Bears Lack Follow-Through

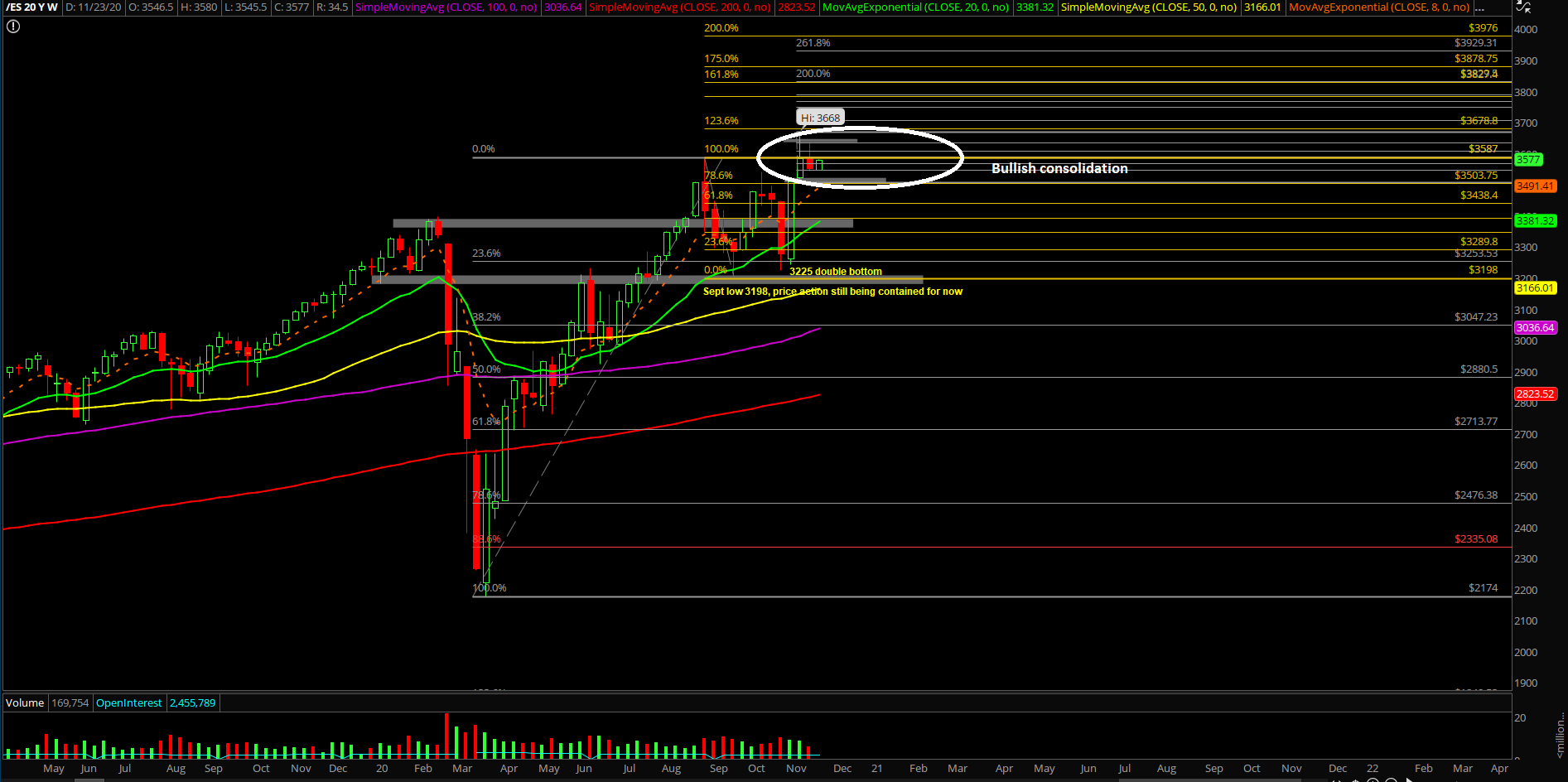

The third week of November played out as an inside week, meaning price action traded entirely within the range of the second week of November. This overall consolidation pattern is quite bullish as we head into November month end alongside with the slightly bigger picture into year end.

