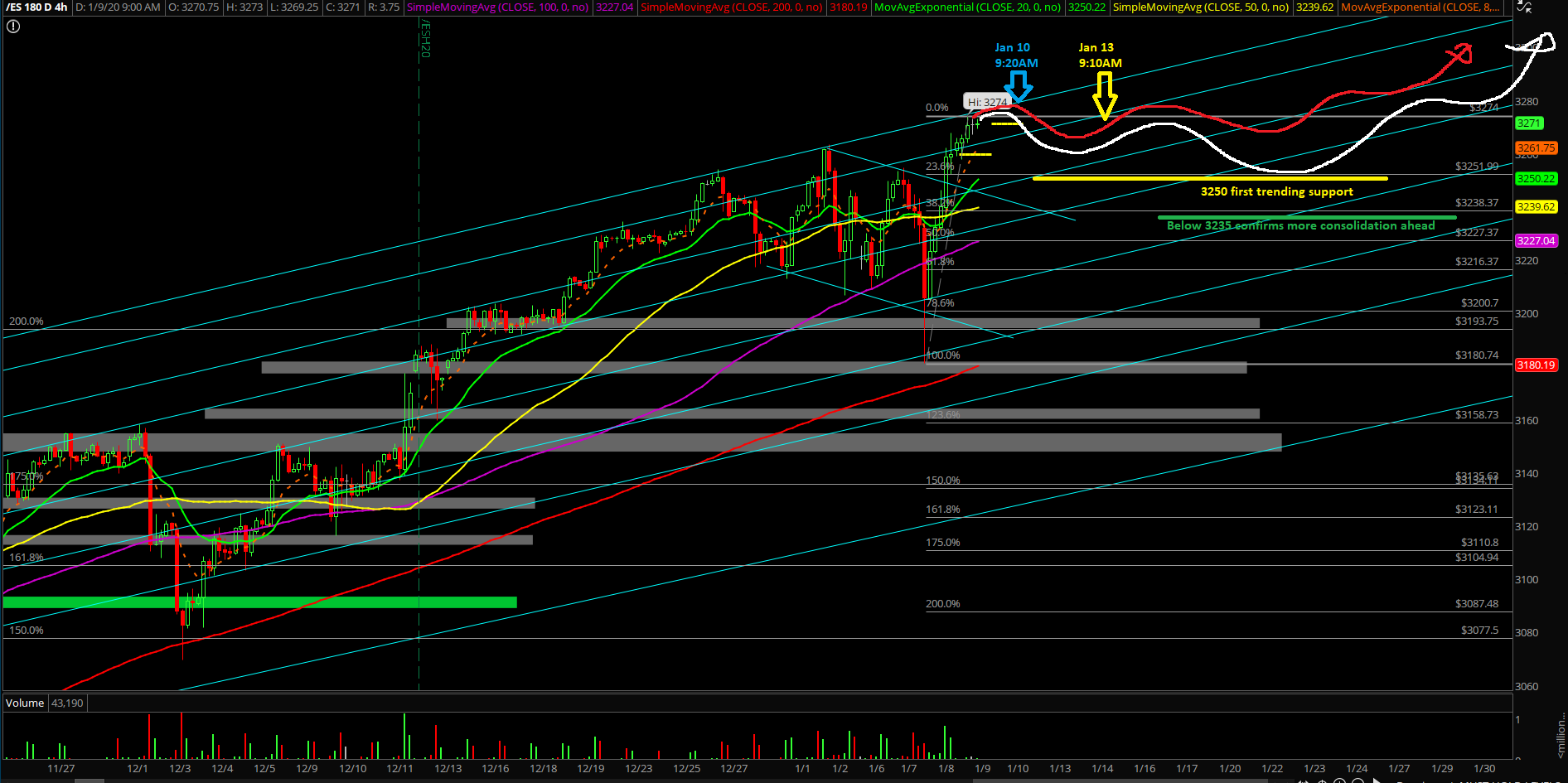

Bull Train Resilient - Market Analysis for Jan 13th, 2020

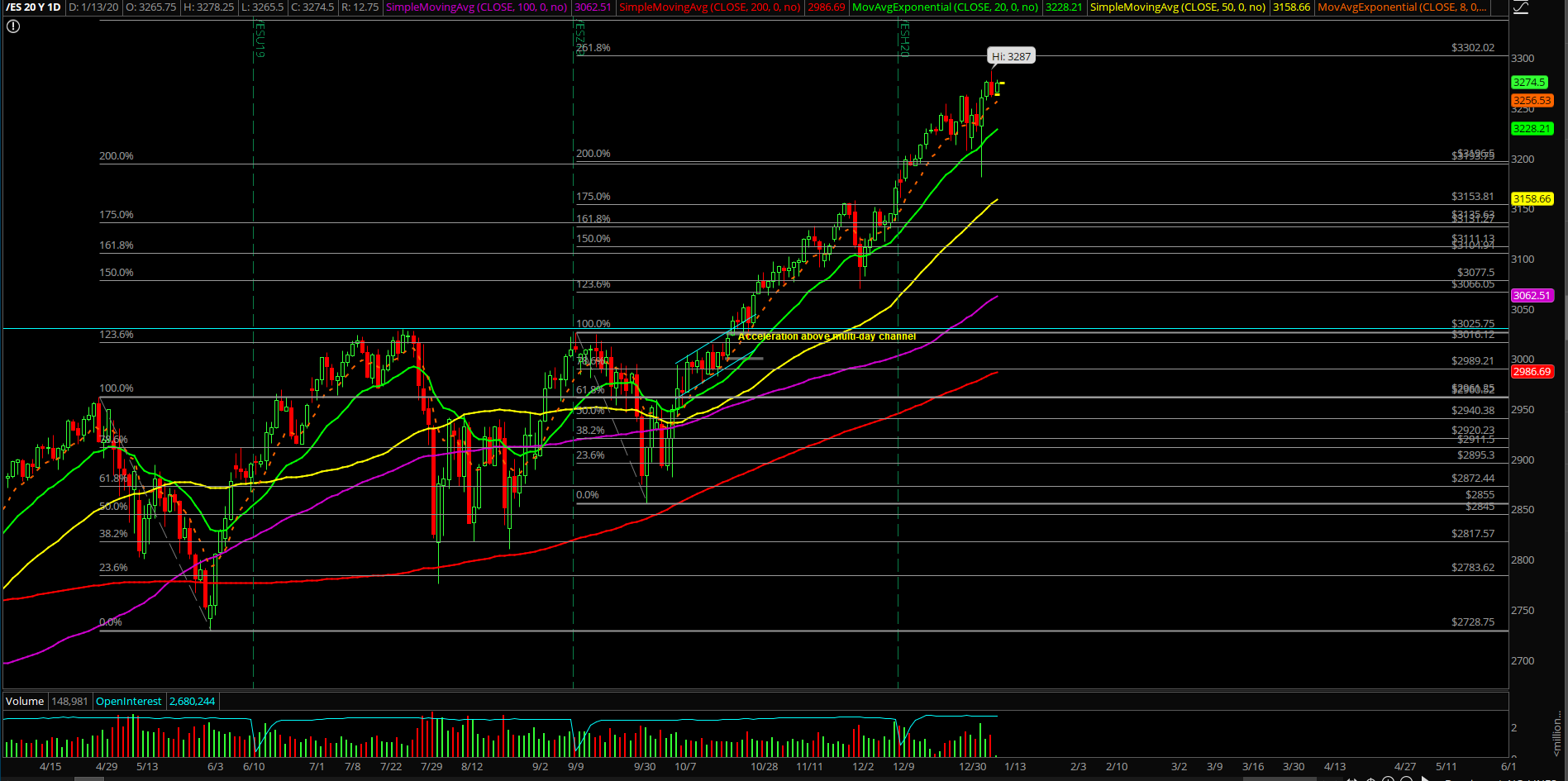

The second week of 2020 went somewhat according to our initial expectations heading into the week as the price action showcased the rangebound playbook during the early part of the week and the adapted. If you recall, the market made an executive decision during midweek Wednesday by establishing a massive bull engulfing candle that stick-saved against one of our key trending levels (3177) with the 3181 weekly low. This led to a quick V-shape recovery back into 3265~ prior all time highs and then the subsequent breakout into the continuation targets toward 3280/3300.

