Bitcoin / GBTC Update - Market Analysis for Sep 29th, 2019

Still Floating

For Long Term Traders: The short term is leading us the way to a bottom, which is not in despite being very close to the ideal targets in my 'intermediate term views'. You have a choice to make which is to put on some tranches, or really watch those short term counts. Until there is an impulse our stops are very wide: $133 Ether, and $4300 Bitcoin. That stop will tighten up when there is an impulse.

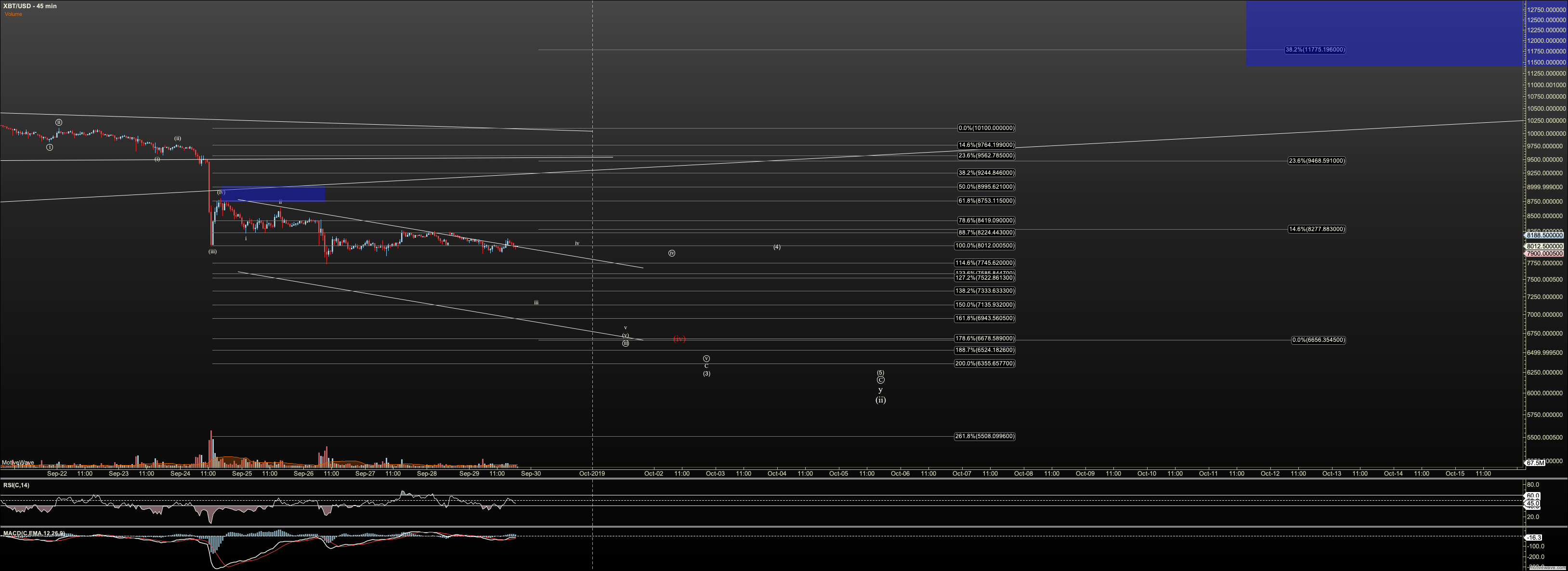

Short Term

The bottom process is still, well, in process. We are seeing immense chop here and no impulsive structures off our lows, so we must assume the bottom is not yet in.

1. Bitcoin is immensely sloppy here. I count this a diagonal but even that is questionable with how much 'float we are seeing. Short term traders should be ready for suprise runs into $9000 as long as we don't see a very clear impulsive C of iii. Note the C is not labeled as I have run out of nano degrees in Motive. But I am referring to the ~$7245 level below us. So, the bottom line is, I prefer the diagonal but am ready for surprises.

Tactically this structure has me sitting on my hands. I have orders at $7600 but they small. They may end up being just short term tranches. Over $9000 still suggests a bottom may be possible but I must also see a completed impulse to trust such a move.