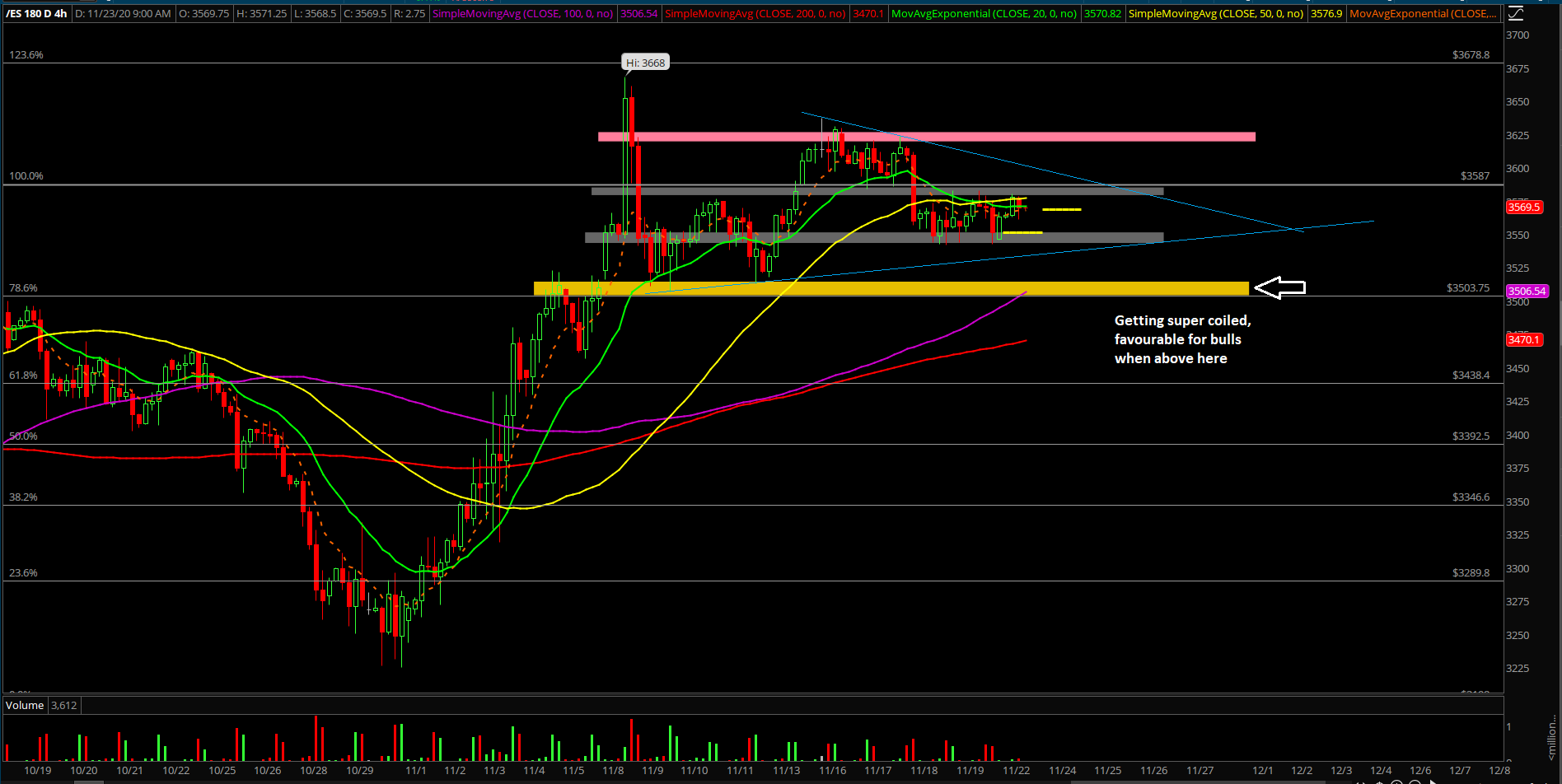

The main takeaway remains the same: Bears are trying their hardest to commit to further downside, but they just lack follow through and momentum on their side. They are running out of time again as there are feedback loop squeeze setups all over the place on key timeframes. Pair this with the fact that NQ/tech is getting super coiled in a bull flag/pennant…you have the perfect recipe of a squeeze when above support.

What’s next?

