Bullish Path in U.S. Indices, Metals & Oil

In the U.S. Indices, the path higher when the signals for SPDR S&P 500 ETF (SPY), iShares Russell 2000 ETF (IWM) and Invesco QQQ Trust (QQQ) went long still has not generally changed with action corrective off the recent high. As we've noted over the past week: "Any type of bullish catalyst should unleash a push back towards 300 in the SPY, if not through it. With a vibration window showing up for early next week and the signal remaining long, the path does seem to point higher."

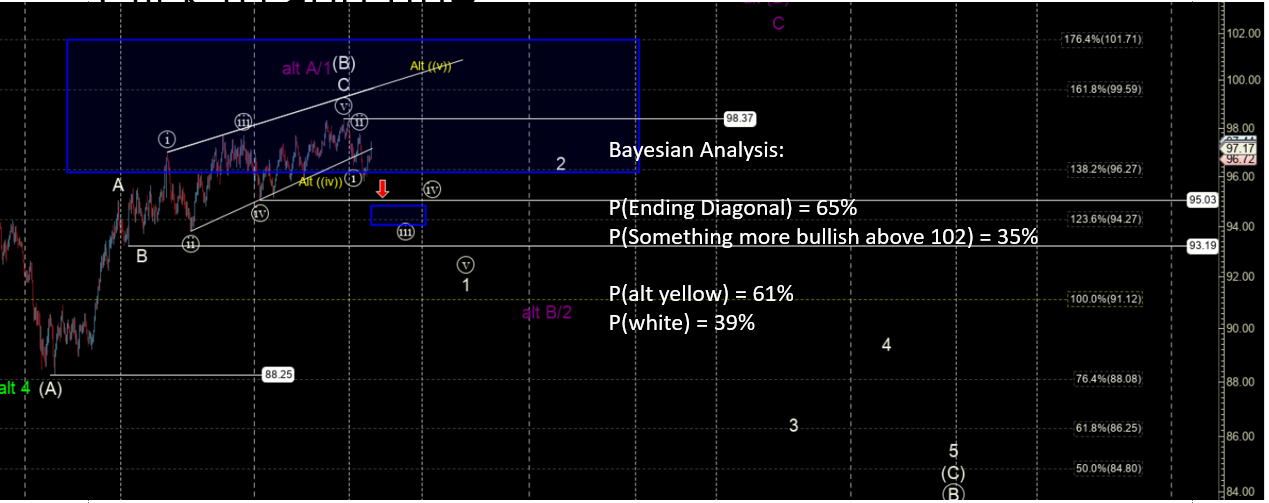

If we focus on the "bullish branch of the tree," there's a 65% Bayesian probability (BP) that SPY gets above 300 and targets 305-308 on the next general leg higher. There's a 35% BP that SPY turns down below 300. Bottom line: SPY is favoring a shot into the 300s before the next decision point.

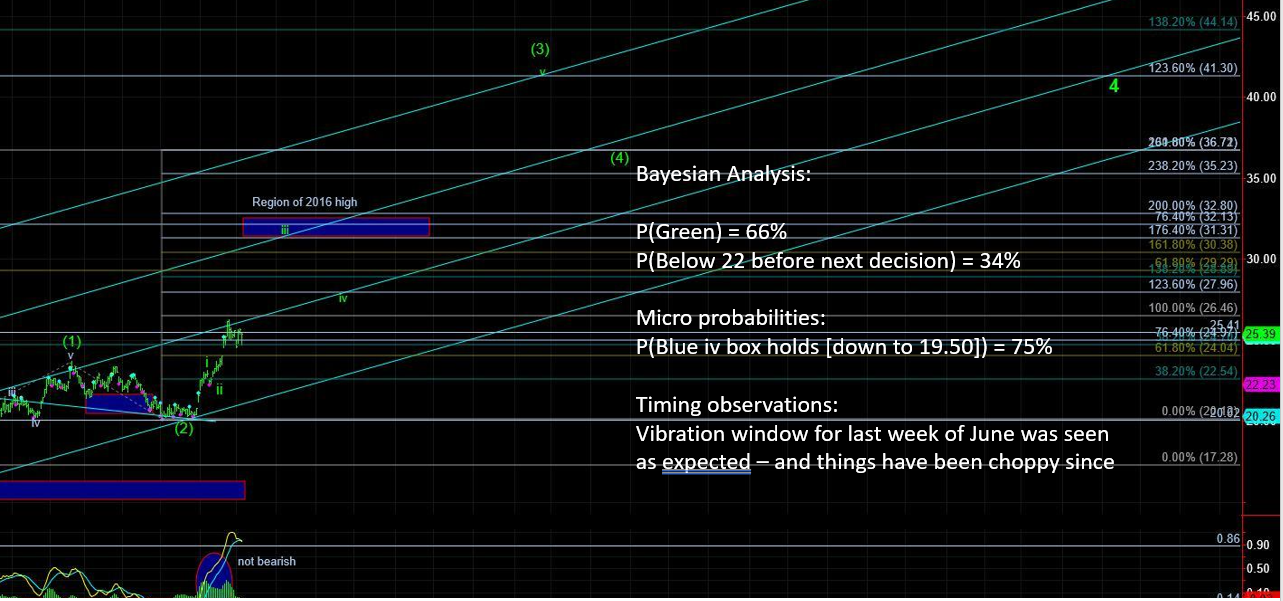

In metals, the Bayesian Timing System (BTS) weighed the data and pulled the trigger on a long trade in the VanEck Vectors Gold Miners ETF (GDX). If correct, a shot at 26-26.50 should materialize quickly. Still not convinced a bullish leg higher commences for several weeks or more; but for now will make an attempt at this swing trade.

