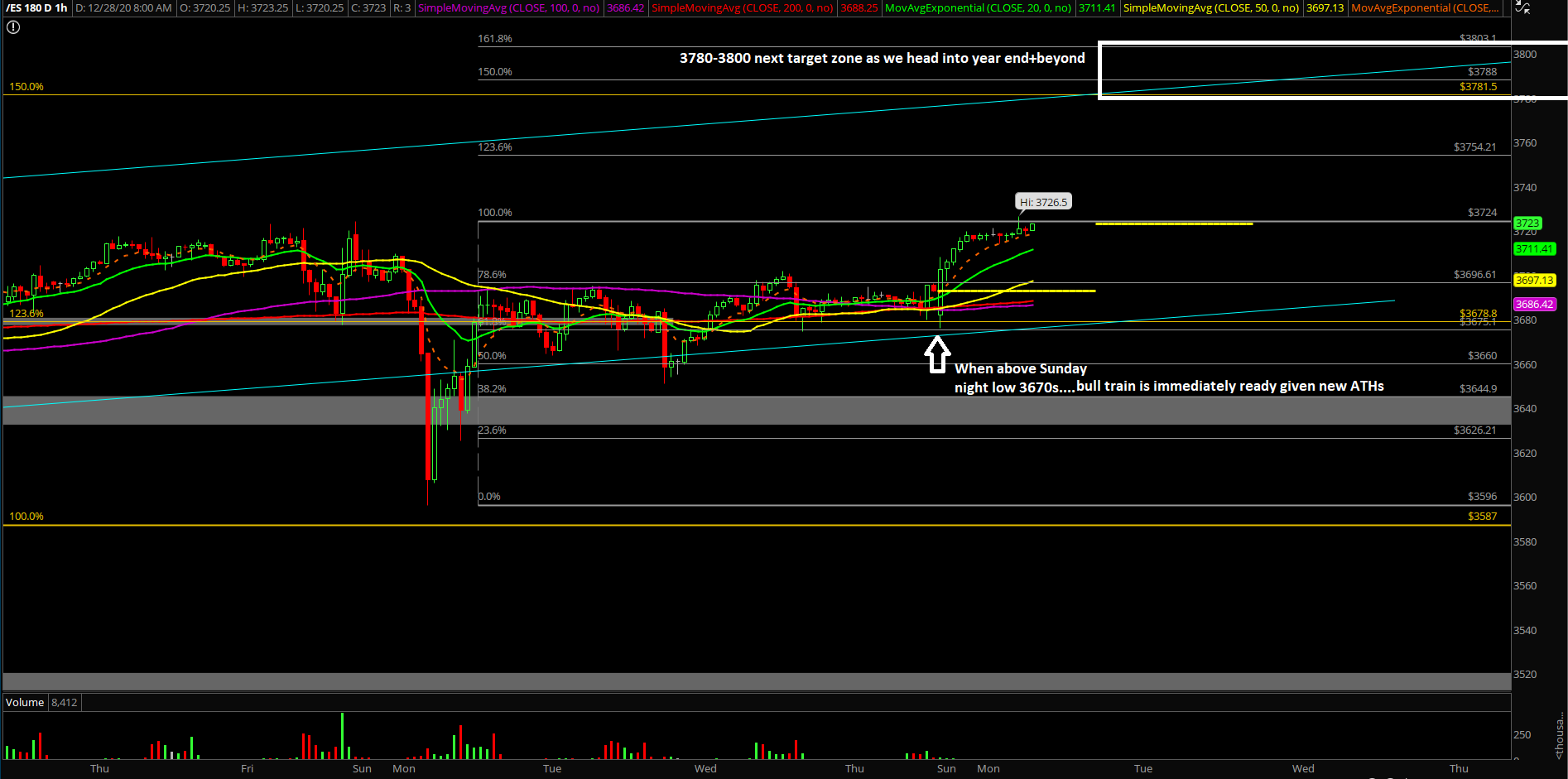

Bull Train Poised To Accelerate

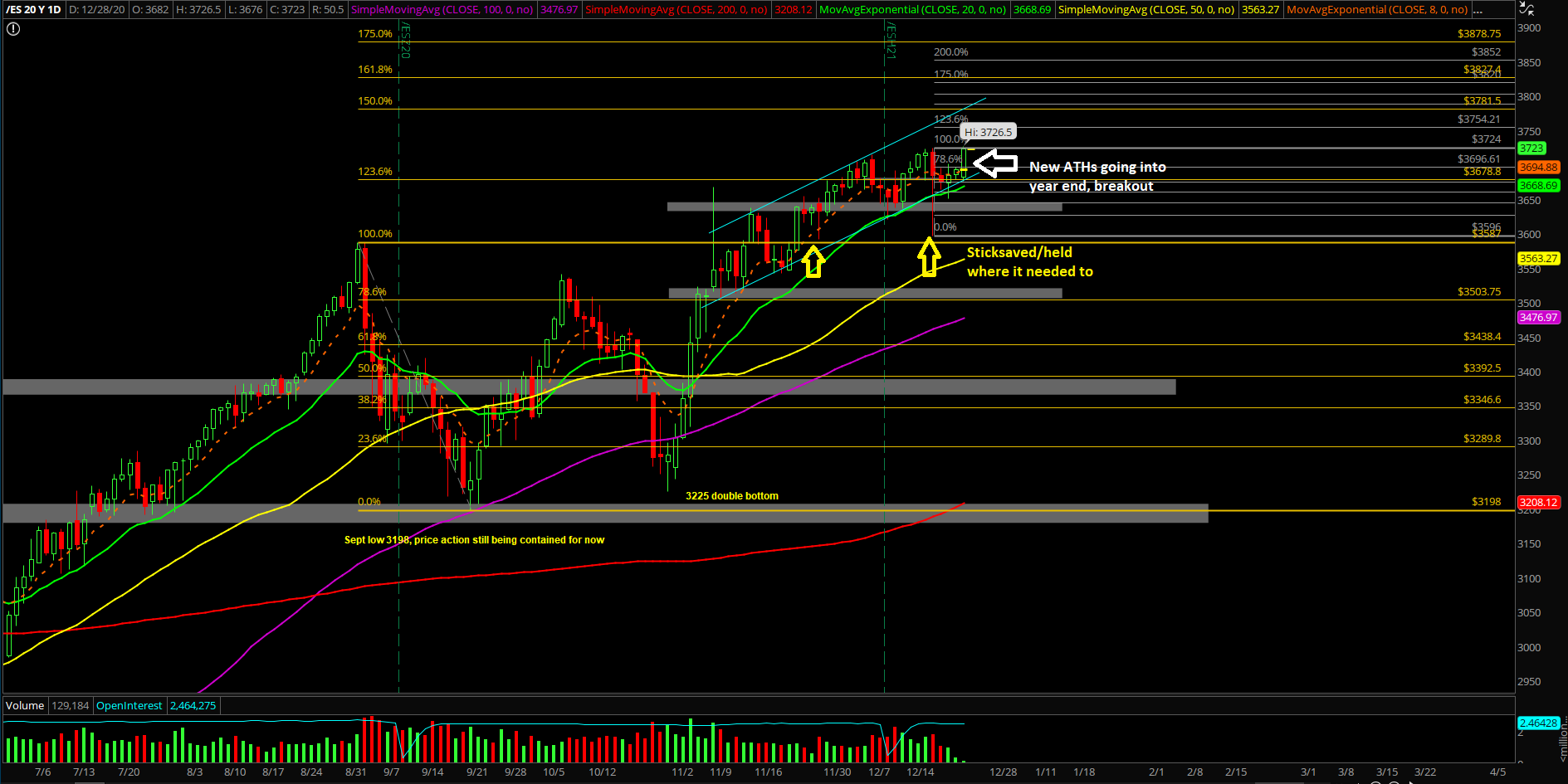

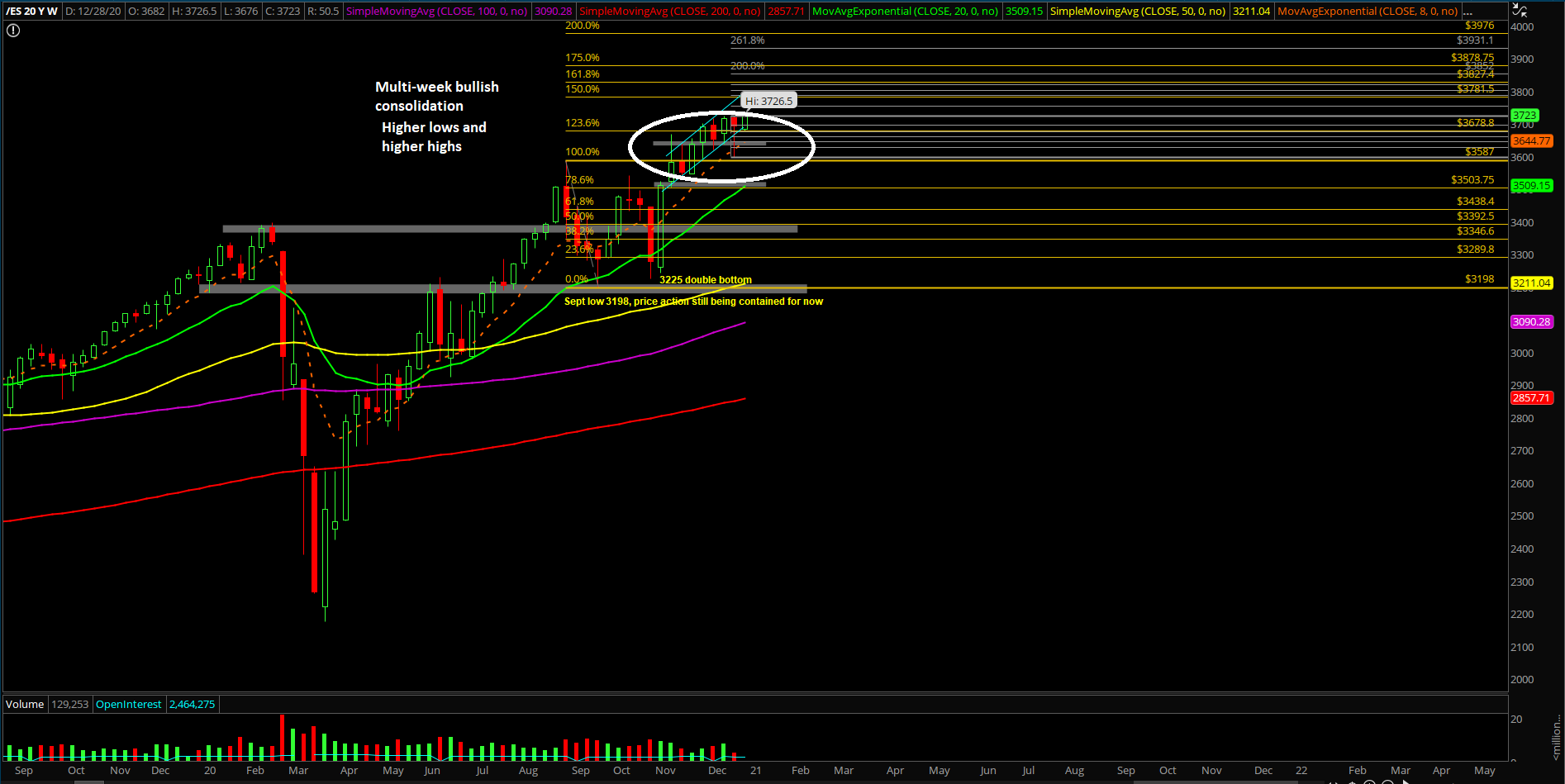

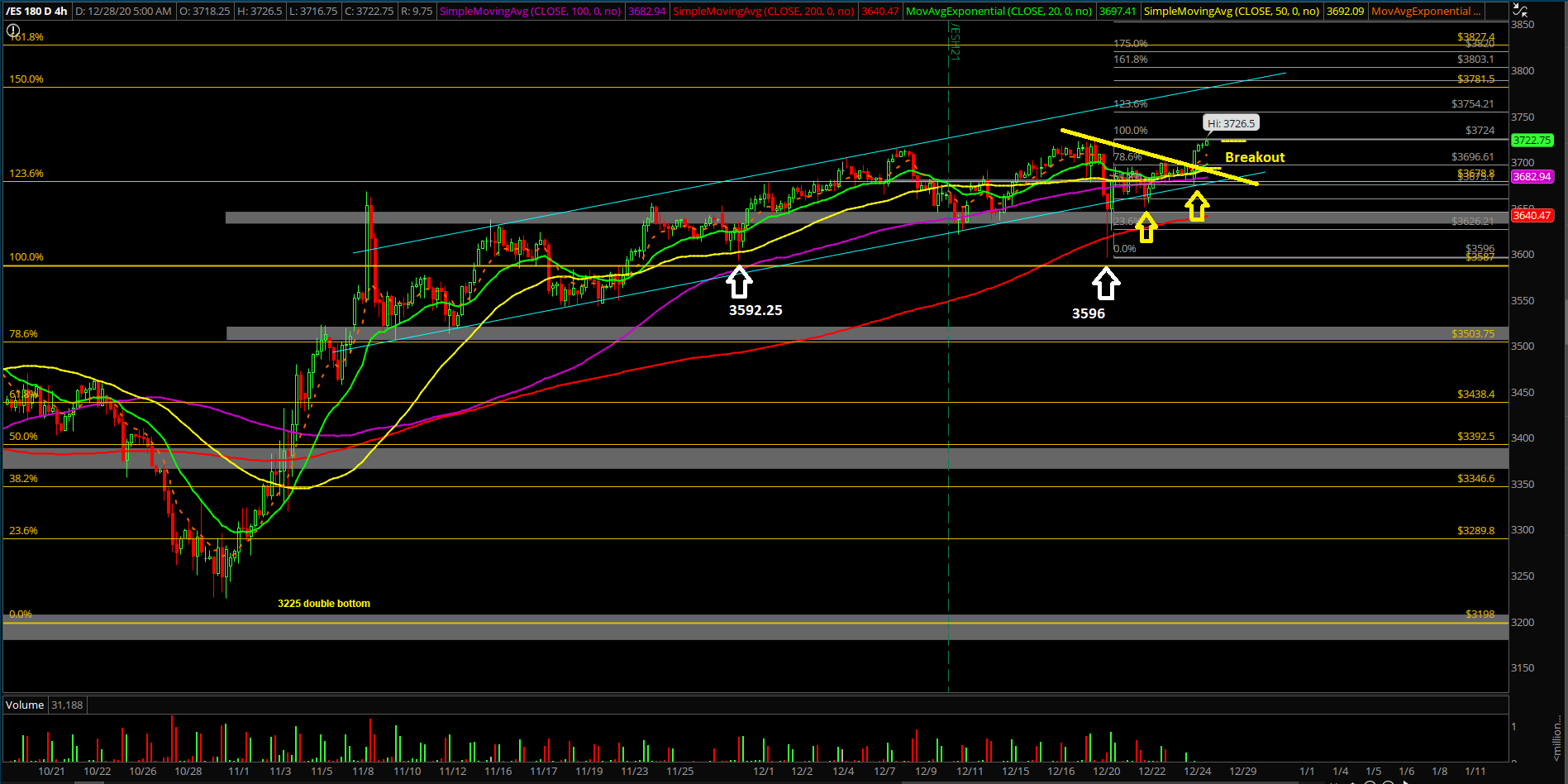

The fourth week of December played out as expected given it was just a consolidation setup within the multi-week basing pattern. It allowed price action to catch a breather in order to try its best to ramp up into year end highs to cement the yearly closing print at/around the highs of the current year. If you recall, price action shook out some weak hands with the prior week’s low at 3596 on the Emini S&P 500 (ES) that double bottomed vs 3592.25 key pivot from the Nov 30th low. The rest of the week was just about forming higher lows and higher highs and remaining coiled as we head into the year end week.

The main takeaway remains the roughly same from the prior reports. As of writing Dec 28, the multi-day bottom/consolidation playing out per expectations and Sunday night made a new all time highs. This means that the bull train is ready to immediately accelerate higher if it could sustain the momentum during RTH. The heavy lifting has been done during the Sunday night price action so rest of today or this week could be quite easy consisting of consecutive higher lows and higher highs.

What’s next?

Friday closed at 3692.75 on the ES, around the top 25% of the prior week’s range indicating that any selloff attempts were dismantled and bought the dips quickly. For reference, prior week’s low and high were 3596-3724. No surprises for this train conductor going into year end here as we’ve been saying the same thing for the past 6 months. The results speak for themselves.

Summary of our game plan:

