Bears' Time To Shine

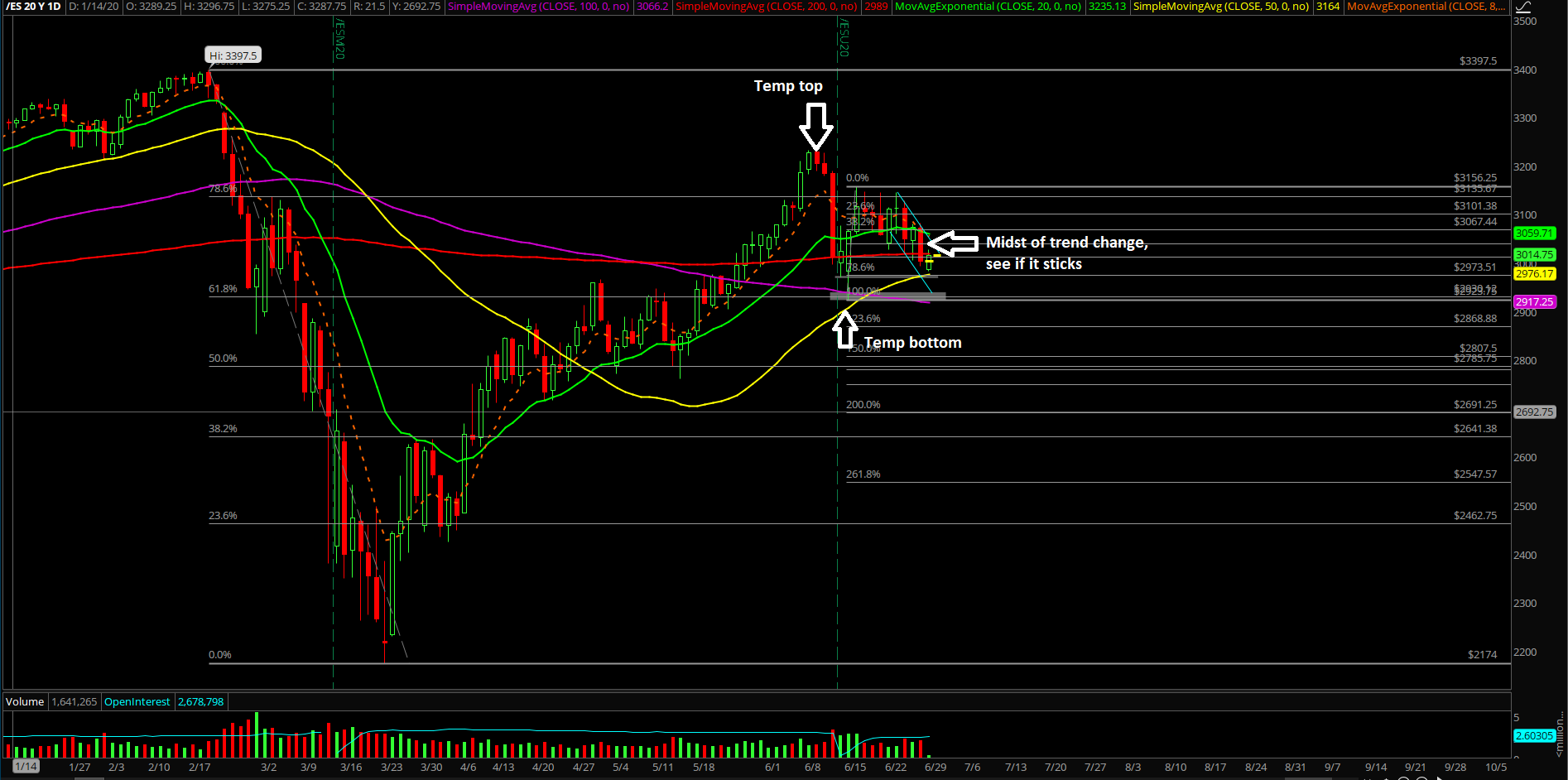

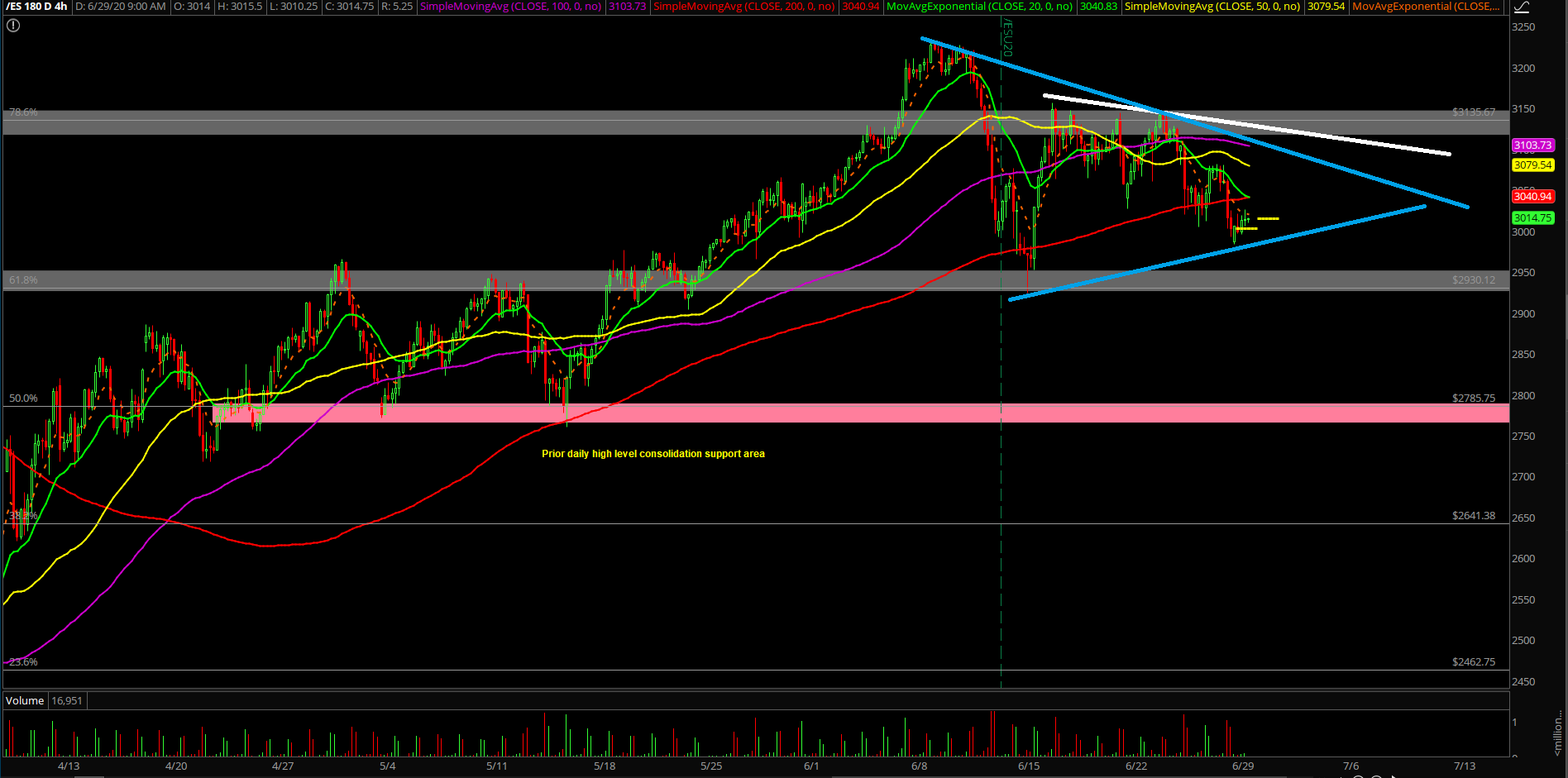

The fourth week of June played out as expected since price action just followed our 4-hour price projections perfectly alongside with our anticipated ‘hold half and go’ textbook setup. Essentially, the market was in a confined immediate range of 3150s-3060s overall in the Emini S&P 500 (ES) that eventually broke to the downside in order to force a range expansion back into the 3231.25-2923.75 bigger range.

