Bitcoin / GBTC Update - Market Analysis for Sep 22nd, 2019

Little Clarity

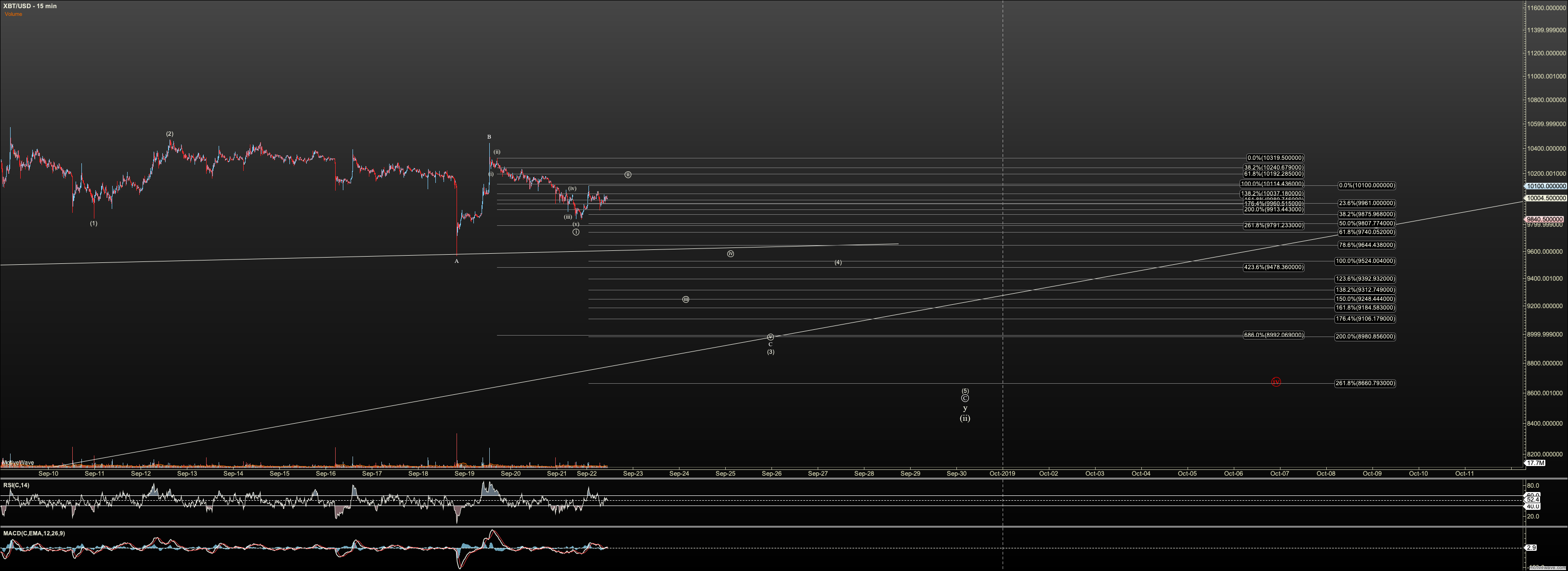

Short Term:

There is little more substance to this report beyond last week's. Action in both charts is leaving us little certainty in direction short term. This is a scalpers market right now, until this correction is over.

While we've seen recent five wave rallies in the GBTC chart, the overall context, with a truncated or rather incomplete bottom pattern, leaves me assuming still that we are heading lower into the $10 region. That would mean the five waves are C waves as per my chart. That said, I will not fight the bullish potential of the larger five rally rendered in red labels.

For Bitcoin, we have seen every recent attempt at a five wave rally fail. So I have no reason to become bullish here. In fact, I do not see a clear path upward, even for an alternate. That said, recent five wave rallies down were cut short as well. So, the downward path for now is a diagonal and we are in C of 3.

Also, of note is that we are now stuck between two trendlines that have three+ hits, both overhead and below. Note these are not trendlines yet defining a triangle, as Elliott Wave theory says a triangle is made of five subwaves which themselves divide into three waves. However, the trendlines are likely important with so many direct hits, causing sentiment to 'heat up', whether a breaks is upward or downward. I am watching them now, just as much as I am watching important fib levels formed by market structure.

