Bullish Trend Intact - Market Analysis for Jul 28th, 2020

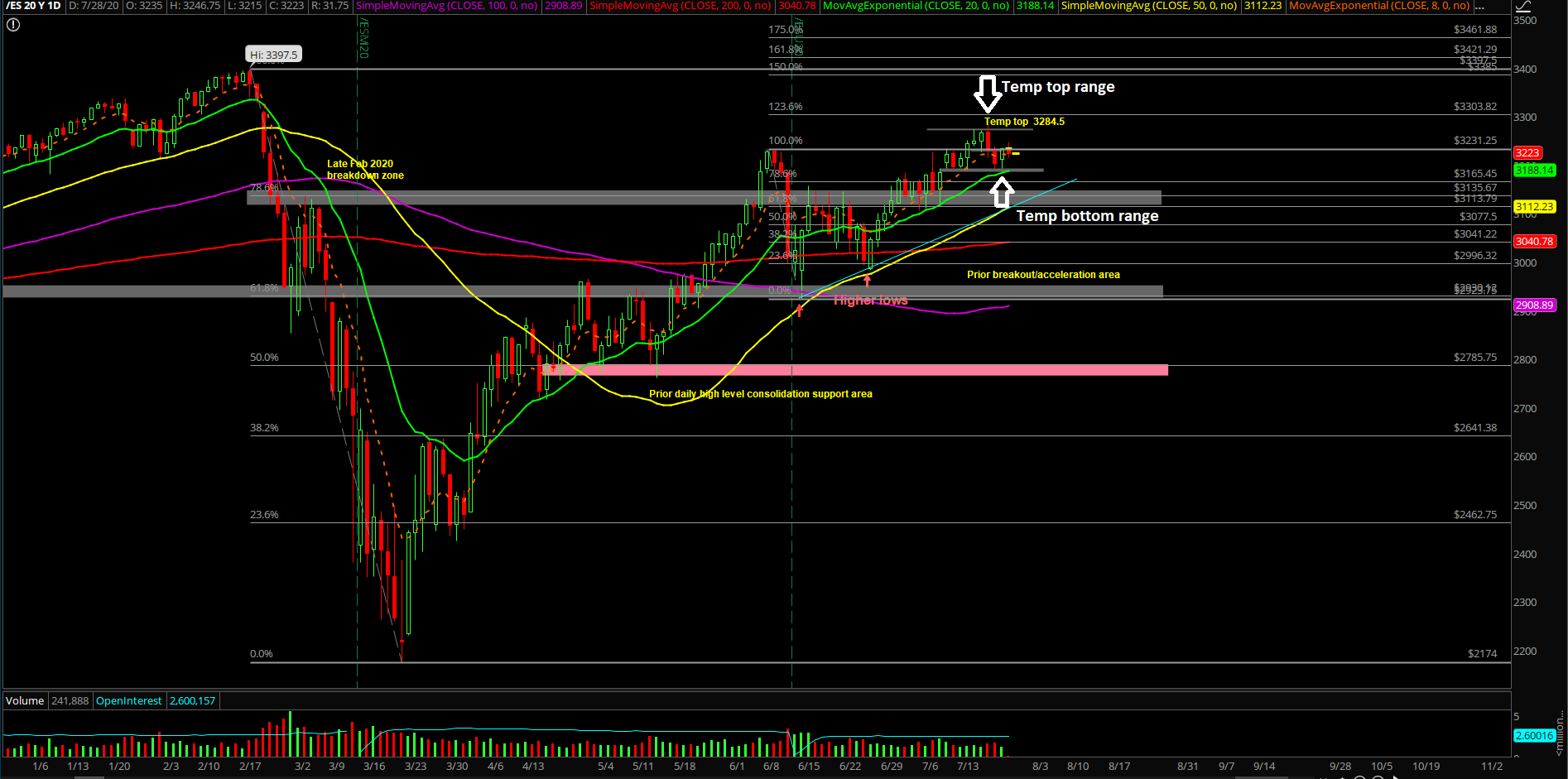

Monday’s session played out pretty much perfectly as it was just a textbook range day abiding by the rules. If you recall, last Friday formed the temporary top at the 3190s support on the Emini S&P 500 (ES), and Monday was all about forming the subsequent higher-lows setup. Price action bottomed out at 3207.25 in the morning swiftly after the RTH open, and the rest of the day was spent as a slow grind up.