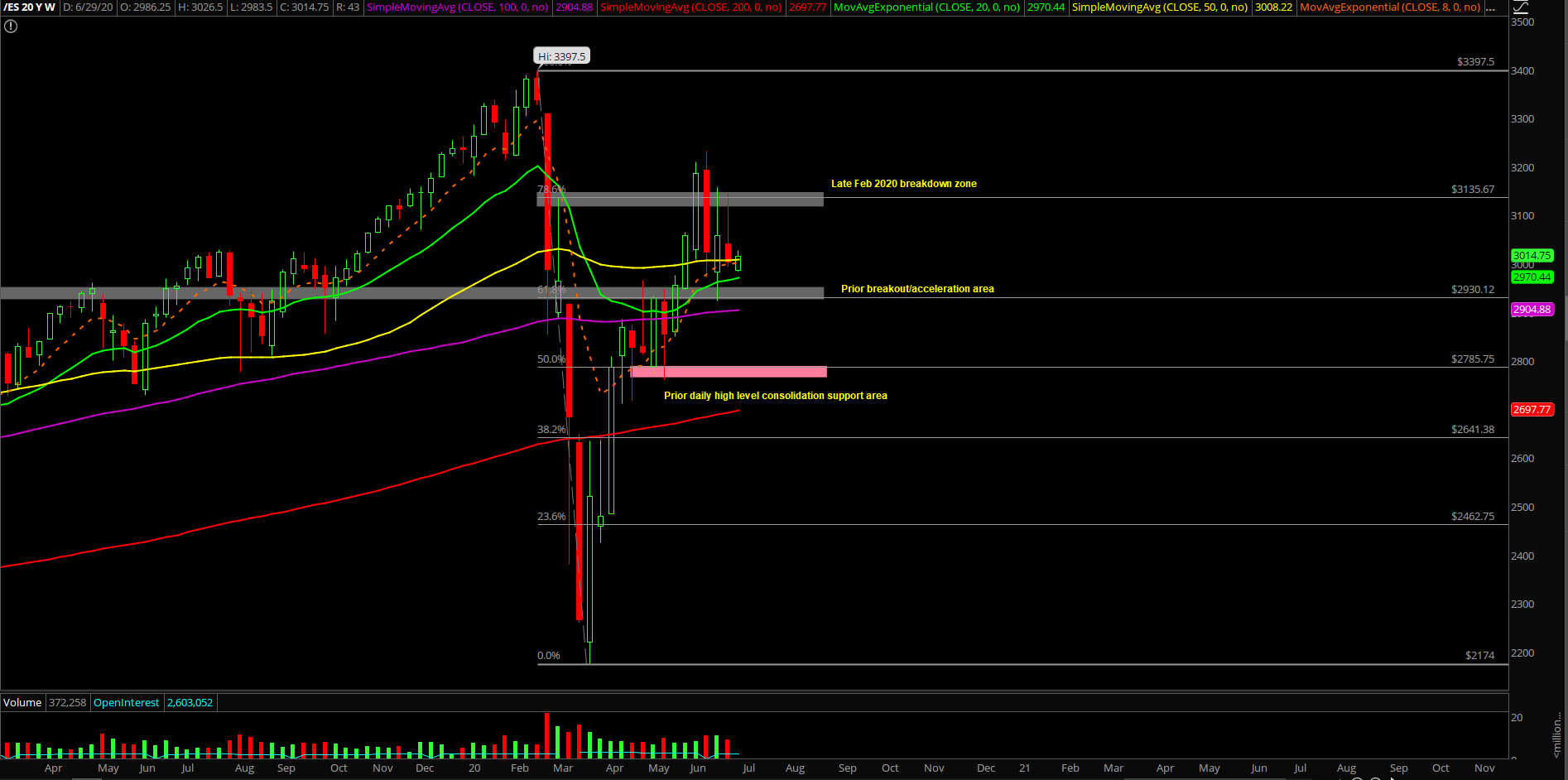

The main takeaway remains the same as the price action remains stuck in an overall daily pattern of 3231.25-2923.75, where temporary top and temporary bottom were confirmed a few sessions ago. The ongoing battle remains tough for both sides because the longer this thing consolidates in a high level consolidation, the better the outcome for the ongoing bulls since the March 2020 bottom based on the overall context. This is why it’s critical for gummy bears to act now and entice the real, big, bad bears to rotate back into town.

What’s next?

Friday closed at 3003 in the ES, around the week’s low and the short-term momentum remains bearish when below our key resistance. For reference, the market is now teasing with the fact that daily 20EMA and 200 day moving average have been broken for one session so it is imperative for market participants to keep monitoring this. By monitoring whether price action stays below or above the MA’s during the next few sessions because it’s a momentum clue heading into month of July.