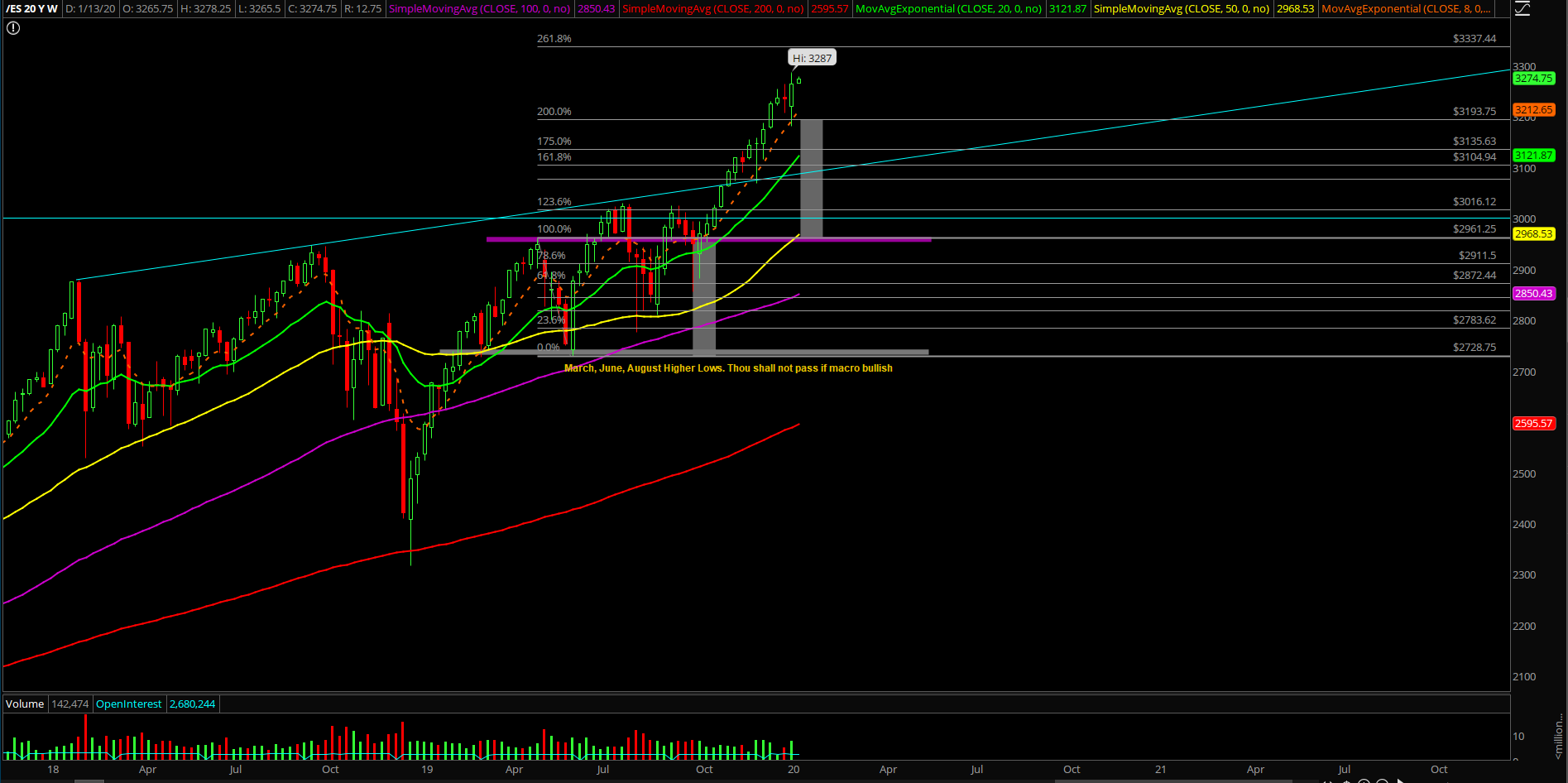

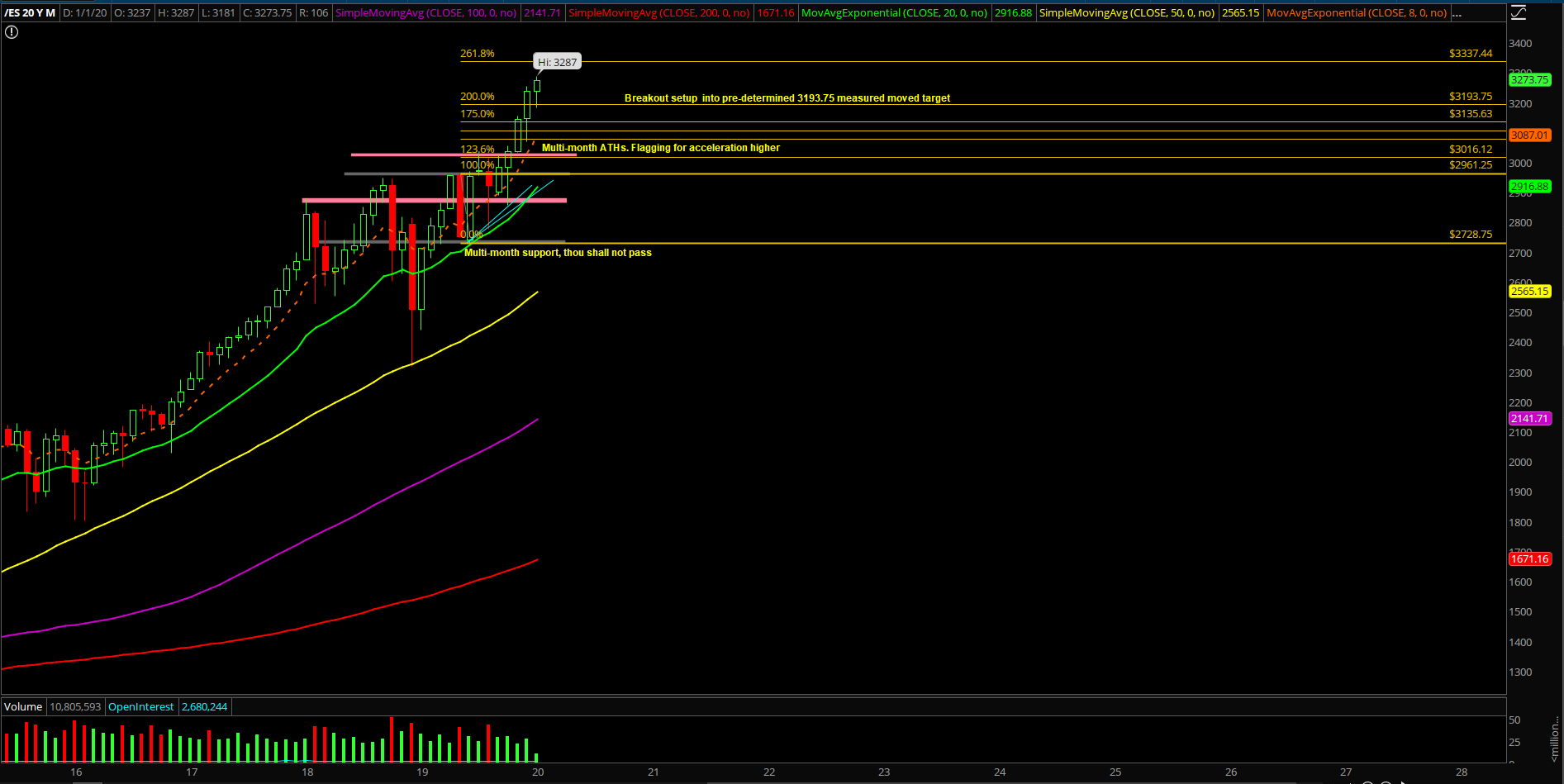

The main takeaway from the week was that the bull train remains quite resilient and doing everything in its power to uphold the ongoing daily8/20EMA momentum trend since October 11, 2019. Until price action actually closes below the moving averages in a decisive manner followed by at least 3 sessions below it to maintain momentum, then it’s really just déjà vu again and again. Essentially, it’s been the same old grind-up structure and game plan every week now with just different levels.

What’s next?

