Buffett Says Don't Do Stupid Things - Consider These Instead

Summary

- Warren Buffett has seen many people do a lot of stupid things.

- Why is investing in the stock market viewed as gambling?

- We examine Mr. Buffett’s thinking and discuss its application to your portfolio.

Recently, CNBC interviewed Warren Buffett to understand his views on the market, specifically about cryptocurrencies. The Oracle of Omaha doubled down on his opinion that Bitcoin and other cryptocurrencies were essentially worthless.

“I’ve seen people do stupid things all my life. And I really empathize with that. I mean, people like to play the lottery. … People love the idea that they’re going to make more money tomorrow. It really drives them crazy if their next-door neighbor is making more money. The gambling instinct is so strong.” – Warren Buffett

Warren Buffett has always been a strategic investor who found value in companies that others overlooked. He's also been a very big fan of collecting dividends, even if he isn't a big fan of paying them. While I don't believe in blindly imitating a famous investor, I believe in applying principles that they have used to create their wealth, in ways that suit me. Today we will look at two funds that provide regular income streams into our portfolio through their exposure to outstanding sectors with tangible assets. Let's dive in!

Pick #1: THQ - Yield 7.2%

Tekla Healthcare Opportunities Fund (THQ) is a Closed-End Fund ("CEF") that specializes in the healthcare sector, including pharmaceutical companies, healthcare providers, medical equipment companies, medical technology, and even real estate.

The U.S. consumer is aging, and the demand for medical care is rising. Additionally, the Baby Boomer generation is, on average, much wealthier than their parents. They have a greater ability to pay for elective medical procedures than prior generations making this sector very promising for long-term investors.

At current prices, you can get an immediate 11% discount and enjoy a much higher dividend yield than you would receive from buying its underlying companies directly.

Pick #2: USA - Yield 10%

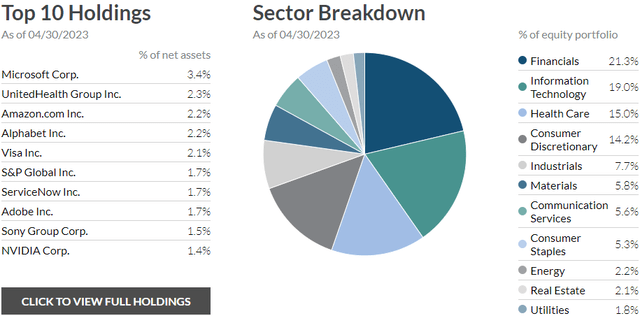

Liberty All-Star Equity Fund (USA) is a CEF that invests in diverse stocks. USA is a CEF for investors looking for broad exposure to the market, and the fund will generally follow the market indexes. The CEF splits its capital among five different managers; three utilize a "value" style approach to the market, and two utilize a "growth" style. The result is a fund that is diversified among stocks and strategies. Source

Liberty All-Star Funds

USA maintains a variable dividend policy tied closely to its NAV. Investors can be assured that USA won't overpay and cannibalize its portfolio while also knowing that when the market recovers, the dividend will be raised.

USA trades at a slight discount to NAV, making it a great time to add to this holding and collect your income while you wait for the next bull market.

Conclusion

Many of us approach the market to try to score the next Netflix, Facebook, or Amazon, hoping that our losses will eventually be wiped away in the massive success from some home runs. This is exactly why the stock market has a reputation for just being gambling.

Despite that reputation, the stock market is the single greatest generator of wealth the world has ever seen, and there are several companies suiting different investment strategies. For me to hold a company or investment, it has to pay me to do so; I am not worried about what the prices tomorrow, or in 5-10 years, because my pocket is periodically filled with my cut of the company’s profits.

My retirement will be paid for by the market. I'm not looking to gamble or do dumb things. The Income Method has helped thousands of investors achieve success in the market, and it can do the same for you.