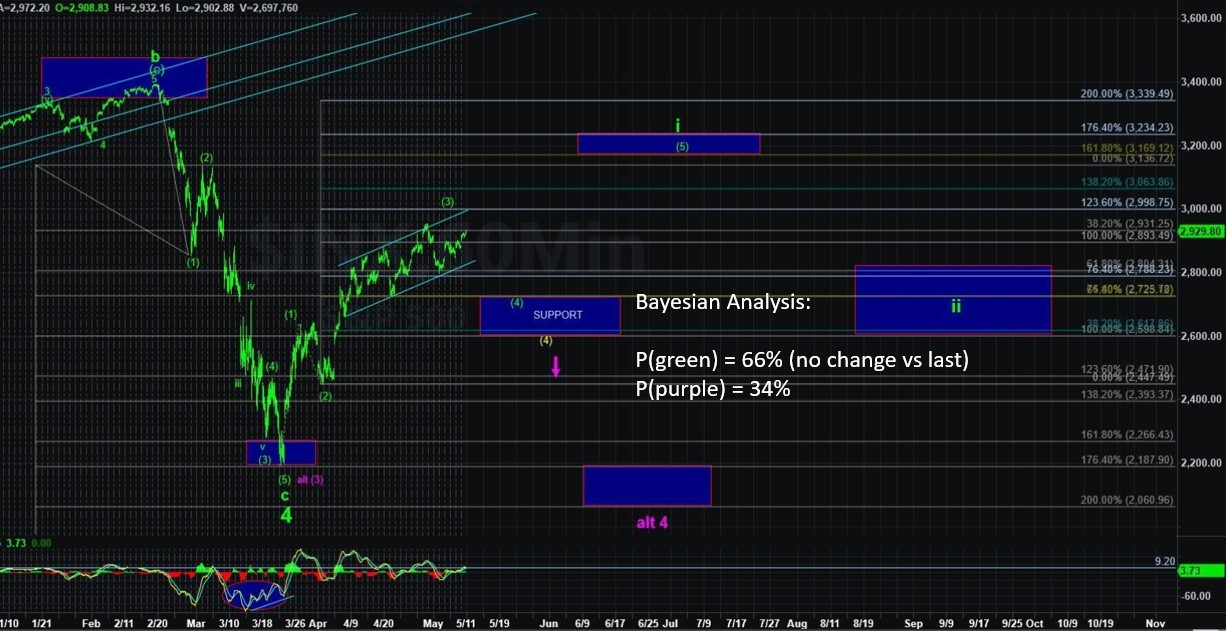

Bayes Signals Remain Short

The early part of this vibration window week did prove to be a relative high. Will we get a sell-off into the last week of May for that other vw alignment relative low?

Time will tell, but the signals remain short; that is how Bayes is leaning. As we noted yesterday: "Although it sure doesn’t feel like it, under the hood things are beginning to look very similar to late February ... Over the next week or so, the BTS wouldn’t be surprised by a few 'lock limit down days' with the way things are shaping up."

Not exactly come true, but close if you think about the hod and lod yesterday in the futures market.

Here are the updated paths: (1) [P=78%] the SPDR S&P 500 ETF (SPY) continues to stall beneath the 295 and begins a descent back to at least the low 280s/high 270s, and (2) [P=22%] The bullish leg begins more imminently with targets sustainably above 295 and closer to 300.

In metals, GDX resistance in the 33-34s continuesf to hold back advances, and into a vw high last week in metals, the BTS still expects a deep retrace to begin shortly (and most likely already underway).

A few paths: (1) [P=75%] GDX stalls in the 34-35 region and pulls back to at least 28 (but 23-25 can’t be ruled out), and (2) [P=25%] GDX continues its bullish advance that targets 38-40.