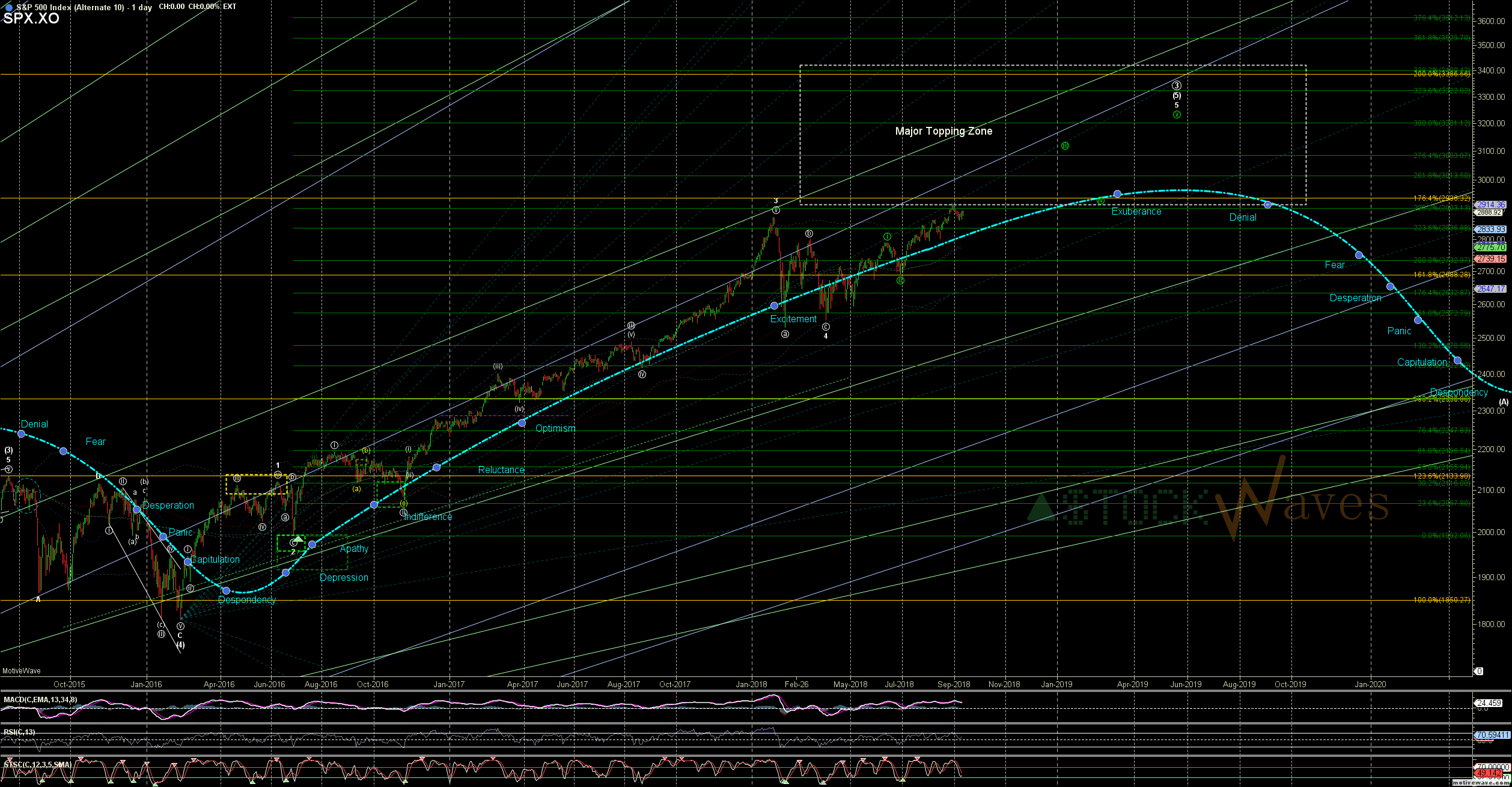

Breakout or just a new swing high?