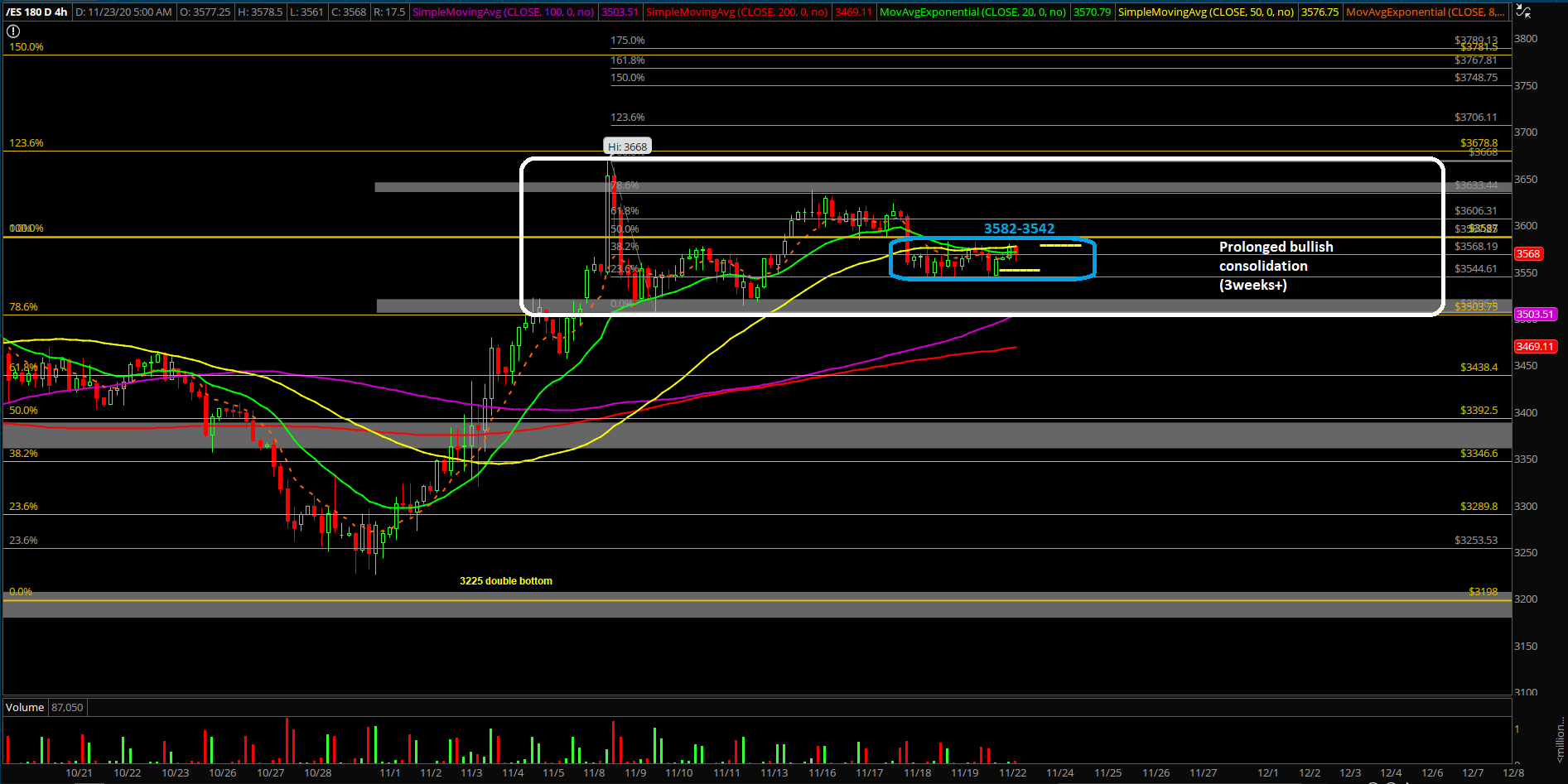

Friday closed at 3551.5 on the Emini S&P 500 (ES), around the lows of the week. However, no support was broken as the micro tight range has been 3542-3582 for the past couple days. Expecting more of the same today when price is within range so focus on the key levels to do quick scalp setups.

Summary of game plan:

- Short-term bullish bias when above 3542 today, focus on higher low setups when/if applicable.

- If above 3582, likely squeeze into 3600/3623, then see if ATHs ready or need digestion again.

- If wrong, below 3542 would open up 3505-3515 next key support.

- If you recall, the bears had a very legitimate setup the past few days, but they are failing to show commitment as momentum is neutral on the micro charts (anything below 4hr).

- Price action could not break below the 3542 on 4 separate attempts since Nov 19th. This is putting pressure on the bears as it’s the same old pattern of prolonged bullish consolidation.

- Short-term bears are on a timer once again because they had many opportunities to really open up the flush gates. The entire consolidation of the past few days could be classified as a feedback loop squeeze setup and it triggers with an hourly close above 3582.

