Big Picture Update: Clarity Quickly Approaches!

In the October video, there was a passing mention of the last week of October as something to closely watch. I was not yet ready to discuss the possibilities as they could be quite serious. Further review shows this to be a point of two potentials that will likely play out over the next two or three weeks as reflected in social mood and the markets. I will discuss these as well as the likely ramifications for the stock market and gold.

As you may be aware, MarketMood takes themes from daily top internet search trends to capture the mood of where “we” are at. This is useful, because news themes and market movement tend to lag the collective mood by a fairly regular time period allowing forecasting of the apparent effects of social mood. About a third of the time, an inversion occurs and for the duration of the inversion, the opposite of what would be expected occurs (for example, bearishness and risk aversion from Expansive mood). At the time of the video, the assumption was that mood vs. effect was in inverted mode and would continue that way. Over the last few weeks, watching news themes and market behavior, this has become clearly ambiguous. It is possible that the weekly mood vs. effect has reverted to normal, but it can not be affirmed or ruled out either way. The best I can do at this moment is to lay out the two scenarios.

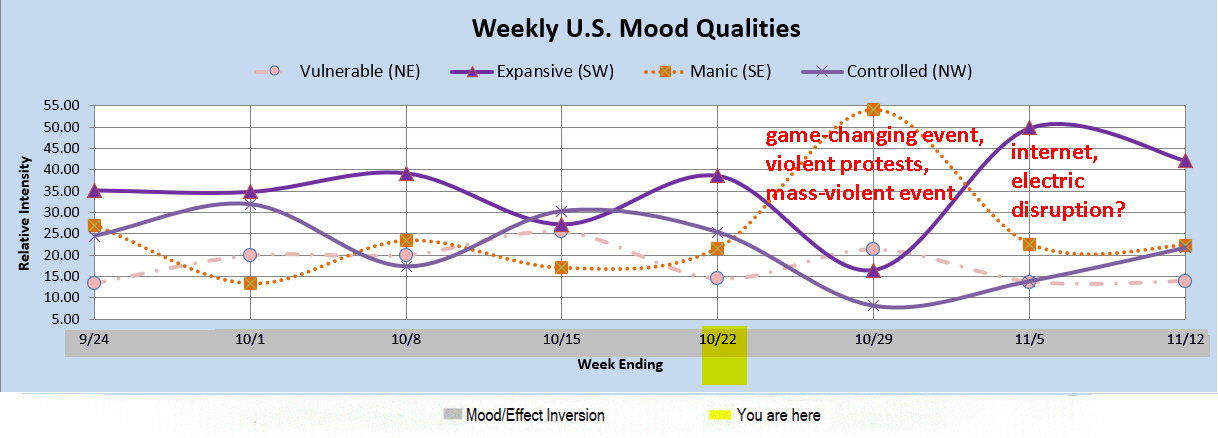

Scenario one, mood vs. effect remains inverted:

The chart below reflects the inverted scenario. In the last week of October, Controlled low and Manic high reflects a serious mood, a game-changing event, and the potential of violent protests or mass violent event. When an elevated risk for a mass violence event is detected, a geospatial analysis is done to see if there is any place that shows up as likely for such an event to occur. There was no specific place showing as likely for a mass violence event to occur within the U.S., which lowers the probability and expectation of this specific manifestation of the pattern. It is still possible to see a serious event of some type that affects the entire country, but it would more likely be of a disruptive or ideological nature than a violent one. There is one known potentially game-changing event that could be less than ominous, perhaps even positive, and that would be passage or at least agreement on the U.S. infrastructure bills.

The following week, in this inverted orientation, we see a pattern that has in the past been associated with widespread internet and / or electric grid disruption. The pattern for each of these weeks tends to be bearish for the stock market.

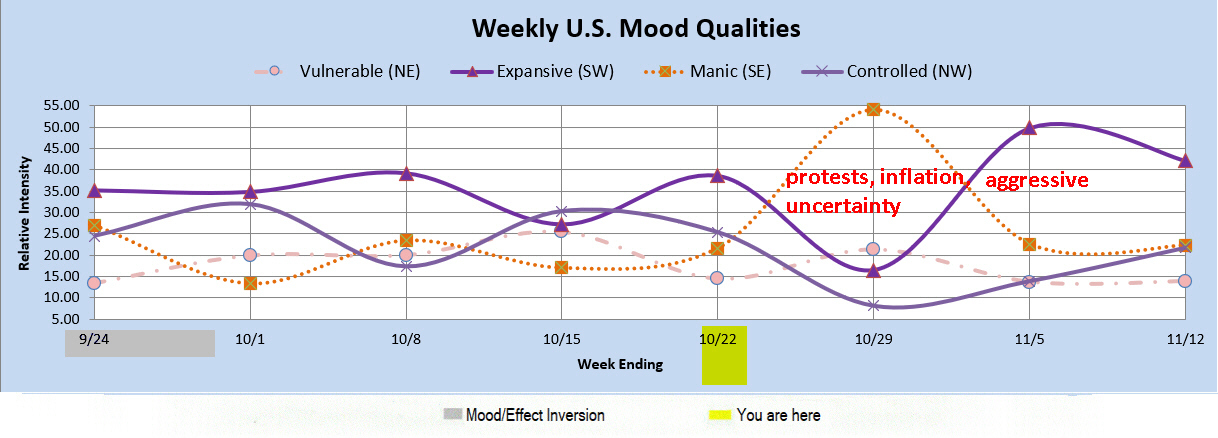

Scenario two, mood vs. effect in normal mode:

This scenario assumes a reversion to normal has already occurred near the beginning of October. It would be the more benign path. Unfortunately, the mood pattern has been a bit convoluted over the past few weeks and it’s difficult to rule out either case. In this scenario, there could be some intense debate, possible protests and concerns with inflation in the last week of October. The following week may see some outbursts of violence as people are feeling additionally aggressive, but not necessarily anything too out of the ordinary. The weekly patterns in this orientation tend to be bullish for the markets.

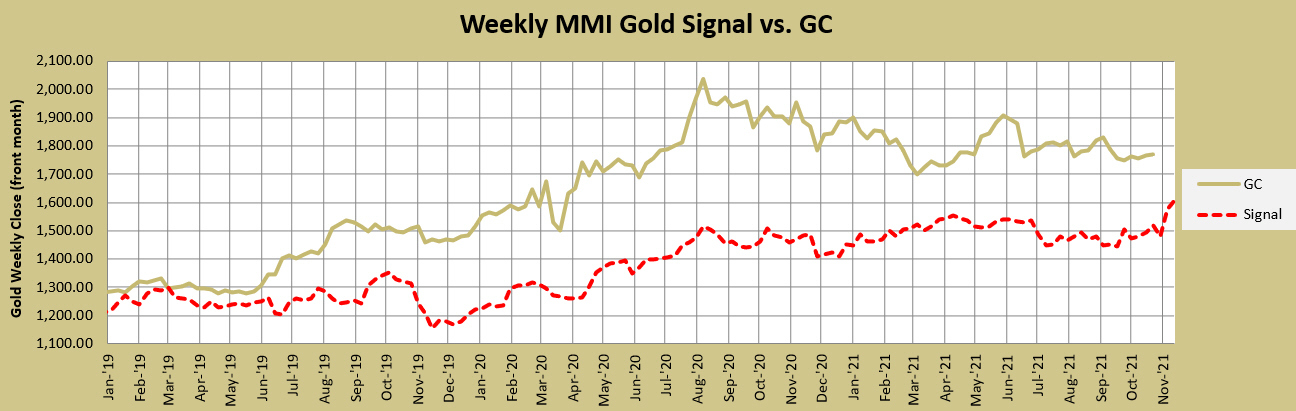

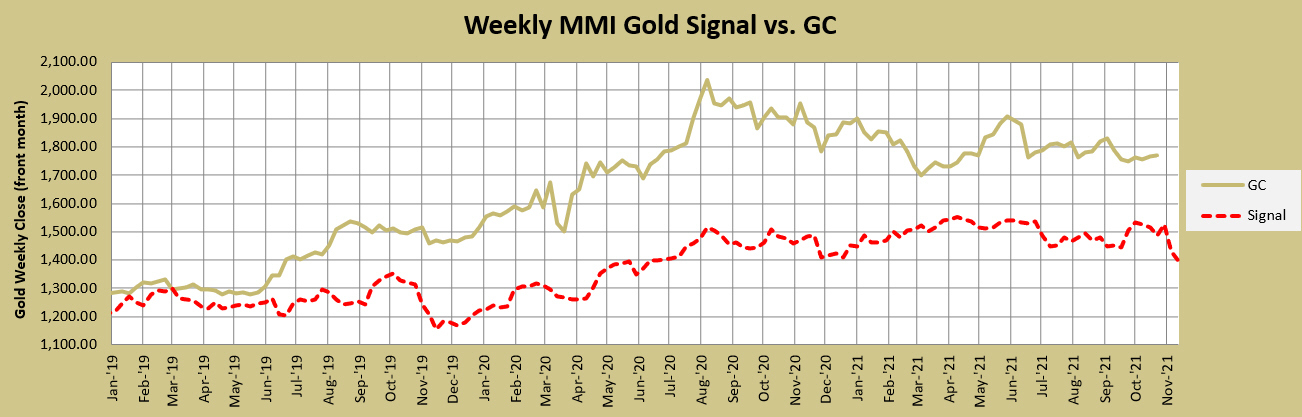

The weekly MarketMood Indicator’s algorithm for gold has two very different pictures depending on which scenario dominates. In the more gloomy scenario one, the first chart shows gold about to make a significant low and take off strongly. The second chart shows gold's negative reaction to the more bullish mood and stock market scenario.

Gold outlook, scenario one-- ready to make a significant low and take off strongly:

Gold outlook, scenario two-- about to top and drop sharply:

Clearly, we are at a critical juncture. It might be prudent to be prepared for either way to play out. We will be closely watching our daily charts to give clues as to which scenario might be the more likely one and comment on any illumination as the path becomes clear. Either way, clarity is quickly approaching!