Big, Bad Bears Are Back

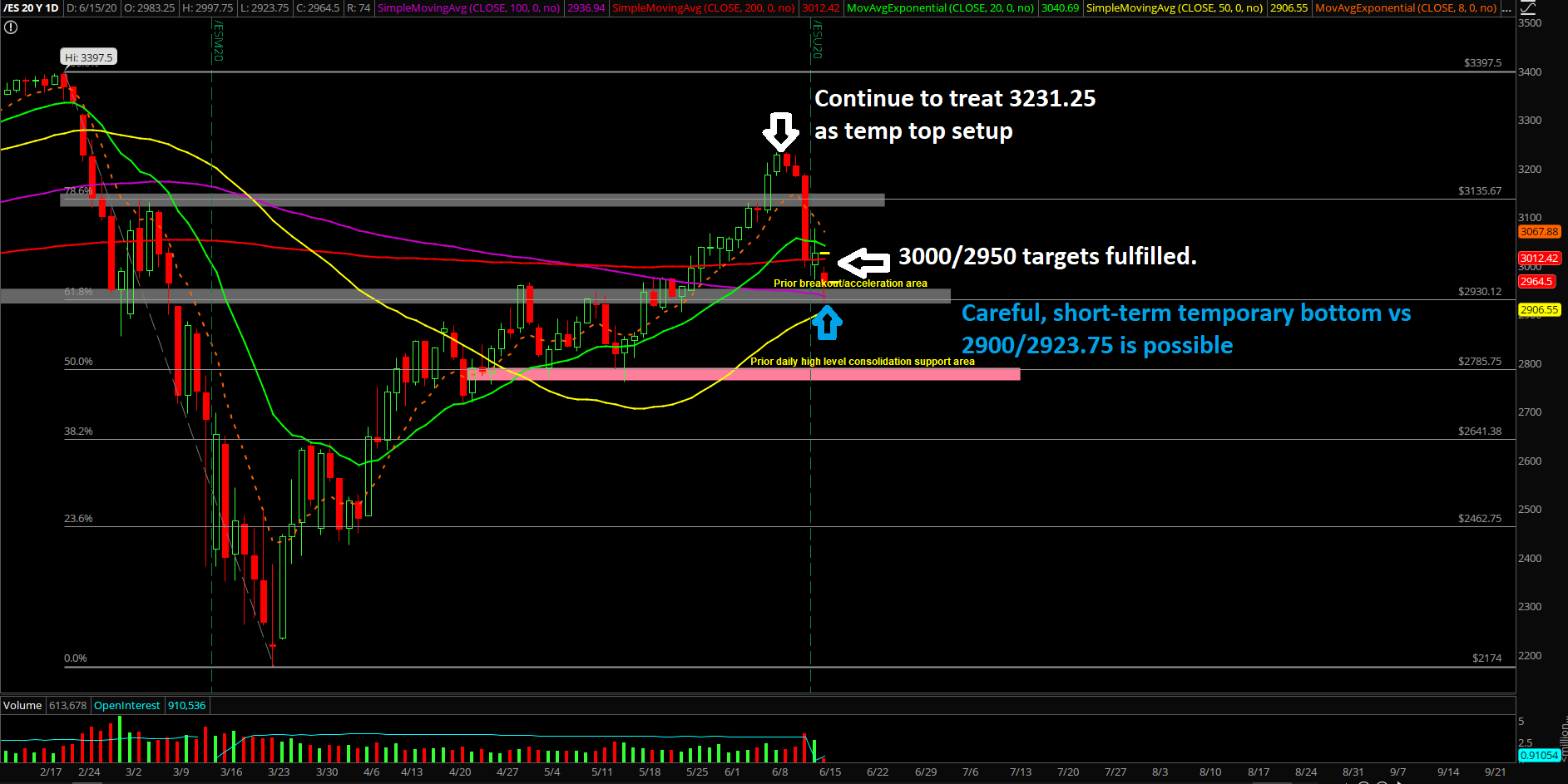

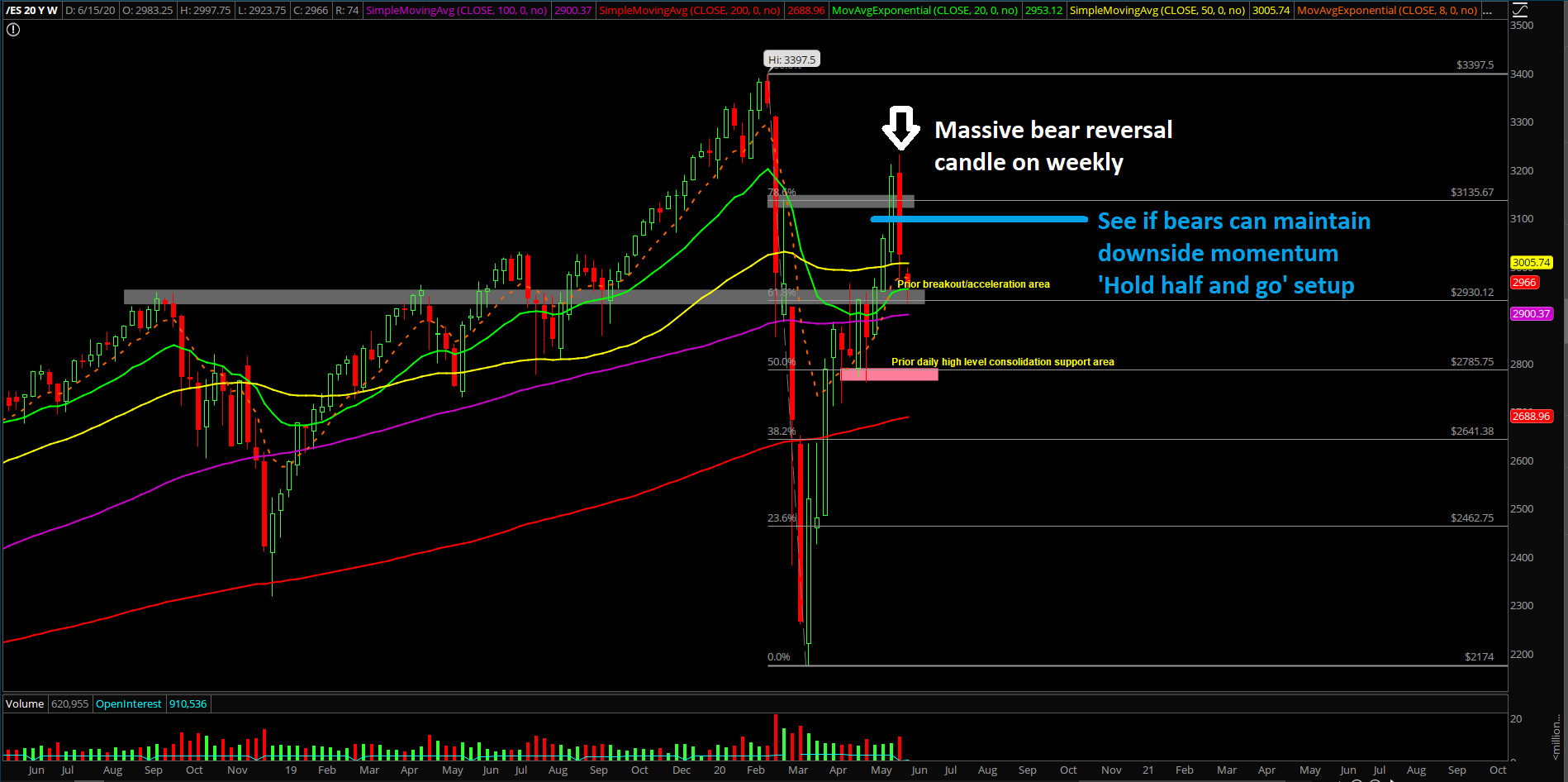

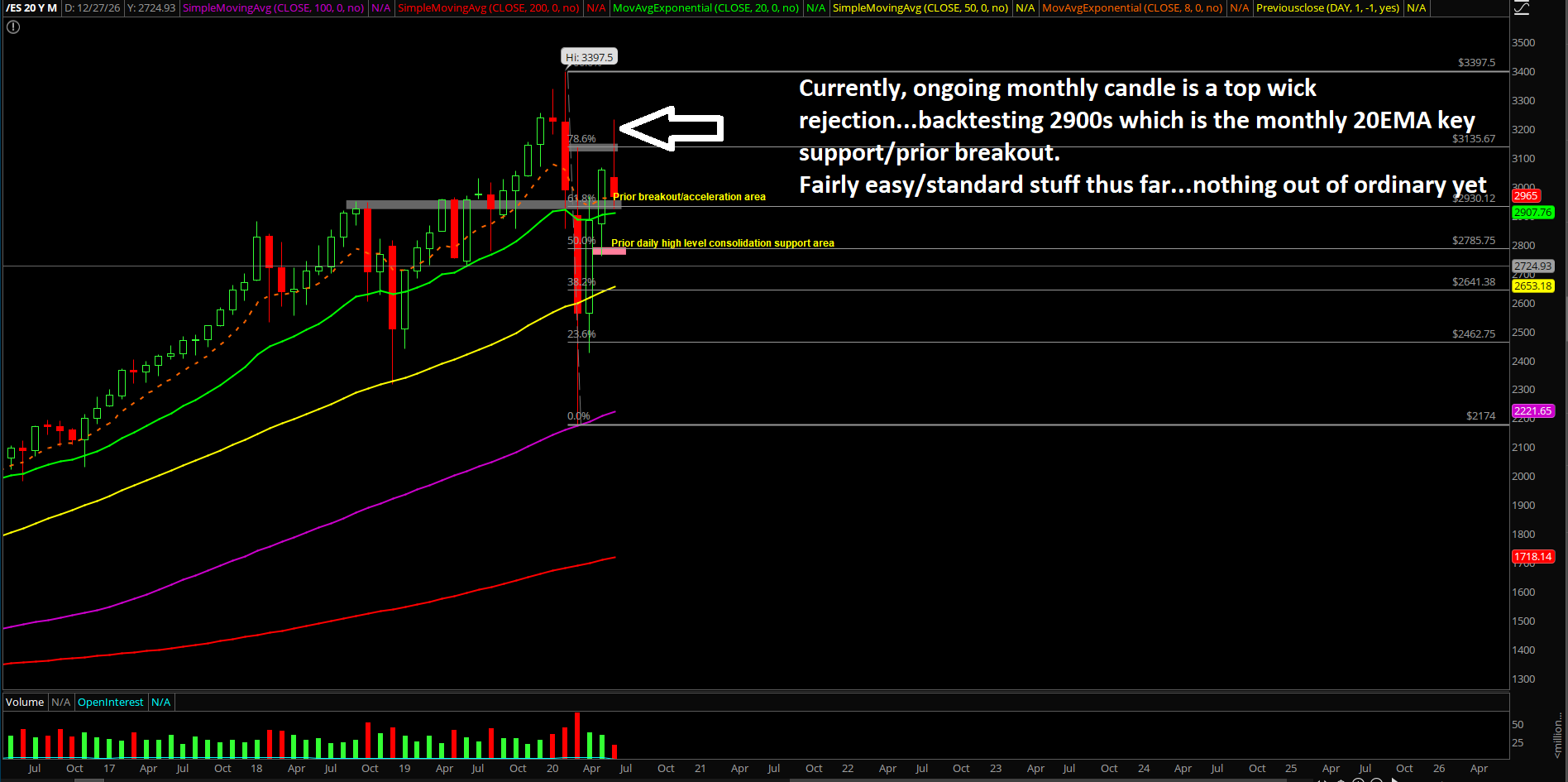

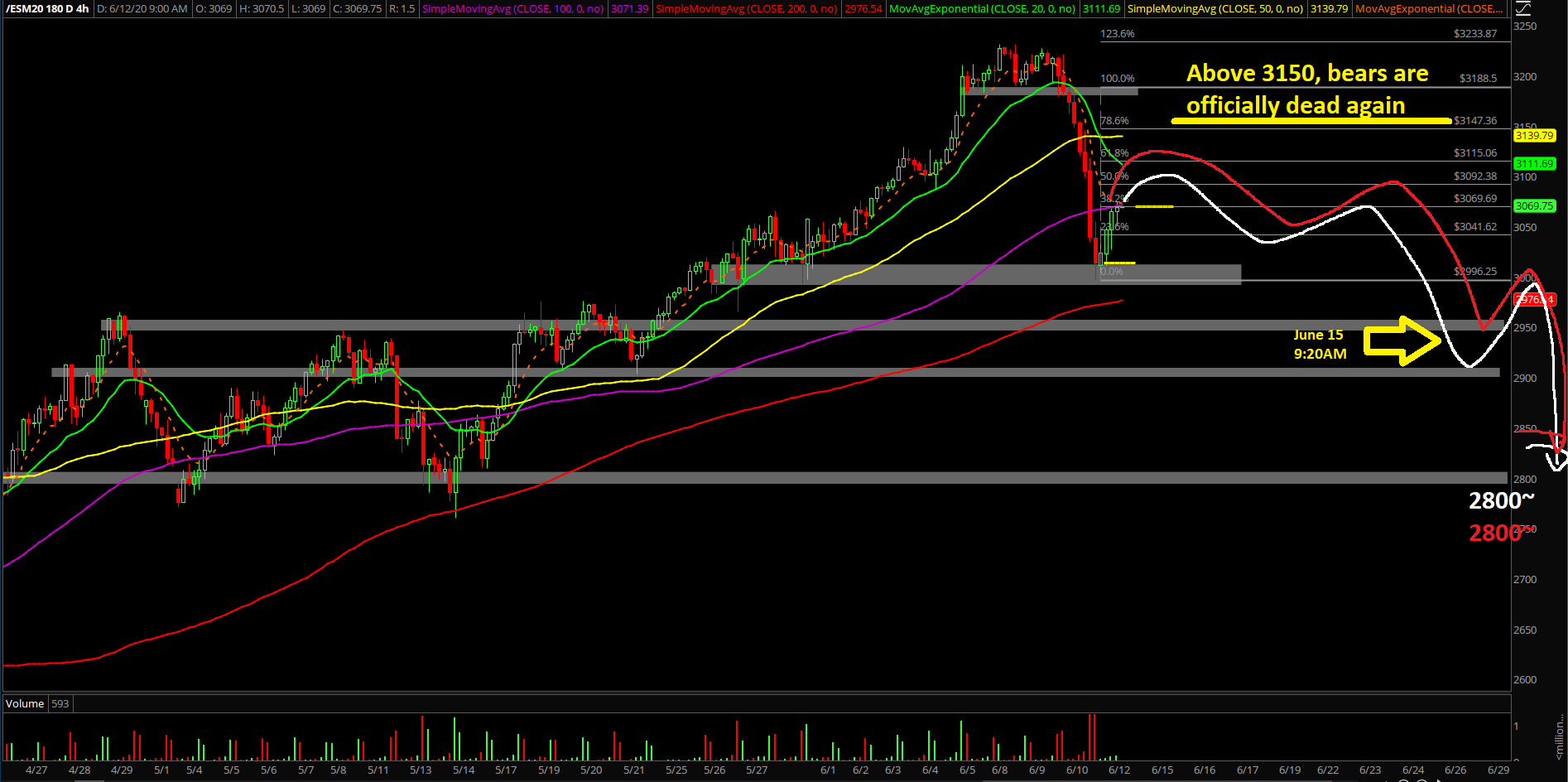

Sunday night futures showcased lower highs and lower lows into 3000/2950 targets on the Emini S&P 500 (ES). This follow-through to the downside is merely just a continuation model from last week’s clues. If you recall, last week closed as a massive weekly bearish reversal candle signifying that the real, big, bad bears are back.

As we warned and executed almost perfectly on getting out all long-term portfolio positions in the past few sessions and alongside with hedging+straight shorting, this is just the result. For now, when below 3085, all bounces are considered short-able setups. In addition, we continue to treat 3231.25 as a temporary top.