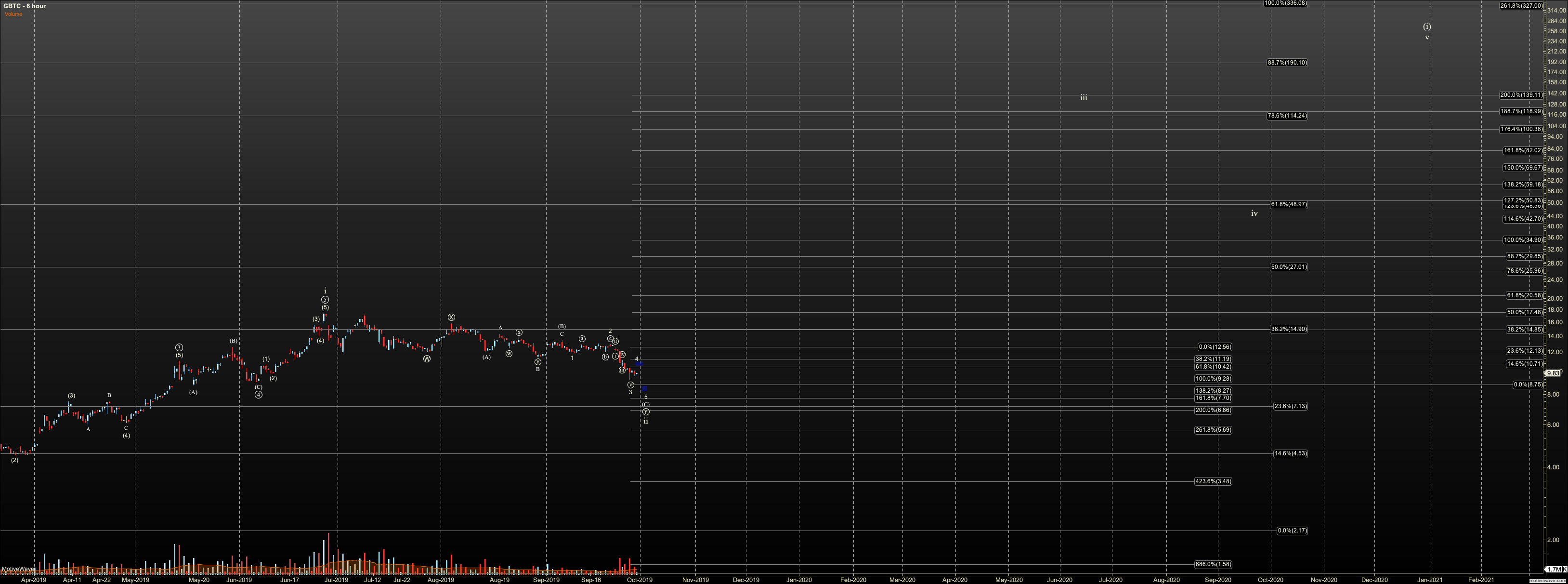

2. Extension in GBTC leaves us with a third wave bottom well beyond the expected level. This subsequently lowers the bottom target. I am now looking at $8.55 to $8.23 for a possible bottom. I have started to tranche into GBTC but keeping it small as the stop is currently $5 until we have an impulse that breaches $10.80, at which time the stop can be tightened.

NOW..please note that I do not ring the bell at the bottom. My process is simple. Once we have an impulse, I move from tracking resistance to support. Support is our 'risk against' level for a tight stop. This makes consternation over whether a bottom is in not needed. It makes the market an exercise in math, boring ol' math. Follow the math and emotion is not needed. If you need me to revisit this, please ask, but this is covered in 'Using Elliott Wave' on my Youtube channel. Now is a good time to refresh if feeling rusty.