Even with bullish action, Bayes believes this should be kept in mind: With a slight adjustment in the SPDR Gold Shares (GLD) support cluster, the focus is on 128-130 now (instead of 130-131). Below that is 124 (with doubts of a multi-month bull). For the moment, the BTS stands by its assessment that much below 124 and sadly this could be another "fake out break out."

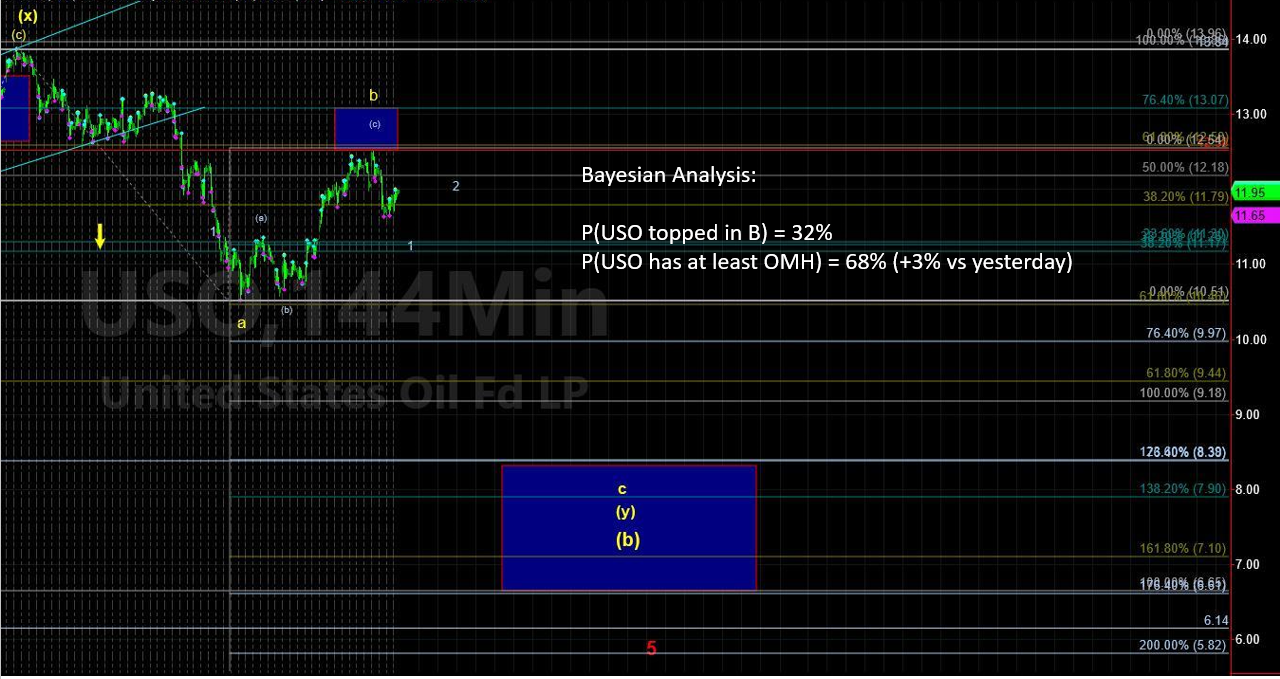

In oil and the U.S. Oil ETF (USO), the path back to higher levels remain intact. On the big down day on July 3, these daily thoughts said the move looked exhaustive and long was the place to be. In fact, the odds of getting another run at 12.50 were quantified on July 4 to be: "The probabilities support this decision and multi-week odds for this swing support seeing above 12.50 (and as high as 14) at 66%."

Pre-market does appear this path is winning out. Not sure we stay near or above 12.50 for very long, so be on the lookout for a signal change.

In the U.S. Dollar, we noted a week ago that with 25.75 not overwhelmed "quick enough," a shot back to the important 26.10 will most likely emerge the week of 7/1 (which did occur)in the Invesco DB US Dollar Index Bullish Fund (UUP).

We also noted that if the UUP is able to base above 26.10, then 26.30 would be the next stop higher.

Thus far, this path is playing within path projections for a shot back above 26.50 on deck – but doubts it will stay there for very long before that long awaited path lower emerges.

Note: For members interested in real-time trade signals for a dozen or more ETFs across a range of commodities and industry sectors (QQQ, IWM, GLD, SLV, TLT, UNG, XLE, XLF, XBI, etc.), you are encouraged to check out the Bayesian Analysis Plus service.