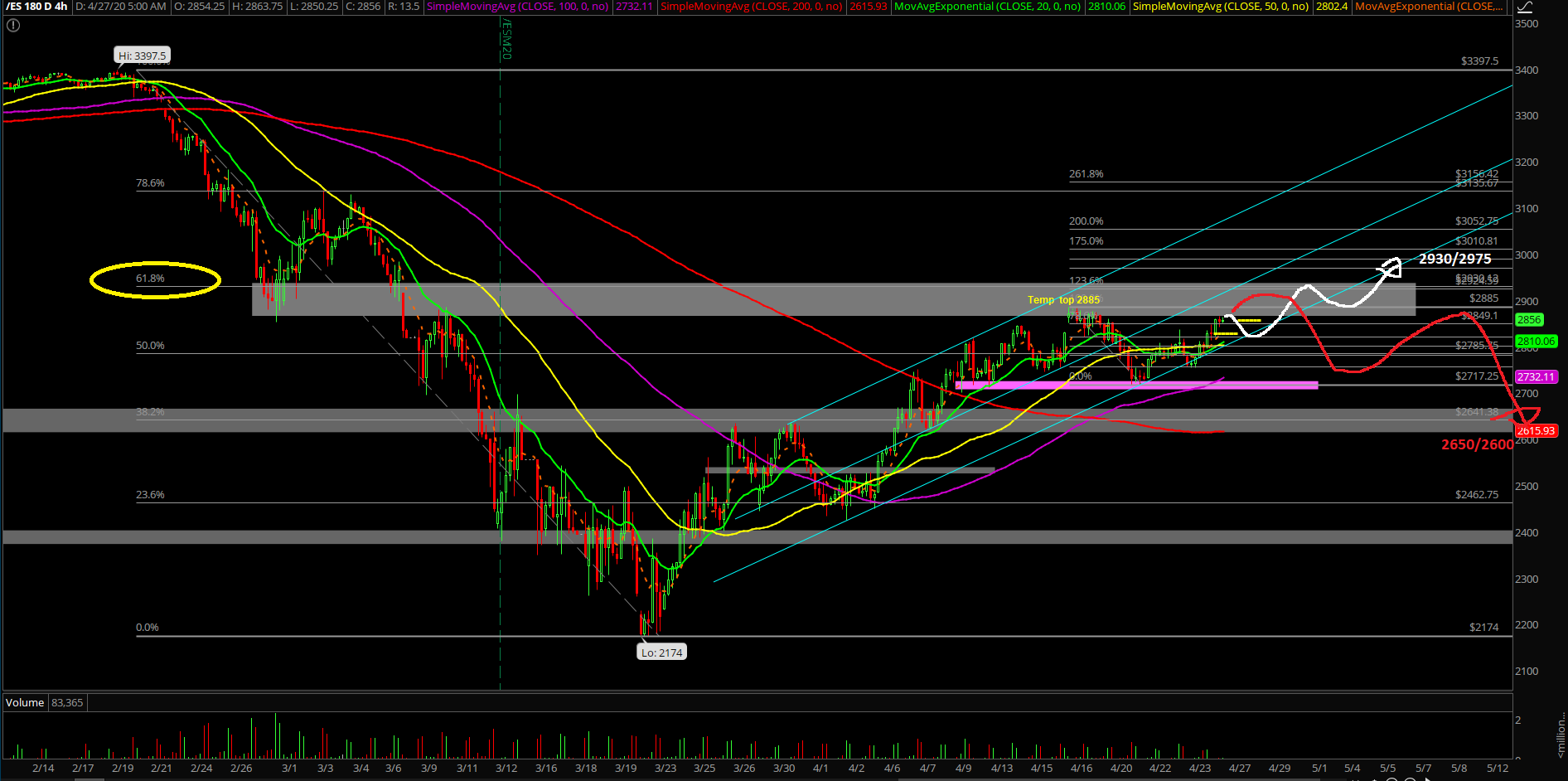

Bears Fumble - Market Analysis for Apr 27th, 2020

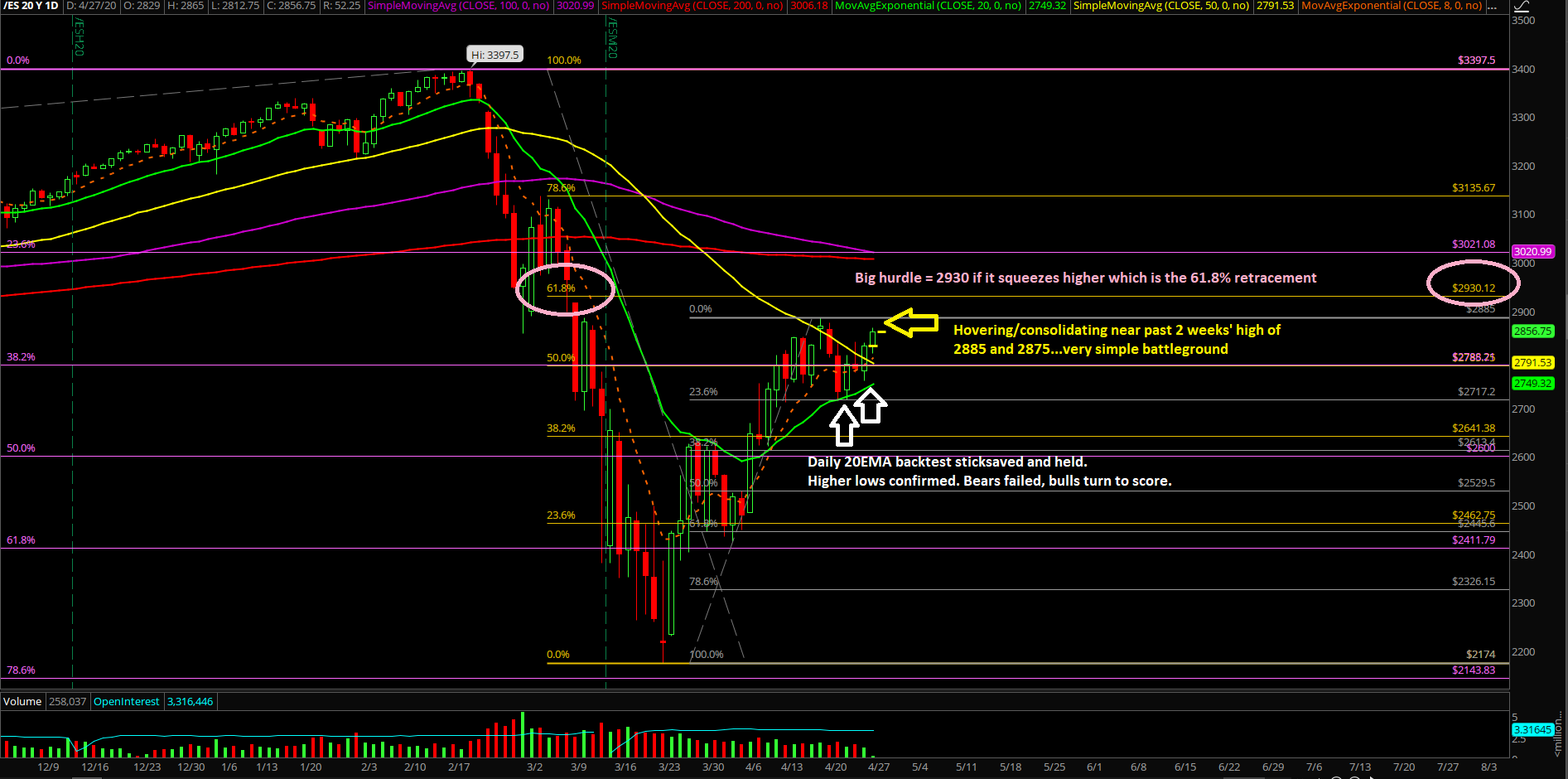

The fourth week of April played out as an inside week as the bears faltered their immediate bearish setup and bulls stick-saved perfectly according to our daily 20EMA trend ruleset.