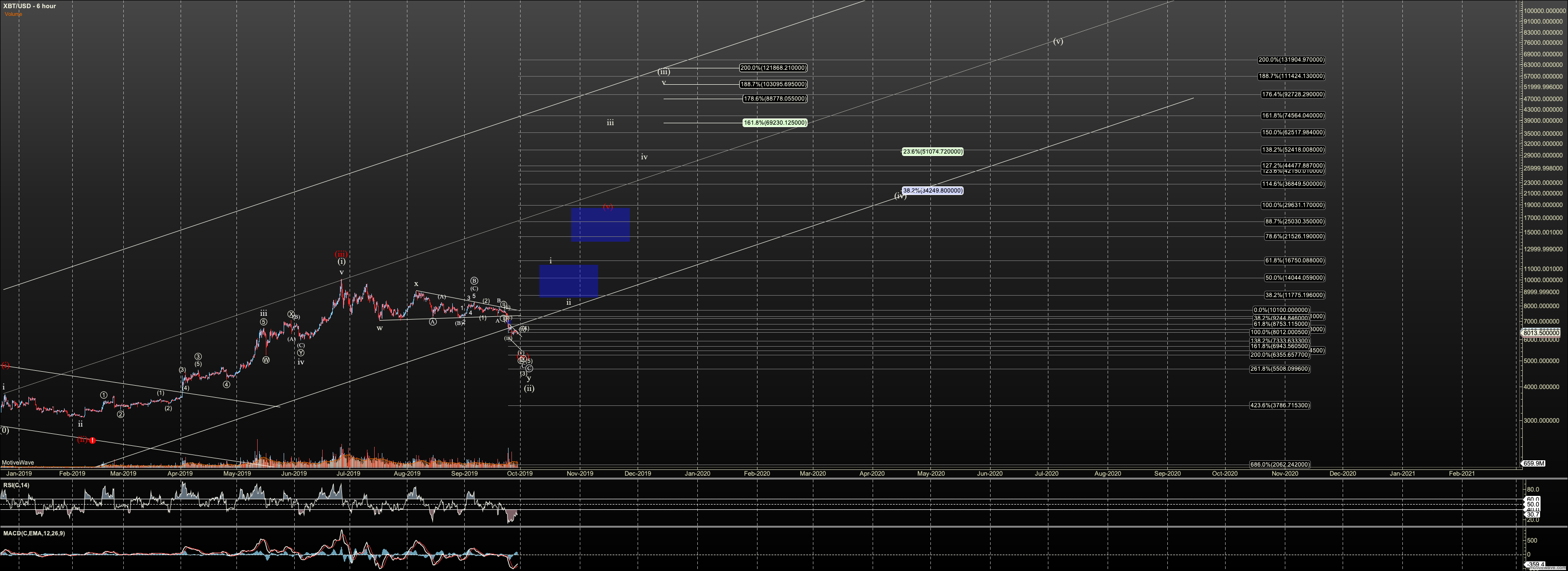

Bitcoin Intermediate Term (No Change Today)

Regarding intermediate term, Bitcoin put in a strong bottom at $3120 which aligns with the long term support for my primary count, at $3000. Holding there suggests good probability that we see a run to $65,000 - $225,000. The current correction we find ourselves, is primarily viewed as a wave two correction, which has support at $4300. We may never see that low, and the current leg of this correction targets $8,400 to $7,800. If we see an impulsive rally in that zone, though this is considered a shallow wave two, I will look forward to a completing a larger degree pattern potentially to between $129,000 and $160,000. By this we see how the smaller pattern refines targets for larger pattern.

The alternate intermediate view is that this is merely a wave four. In that view, the next wave, to the $20K’s may terminate the 2019 bull with a nominal new. Although, it is remotely possible we hold for a higher degree which will be discussed when important.

Note that timeframes is not a given. I am putting labels in a very aggressive timeframe but that may not be what we see. What is important is these price pivots and how price interacts with them.

GBTC Intermediate Term (No Change Today)

Note there is discordance between the long term GBTC count and that of Bitcoin, because of its release to the public does not match BTC genesis. And, so the question in my mind is whether GBTC will see a large ABC, or a full impulse in the longer term. If I am strict to the impulsive view, GBTC can bottom in the $9 to $10 region, corresponding to the $8,400 to $7,800 bottom in Bitcoin. And, the rally in Bitcoin to $129K+ can correlate to a move to $220 target in GBTC. If we only see a C wave, we should not see GBTC rally higher than $85. Knowing which from this vantage point is not possible and we’ll need to see the market progress.