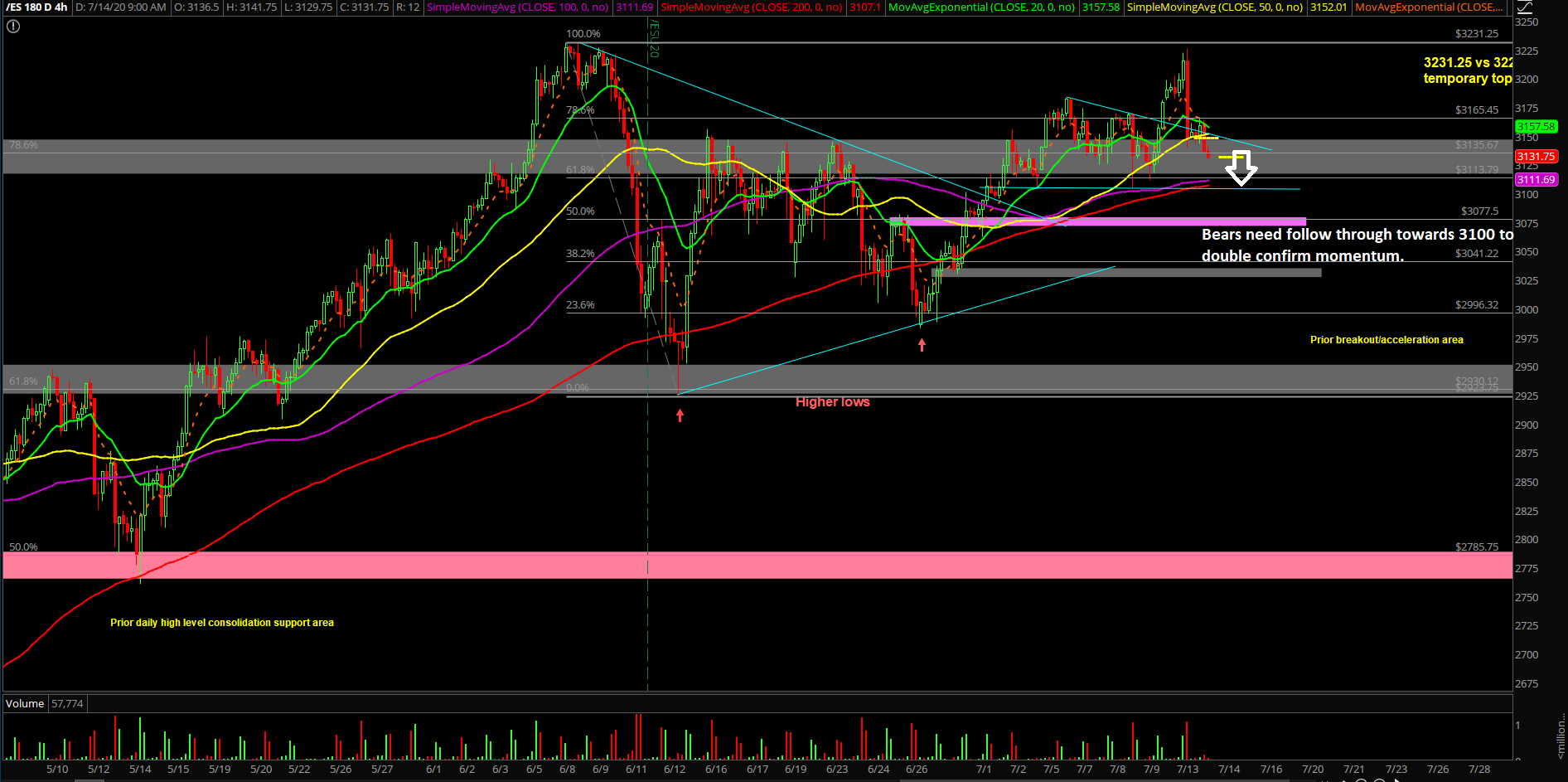

Bears Striking Back At Key Moment

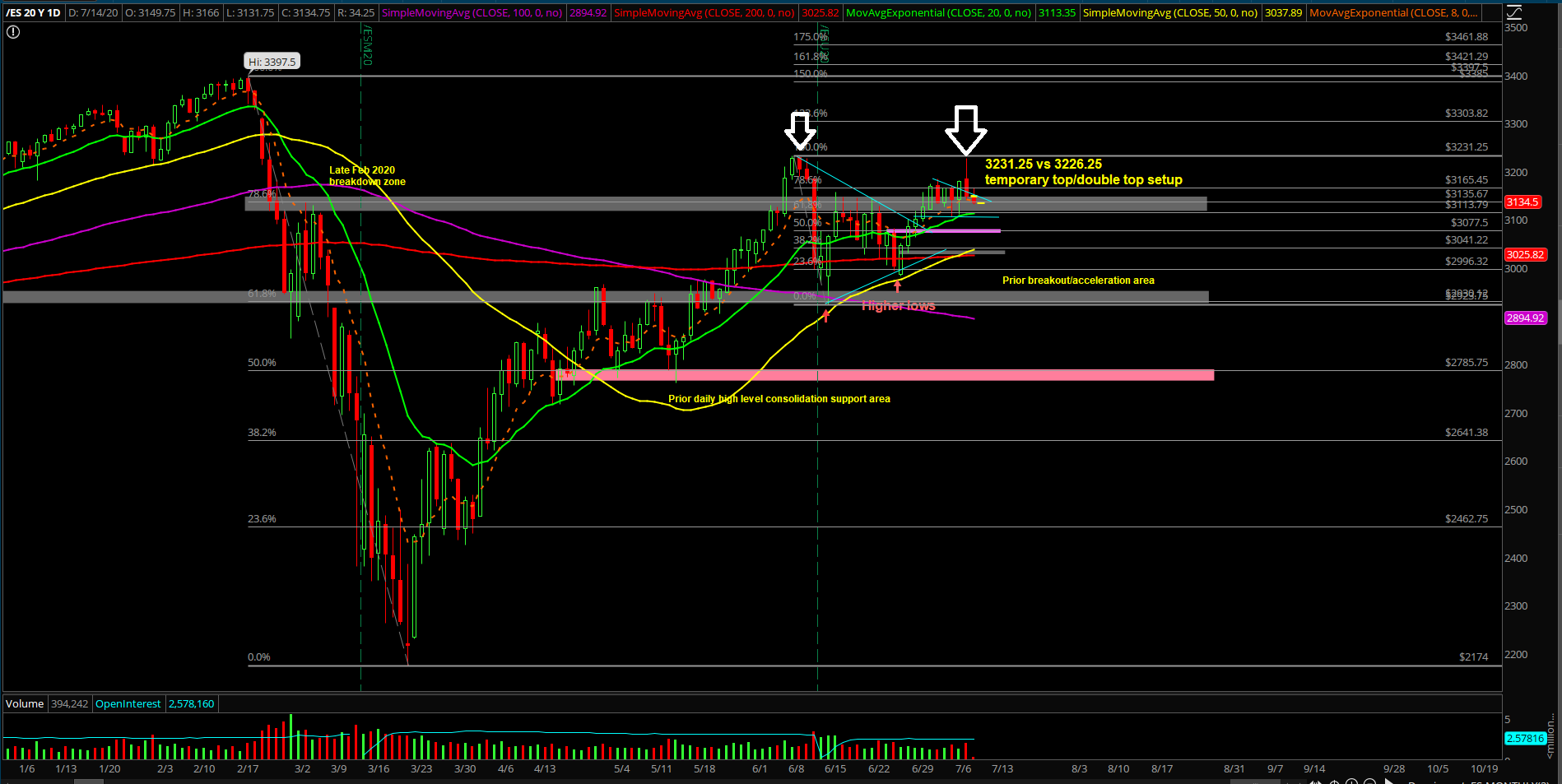

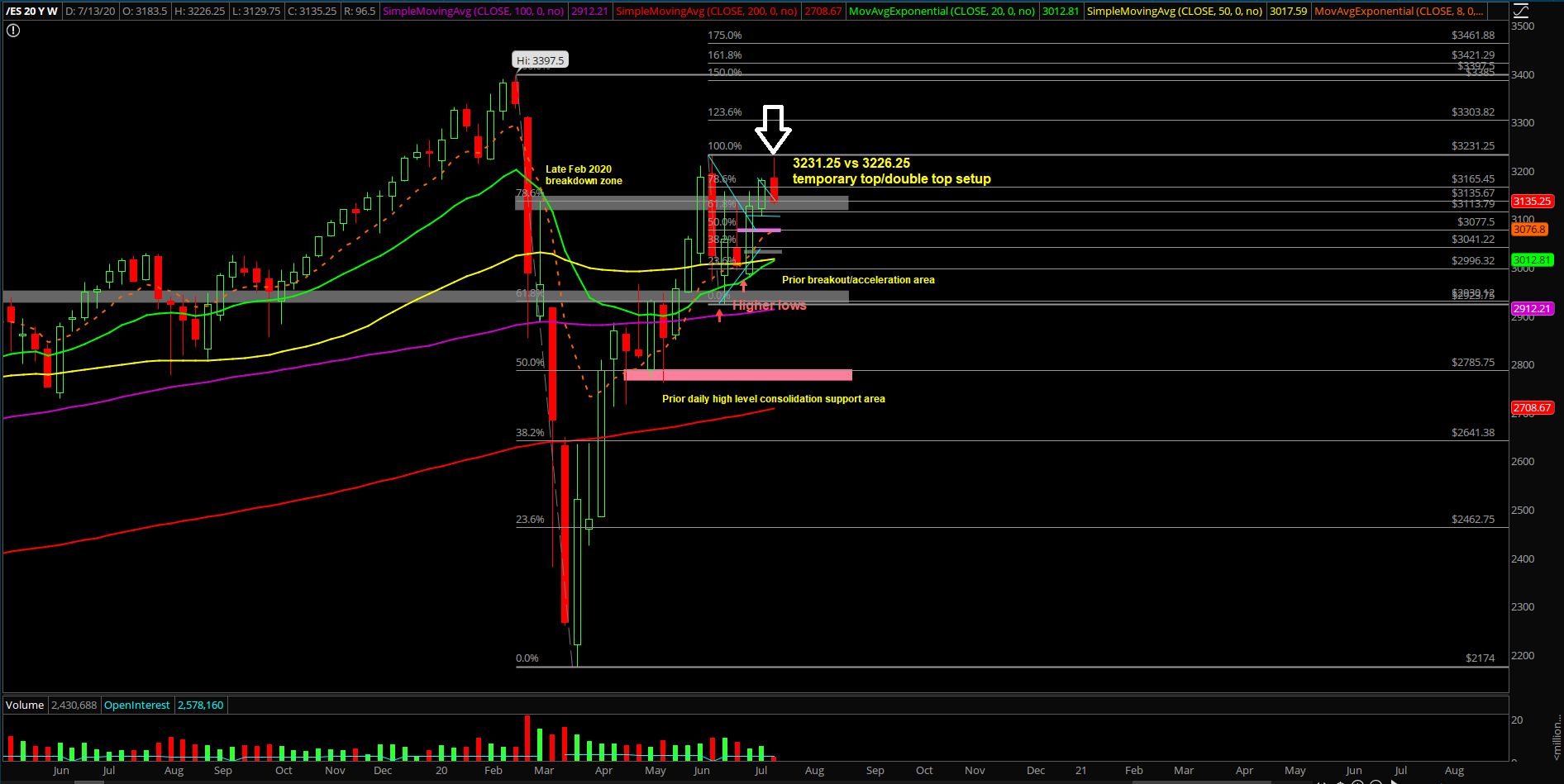

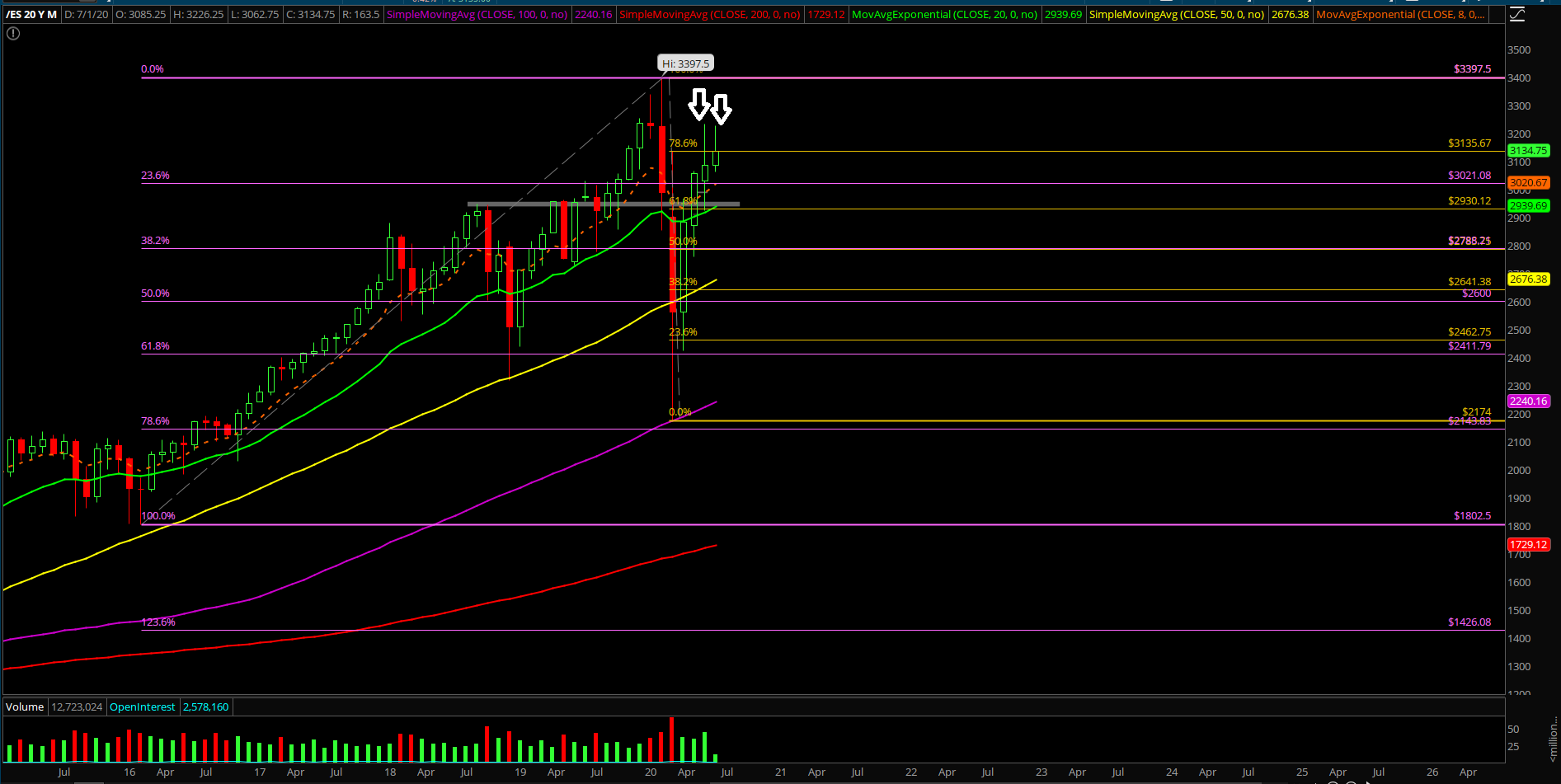

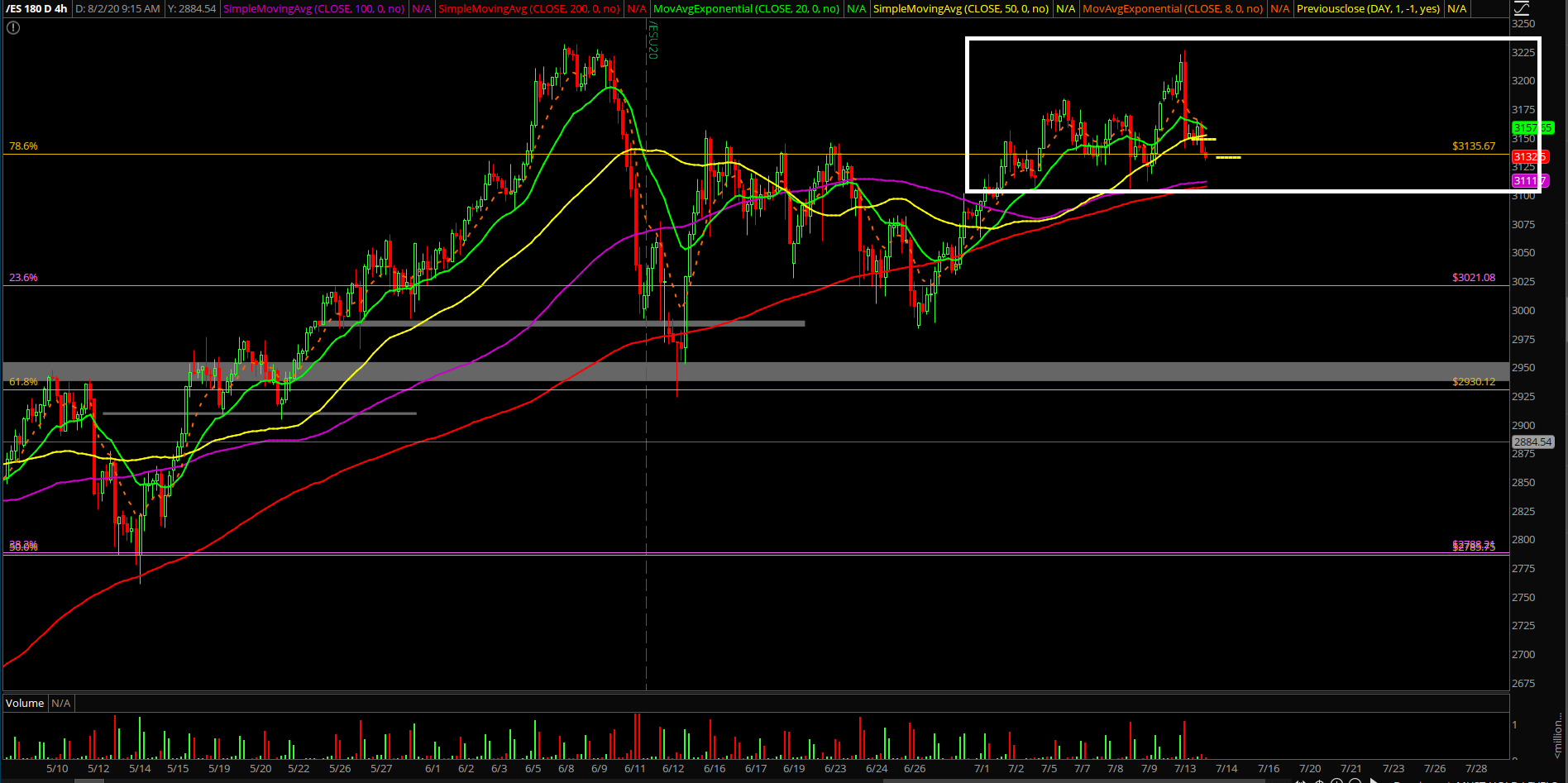

Overnight price action remained in a tight channel showcasing micro lower highs and lower lows. We’re treating 3226.25 on the Emini S&P 500 (ES) as the temporary top or double top, with the prior high at 3231.25, so we