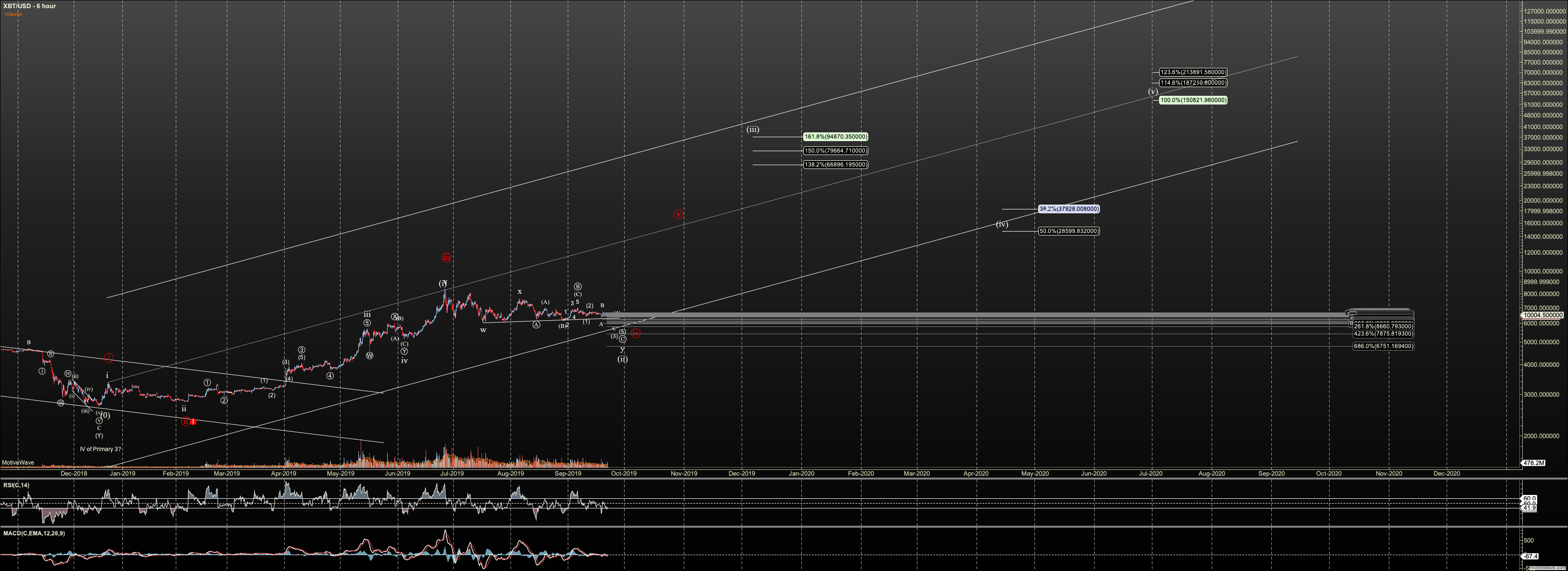

Bitcoin Intermediate Term (No Change Today)

Regarding intermediate term, Bitcoin put in a strong bottom at $3120 which aligns with the long term support for my primary count, at $3000. Holding there suggests good probability that we see a run to $65,000 - $225,000. The current correction we find ourselves, is primarily viewed as a wave two correction, which has support at $4300. We may never see that low, and the current leg of this correction targets $8,400 to $7,800. If we see an impulsive rally in that zone, though this is considered a shallow wave two, I will look forward to a completing a larger degree pattern potentially to between $129,000 and $160,000. By this we see how the smaller pattern refines targets for larger pattern.

The alternate intermediate view is that this is merely a wave four. In that view, the next wave, to the $20K’s may terminate the 2019 bull with a nominal new. Although, it is remotely possible we hold for a higher degree which will be discussed when important.