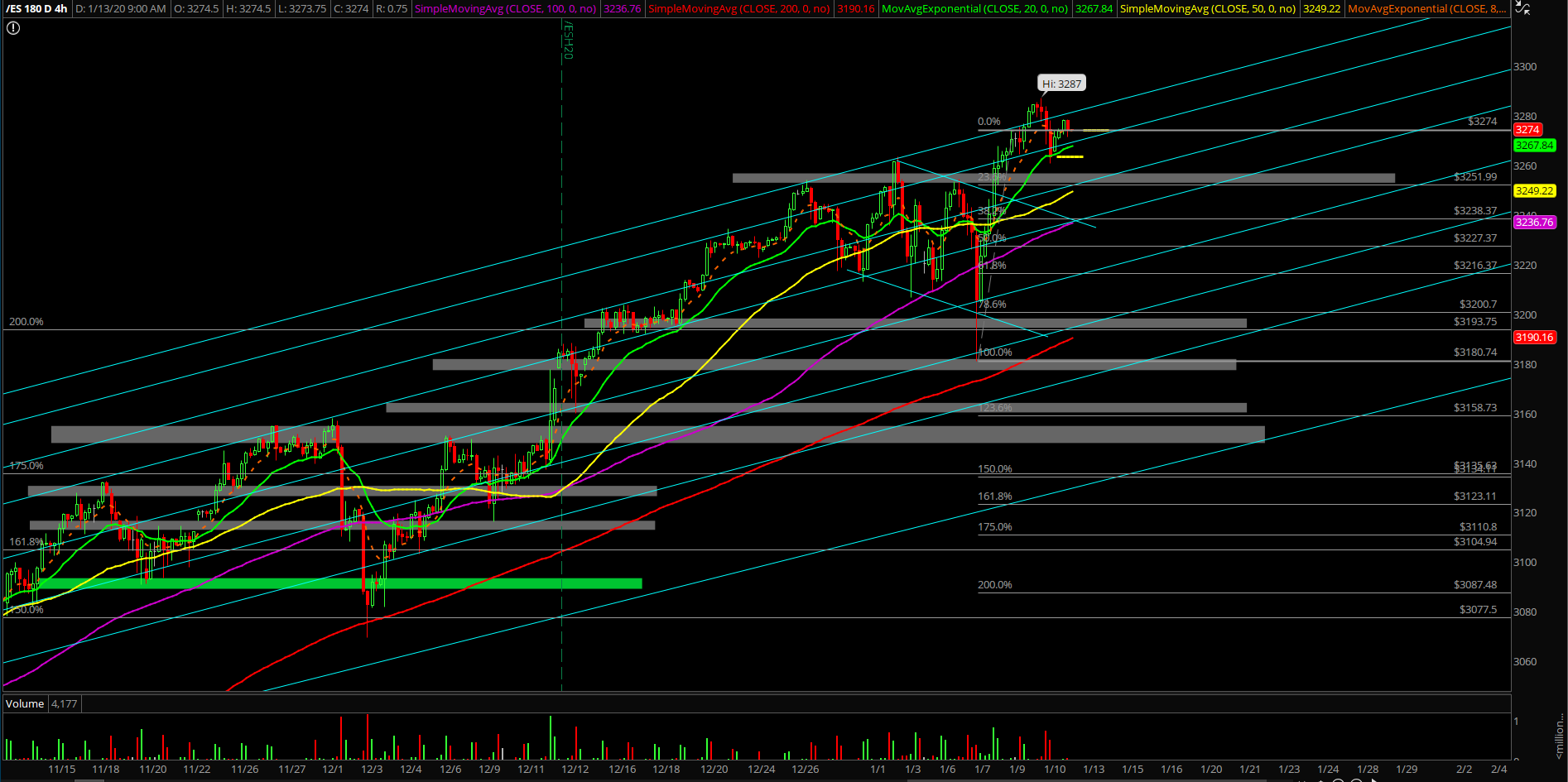

Friday closed at 3263.5 on the Emini S&P 500 (ES) and price is just grinding in a horizontal manner after the 3265 breakout into the 3280 target. Remember, when price action does this above the key micro trending supports such as 3250/3260~, it is just a high-level consolidation that lets a lot of the MA’s and internals play catch up for the eventual likely outcome given the insanely strong prevailing trend conditions.

Here's a section from our pre-market ES game-plan report:

- Treat today as an inside/range day given Friday’s small top pin bar showcasing the 3287-3260.75 range that may need to be digested for a session or two

- It also allows price action such as internals and MA’s to play catch up

- If we zoom out, it’s been the same old daily 8/20EMA trend for the past few months and until mythical creatures/bears are able to decisively break below it…then we’re pretty much stuck with the same game plan and strategies for trading this textbook structure according to the rules

- For now, the market is following our 4hr red line projection given the structure of the grind up and it remains valid until supports actually break or when we see the odds change

- Again, when trending above 3250 then the targets remain the same at 3280 and 3300 via our level by level approach

- Friendly reminder, quality>quantity in this environment when price action is now hovering around on top or at the top end of the boll band and keltner channels on the most important higher timeframes such as weekly, monthly and quarterly

- With the breakout above 3265, the rest of January range has opened up to 3337 upside from 3155-3265 given our current calculations (Jan low could very well be in already at 3181 though)

- Bull train is back in full control right now on all key timeframes due to the structure of Jan 8th Wednesday’s massive bull bar stick-save, this means that no direct shorting is allowed…only hedging vs. portfolio approach is appropriate when above our key trending support levels

What are the key levels to be aware of?

- Resistances 3280, 3300, 3305, 3312, 3320, 3330, 3337

- Supports 3265,3250,3235,3225, 3215,3208,3200,3190 ,3177, 3172,3165,3158, 3150, 3140,3135, 3125, 3120, 3117, 3112, 3107, 3100, 3095, 3082, 3074, 3063, 3050, 3035, 3030, 3016, 3000

Trend day vs. range day?

- Likely another digestion/grind up bias day focus when above 3260~

- Today is all about the digesting last week’s move and trying to stabilize horizontally in the established range in order to eventually grind higher.