Bears Running Out Of Time

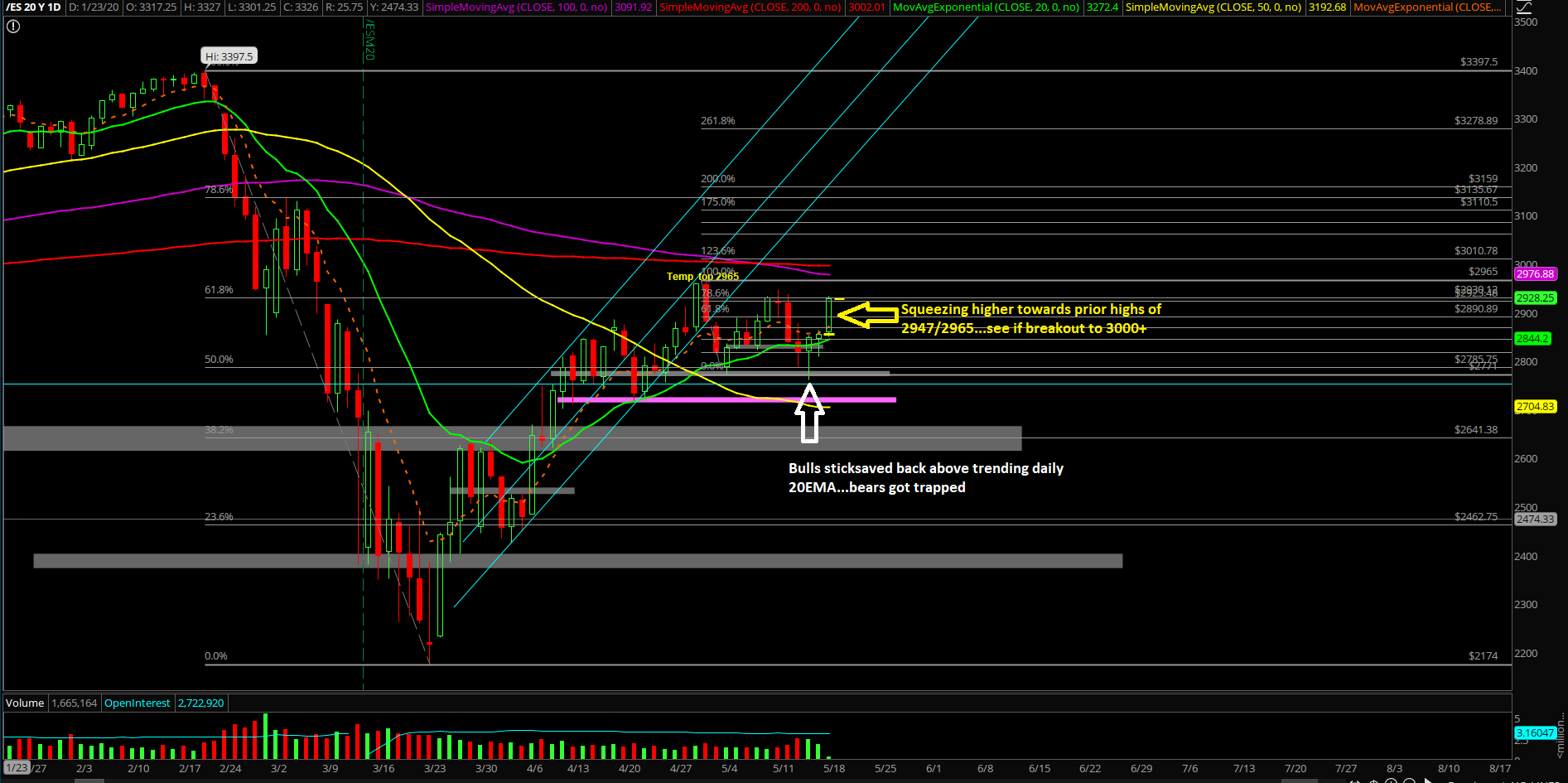

The May 11th-15th period played out as a consolidation week as the majority of the time was spent within an inside week. However, price action pierced the highs and lows of the May 4-8th week to kill some stops.

If you recall, the most significant things occurred on May 11-12th with the lower highs setup and then backtesting the daily 20EMA trending support and subsequently closing below that key trending support on Wednesday May 13th.

However, the price action was unable to sustain lower for the next session as Thursday produced a +90-point bounce that we predicted in advance with our real-time analysis and trading alerts.