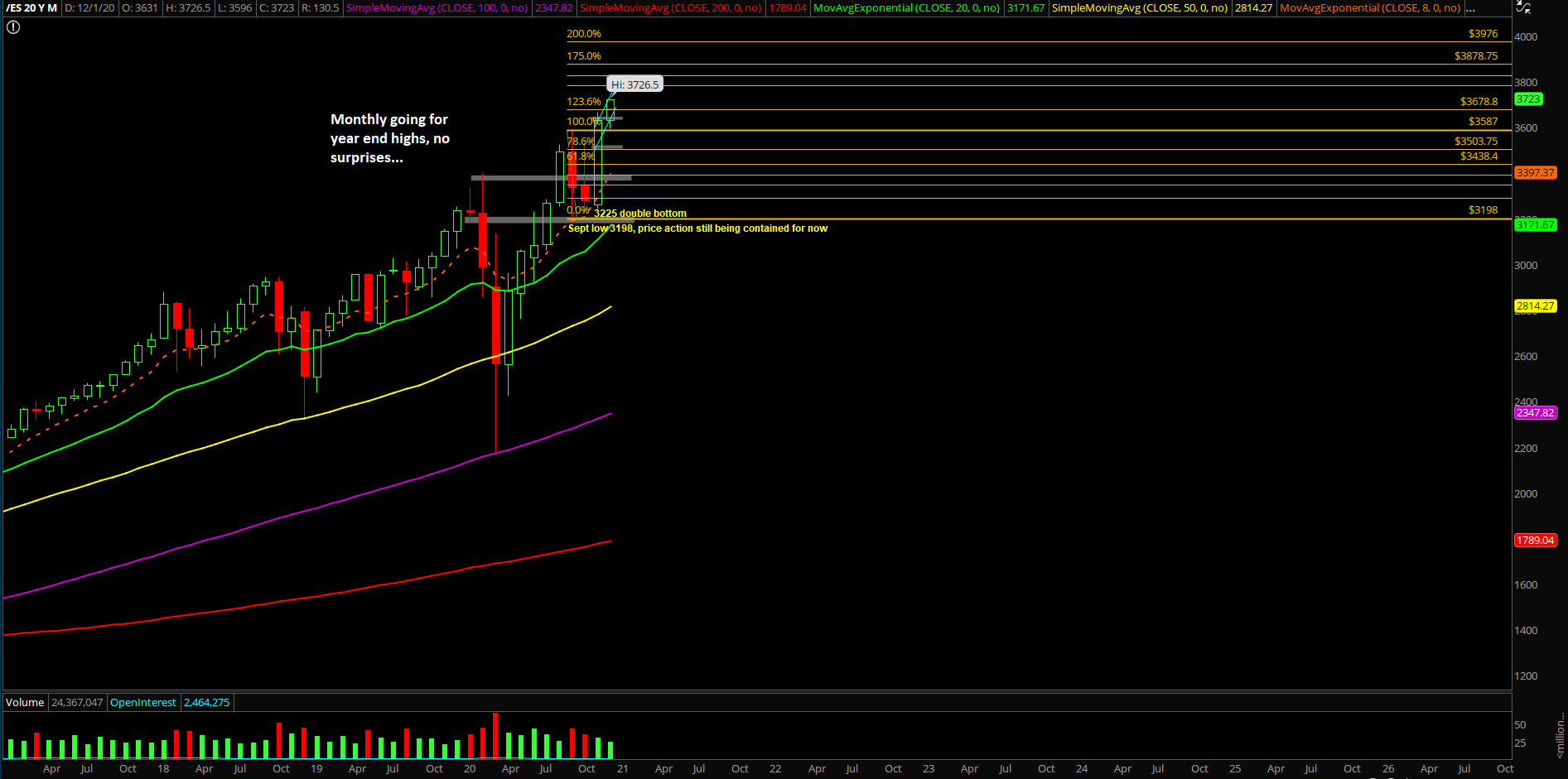

- If you recall, we’ve been saying the same thing for the past few months since the April V-shape reversal setup. It’s a bull train going for year end highs and here we are about to open for the final week of the week at new all time highs. No surprises from this train conductor ;).

- 3676 could be the week’s overall low area so our mission is to find the RTH LOD setup once the market opens, which typically would occur around 9:30-11:00AM ET

- Don’t overtrade in this juncture because it’s a slow grind up environment until price proves otherwise.

- All you need to do is figure out whether you want to ‘set and forget’ and ride the bull train into year end or the first week of Janurary 2021 or do quick morning scalps, or a combination of both.

- Friendly reminder, seasonality suggests a typical bullish grind up into first week of Jan per historical stats and this seems to be the case given today’s gap up open.

- From prior reports: at this point, it’s very clear that bulls are doing a multi-day basing setup and then rinse and repeat the grind up into year end. (price action is confirming this rotation).

- In reality, the market followed our expectations as it consolidated with a solid base during the past few days and now it’s working on sustaining the breakout above the 3724s (the prior all time highs).

- At this point, anything above 3676/3700 are considered buyable into year end/first week of Jan.

- When below 3676 means that you ought to be cautious again as price action changes, you adapt.