Bullish Seasonality Week, Need To See Breakout Continuation

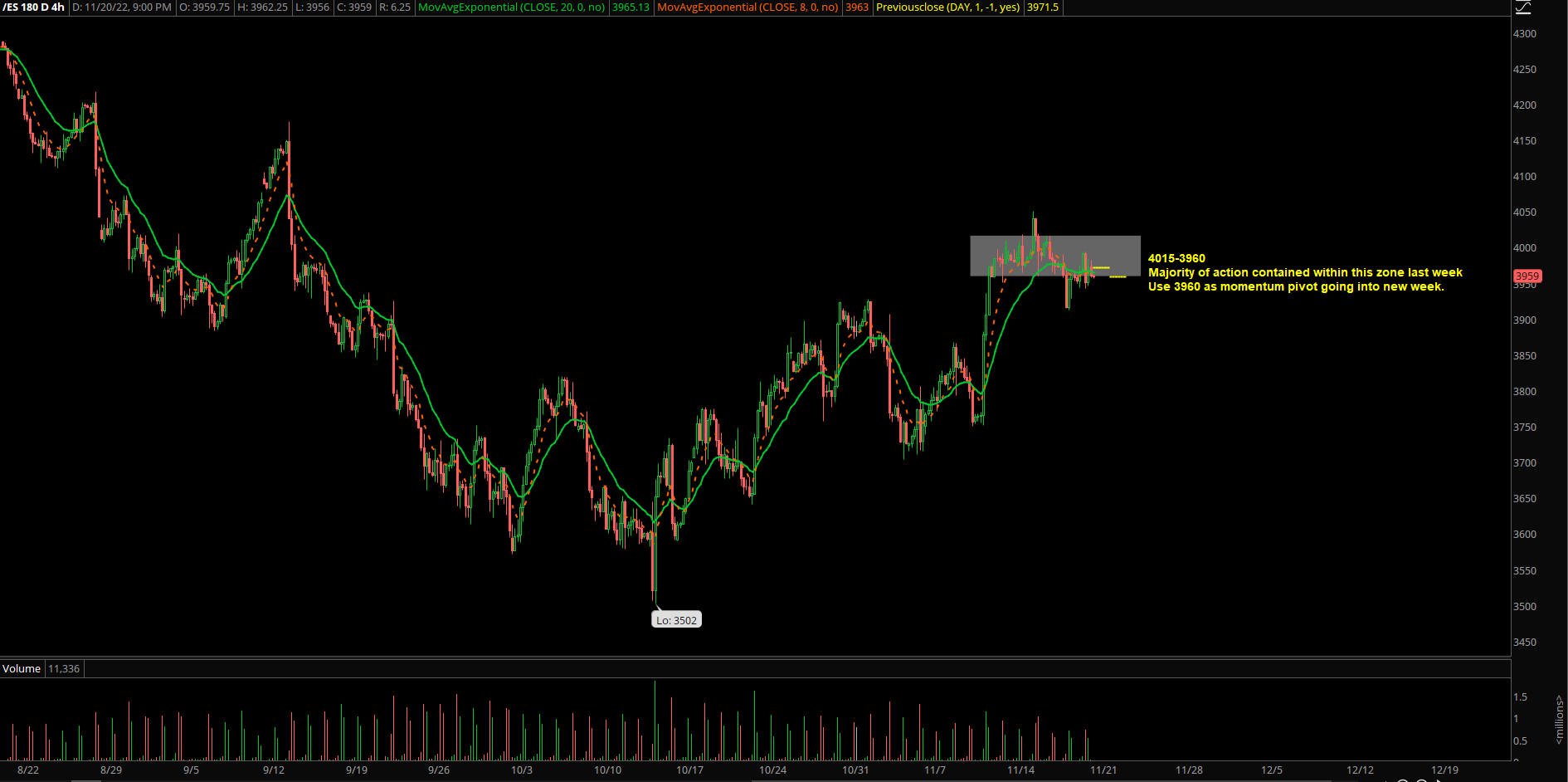

The third week of November played out as bullish consolidation as sellers couldn’t even retrace more than 1/3 of the second week of November’s +6% breakout range. The majority of the week’s action was confined within 4015-3960 on the Emini S&P 500. (ES), with the weekly range being 4050-3912.

This means that buyers are in pretty good shape going into one of the most bullish seasonality weeks as long as support keeps holding. Thanksgiving week and into first week of December is typically fairly bullish per historical stats.