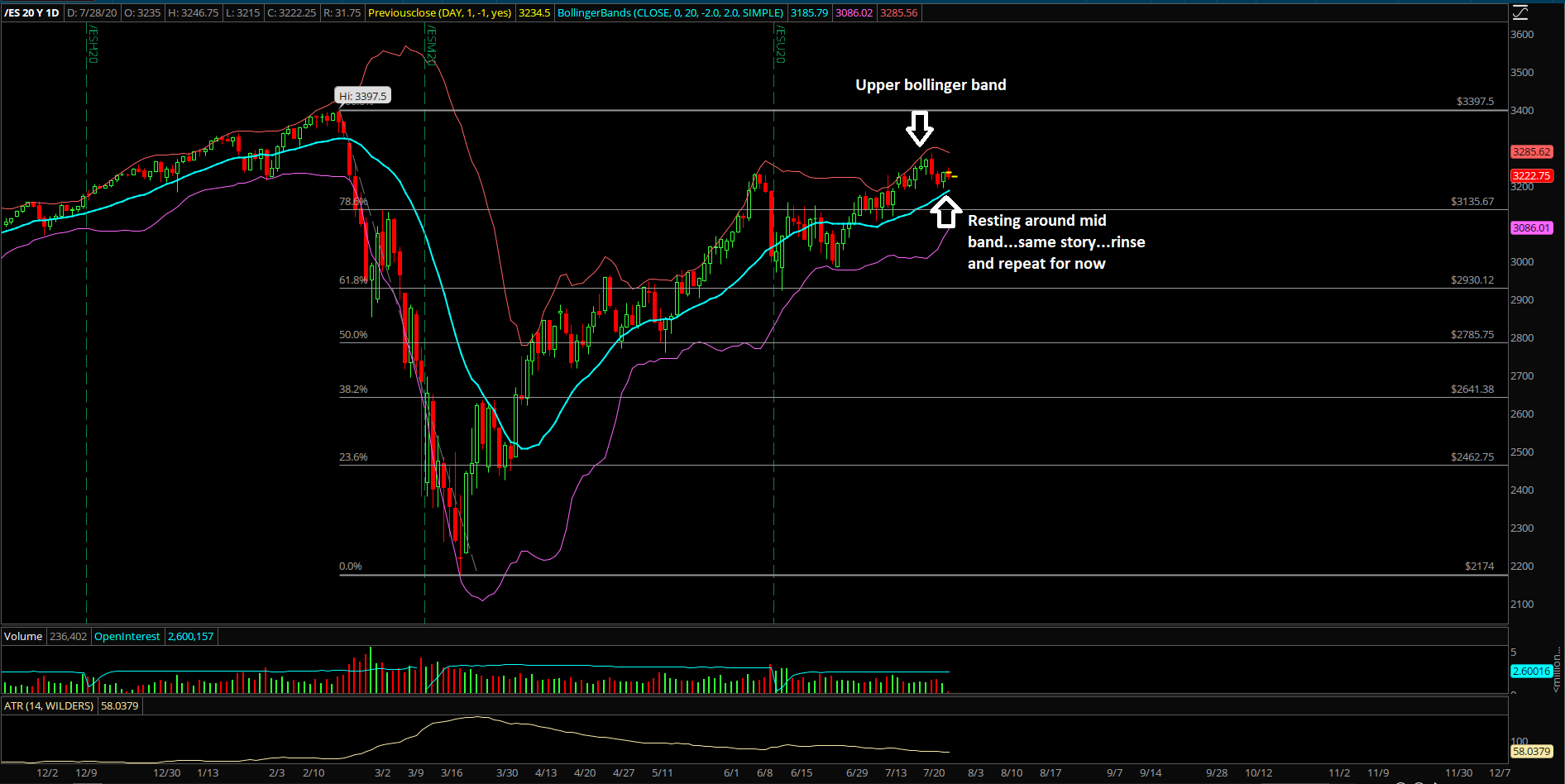

The main takeaway from this session is that the run towards 3250 was accomplished overnight, and market participants got what they wanted by taking profits and backtesting now towards 3210s-3220s for the next higher-lows setup. The rest of the week is more of the same as the price action is just forming a base here vs daily 20EMA in order to ramp up higher eventually. It would need a decisive breakdown below last week’s low to entice real bears to come back into town and showcase their strength.

What’s next?