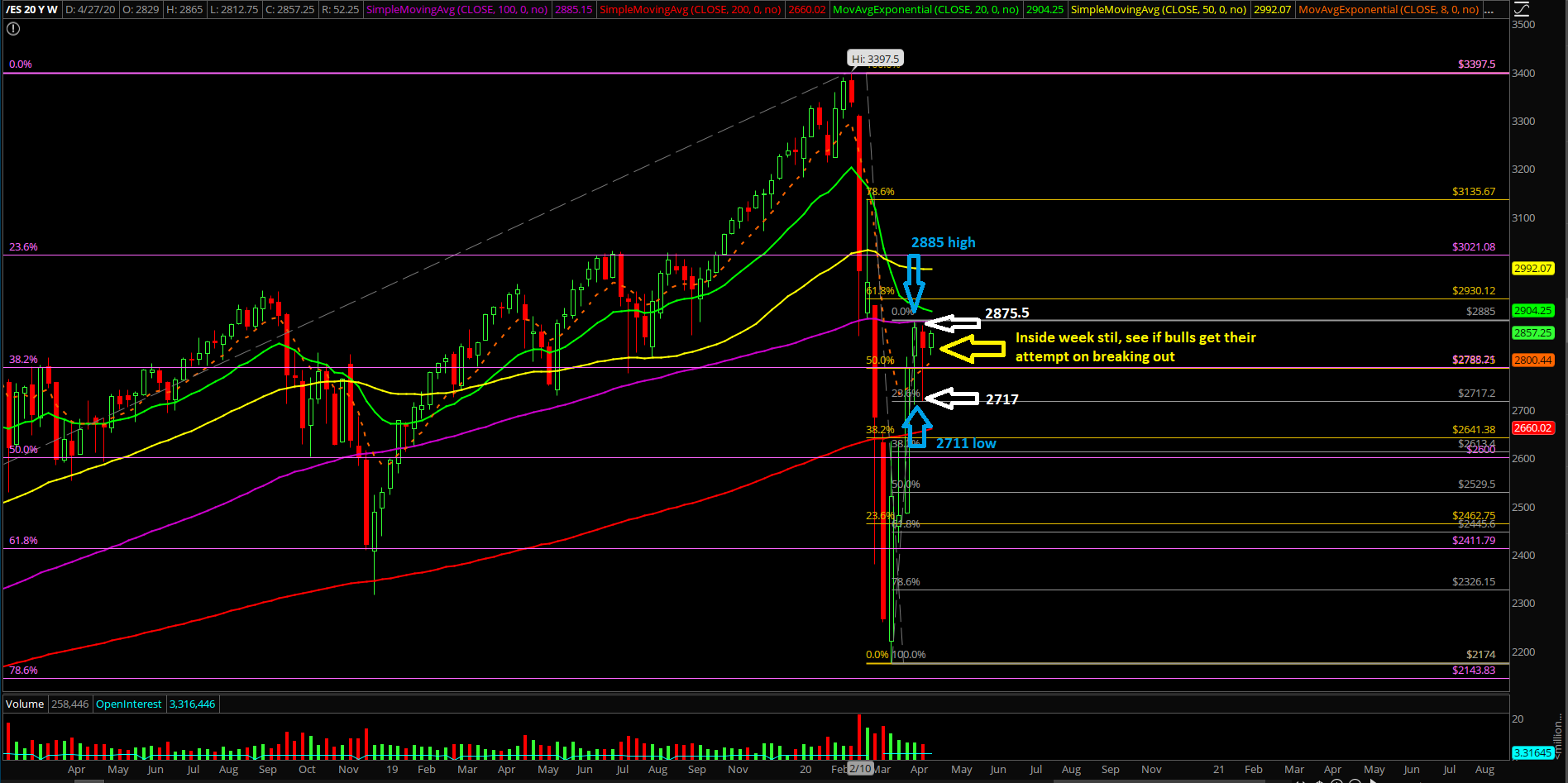

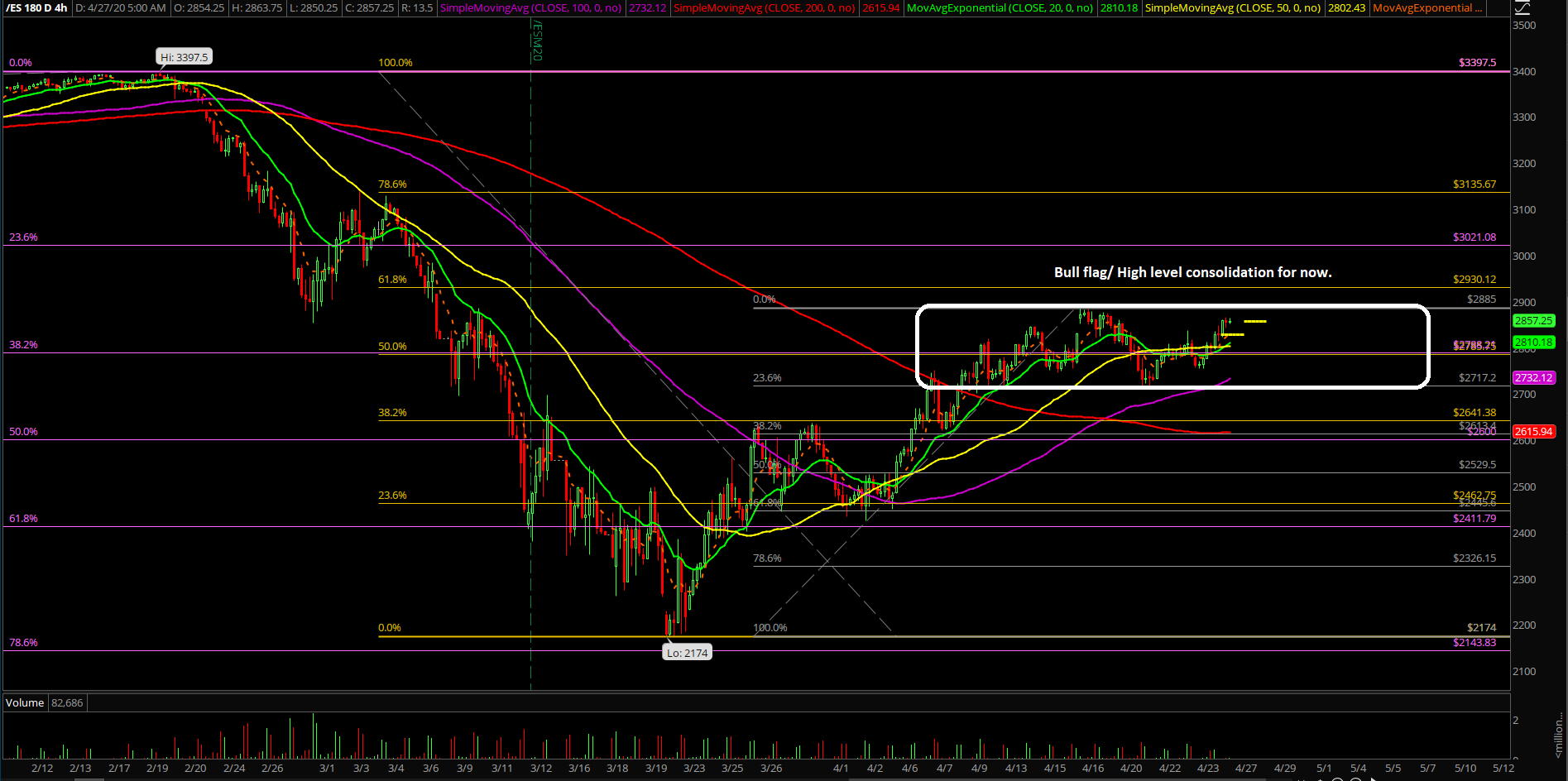

If you recall, early last week the price action topped at 2875.5 on the Emini S&P 500 (ES) after its prior-week high of 2885. Then, it swiftly made a backtest against the key support zone of its prior week and eventually bottomed out at 2717.25. The rest of the week became a high-level consolidation/bull flag pattern.

The main takeaway is that the bears fumbled an immediate downside continuation setup, and bulls now have the ball and everything favors the prevailing trend given the past few weeks’ context and structure.

