Balance In The Force: Wheaton Precious Metals And SSR Mining

Balance In The Force: Wheaton Precious Metals And SSR Mining

Summary

- Quick background on Wheaton Precious Metals Corp. and SSR Mining Inc.

- Fundamentals that make these companies attractive.

- Technical Elliott Wave view of these miners.

- Additional FA nuggets from Lyn Alden.

Contributed by Mark Malinowski, produced with Avi Gilburt.

“It’s the Energy between all things, a tension, a balance that binds all things.” Luke Skywalker

Who are these companies?

Wheaton Precious Metals Corp. (NYSE:WPM) is a top tier Canada-based precious metals royalty streaming company and currently the fifth largest component of the VanEck Gold Miners ETF (GDX). Based on the share price as of May 15th, it has a current market capitalization of $22.9B (USD). The company has streaming agreements in place for 21 operating mines and 13 development stage projects. The primary gold stream is from Vale’s (VALE) Salobo mine in Brazil, while its primary silver stream comes from Newmont Corporation’s (NEM) Penasquito mine in Mexico. Other products such as copper, cobalt, zinc and other non-precious metals are also part of this streamer’s portfolio.

SSR Mining Inc. (NASDAQ:SSRM) is an intermediate-tier gold company with a market capitalization of $3.4B (USD) and sits at number 19 on the GDX holdings list. SSR Mining owns four producing assets located in the United States, Turkey, Canada, and Argentina. Development and exploration assets are located in the USA, Turkey, Mexico, Peru and Canada. The four operating assets produce 700k gold equivalent ounces (GEO) annually, mostly consisting of gold and silver.

Fundamentally Speaking

Wheaton Precious Metals

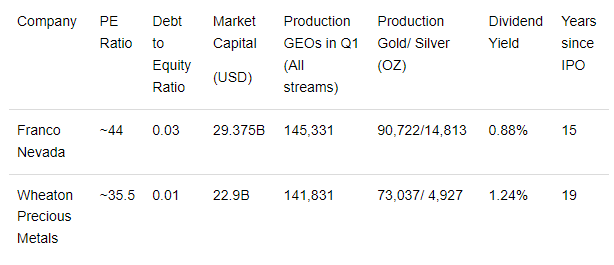

WPM is a royalty streamer and by default is compared to its direct streaming competitor Franco-Nevada Corporation (FNV). Here’s how the two stack up on an a comparative basis:

While in most comparable fundamental categories, these two companies align very closely, it seems that Wheaton has not kept up from a sentiment perspective. Both companies have experienced a large consolidation since Summer 2020 but while FNV not only kept its fade to -30% from the highs it also held a nominally higher low in 2022 from the 2021 low. WPM by comparison saw a low in 2022 nearly -50% from the 2020 top. However, they have continued to invest in new streams and continue to take advantage of the royalties they do have with a 30-year average life on their operating assets. They are also not taking on debt to finance these new investments, a very intelligent decision at the current rate for borrowing.

SSR Mining

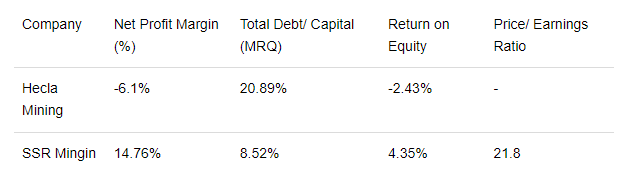

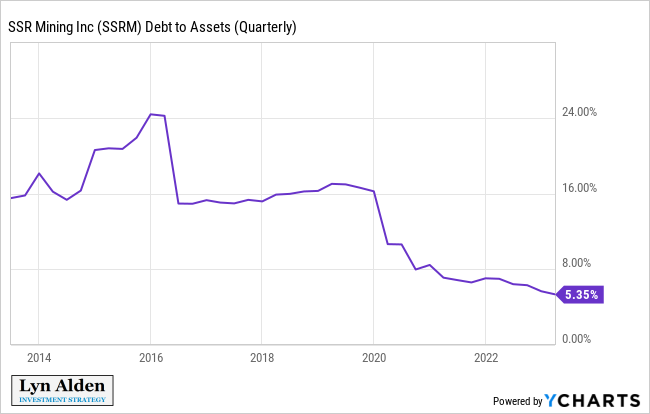

SSR Mining is a diverse gold and silver mining company that is almost identical in market capitalization to Hecla Mining Company (HL). Except that Hecla has more of a focus on silver production from Canada and the U.S. vs. SSRM’s broader distribution of assets. However, SSRM has lower debt and a higher profit margin (still nicely above zero at current prices for gold and silver) of 14.76%, which is greater than the industry average of 12.6%. While these numbers trended lower over much the past 2 years as metals prices fell, they should continue to improve as gold & silver continue their patterns higher off the 2022 low. We think that SSRM can continue to operate at higher margins relative to many of its peers.

Why is this important?

