Bayesian Probabilities Pointing To Pullback

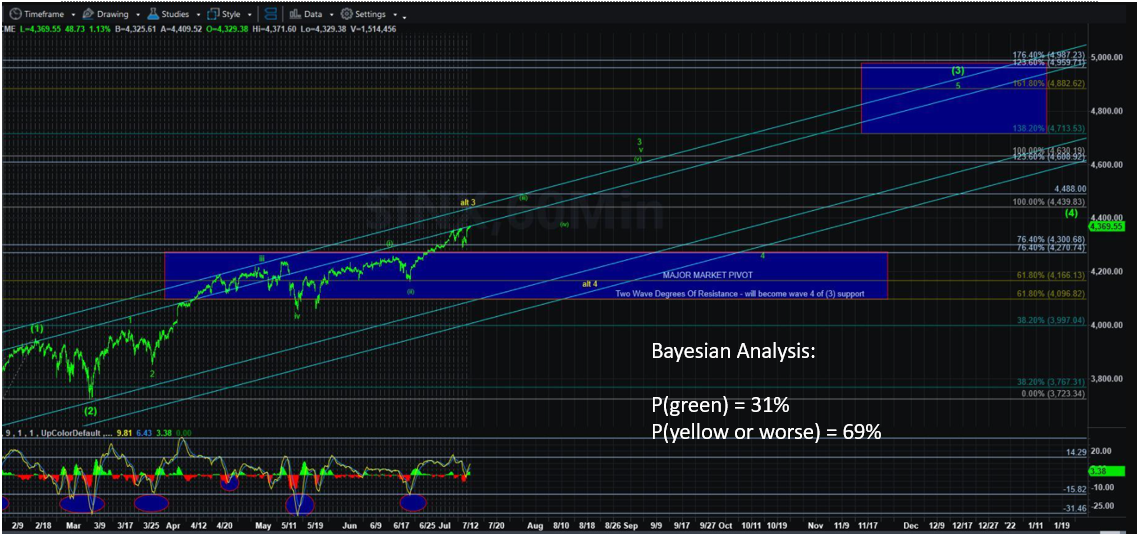

Bayesian Probability (BP) still supports the narrative of a larger pullback in July (versus a shallow one and continuing higher into August). Odds are at 70% to 30% at the swing trade timeframe.

As such, BP price path work sees initial targets in the 410-420 region on the SPDR S&P 500 ETF (SPY) if/when a down leg gains traction.

Otherwise, there isn’t much to add as this short attempt has been telegraphed in this service for several quarters.

SPY support 425-ish, resistance 430-34s.

In metals, after we correctly booked profits and moved to the sidelines a week ago, metals are about back to where we got out. They are looking interesting again from a probability perspective, as the basing region has not broken support.

GDX support is 32-34, resistance 38.

In oil, no changes to our swing positions as USO continues its chop beneath the 2021 highs. If this 50-52 resistance region holds, then USO has a BP path lower to the 43-45 region.

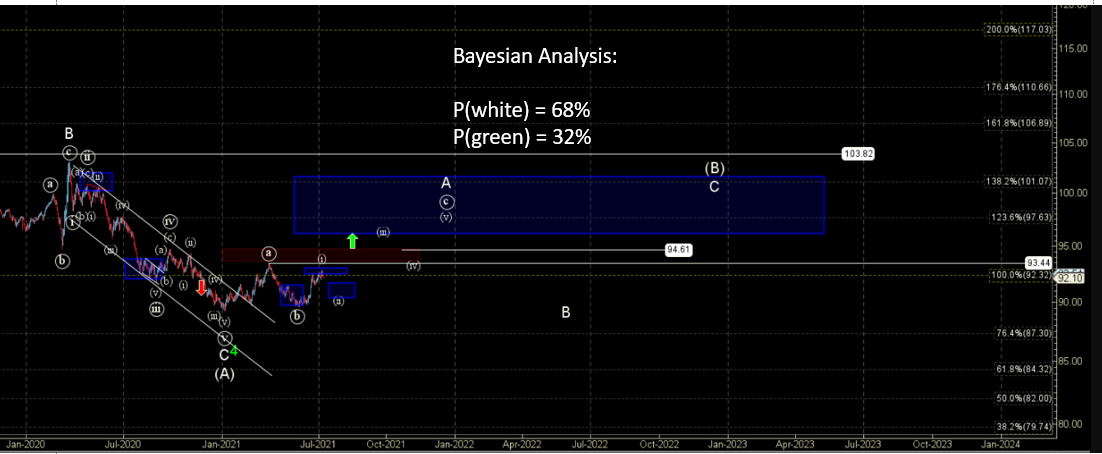

In the US dollar, BPs pointed to a basing region and then a move higher into 2022 (newer members see comments from several months ago). That basing region has broken higher, but in the swing timeframe we are expecting a modest pullback/consolidation before moving higher yet again.

UUP support is 24, resistance 25-26.