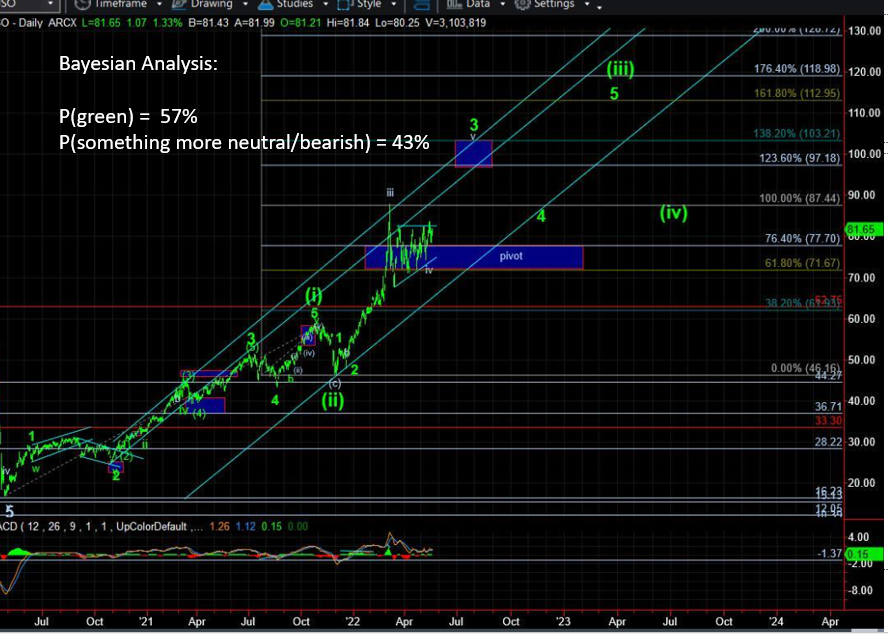

Bayesian Probabilities Support May Forming Multi-Month Bottom

As posted two weeks ago, the vibration window (VW) extended from late last week into early this week, and on 5/20 there was definitely relative low action that stalled the bearish trend intraday. Interestingly, the IWM cluster I identified two weeks ago in the 168-172 region continues to hold.

This still applies: The most important leading index for this potential bottom remains IWM holding above its important 168-172 cluster – of which it continues to do. I know members want a magic wand to be waved for all of this volatility to go away, but sorry, it ain’t going to happen.

And members in Bayesville should also understand we trade probabilities, and 68% isn’t 100% (i.e. stop viewing things so deterministically). Bayes and I had similar BPs (Bayesian Probabilities) at the ATHs in early-January 2022, and despite all the permabulls looking higher, we put on hedges across our entire longer-term accounts and protected 20% in drawdown exposure – as posted dozens of times in the room.

Will these same BPs portend a multi-month bottom? Possibly. It’s obvious we have entered into another weekly VW; and as such expect to see increased volatility. BPs still support May forming a multi-month bottom, and the IWM level cited continues to hold.