Bullish Lean To SPY's Chop

With SPY barely nudging on 5/17, this discussion still applies: Just been pure chop, with a "BP"-bullish lean to it and thus, we remain long and looking higher. (BP refers to Bayesian Probabilities.) SPY is back in the 414-418 web, yet again. This time, however, back above 418 more directly points to our 425-428 target. Above that is 440ish.

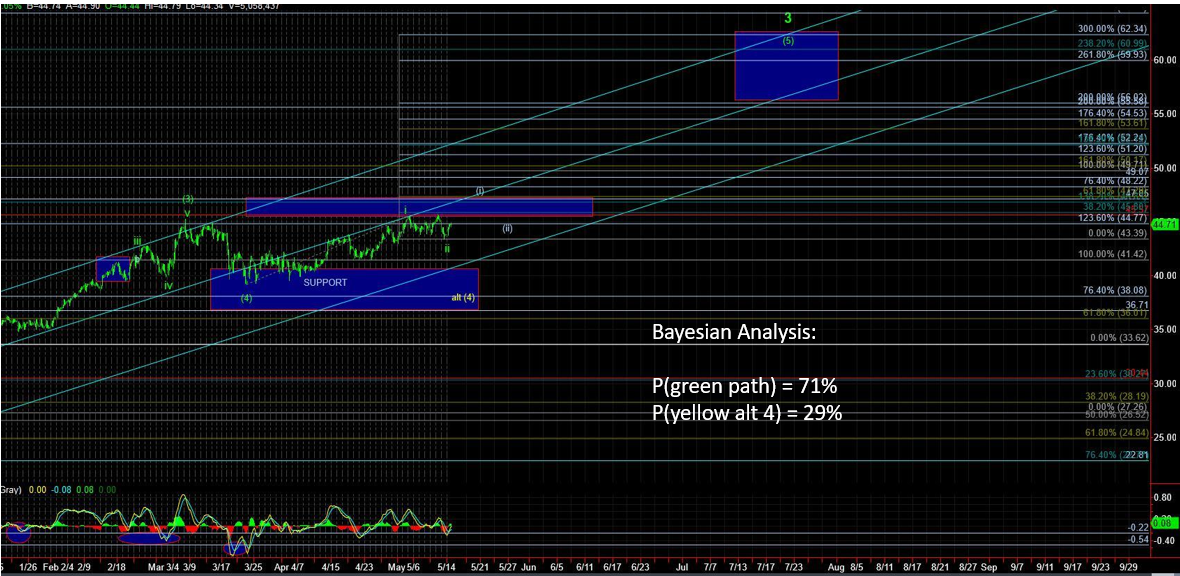

In metals, coming into a vibration window timing band. Other than that, the following applies: Bayesian analysis identified GDX remaining in a corrective chop (vs. a more immediate bearish leg), and so we hold onto our longs and look higher. Back above 38 points to 40. Other than that our GDX ATM continues to hand out cash for members following along, with cumulative returns over 100% in 2021. We’ve got a "vw" opportunity coming up early this week, so let’s be on our toes for profit-taking in a relative higher, or even better, a violation!

Bottom line: Sitting on another batch of GDX profits, BPs support higher targets closer to 40; but, we may sell at any time (all real-time signals will be posted in the room per usual).

In oil, nothing to add, as the BTS (Bayesian Timing System) has correctly traded USO. The BTS continues to hold USO thru all of this chop and sees another bullish leg commencing on the horizon. With that said, my Bayesian-only work points to a potential 2021 high being hit within this swing timing window. For now, we hold our longs and then we’ll see.

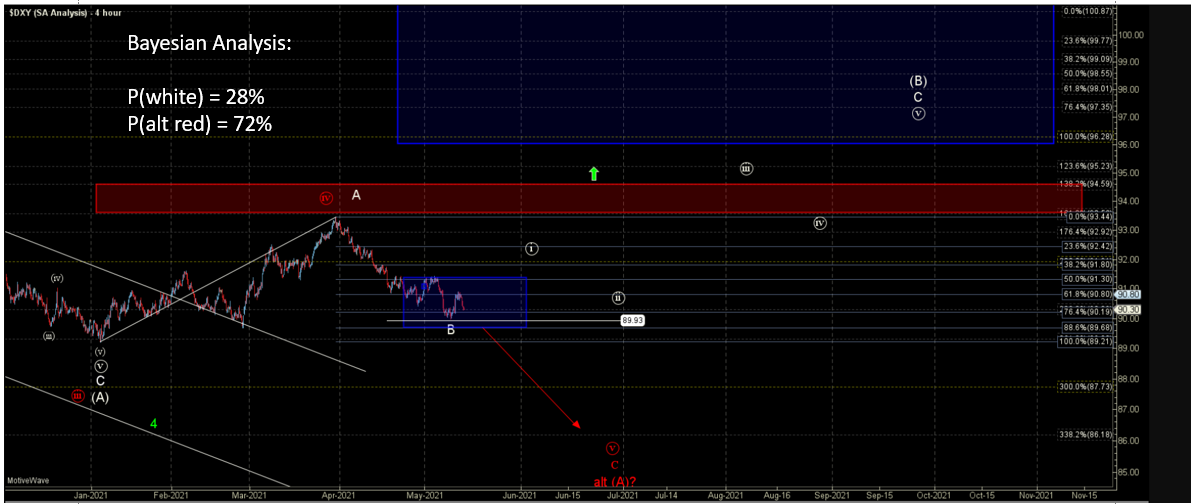

In the dollar, with UUP unable to get back above the 24.40s, it does appear another down leg is on deck. Target is new 12-month lows.