Bitcoin: Stuck in the middle

Bitcoin: Stuck in the middle

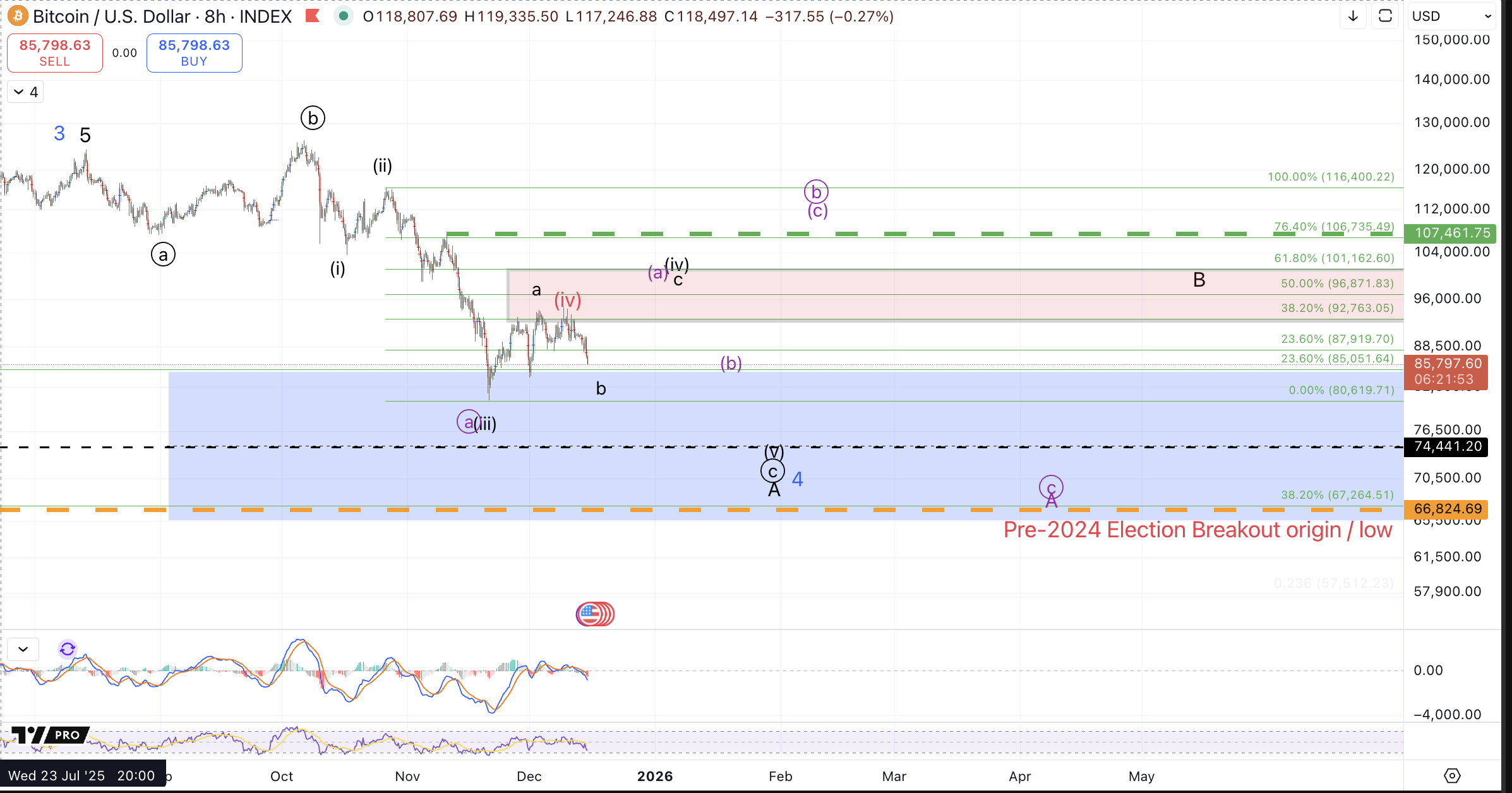

Price has developed a trading range from the November low into last week's high, roughly $80k-$95k. This range is filling in a corrective bounce within the larger expectation of seeing price retest the April low (74.4k~) so long as lower resistance $92k-$101k is respected.