Highlights from our game plan:

- Immediate resistance of 3100 has moved down to 3050. When below it, same 2950-2900 target

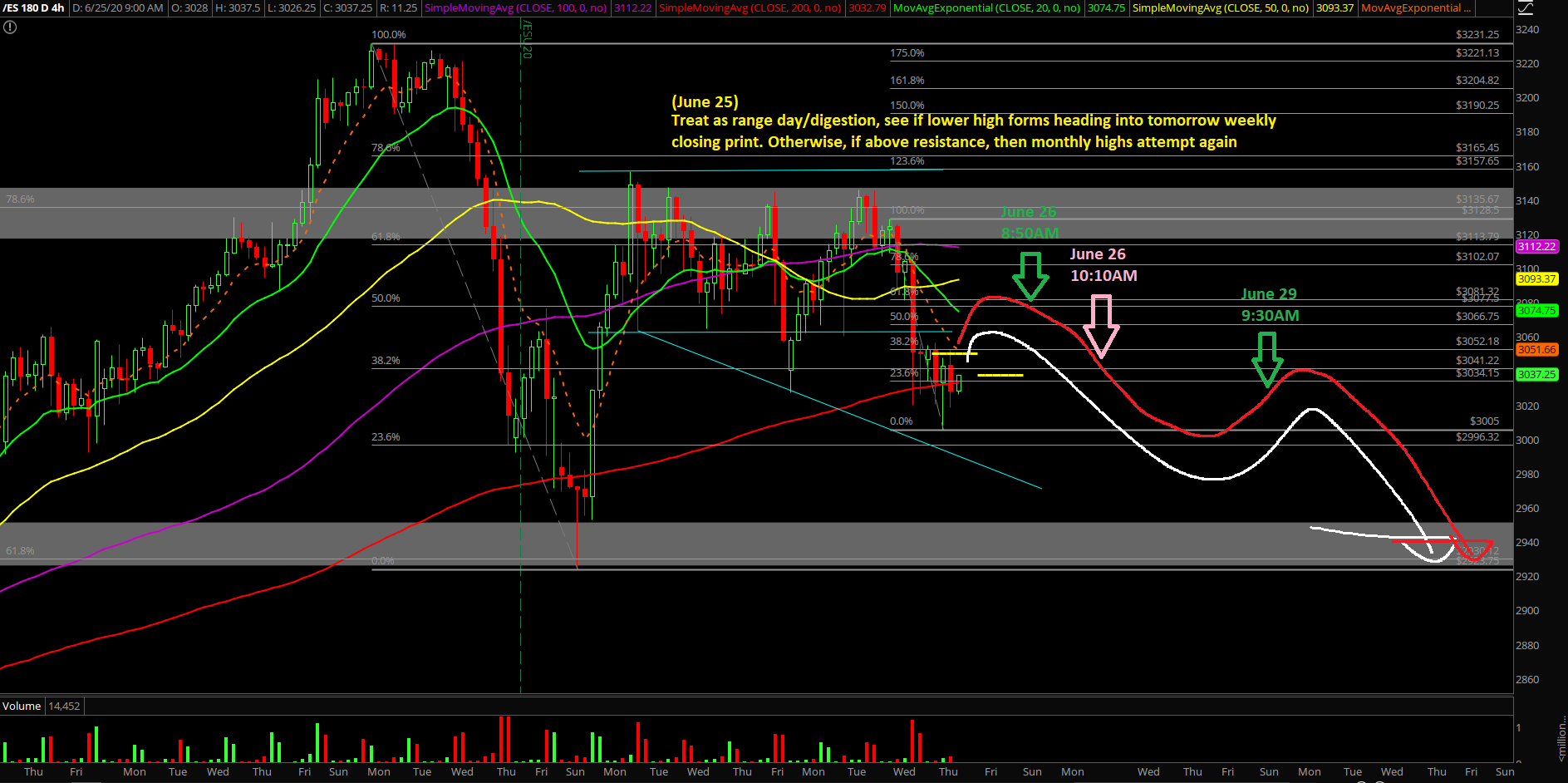

- Nothing has changed for us, last week’s 4hr red line price projection remains perfect and valid until we are proven wrong by price given that the market continues to follow it

- Last week’s price action followed our price projections perfectly. If you recall, the market played out as a standard textbook ‘hold half and go’ setup and by end of last week the market closed back below some key daily trending supports. It should be beneficial to keep monitoring whether that was a decisive breakdown or just a 1-2 day tease

- This is bears’ time to shine by opening up the range; if they cannot capitalize on a breakdown continuation setup, then you would know that they lost a big battle. Then, the bulls would likely attempt the monthly highs instead so today and tomorrow will tell us a lot about early next week. When one side fails, look for the other side to win in a big way.

