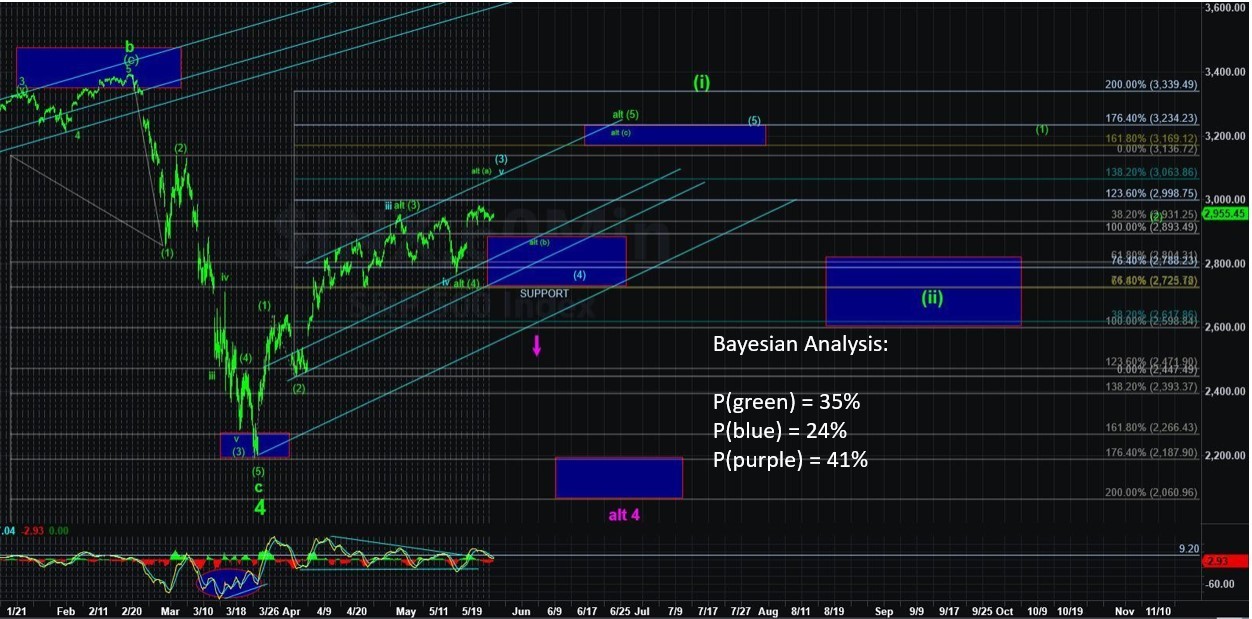

Bayesian Probabilities 2 to 1 In Favor Of Continued Strength

After locking in profits on our shorts last week and cumulative gains of 8% this week on our long positions, the Bayesian Timing System (BTS) wasted no time getting back in the game with another long trigger into the selloff in the morning on May 27.

Whether you averaged-in or not, you should be sitting on quality gains. Here are the paths:

(1) [Probability=35%] SPDR S&P 500 ETF (SPY) stalls below 308-310 and begins a multi-week correction, (2) [P=65%] SPY gets above 310 and probably doesn’t stop Forrest Gumping until the mid-320s before a rest.

Bottom line: The SPY 320s have a 2-to-1 lead over topping in this region for our swing trade –- and I’d imagine we should know relatively quickly how this will shake out, as continued strength versus a hard reversal will be the most likely outcome over the next week.

In metals, a larger degree pullback has most likely begun with a bounce off of obvious support in the 32s in the Gold Miners ETF (GDX) on May 27 that should lead to at least OML (and possibly several).

The BTS still leans bearish and I don’t anticipate a bullish attempt at this time as there still remains some bearish paths at the multi-month level to contend with.

Here are where the probabilities stand: (1) [P=71%] GDX stalls early the week of 5/18 and pulls back to at least 32-33 (but 28 and even 23-25 can’t be ruled out), and (2) [P=29%] GDX continues its bullish advance that targets 40.