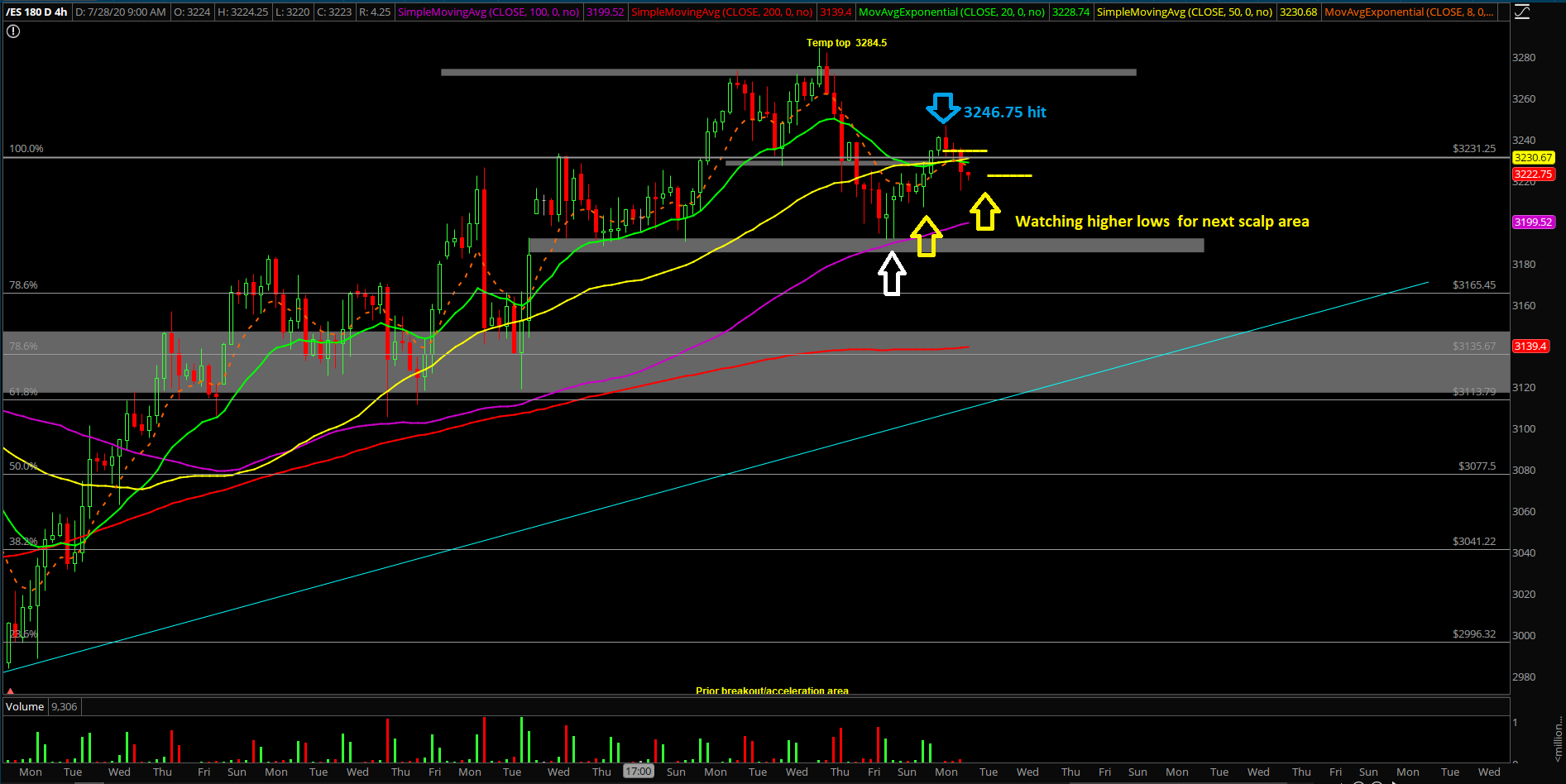

Monday closed at 3234.5 in the ES, around the high of the session and also around the high of Friday. Overnight price action did what was expected with the run towards 3250, which then got rejected at the 3246.75 high as we took profits on our short-term long position with some anticipated pre-determined levels at the highs.

Our game plan:

- For today, watching 3210-3220s as the higher lows formation given the likelihood of another range day. A decisive break below 3200 would be the first warning sign that something isn’t right and thus 3190 becomes at risk for a backtest/breakdown attempt.

- We’re still treating 3180-3284.5 or 3190-3280s as the immediate overall range meaning there’s more upside potential than downside right now until proven otherwise in the bigger timeframe.

- Based on the temporary bottom formation from the 3190s, we are watching the subsequent higher lows like a hawk as we have both a temporary bottom and top from the past couple days.