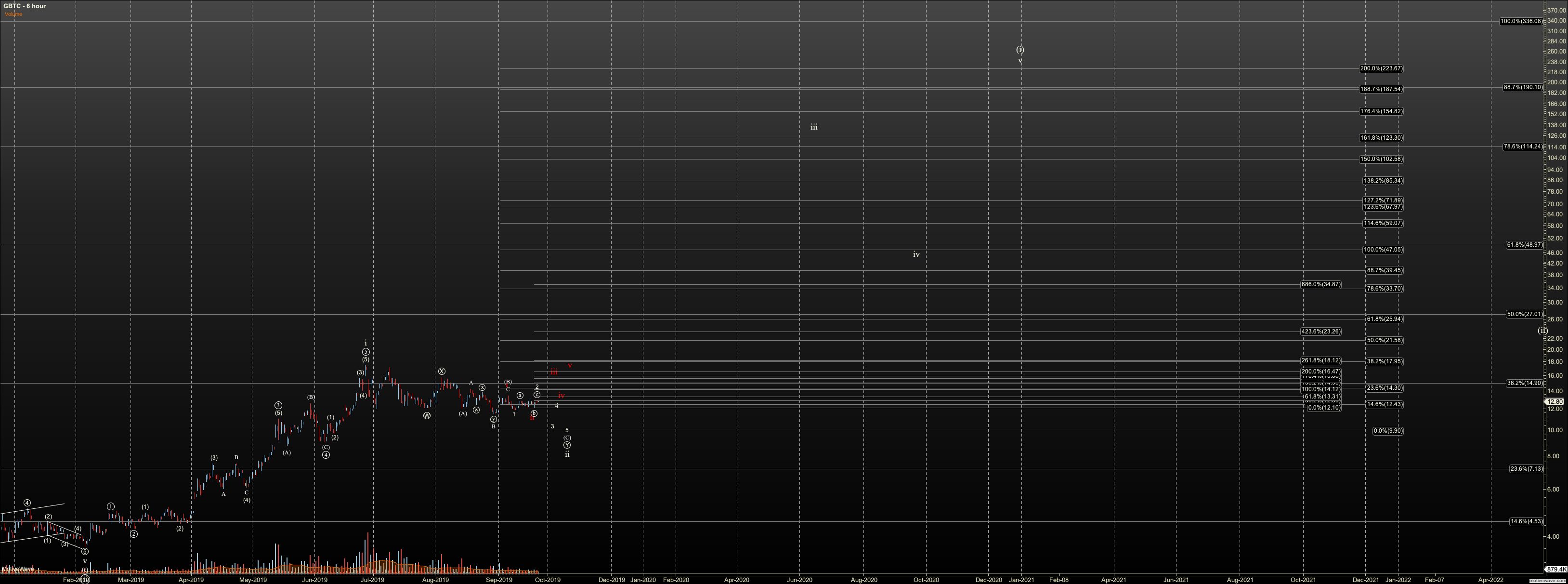

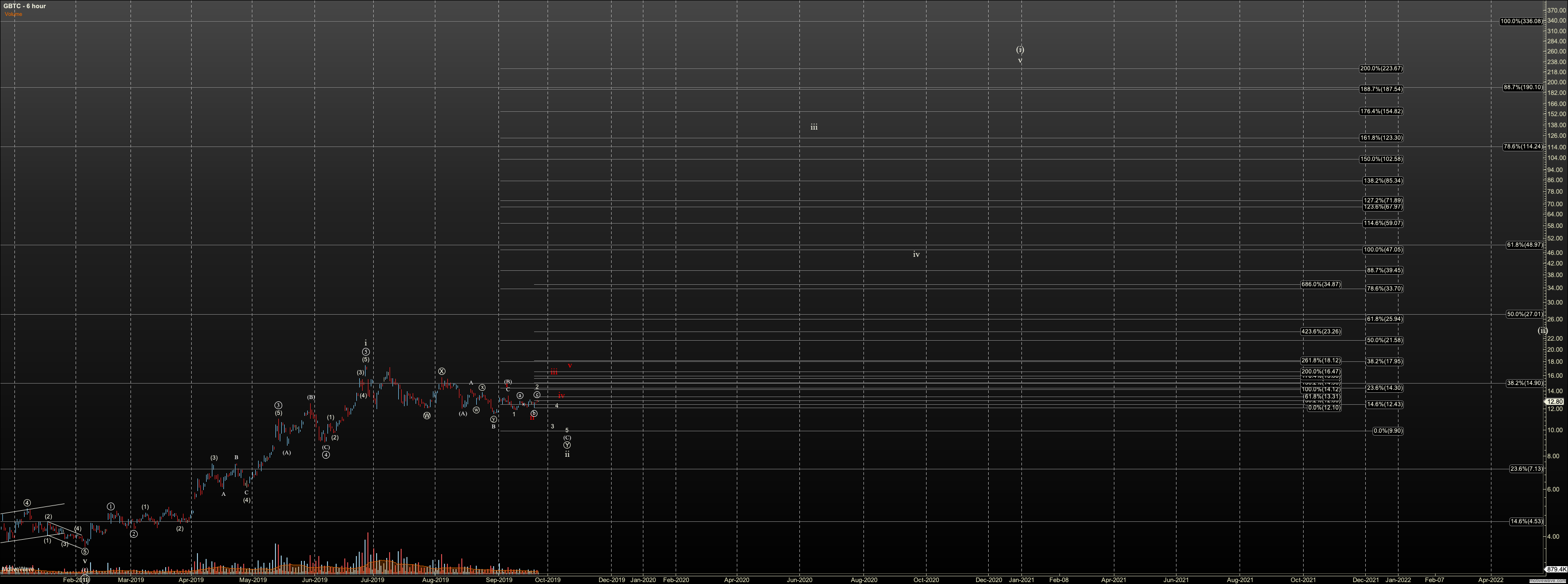

GBTC Intermediate Term (No Change Today)

Note there is discordance between the long term GBTC count and that of Bitcoin, because of its release to the public does not match BTC genesis. And, so the question in my mind is whether GBTC will see a large ABC, or a full impulse in the longer term. If I am strict to the impulsive view, GBTC can bottom in the $9 to $10 region, corresponding to the $8,400 to $7,800 bottom in Bitcoin. And, the rally in Bitcoin to $129K+ can correlate to a move to $220 target in GBTC. If we only see a C wave, we should not see GBTC rally higher than $85. Knowing which from this vantage point is not possible and we’ll need to see the market progress.