In 2016 SSRM took on large amounts of debt to continue to grow their operation, pushing their Debt to Equity Ratio close to 50%. Wheaton Precious metals was in a similar state and had pushed their Debt to Equity Ratio close to 35-40%. This coincided with the top of the initial move for metals off their 2015 extreme lows and growth began to slow. Through sound management, these companies have brought their debt levels down to less than 5% of equity and both companies are paying a small dividend. The current cost of borrowing has increased significantly with the Fed raising rates 8 times since March 1, 2022. Companies that have been able to avoid these additional costs will continue to benefit.

Lyn Alden who contributes the "Where Fundamentals Meet Technicals" articles for Stock Waves had the following to add:

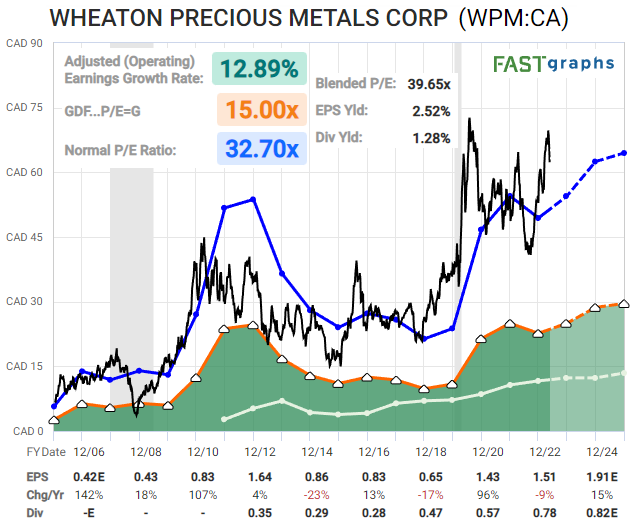

"Many royalty companies such as FNV and WPM have encountered stagnant growth conditions, which has resulted in sideways choppy price action. Expectations around their forward share price must necessarily involve predictions around the price of gold, which formal analysts tend to be conservative on (projecting gold to be a small margin +/- from where it is at the time of analysis)."

"A general trend of gold miners over the past several years has been an emphasis on free cash flow generation rather than aggressive exploration and development and acquisitions. During the 2010s decade, many of them made aggressive expansions near the top of the cycle, which devastated them in the years that followed. So, in this current cycle, many of them have been far more conservative. However, to make a truly bullish case for them, an investor must expect notably higher gold prices over the next 3-5 years, because otherwise they are likely to get stuck in a trading range."

Both companies pay dividends at different rates. This means they are generating positive cash flow and maintained that, even as prices for gold and silver drifted lower for almost 2 years. As the prices of gold and silver have climbed over the past 6 months off the 2022 lows, these companies are both generating increasing levels of free cash flow and have used those improving margins to pay down their debt significantly.

Lyn says that on mining companies while management decisions are important, but the direction of gold is also of key importance.

“I view gold as building a pretty good long-term base ever since it began consolidating in mid-2020. The Fed's ongoing tightening is putting some pressure on it but that can only on for so long, and so as we look out in the years ahead I think gold is rather well-positioned for an upside break-out. Higher interest rates by the Fed can slow down private sector lending, but increases interest on public debt and therefore increases fiscal deficits, which are a source of new money creation. The 2020s decade is likely to be defined by varying levels of fiscal-driven inflation, and if this starts to be seen by market participants as a longer-term problem, then gold is likely to be among the major beneficiaries.” -Lyn Alden