- In addition, the main trend of daily 20EMA for the past few months is still holding so the ongoing bullish trend heading into end of July remains intact for now. The side that is running out of time to get some traction is the countertrend bears due to the critical timing aspect of this week

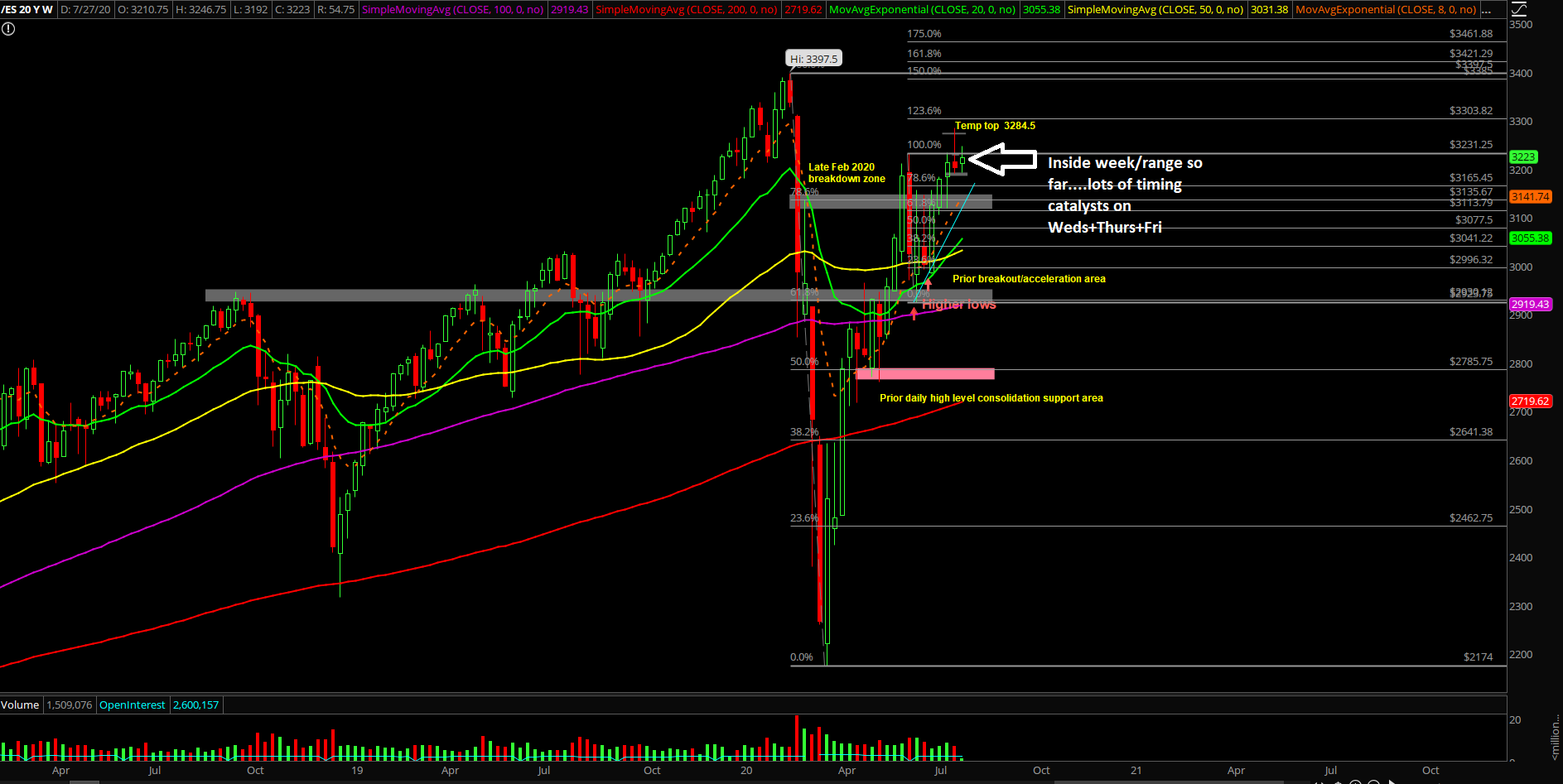

- On-trend market participants have built out July as an upside continuation model, so it’s very obvious what the end goal is for the month of July and especially heading into numerous timing catalysts.

- Conversely, the current temp bottom of 3190~ remains the must-hold level. A break below 3190 followed by a closing price below 3180 would be a key indication of a short-term trend change signal on the daily chart timeframe.

- For additional momentum clues, we must look at NQ/tech stocks as they are attempting to lead the downside. If things start to sustain below daily 20EMA on tech then the 12-15% quick mean reversion I keep attempting should be going to plan for the higher timeframes. Must stay vigilant because daily 20EMA has held for months so it's a cascading effect if it finally turns.

- We have lots of timing catalysts ranging from FOMC meeting, mega-cap earning and month-end this week, so it could be a wild week worth of whipsaw in this 100~ point range.