Bearish Under The Surface

The Bayesian resistance band identified weeks ago at 440-444s in the SPDR S&P 500 ETF (SPY) continues to thwart any bullish advance.

Under the surface, things remain bearish and thus we are positioned short.

This is what we wrote yesterday: For those feeling frustrated with our bearish positioning ... guess what? The bulls have been equally as frustrated over this timeframe. Why? Cuz SPY hasn’t moved out of its + 0.6% trading band over the last 3 weeks. Welcome to a potential intermediate-term topping process – where everyone is a loser (in terms of mental capital)!!

The odds still support our current positioning and IWM continues to lead. Following our process, we trade the odds, and odds told us to get into short positions Thursday and Friday of last week.

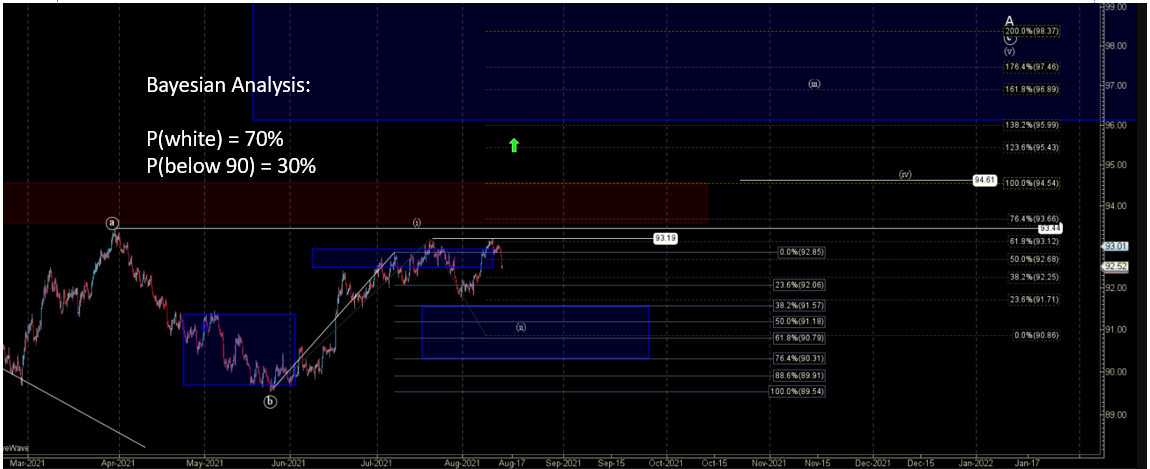

IWM is behaving and premarket it looks like SPY and QQQ have subtly taken IWM’s lead. Will it build to more for the bears? With a vibration window (vw) later this week, things look encouraging.

For those wanting Bayesian-only longer-term discussion, then I encourage you to read the SPY section randomly from one month ago, two months ago, three months ago, wherein I told members to hold longs until this June/July.

Here’s a summary from before: For those members reading daily thoughts over the last several quarters, my Bayesian work identified summer 2021 (as early as June/July) as a potential topping region for a minimum multi-week to multi-month (or worse) correction. So as we find ourselves in the June/July timing window we are at risk of a longer-term timing-induced pullback.