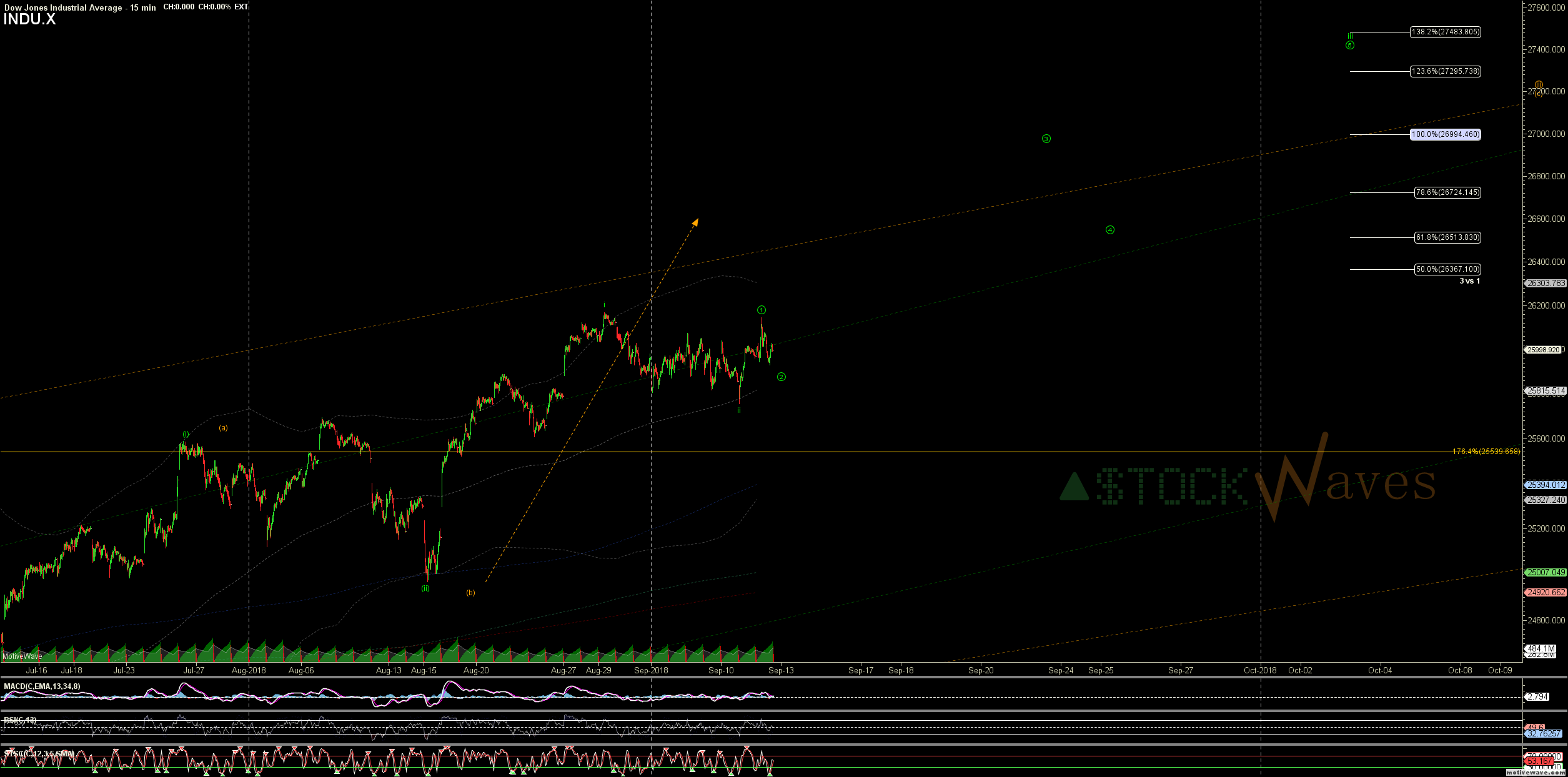

I am on the Dec contract now.

The price shifted 4-5 pts at the 6PM open. That is not a "gap up" last night in ES, though an open ~here would be a gap up in SPX.

Though not yet confirmation of a breakout or even an impulsive start to a new swing high in any pattern, there are a number of charts that can provide "fuel" and others that can "finance" or supply "industrial" level support for a stronger move than many expect*. That said I think it is still prudent to plan index trades with only the next "Pirate Ninja" target regions in mind and not "rely" on longer term follow-through as well as continually ratcheting up support. We are in the final stages of the P.3. The Intermediate wave (5) off 2016 low has reached substantially higher than the (3) into the yellow 176.4% fib, the Minor 5th of that (5) is already proportionate to wave 1 of (5) and is higher than the Jan top of 3 and it is possible to count an ED complete. That does not mean hide in a bunker yet, but one must maintain an awareness of where we are and not get swept up in the "Exuberance" of this possible "last hurrah".

*If you do not know what charts I am talking about you should really consider trying out StockWaves!