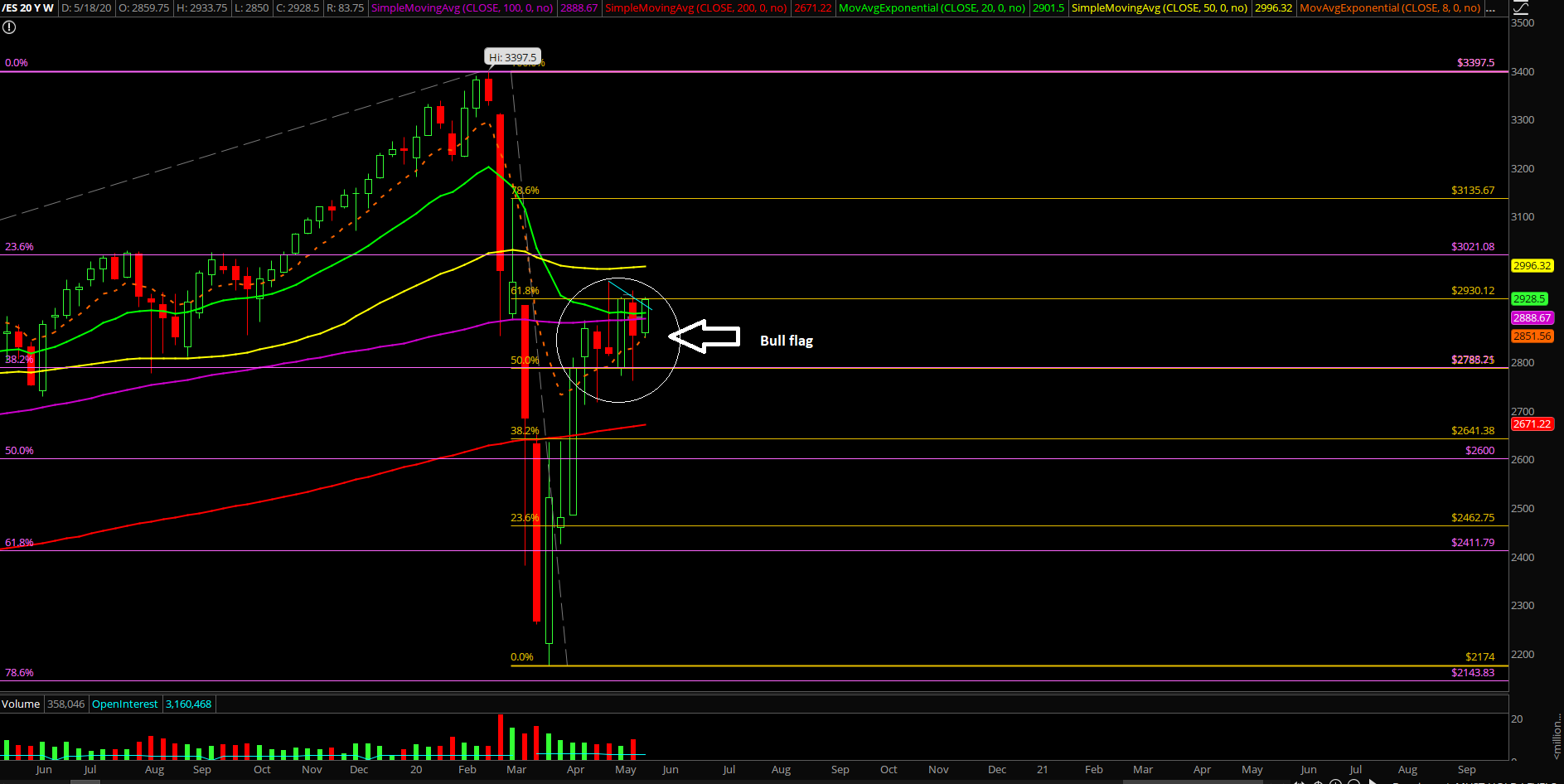

The main takeaway from last week was that the bears had another perfect opportunity to capitalize on wrapping up the week at the lows, but they failed to do anything concrete. Thus, another vicious feedback loop squeeze/bull flag continuation pattern setup been built and today’s gap up is crystal clear.