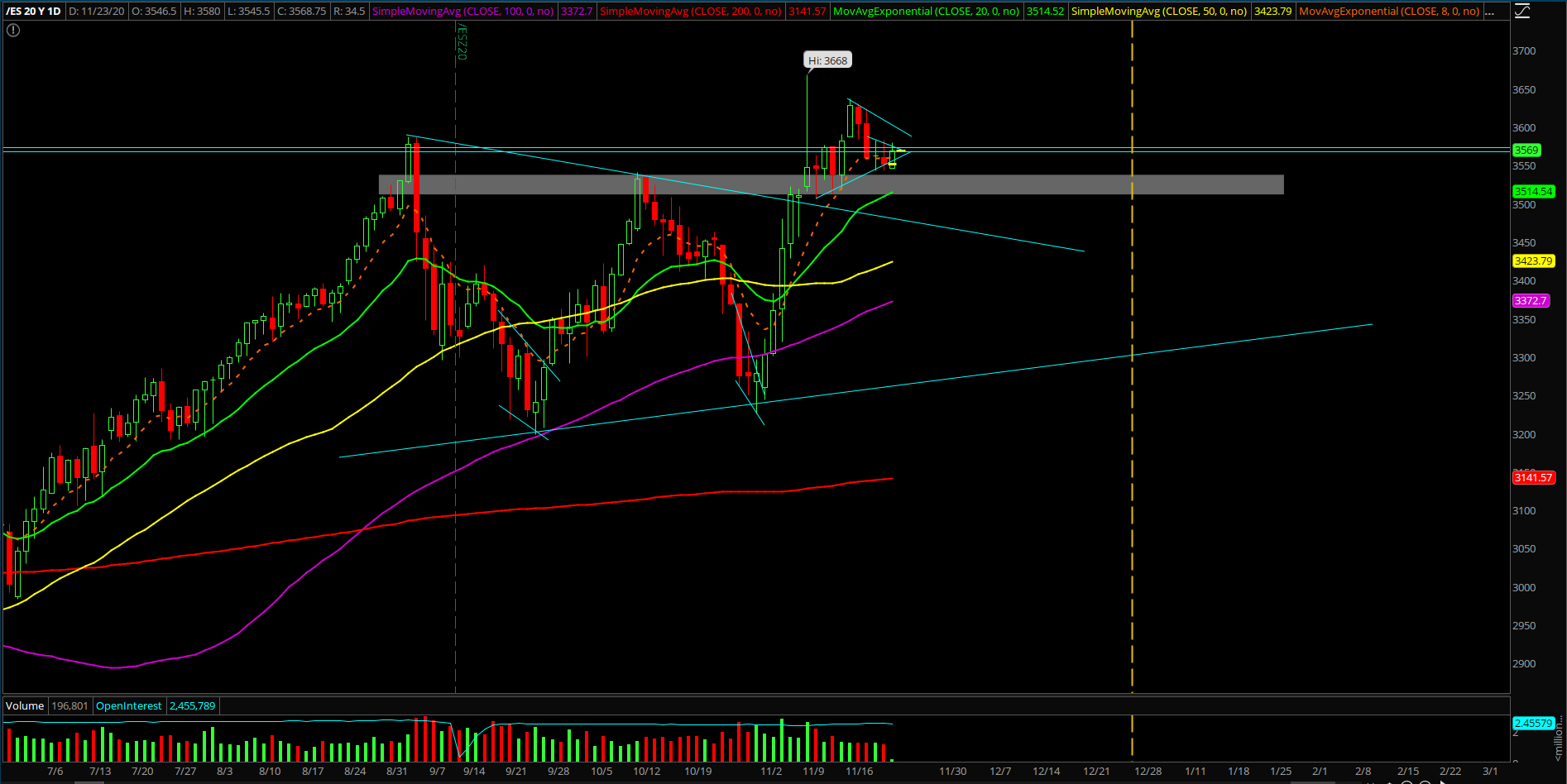

- Daily timeframe, testing and holding daily 8EMA right now and the next area of interest 3505-3515 would be a hugely contested zone for a large dip buy opportunity (see if 3540s keep holding or not, there’s a double bottom/higher lows setup).

- Weekly timeframe, we are treating this inside week as a hiccup towards the year end highs attempt as long as last week’s 3505-3515 support area holds. Adapt accordingly.

