Bounce Should Be Seen

Over the weekend, I highlighted the GDX chart, and outlined a VERY important support level, which is highlighted by a blue box on the attached 60-minute chart. Today, we have struck that support. Moreover, it looks like we are completing a 5-wave move down into that support from the high struck in early August.

Now, if my micro count of 5-down is correct, it means we should see AT LEAST a bounce in wave [ii] in red. And, that is the more aggressively bearish pattern. And, personally, I think I am going to be adding some hedges at the wave [ii] target zone for protective purposes. While I cannot put out that target box until we actually bottom in this move down, I am guestimating it will be in the 33-34 region.

But, as I warned, if the market is unable to bounce from this support, and we instead directly break below the support region, then this box will become our resistance zone on a wave [iv] bounce, and it would suggest we are likely heading down to the 21 region for the larger degree 2nd wave in the GDX.

And, if you are asking yourself if the immediate bullish potential is now dead, I will reiterate that it is on life-support. I MUST see a VERY clear 5-wave impulsive rally before we break below the March low for me to consider that potential again. But, if the next rally is CLEARLY corrective (or if we see a direct break of the support region), then I will be changing the priority of my counts, and will make the drop to the 21 region my primary analysis.

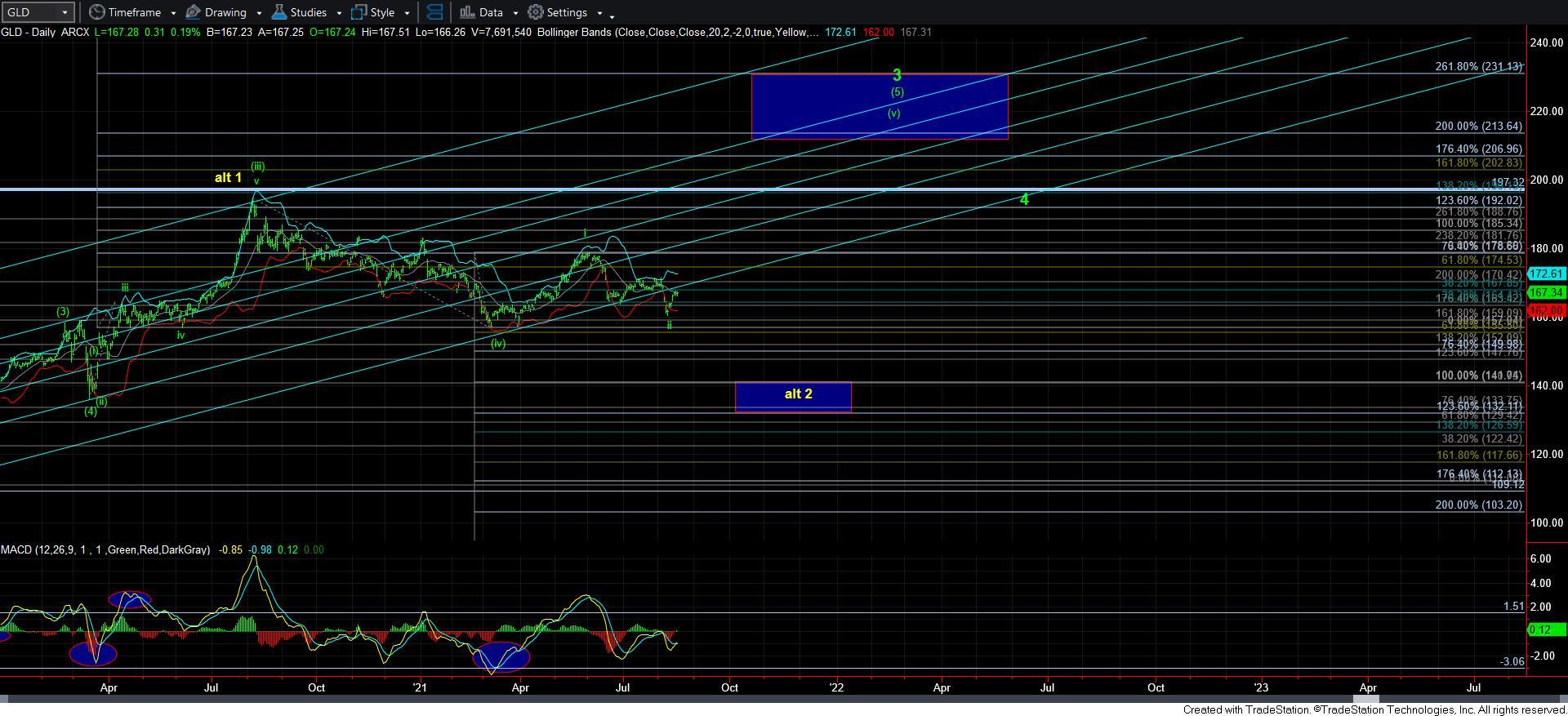

In the meantime, gold is still potentially going to push higher one more time into the resistance zone – as long as we hold the wave 4 support box. The rally off last week’s low is clearly overlapping, which is strongly suggestive of a corrective rally. For this reason, I am viewing this as potentially bearish, unless the market can break us out through the resistance noted on the GC chart. And, even if we do, it would only count as a leading diagonal, which I am clearly not going to trust with the market in this posture. Rather, I am going to need for the market to prove that to me, but we have quite a few stars which need to align for me to even discuss that potential – at least as long as we remain below the resistance on GC.

Lastly, this brings me to silver. Silver still has the best bullish potential set up, but with the way the rest of the market is postured, I am looking at it a bit askance.

So, in summary, should the market provide with clearly impulsive 5-wave rallies off the lows we should be striking in here, then I can more strongly consider the bullish case. But, if the next rally is clearly corrective, especially in GDX, then I intend on protecting my positions, as the 21 region is a real target for a bigger wave [2] in GDX.