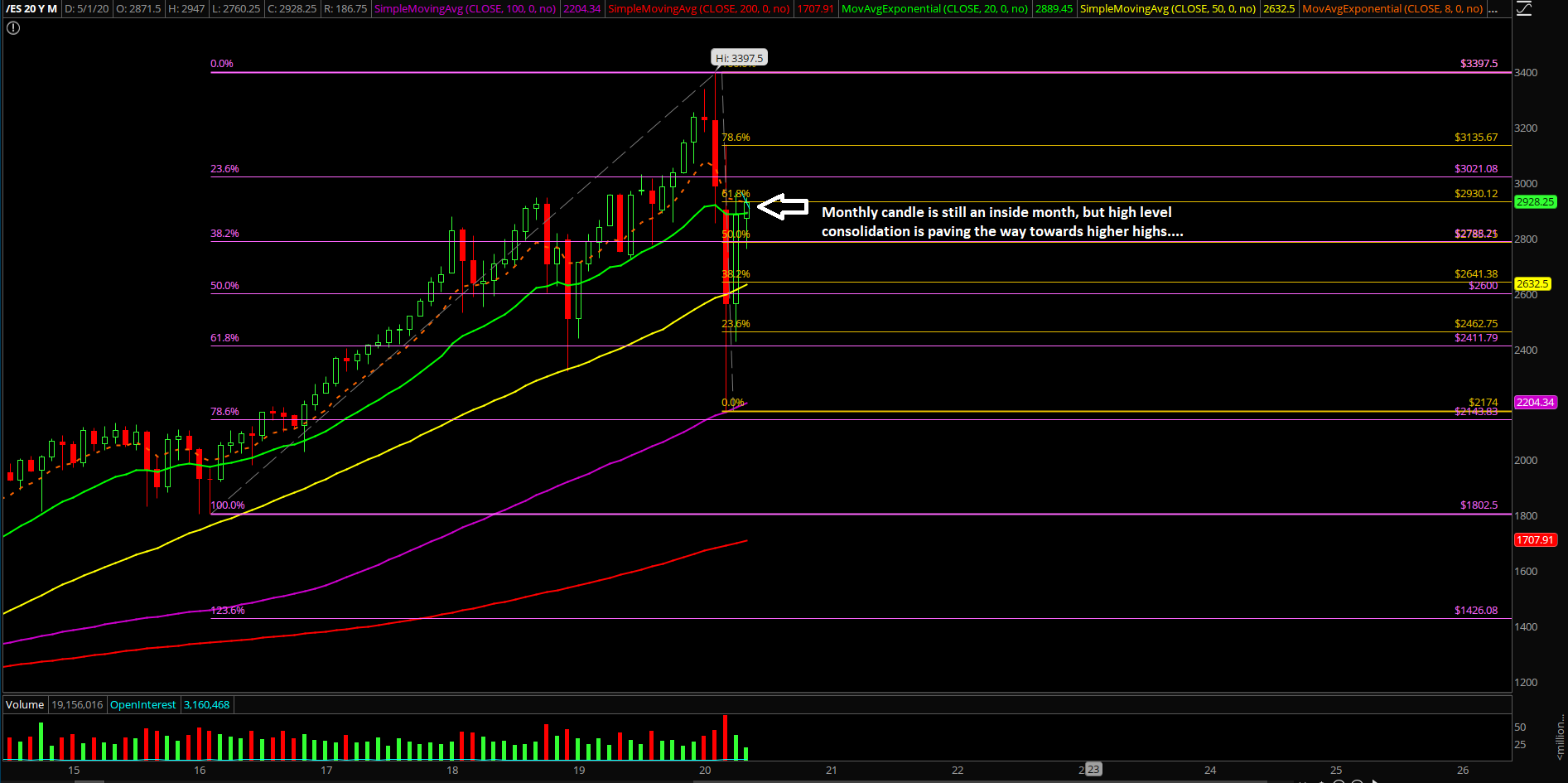

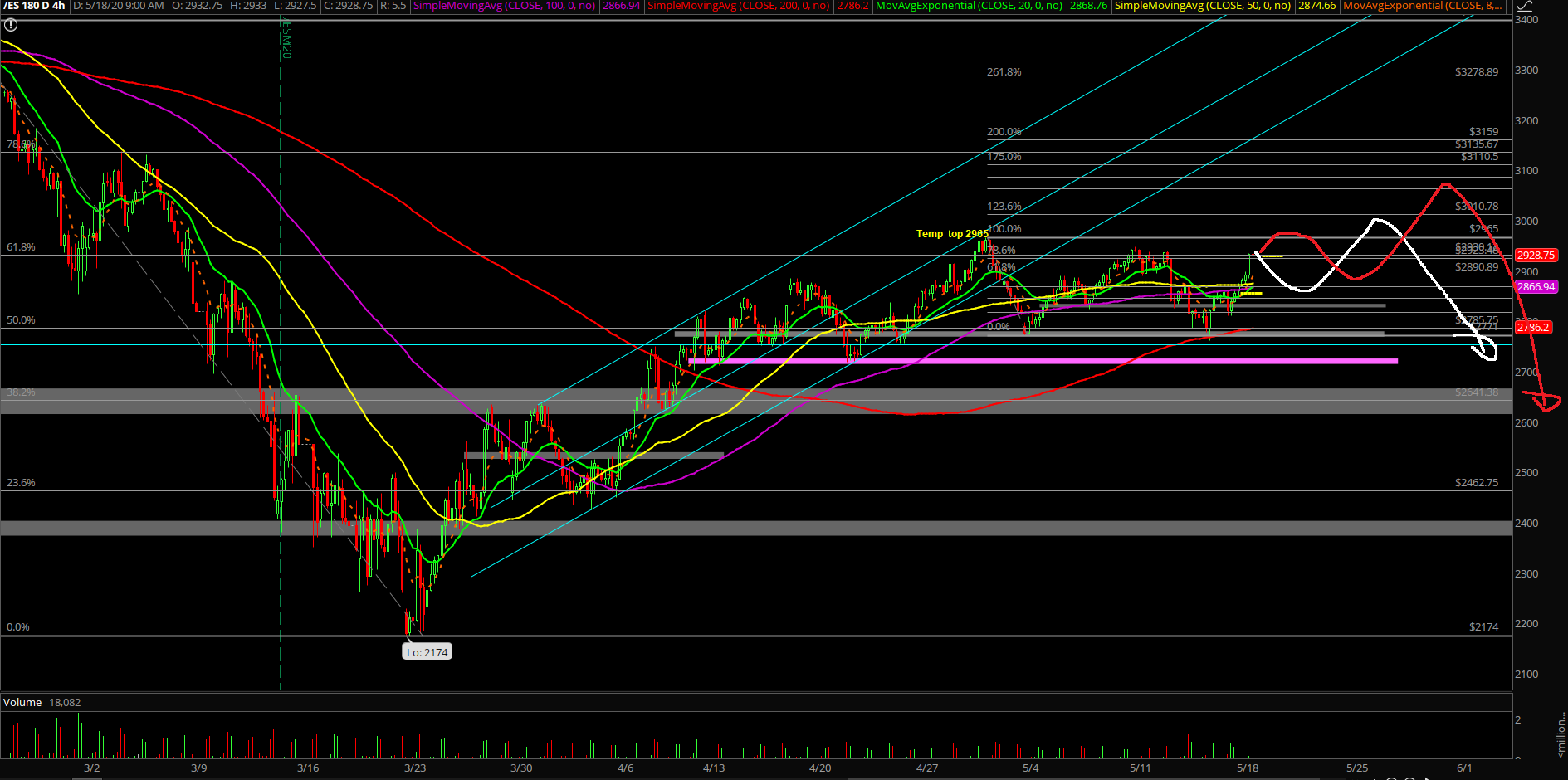

Price action is gapping up above some key resistances of the past few sessions while maintaining below the 2947/2965 prior highs on the Emini S&P 500 (ES). The longer that price action spends here doing a high-level consolidation/ bullish consolidation would enhance the odds of an eventual breakout towards 3000 or higher. Yes, you’ve got that right, the gummy bears are running out of time again when price action remains trending above our key support levels. It is what it is.

What’s next?