- Similar parameters with the immediate range vs overall daily range (3156.25-3005 within 3231.25-2923.75)

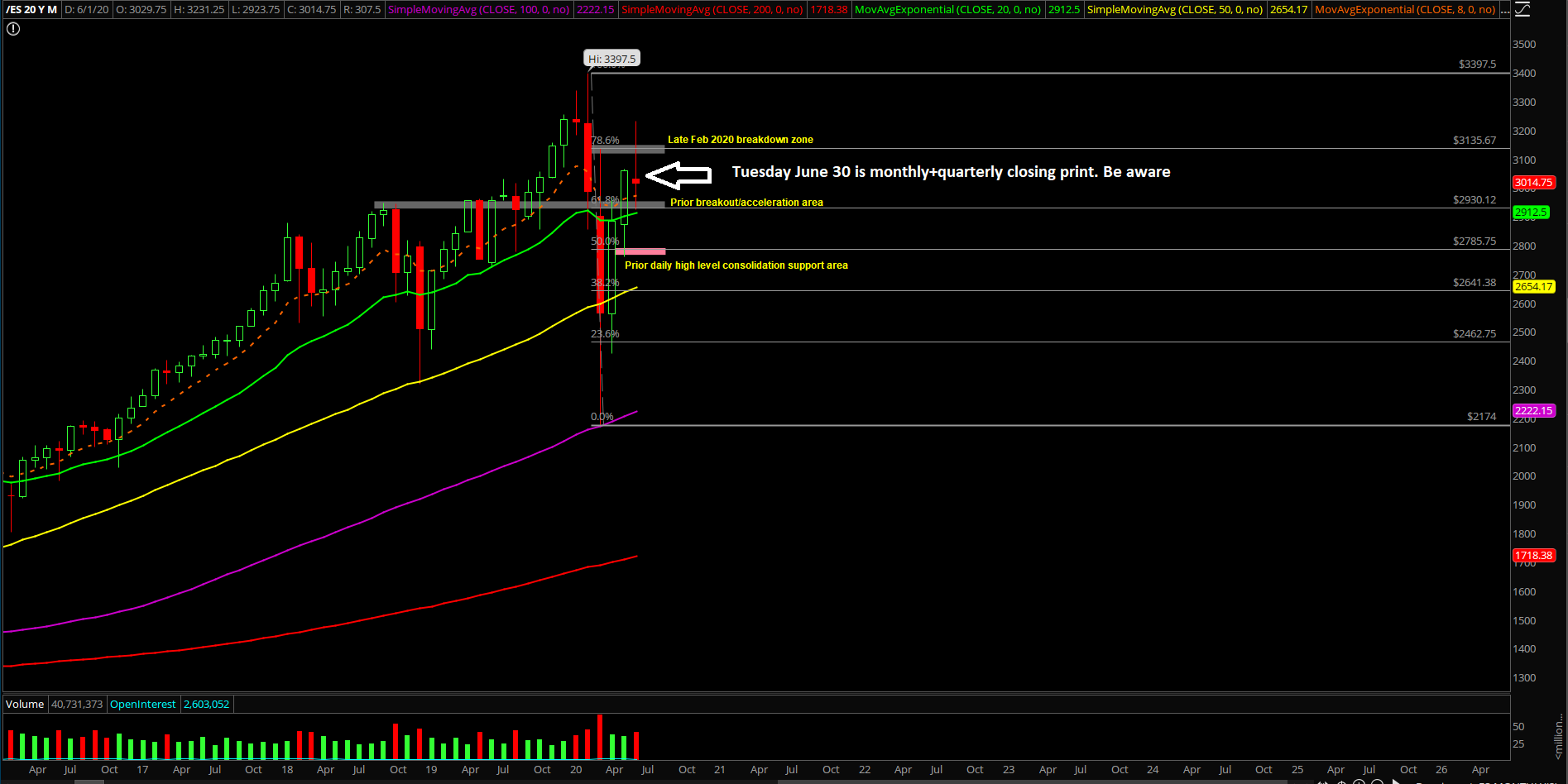

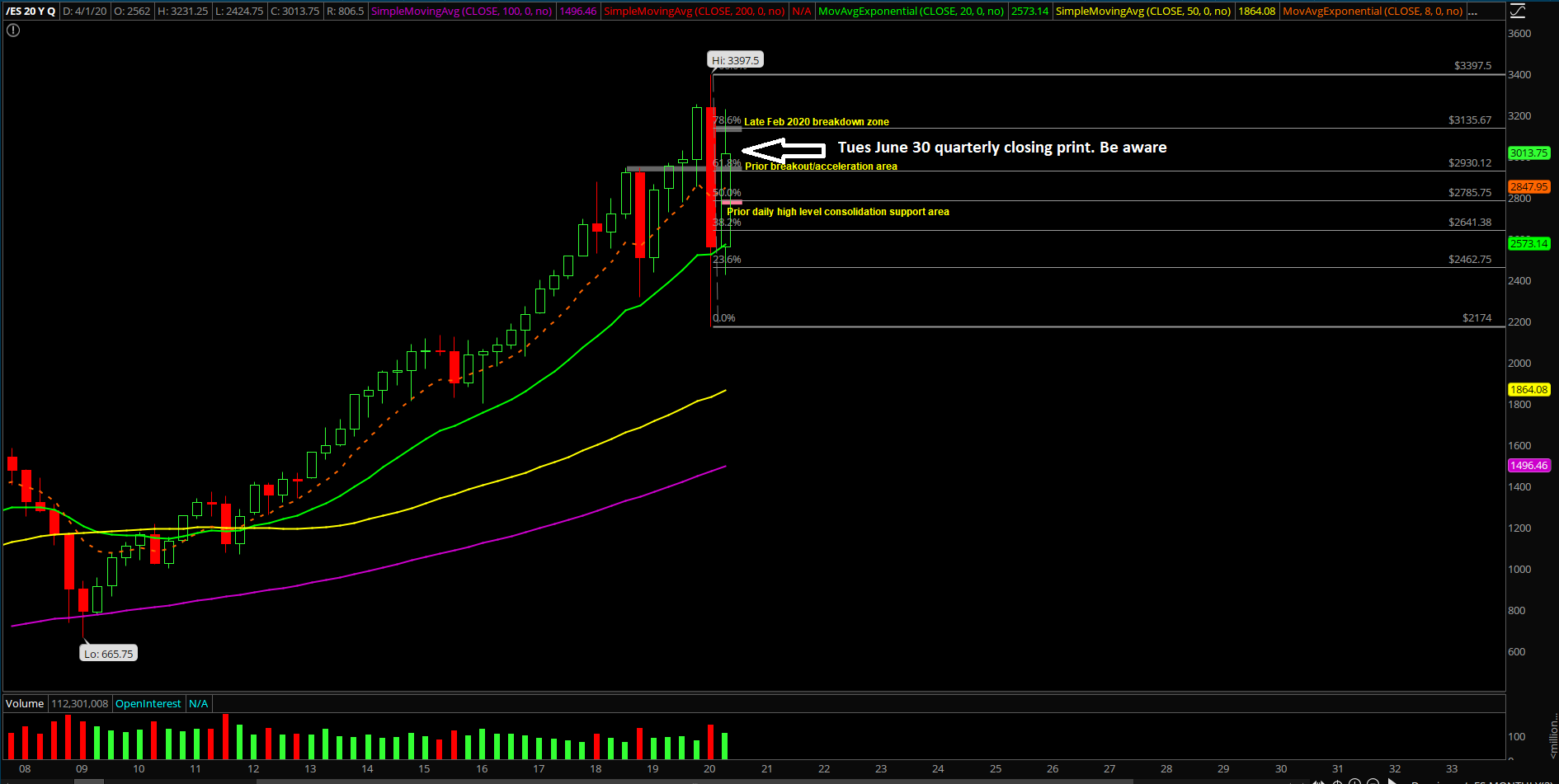

- For reference, Tuesday June 30 is the monthly+quarterly end closing print so both sides are fighting ferociously for the momentum heading into month of July.

- Bulls will be trying their best to stick-save this current short-term breakdown and wrap up price at least around the midpoint of this month’s range (FYI, 3231.25-2923.75, midpoint = 3070s). Conversely, bears are trying their best to wrap up price at the dead lows/near the lows of the month. As of writing, price is hovering at 3014~ which is bottom half of the month’s range, so short-term bears are more powerful for now.