need to see bears show commitment today or tomorrow. Otherwise, it’s the same old consolidation at support and then re-attempt to grind higher at a later date.

What is the bias/gameplan going into today? Do you see a feedback loop setup?

- If you recall, we took profits at the highs given our proprietary signals warning us of an extreme overbought level combined with price action being outside of the daily BBs on the leading tech index.

- As demonstrated, we had to choose a safety route by taking all the profits on our short-term long positions, and then shorted the market via million dollar lotteries setups across the tech stocks

- Short-term momentum has shifted, so shorting is allowed again given the current situation when below 3226.25, which is a big shift since July 1st where we had a no shorting rule allowed for almost half the month.

- Trending resistances are now located at 3180/3165/3150, so let’s see how momentum acts today as we need more info. Bears main goal would be a continuation flush towards 3100 to indicate that they are back and they are powerful, otherwise consolidation comes to mind and that’s not optimal for a big short-term momentum shift according to the odds.

- We are short-term bearish right now when below 3226.25 as we grabbed some short-term put and put spread positions across multiple tech stocks yesterday for a quick mean reversion playbook, see if things stick.

- We will look for additional STFR setups if/when applicable because price action needs to give us an opportunity with the lower highs/lower lows if so. ‘Hold half and go’ setup if possible.

- Treat ES range as overall 3226-3100 for now or tighter range of 3100-3165

- A break back above 3180 resistance and a daily closing price above 3180 would be a huge indication that bears are just weak sauce and showing no commitment.