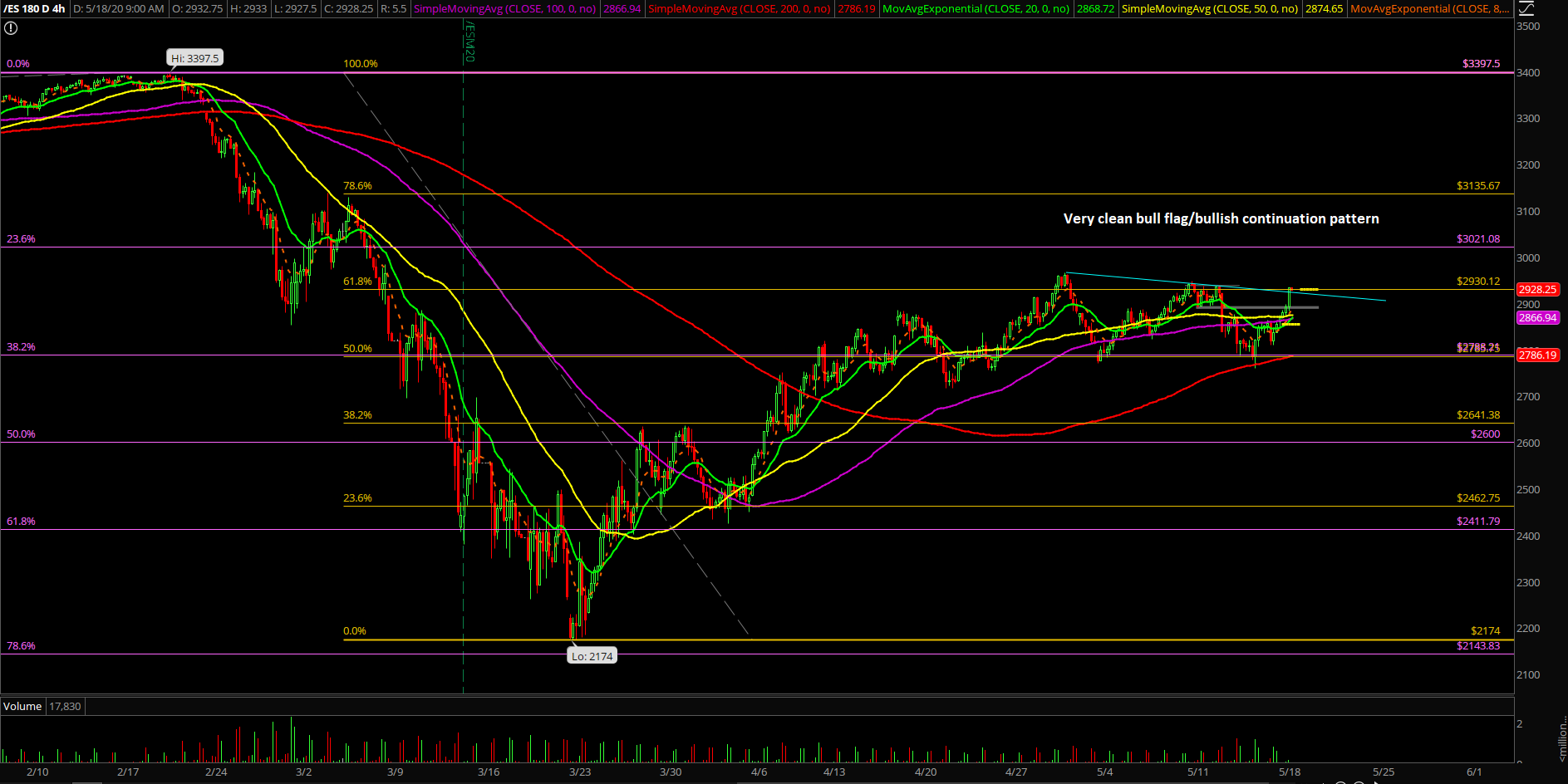

Friday closed at 2854.75 on the ES and it was sandwiched between the daily 8/20EMA. For reference, the Sunday night low was 2850 and current price is now 2927 as of writing. This means that it’s going to be a +80 gap up open for RTH in just a few minutes.

Summarizing our game plan:

- When above 2850, look for long setups only, unless you know what you are doing given the odds are stacked in the favor of bulls right now.

- Utilize 2947/2965 as the resistances from the past few weeks to judge whether the bull train is whether to squeeze immediately higher towards 3000 or more. Re-evaluate in real-time.

- Absolutely, no shorting allowed when above 2850, unless you know what you are doing. This should eliminate a lot of potential rookie mistakes.

- Last week bottomed out at 2760.25 versus our 2752 pre-determined key support level. We bought the dip at 2765 and the market has bounced way more than 100 points given our initial expectations. When bulls are in charge and bears are trapped market participants, there is no reason to doubt until support actually breaks and confirms some sort of breakout failure.

- We have drawn out new 4-hour white/red line projections, former is primary and the latter is alternative. Notice the same end goal target zone. Level by level approach, know your timeframes!

- We are on hold for our intermediate bearish bias until there’s a decisive breakdown below 2752, followed by 2717 indicating immediate momentum aligns with micro+intermediate timeframes. Know your timeframes!