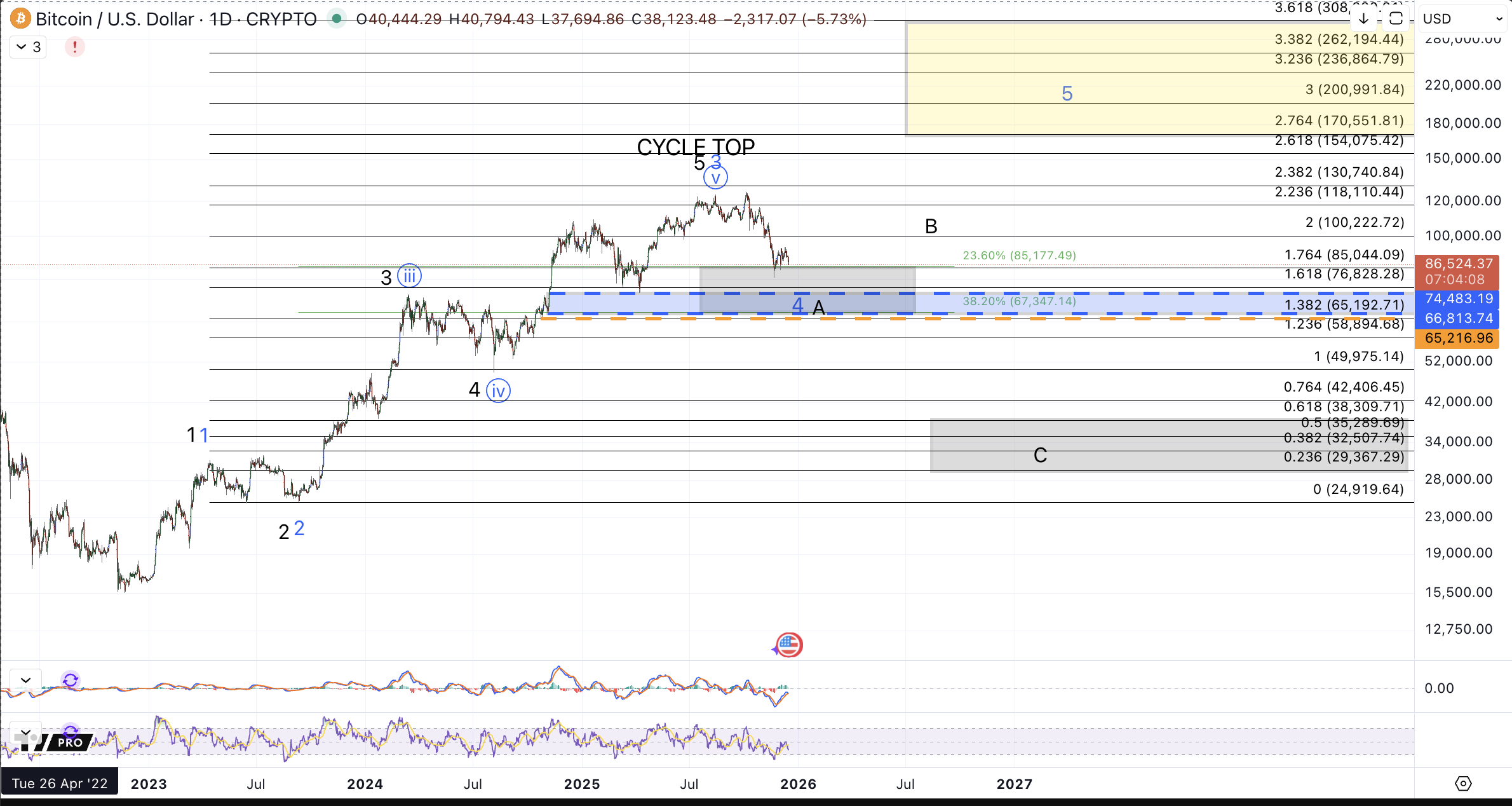

Assuming price follows through on the medium timeframe forecast, ie, to respect resistance and maintain below $101k and then head down to $67k-$74k region, our subsequent bounce can provide clues as to whether 2026 will setup bullishly, in the case of the blue count or bearishly, in the case of the black count. In order to maintain the blue count as a reasonable forecast, I'll want to see price leave the immediate pre-2024 election low, $66.8k untouched. Should price slice through that level, it will be further confirmation of the black count. As a reminder, the black count displays price having completed the bullish cycle from the 2022 low and filling in a larger bearish Crypto winter.

Regarding the shorter timeframe, price is still maintaining resistance for a wave (iv) within the decline from the all-time high. However, the duration of this consolidation is getting a bit protracted and as such requires consideration of other alternatives. Additionally, while price has been rejected (thus far) from resistance, there's nothing suggestive on lower timeframes of a complete structure for the wave (iv) bounce and as such the prospective move to immediate lower lows is being treated for now as a more immediately bearish alternative, presented in red. In order to adopt this perspective as a primary micro level count, I'll need to see a sustained break below $83.5k.

Instead, what's favored here is for price to be filling in a very sloppy b wave flat within wave (iv) flat, and currently in the latter stages of wave circle C of b. So long as price remains below $90k, I'd prefer one more low which can ideally get a bit deeper to test $84k-$85k region and possibly test in the area of the December low, $83.9k. I'd like to see price then turn up from there to fill in a rally up to $96k-$100k to complete the wave (iv).

However, as mentioned, this (iv) is already quite protracted and as such I've started to consider whether the downside is setting up in a more meandering fashion for the larger minor degree A wave down. This prospect is presented in purple, and suggests a completed circle a of A at the November low and price now working on a bigger circle b. In this case, the lower timeframe can be identical to the black count described above, (price holding $84k and heading up to $96k-$100k) but in the purple count, the next drop would remain corrective forming a higher low above the November low and then rallying up once more to the $107.5k-$111k region to complete the bigger circle b.

As always, we can take this one step at a time and these consolidation regions tend to be very complex without a clear directional bias for trades. As such, I consider it best to focus on the bigger narratives for possible actions.

In summary, I'm looking for price to hold $84k-$85k and set up a rally into later this week / next week targeting $96k-$100k to complete the (iv). So long as resistance is respected, I'd then like to see a final low targeting $67k-$74k before price starts the larger bounce in the black B wave or the blue wave 5.