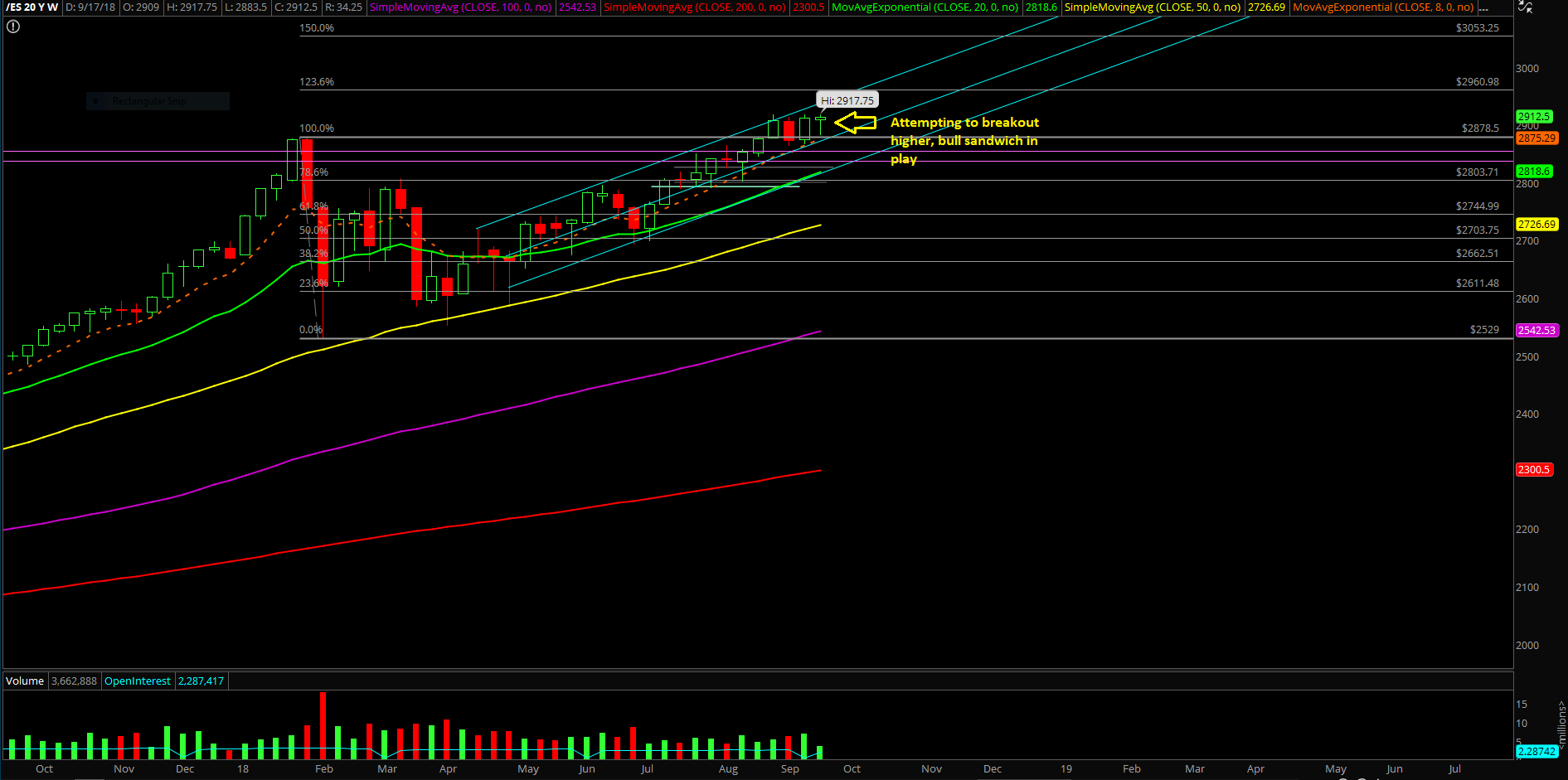

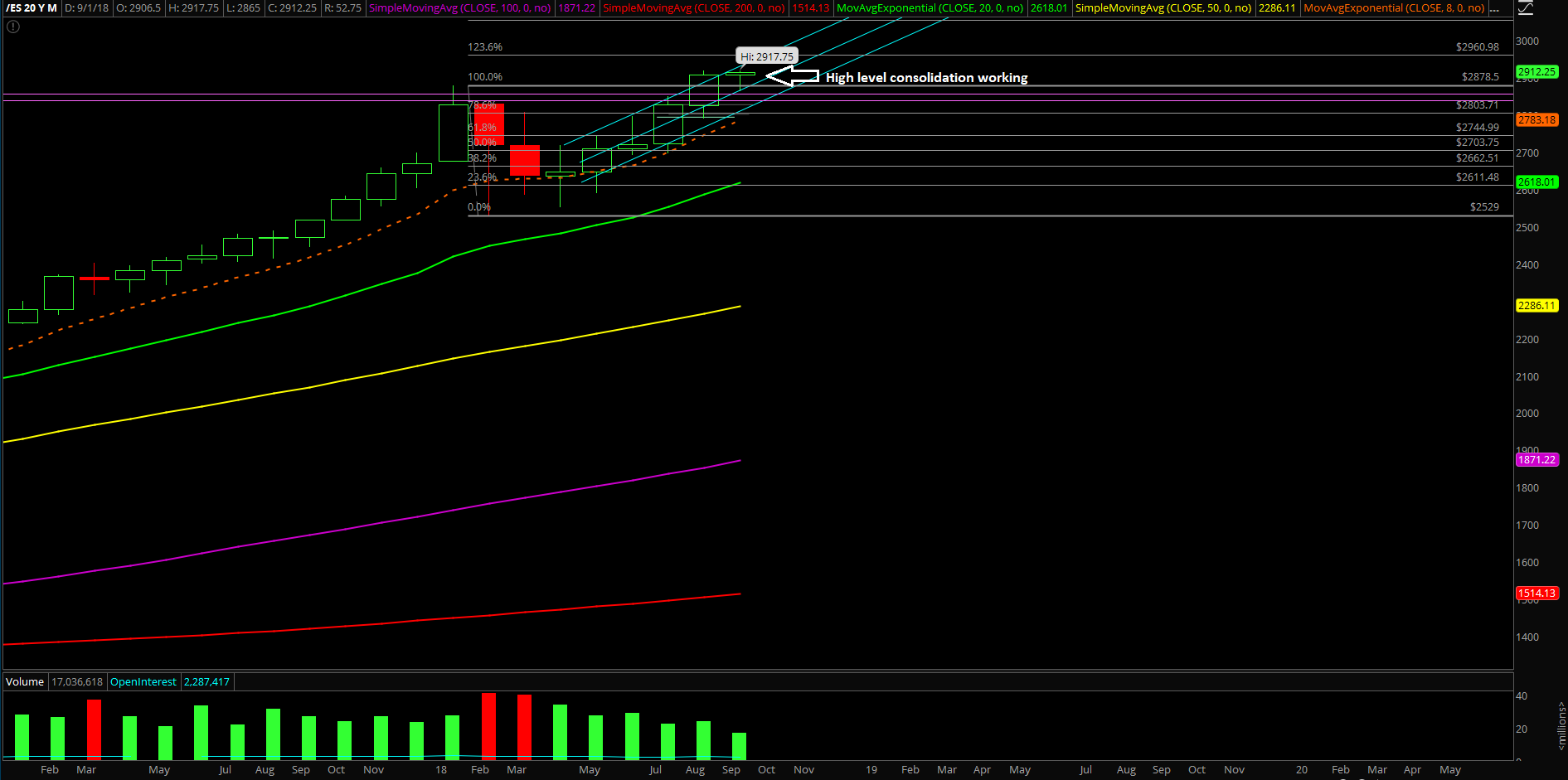

The main takeaway from this session is that bulls are back in full control given the sticksave pattern and bears failing to pierce below the must-hold 2880 level. Thus, the bulls won the battle again, which means the market is ready to do a continuation pattern towards 2960-2970 as long as support keeps holding.

What’s next?

Daily closed at 2912.75 around the highs of the day as a large engulfing bull candle similar to Sept 11. Heading into Wednesday and the rest of the week, treat 2865, 2867.25 and 2883.50 as the daily higher lows structure, and the latter should not be broken in terms of the immediate trend.

As discussed earlier in our ES trading room, we’re cautious of Wednesday being some sort of inside/range day similar to Sept 12 in order for the market to take a breather and consolidate before accelerating higher. Obviously, the other scenario could be straight continuation up depending on how the overnight action goes. Basically, if it is just a tight high level consolidation/bull flag, then the bulls could already start the march higher right out of the gates tomorrow at RTH towards 2960-2970. For reference, we’re already within striking distance of the first measured move target of 2920s given the huge bounce from last night, so momentum is going extremely well for bulls.

At this point, the immediate micro trending supports are located at 2904 and 2985 where anything above 2883.50 is considered swing BTFD zone as the must-hold level of 2880 moved up a few points. For now, think the 4-hour red line projection is king as the pattern of higher lows and higher highs keep playing out until price action invalidates our thesis.