Bitcoin: Stuck in the middle Pt.2

Bitcoin: Stuck in the middle Pt.2

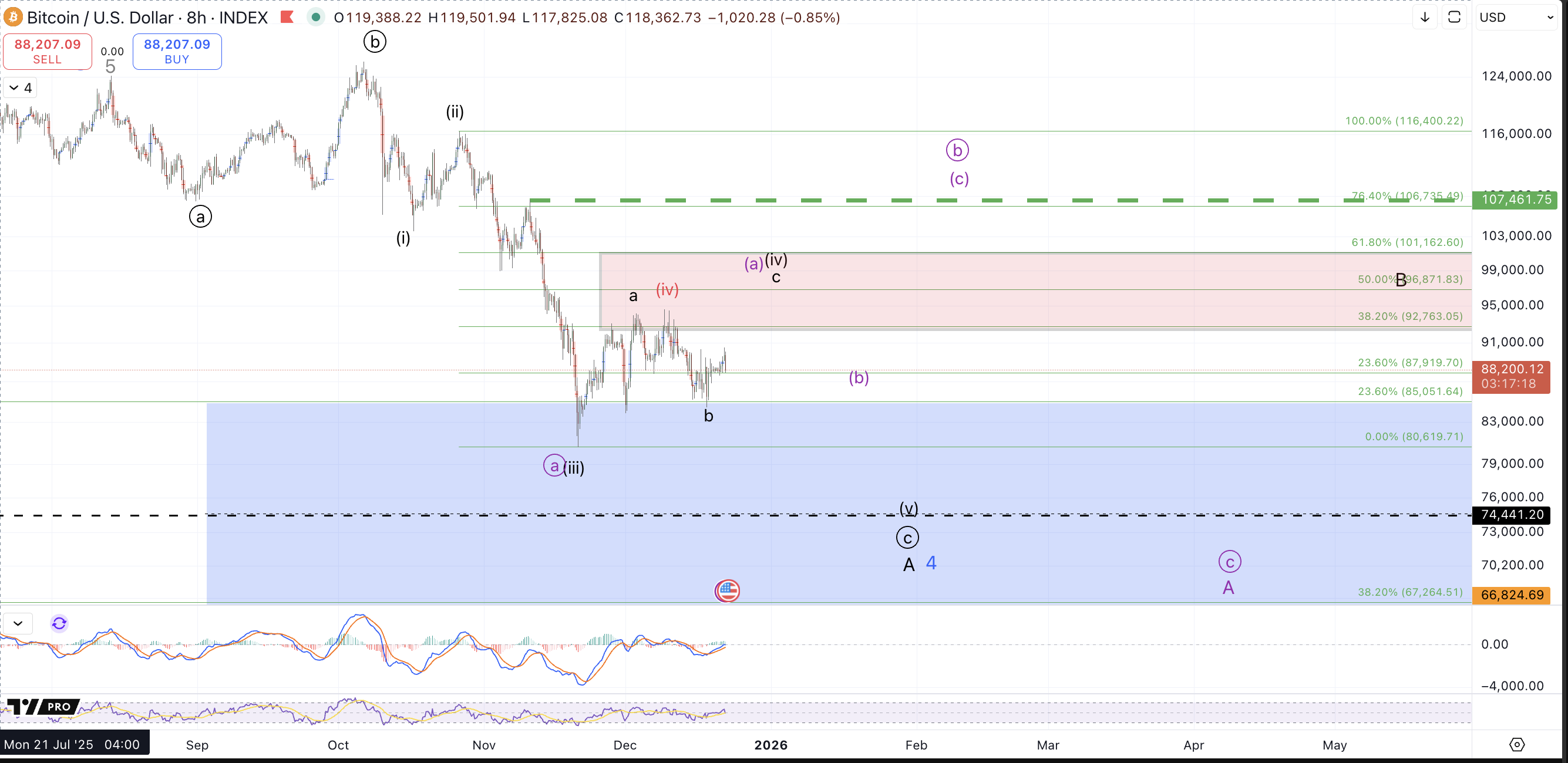

Last week's article described how Bitcoin had developed a trading range from the November low into the December high, roughly $80k-$95k. From a zoomed out perspective nothing of note has occurred in the past week considering that price remains stuck in that region. As such, our medium timeframe paths all stand intact.

The most immediately bearish count entails a top in place for wave (iv) as shown in red and price working on the fifth wave down targeting $67k-$74k. From a zoomed out perspective, this path is the tidiest for a typical look of a C wave. However the micro degree shows a subwave path that appears rather incomplete into the December high and so this path still appears unreliable until some support breaks on the micro level within the larger trading range. In the current stance this entails minimally a sustained break back below $85k to challenge the micro bullish setup.

The next most immediately bearish path, which I'm tentatively considering the primary count, shown in black, entails a wider flat wave (iv) still in progress. Opposite of the red count, this path is thus far nearly picture perfect in terms of the micro count but at the larger degree entails a very protracted / expanding diagonal wave (iv) which is also hard to rely upon. That said, notice last week's micro chart (reposted screenshot below) and how well price has followed that path thus far. This count entails followthrough from last week's bottom up to $96k-$101k to complete a very wide corrective bounce as a wave (iv) from the November low with one more low to complete either the larger A down or wave 4 down into the $67k-$74k region.

At the micro level, price will need to maintain micro support, $86.3k-$87.5k to keep this perspective favored. A move back below $85k shifts odds in favor of the red count.

Lastly we have the purple count which in the shorter term should follow the same path as the black count for a rally up to $96k-$101k. However, unlike black, the next drop should remain corrective forming another higher low to set up another leg in a corrective bounce higher to the $107k-$117k region in a bigger circle b.

As mentioned above all counts remain intact and so we'll need to allow more price action to develop to see how price ultimately fares in this region.

The larger degree perspective still favors a significant cycle top in place with the reasonable alternative shown in blue for a bigger 5th wave to develop in 2026 but ideally after a final lower low into the $67k-$74k