Key ideas going into the next session(s):

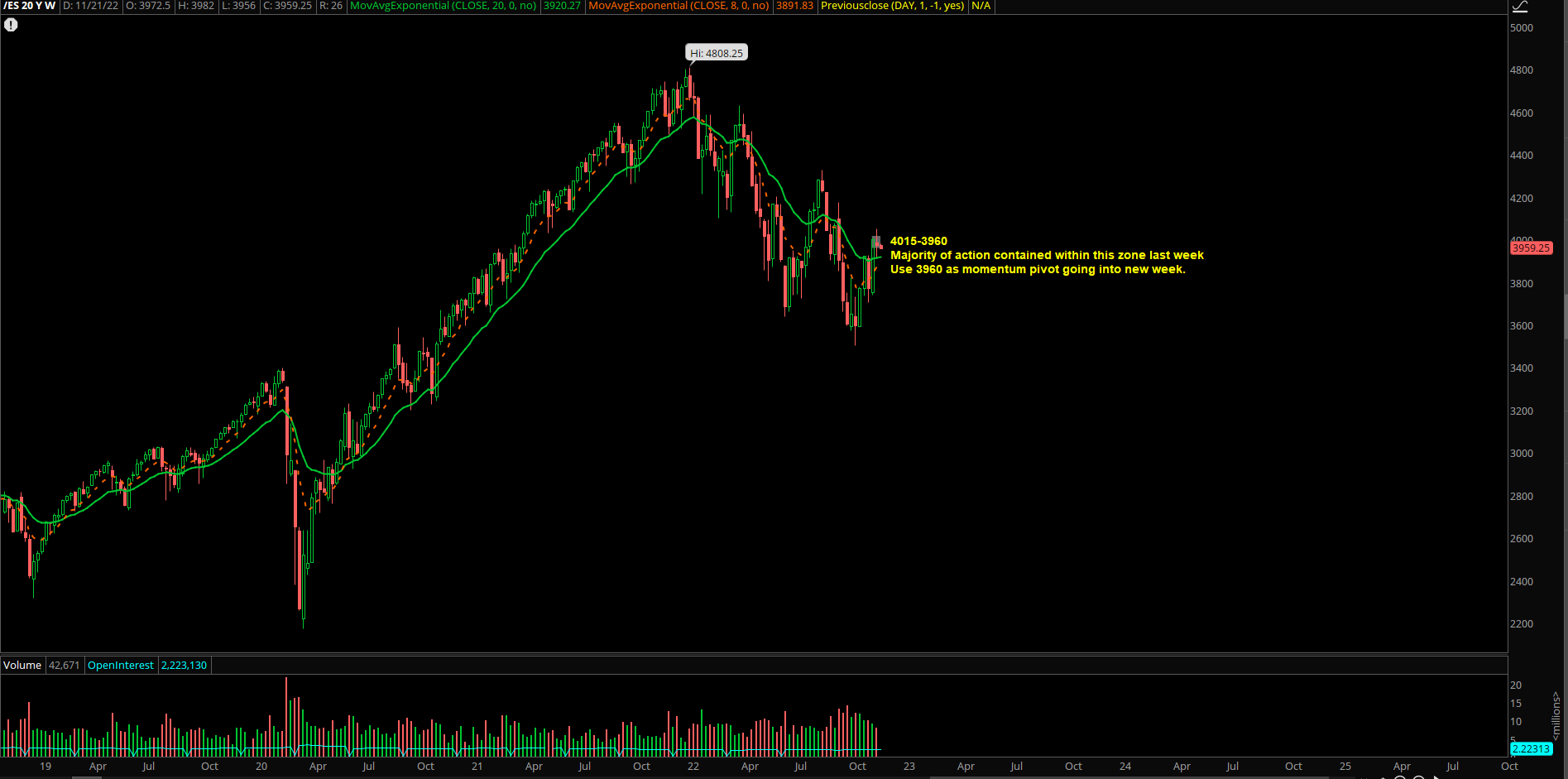

- Starting with a top-down approach, given last 2 week’s ongoing context+breakout structure, this upcoming week is mostly about whether buyers can continue higher immediately or need to retest lower first. Otherwise, it may result in a breakout failure if weekly LIS starts breaking.

- Daily chart remains bullish as price broke out of a 3 week consolidation range.

- The weekly line in sand(LIS) is 3850, meaning all dips must hold above. Any daily/weekly close below 3850, then the risk of a breakout turning into a failure/trap becomes very real.

- Slightly weekly bigger wise, we’re expecting a trend continuation towards 4080-4130 as long as 3850 LIS remains valid (adapt if 3850 breaks or when last week’s 3912 low breaks is a big warning sign).

- A daily close 4015 would be the first sign that 4080-4130 need to be on the immediate horizon (aka signalling a breakout continuation from past 2 weeks).

Intraday trading parameters:

- We’ll continue to use 3960 key level as a momentum gauge for tomorrow’s session.

- If/when trending above 3960, look for rotation back into 4000-4015 targets.

- Below 3960 immediately opens risk for 3930/3920/3900.

- We are short-term neutral-bullish heading into this week based on a timing component + context.

- We’ll glean additional clues from the overnight globex structure and have a better idea by RTH open.

- There are different timeframes discussed here between intraday short-term vs. swing vs. long term. Must know your timeframes, risk parameters and gameplan.

- Key levels are static, context is dynamic, real-time execution is fluid.

- Reactionary day-to-day market environment so capture points/profits and cut losers quickly, know your timeframes and adjust. We utilize a level by level approach.