Bitcoin Update - Market Analysis for May 7th, 2020

GREETINGS from the Crypto Room

I have been very quiet in the main room after the March 12th Breakdown in cryptos. Simply put, the breakdown opened up many long term scenarios that I must now navigate. While the breakdown itself does nothing to affect my call for over $100K Bitcoin it does challenge timeframes, counts, and demands a lot more nuance in my analysis. It might be hard to follow this report if you did not watch my post breakdown webinar. So you might stop and take that video in before reading further. If you are not in the service following my stream of consciousness, it is hard to report out publicly on the nuance I see without being pedantic. Watching that video helps clarity. But today is a good day as the crypto market is heating up once again, and I don't want to see anyone hurt.

That Fateful Day

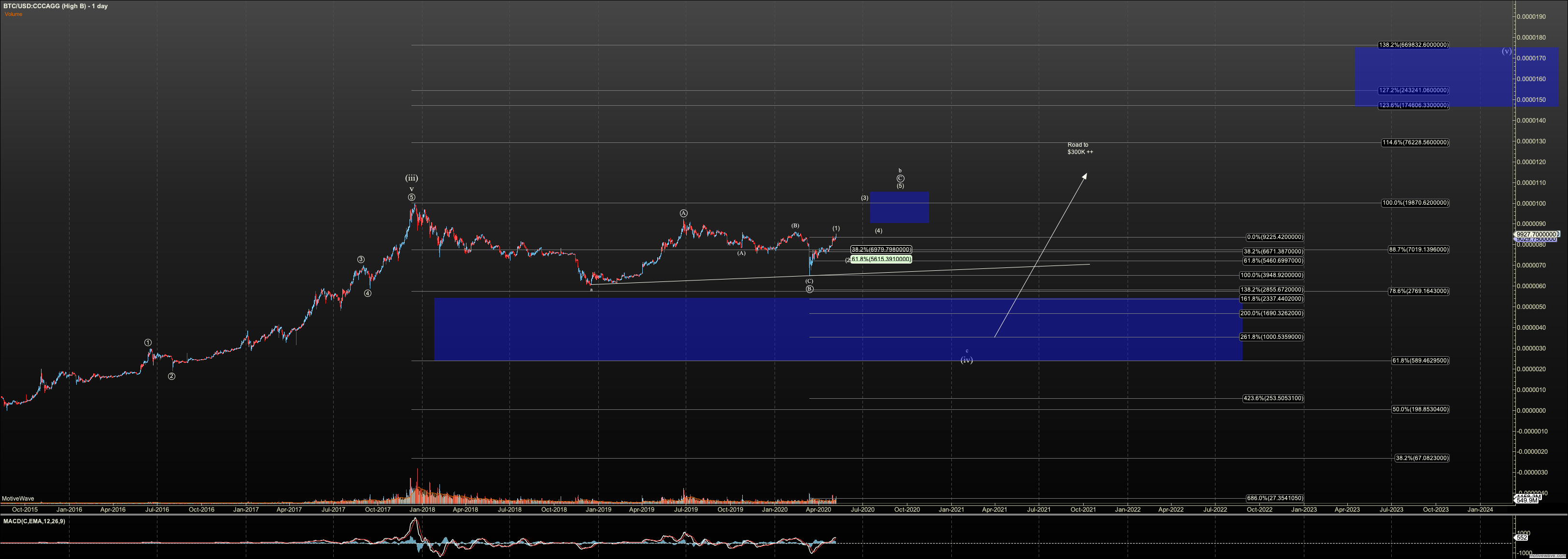

To recap prior weeks in the run up to March 12th, I was following a projection based on Avi's Fibonacci pinball work in Bitcoin, which suggested a move over $100K in Bitcoin was in the cards. Believe it or not cryptos follow his 'rules' sometimes more pure than equities. These rules led me in 2017 to turn a miserly investment in cryptos into a small fortune (before taxes), and call the Bitcoin top within a few days, as well as the $3K bottom in 2018. And finally expecting a $13,425 top in Bitcoin in May 2019, but got $13,900 instead. My perspective then was that as long as over $4300, we'd see a run to six figures. Further, on March 12th, as long as over $7125, we may have completed a reasonably shallow wave 2 in that setup and ready to go. But instead we broke down.

