Bears Keep Letting the Bulls Back In

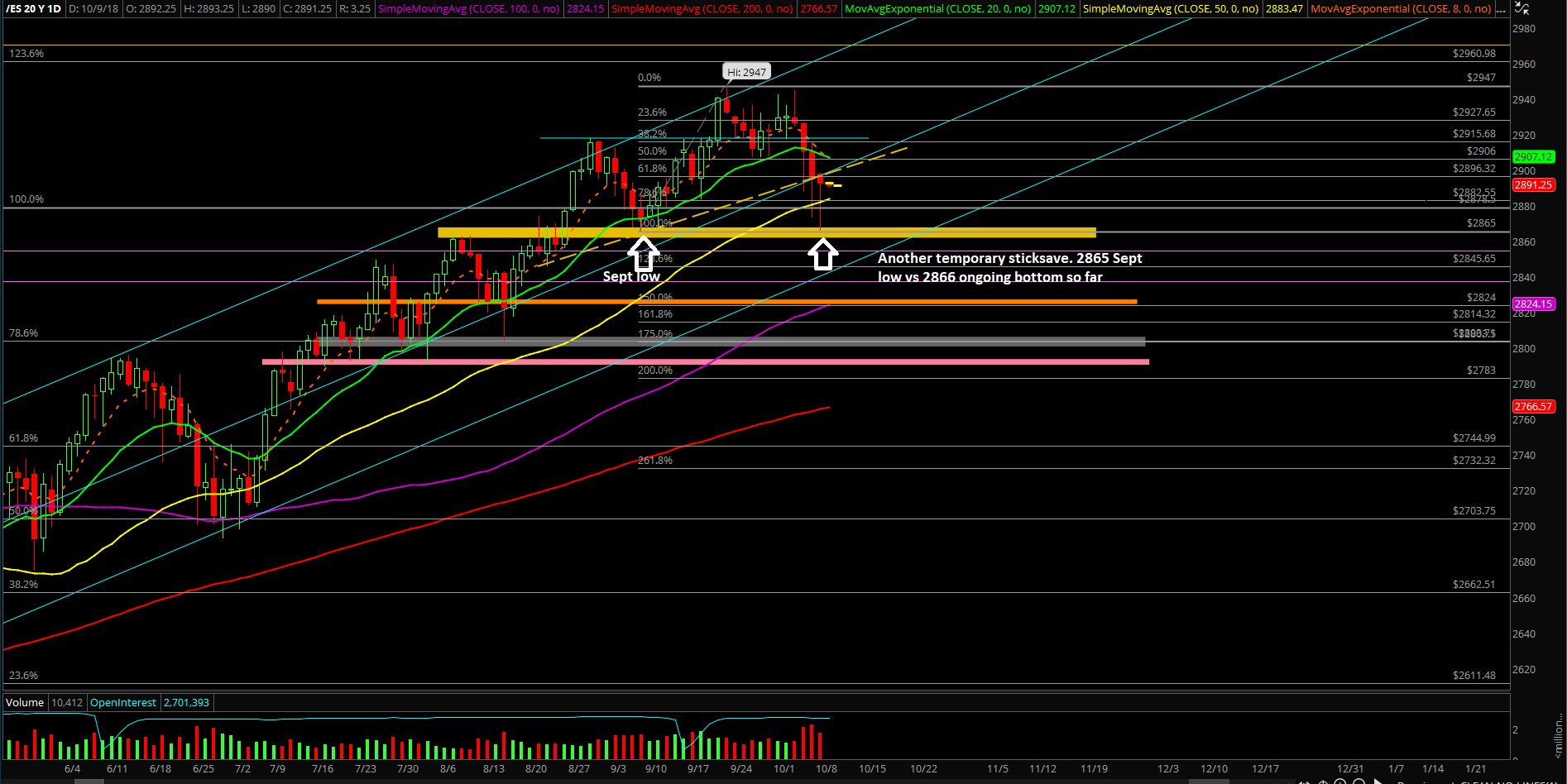

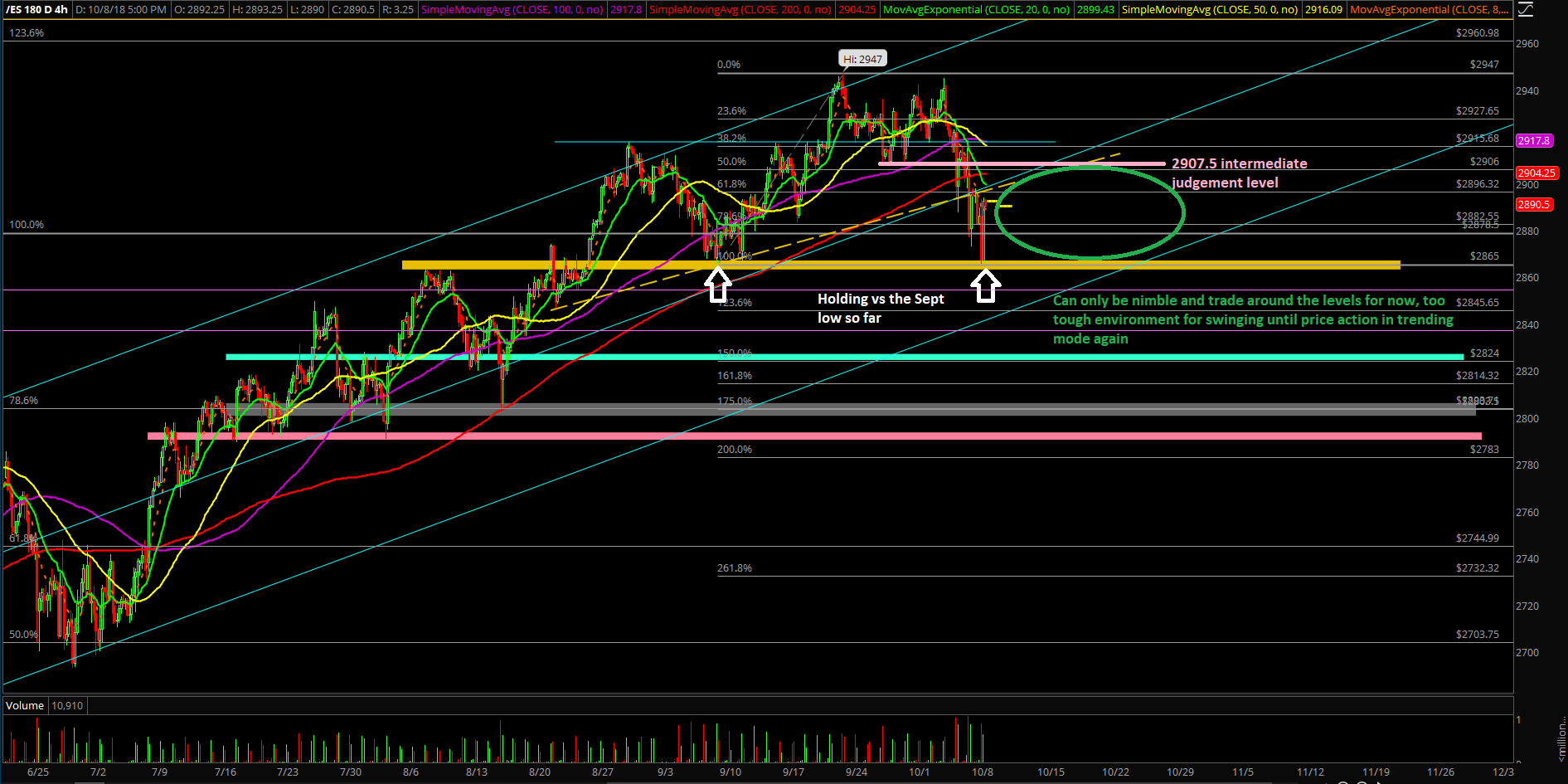

Monday’s session was a bit similar to the prior two sessions where price ground down towards support. However, it’s now three times in a row that bears are unable to close in strength at the lows and keep letting the bulls recover in the afternoon around 1-2PM with the making of the temporary sticksaves near respective supports.

In this case, today was one of those unfortunate scenarios of perfect stop runs as the intraday low was 2866 versus the 2865 must hold support from the Sept low.