- 3515 is also our SHTF(shit hits the fan) level if multiple daily closing closes are able to sustain below it. This means that a sustained break below an important daily momentum level combined with last week’s low area would be a deadly combination.

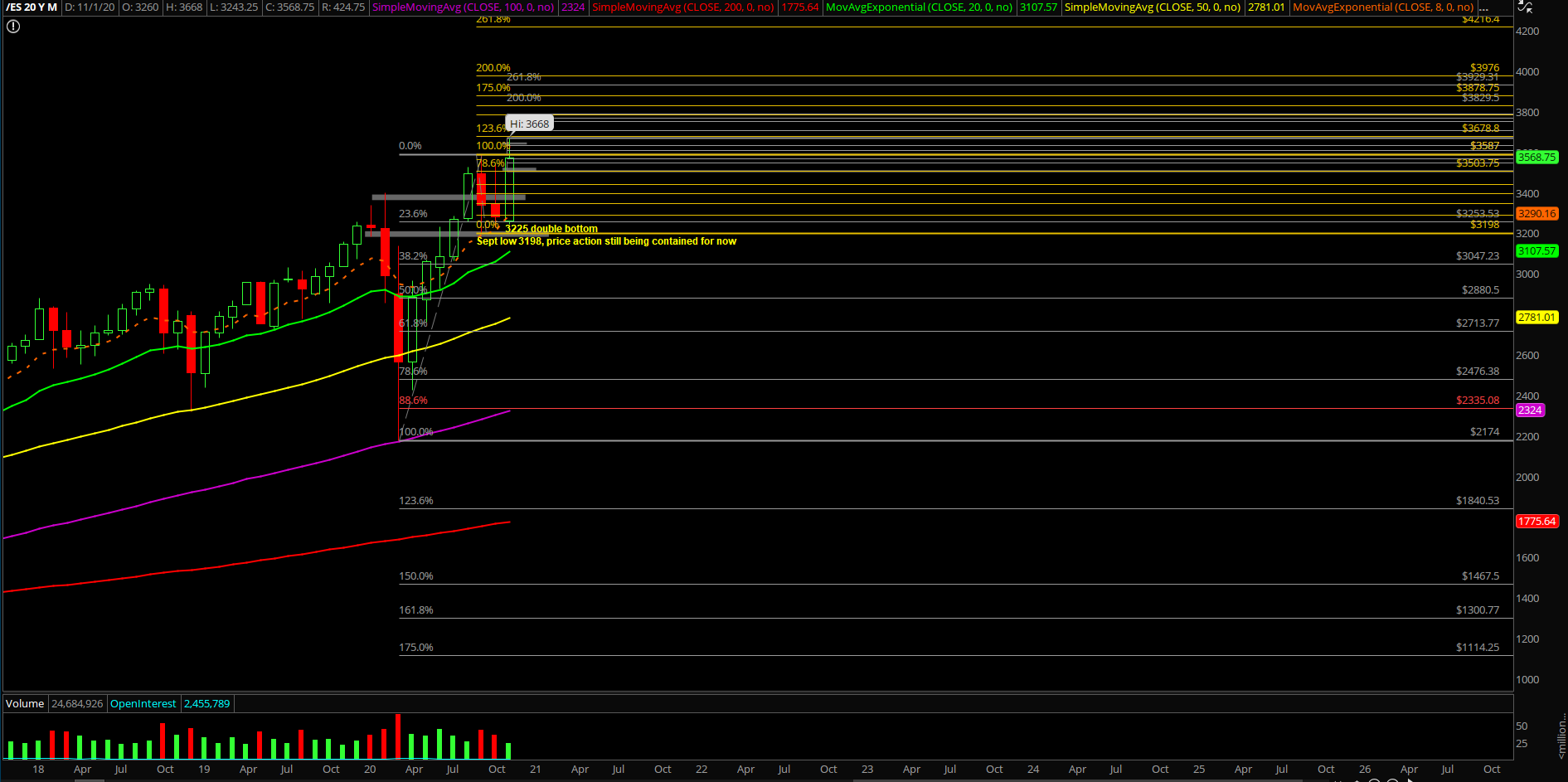

- For reference, as discussed in the past reports; a breakout of the 3587-3198 range = 3589+389 = 3976 (100% measured move target). Market is still at least 300 points away or another 8% away as of writing from bigger picture target.

- Please know and understand the timeframes in this report, it is overwhelming, but when/if short-term aligns with bigger picture…it is often a recipe of success.