Now, if you were live in the room you had good warning of the importance of $7125. As I say, 'I don't trade counts, I trade the levels they reveal' . So $7125 put $4300 in sharp focus and I went short. So that break of $7125 was not the real problem, but the break of $4300 was. Further, many altcoins (which I rarely trade) broke their 2018 bear market lows. Clearly this day required a step back. In Bitcoin, we only dropped to $3700, keeping the 2018 bear market low intact. But we did drop low enough, and in light of the more severe breakdown in many altcoins, I had to look at the market with a different lens.

Per the video above I can still see an argument for a run to near six figures in the next year or two, as we did not breach the beginning of wave one. However, I had to put one foot in the bear camp as the break of $4300 suggested two new scenarios. One was very bearish with an immediate drop to $2K in my alternate long term count where we are still in primary wave four. Or, we rally in a high B wave, still in that alt count. That B wave can rally as high as $35K, though $25K is more nominal, then we can finally drop to $2K to finish primary wave four. Note in my primary long term count up until march 12th we were in wave 5 of primary wave three and that requires that $3K hold which it has, in December 2018. Don't worry, I have charts!.

Well, within 24H we came back up and invalidated a direct run to $2K so by March 13th in the service I was looking up again but with more cautious expectations.

Well today I am here to report hat I see a B wave far more likely. I cannot say for sure, but we have a warning in this currently heated market. We have not seen a reliable five waves below the .618 extension of the move off the December 2018 low. You see this level is very key in Avi's work for denoting the first of the third. While in many asset classes it seems to me this is a guideline. But in crypto, which is a purely sentiment-driven market, it is more reliable, again in my experience. So reliable it is that it has kept me out of many C waves. Well here we are below that level at $10,040 with no five wave structure. I find an impulsive third here unlikely though we sometimes see that five waves by the .764. There is a chance we see a move to six figures, but I doubt it.

Note the crypto world is falling all over itself to buy Bitcoin right now because of 'halving', where miner's rewards are cut by half. This is Bitcoin's inflation controlling measure built into the code. Classically a large move happens after halving. You'd think that my move to six figures is a given!. Not so fast. This structure isn't right.

So the bottom line is a move to at least $80K is possible in a new impulse based on the March 12 wave 2 bottom, but I am more readily accepting of a move to $25K to $35K. I'll be watching both.