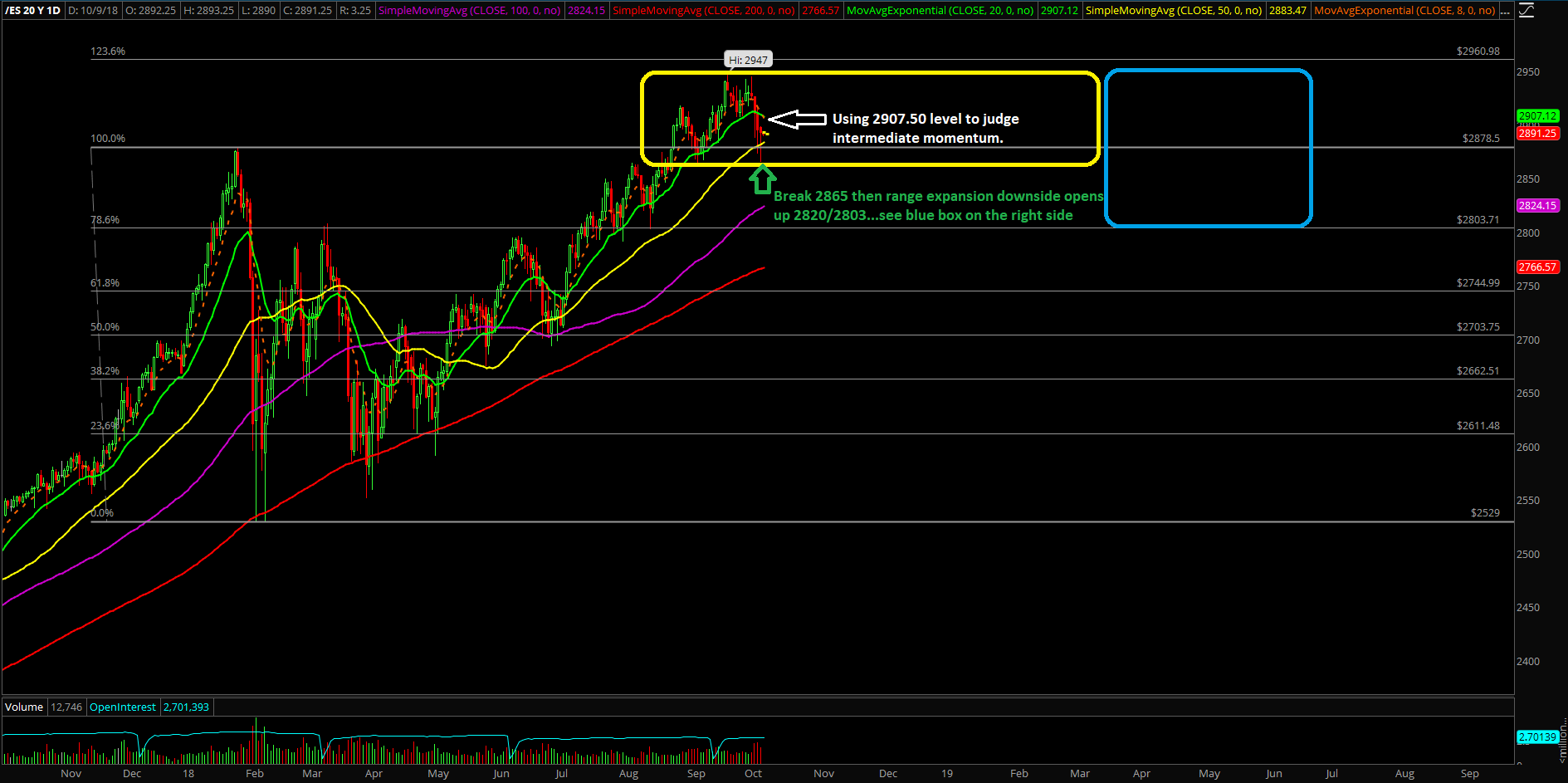

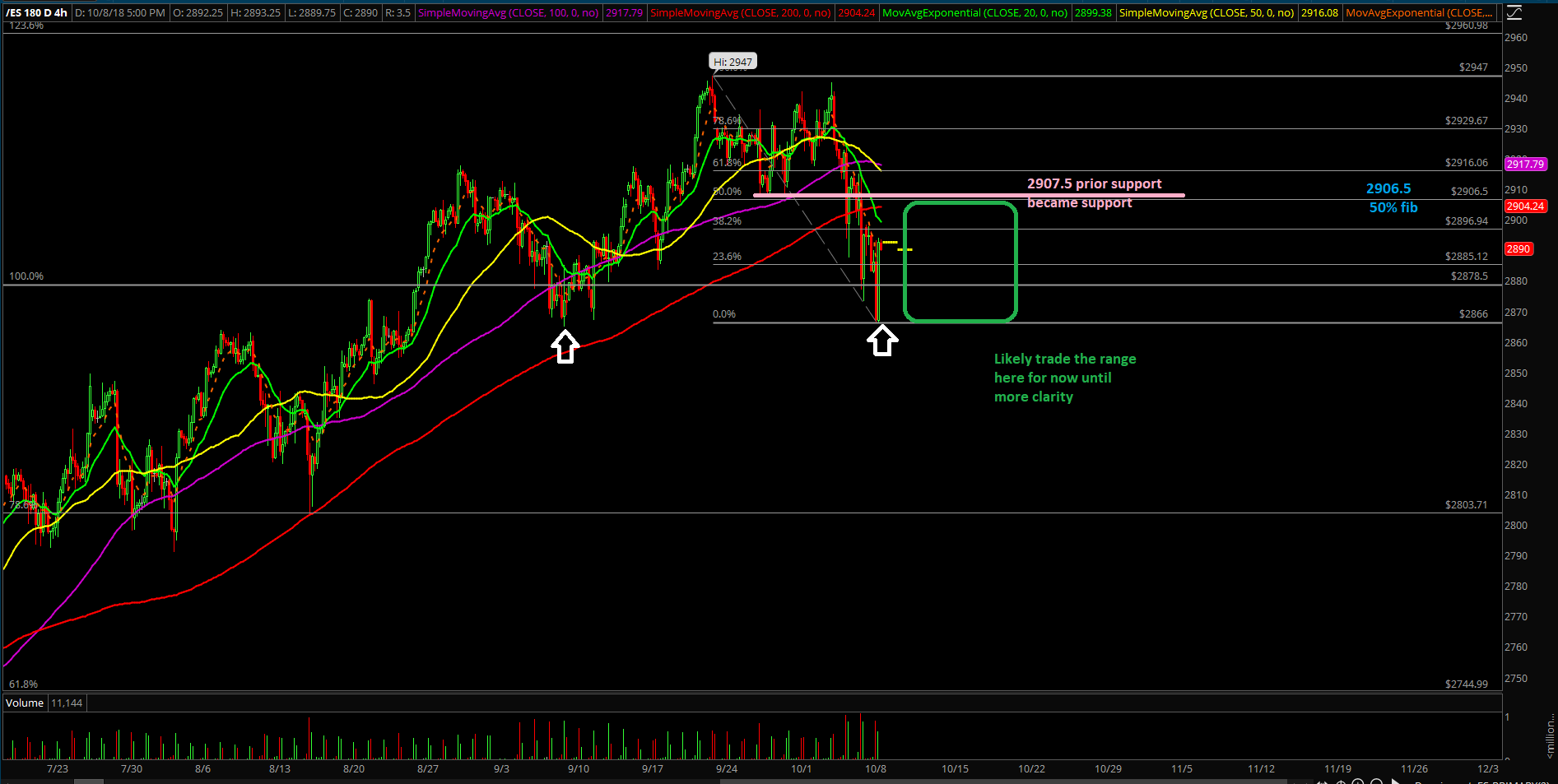

The main takeaway from this session is that the inside month context remains valid after all that transpired earlier. Technically speaking, it is still a double bottom/higher low pattern with 2865 being the Sept low compared today's stick-save low of 2866. As mentioned earlier, if the price action breaks back above 2893 and then 2898.25, the odds would shift back towards the V-shape reversal pattern that we were originally looking for towards the range high 2940s. The bulls would also need a stronger confirmation by taking out 2907.5 to further enhance odds of a sustainable bottom instead of this.

Conversely, the bears still need a breakdown below 2865 in order to open up the floodgates into the next major supports at 2820/2803.

Currently, the action has been fairly tough with the whipsaw as we’re hovering below the immediate daily 20EMA bull train track compared to one directional trend from past few months. Traders need to on their tippy toes here given the inflection point and more nimble as our standard BTFD strategy has been suffering in this environment given the market conditions.