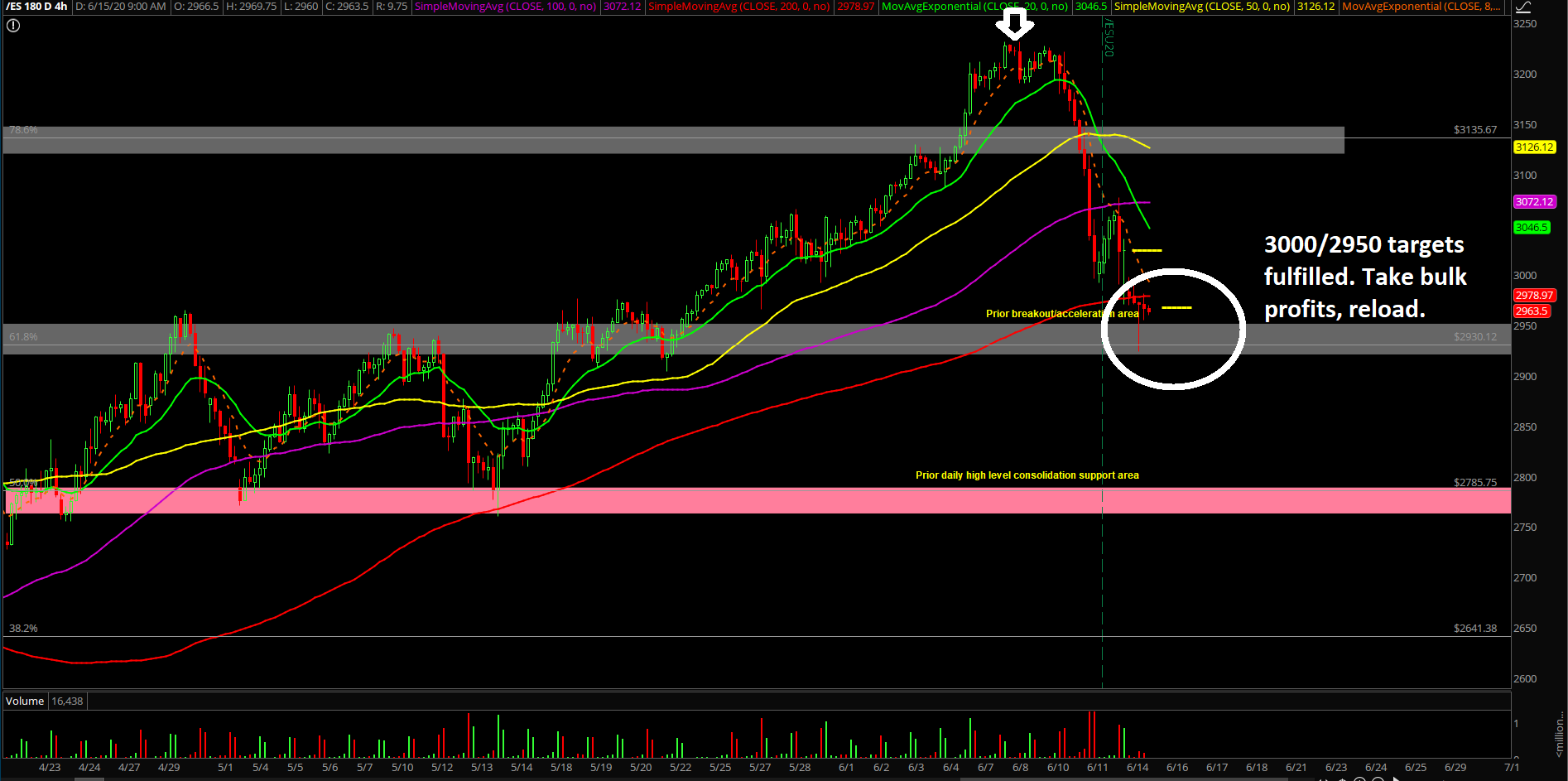

Our proprietary 4-hour white line projection remains king from last week as it remains valid. 2/3 of our three immediate targets have been fulfilled 3000/2950/2800. This means that the easiest and majority portion of the ride is also considered over, so traders must be aware of whipsaw territory as the final target is still quite far away.

Utilize 3000/3030/3085 as immediate resistance levels for continuous lower high setups

For today, please be aware that the overnight Sunday low of 2923.75 or 2900~ area could be the temporary low/range low for a session or two already. If we break below them, then it would confirm downside acceleration again to open up the next supports.

The current likely situation for micro is to see whether price bounces back into 3000/3030 key resistances for a quick countertrend vs. on-trend setup.

For rookies: no long setups allowed unless above 3085, focus on-trend short-term downside setups only vs. key resistance levels.

For intermediate/veterans: proceed with caution on countertrend vs on-trend setup, the range is large enough to do both easily and in a nimble manner.