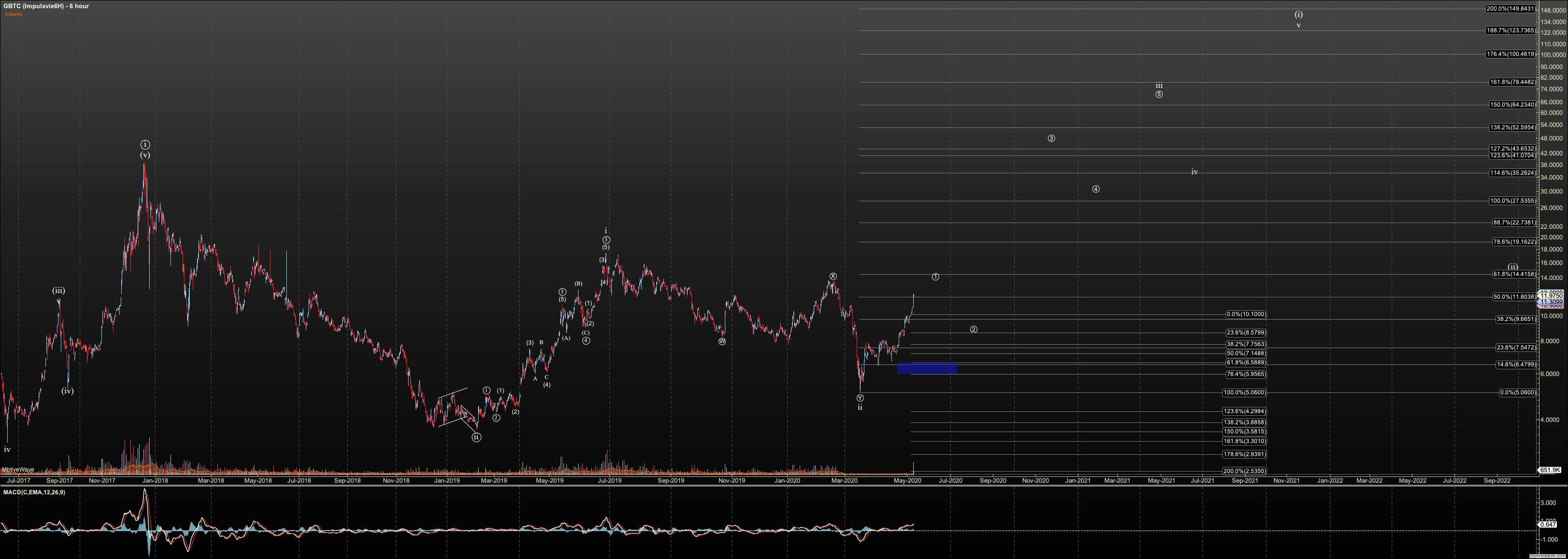

Short term the potential of an immediate top in the first wave of the C wave to $35K BTC or $44 GBTC is high. So, I've suggested subscribers cut some risk. Tonight we continue to push, and until some nano support goes, there is no top. But risk is high. I'll save supports for the crpto room as that is a report in itself.

A New Assistant for GBTC Traders

I saw a large influx of subscribers in the service before March due to my daily intraday coverage of GBTC. It trades in our brokerage account, and is Bitcoin 'with convenience'. While my 'true' crypto traders have gotten used to the overnight moves in Bitcoin, and have listened to all my overnight risk measures, new GBTC traders know nothing of this volatility. The seasoned ones should have been relatively unscathed. I know this is not true of solo-GBTC traders. I also trade GBTC and this is where I saw the pain, unfortunately in my retirement account. The problem is the nighttime gapdowns we see in GBTC when Bitcoin flushes. GBTC tumbled from the $8's's to the $5's overnight. Never mind that we are back to $11 today. The damage was done. Funny enough though, the equivalent of $4300 BTC is $5 GBTC and that was not breached. So, technically we should still talk about GBTC running to $80 to $100. But alas it will follow Bitcoin. So I have included my high B scenarios in GBTC here as well.

Given the pain in GBTC for myself and my subscribers I endeavored to add a new flavor to the service that helps in the futures This is a new algorithmic momentum signal. We are in early development. The recipe of this signal is based on some of my old trade ideas. However I enlisted the help of a friend and member, who applied machine learning to optimize the idea This idea is based on a mix of price and momentum-based indication. In backtests the signal outperformed buy and hold of GBTC by many fold. Backtests are backtests, but how does it work for real? Well to answer that question, we are in trial. I am posting the signals in normal posts. If it gains a track record we'll build it into a table with notifications. This signal, do note, loses more trades than it wins but it wins based on skew. It gains well more than it loses in backtests. In our in-service posts the first signal on 3/19 gave up 3% on 4/1 when it stopped out. The second is still live, posting an entry at $7.20 on 4/2 and now standing with a 61.5% unrealized gain. This signal avoided one of the gaps in march but was caught in the last. So, it isn't full proof. Again, it wins on skew. While I'm excited about these results, I'm not sure I'm going to include it in a table until I've seen a track record over 30+ signals. But I am trading it myself with real money in some accounts.

So, do review the charts, both the impulsive counts, and the alternate high B waves. Note the high B waves just delay the move to over six figures unless we then break more dangerous support. (I'll warn below $2K but it takes <$600 to really be dangerous). But these high B wave counts put some heat on holders (or HODLers in crypto lingo), so such folks may see their patience tried. I'll be excited to accumulate during this trying period through short term trades. But I am short term motivated.

The service itself is now geared toward managing both perspectives I have been doing this a while now and survived the 2018 bear. If you are a long term trader in crypto you need to hold some cash in case we drop. If you're like me and more short term you aren't in that drop. Just know your timeframes to take a phrase from Ricky.

Take a look and happy to answer questions.