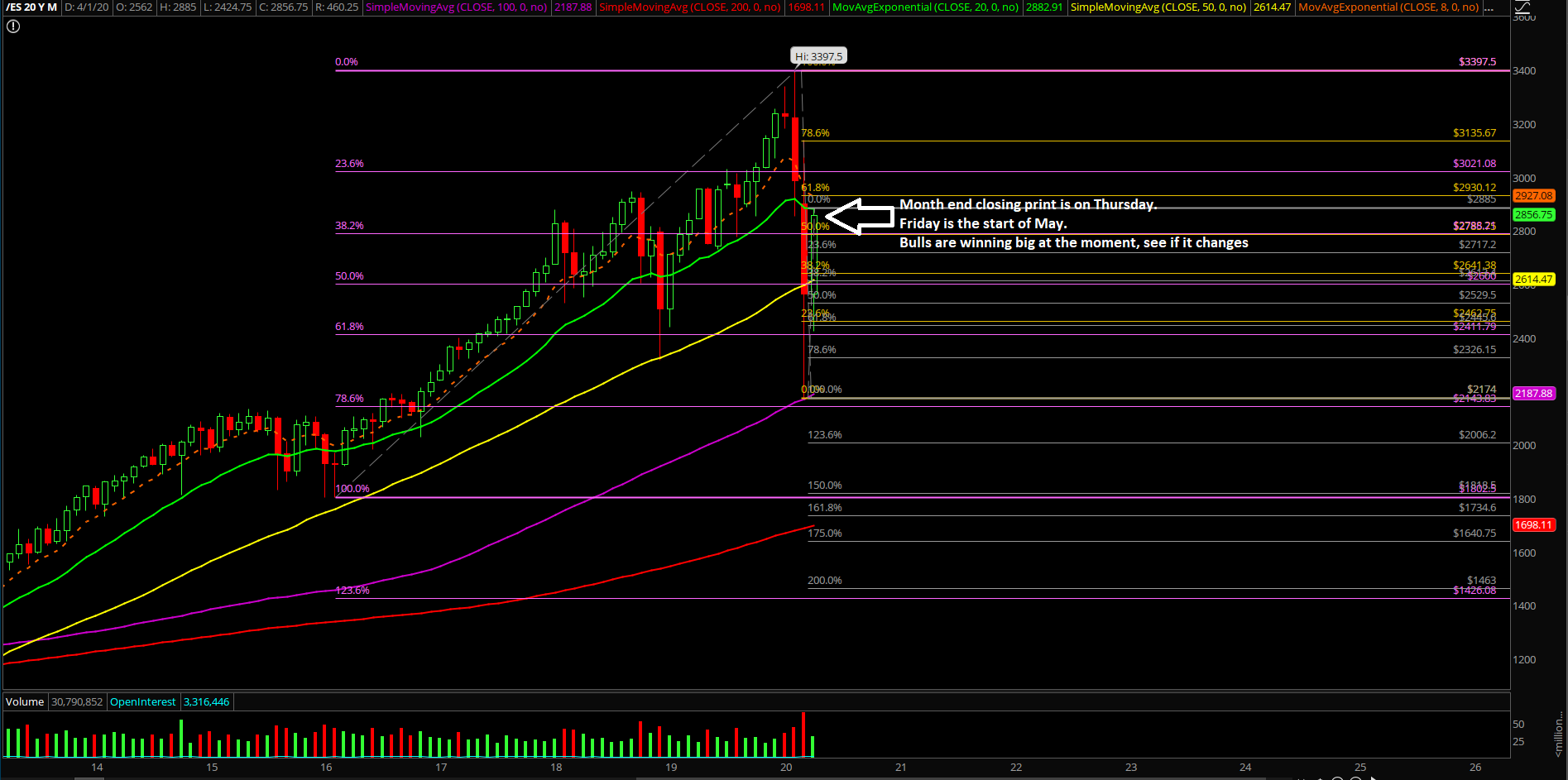

The billion dollar question for this week is quite simple: Could bulls score in a big way and break above the 2875/2885 range high resistance levels and squeezing into 2930 and beyond? At the moment, it is still an inside week, but the range is getting tighter and tighter so there should be a resolution very soon. For reference, it’s been a relatively easy up trend month and there’s 4 sessions left until Thursday’s monthly closing print for April. If there was a time that countertrend bears need to show up, then it is now or never.

What’s next?

Last Friday closed at 2828 which was the upper half of the inside week ranges. The battle lines are crystal clear for both sides here given their respective goals.

Our game plan highlights:

- If you recall, during last week, the price action backtested against the daily 20EMA at around 2717.25 and bulls stick-saved it perfectly. This meant that bears attempted the weekly inside week breakdown, but they couldn’t win so our initial expectations of the immediate big downside setup disappeared and evolved into higher highs. Ultimately, this means that bulls are winning as we head into this Thursday’s monthly closing print for the month of April.

- For now, 4-hour white line projection is valid when above our trending immediate support level, 4-hour red line as alternative if the bears show up at resistance/range high to stop the breakout.

- When price action is above 2812, northbound trains remain favorable due to on-trend setups.

- We are on hold for our intermediate bearish bias until there’s a decisive breakdown below 2752, followed by 2717 indicating immediate momentum aligns with micro+intermediate timeframes. Know your timeframes!