Bitcoin/GBTC Update - Market Analysis for Jul 11th, 2019

Fallen And Can't Get Up (Yet).

It's pretty simple right now. We've seen some nice impulsive follow through on the bearish counts, and until I see an impulsive structure to the upside I'll be looking down, even to $4300 BTC and $157 Ethereum, if this market wants to roll that far, though I'm a bit skeptical it will. But let's see....

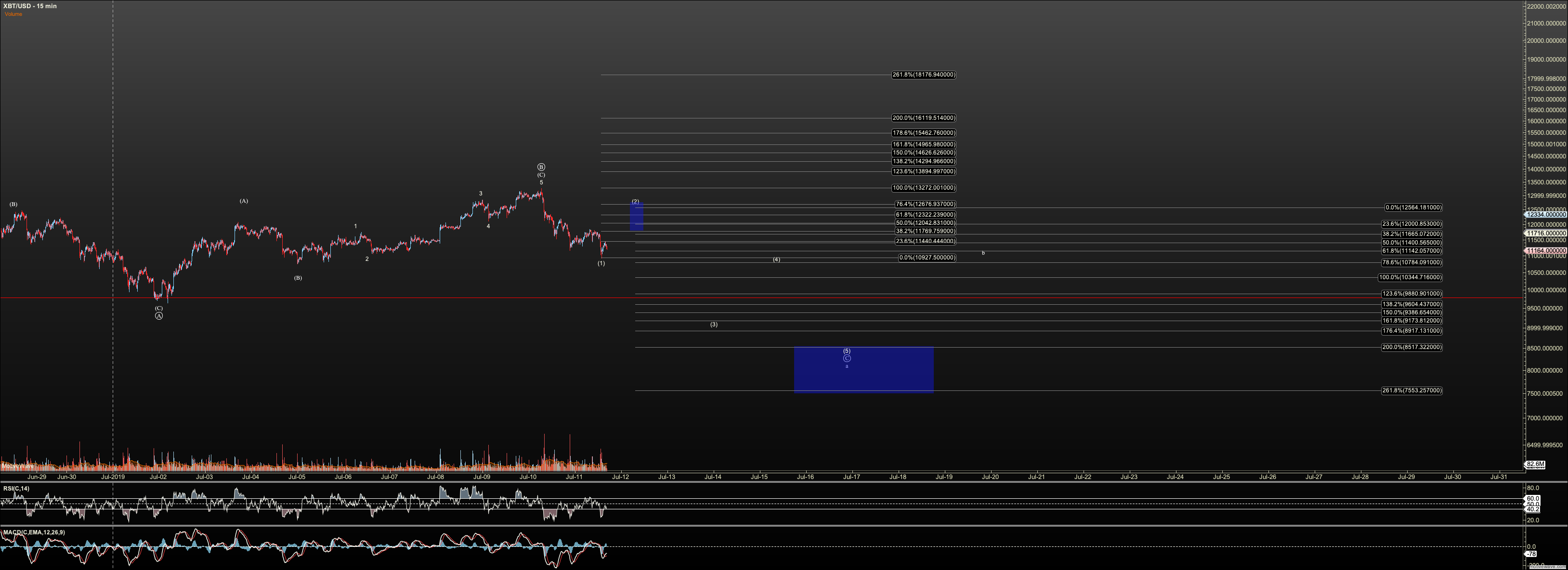

Bitcoin

I have reworked the micro on Bitcoin. While I had us in the third down this no longer makes sense as we've seen too many small corrections without that large third extension. Now, as long as it is under $12,655 I'm looking down. And now we have perfect confluence with the larger A+C and .382 retrace of the move off the December low. That is Fib Geek speak for 'High Probability Target'. This is for A of ii or all of ii to wrap up shallow. Note the alt red has come off my chart.

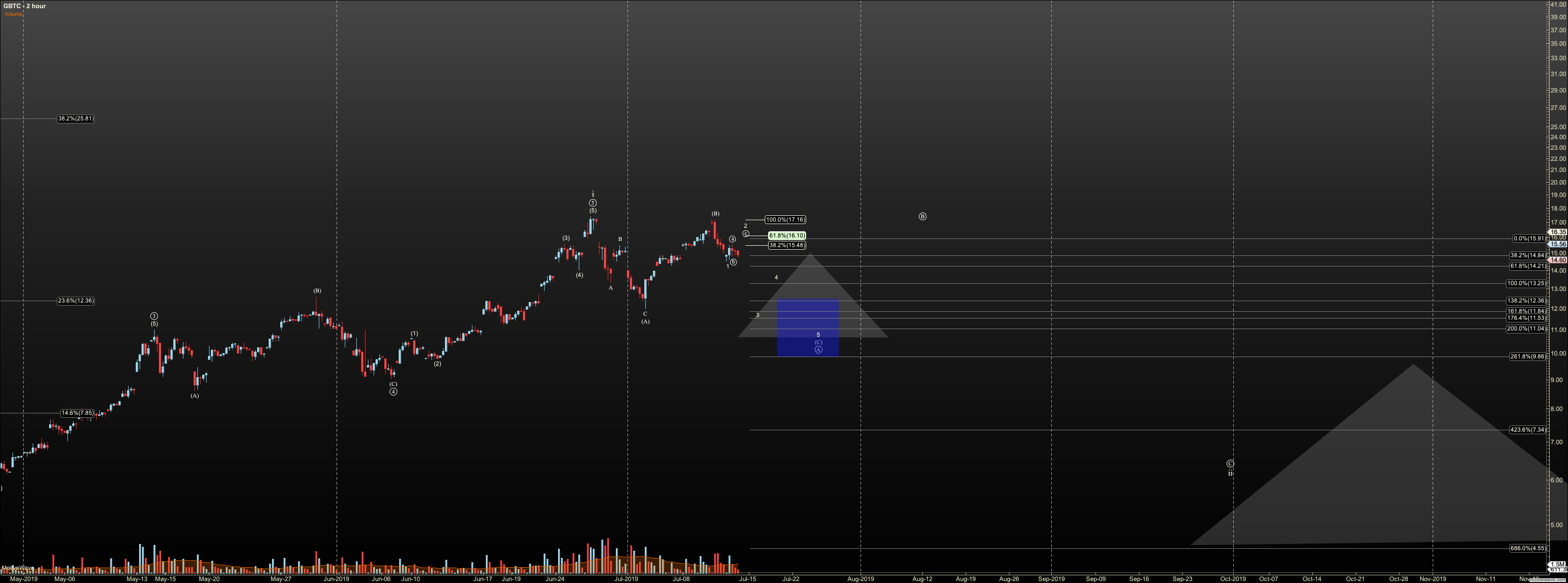

GBTC

For Bearish follow through in GBTC, I need to see $16.10 hold, and right now the normal impulsive projection aims at $11.04 for A of ii or all of ii. This also has real nice confluence like BTC with that .382 retrace.

Note: A natural question is what are the triangles. These are triangles I put on charts at EWT to note where positions should produce a decent risk to reward. And the width of the triangle suggests the relative size since cryptos are easy to scale into.