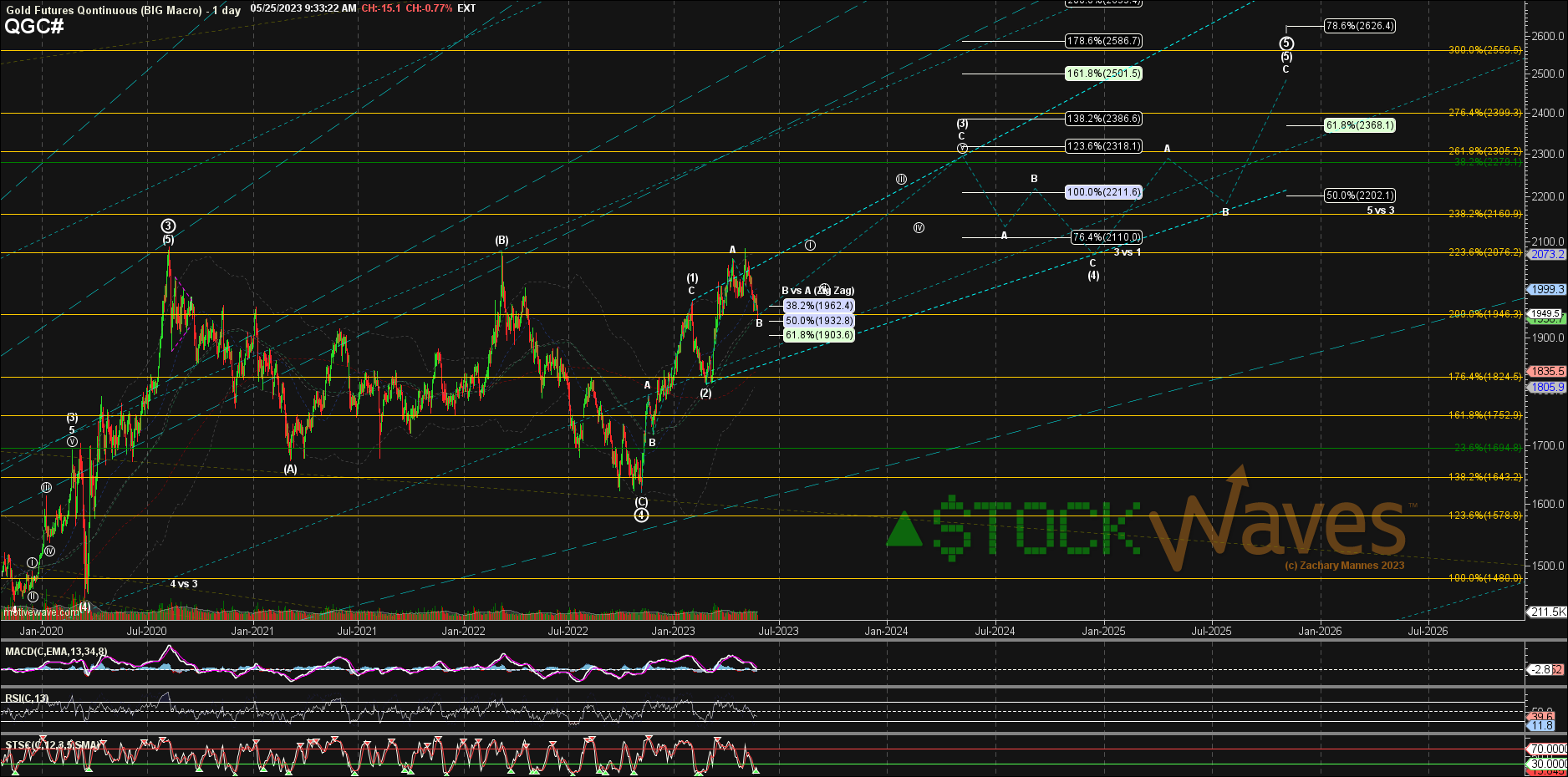

We too share a longer term bullish outlook on gold, seeing the 2022 lows as a significant bottom and the recent consolidation as part of a swing that should continue toward 2300s and potentially even 2500s after holding another consolidation.

What do we look for in a setup?

We want companies with strong balance sheets and strong operations in safe operating environments, like Canada and the USA. The stability in government and regulatory requirements creates clear conditions for investment decisions.

When we compared SSR Mining and Wheaton Precious Metals with peers, these two companies are near value or slightly undervalued. We see their latest consolidations in pricing as a great opportunity to own companies that are running in the black at current gold and silver prices and therefore will continue to create return for investors as gold and silver prices move.

Technical Analysis

The technical view on these companies is also very similar. Most stocks in the Precious Metals Mining Sector tend to be fairly closely aligned in their price patterns. The sector is closely tied to the movement of the metals and all are heavily based on investor #sentiment making sharp and emphatic turns from extremes of fear & greed. Elliot Wave using Fibonacci ratios and Avi Gilburt’s “Fibonacci Pinball is in our opinion the best tool for placing these extremes in context to larger trends in the price pattern and laying out clear parameters of support, resistance, and price targets.

Zac Mannes and Garrett Patten have tracked Wheaton Precious Metals in the Miner’s service since the service launched on EWT dot net in early 2016, and before that as a part of the Stock Waves service. However, back in October of 2022, the Miner’s service team identified a long “Wave Setup” for WPM. They were looking for the start of a long term swing trade after an almost 2 year long consolidation. Following that Wave Setup there have been frequent updates with charts showing clear support and resistance, as well as reminders to place stops, trim profits or adjust positioning to manage risk.

WPM has climbed nearly 60% since that October 13th Wave Setup.

SSRM has also been one of the stocks regularly tracked by the Miner’s service since it started. Recently on April 27th, shortly before the May 3 earnings report, Zac Mannes identified a Wave Setup showing a clear bullish Risk:Reward scenario.

SSRM continued to dip slightly lower into ER, but held support and popped VERY strongly rocketing up +25% off the exact 61.8% Fibonacci retrace level. Despite the fade from that high (also warned about) it is up around +10%.

Both of these stocks are displaying price action behaviors that are associated with Diagonal patterns at least at larger degrees rather than standard Impulsive moves. Many traders find the “choppy” structure inside diagonals challenging patterns to navigate. However, when the path is laid out clearly, there are actually many more trade opportunities over a longer period of time and therefore it can actually be more rewarding.

WPM is coming into ideal support now as one of the most coveted pattern setups in Elliott Wave. The #textbook "1-2-i-ii" off the Sep 2022 low.

We continue to see opportunity, both near term and longer term in the precious metals and miners space for investors and traders alike. We identify these opportunities and help our members monitor them as the market ebbs and flows.

We see the price of gold and silver significantly higher over the next 2 years and as Avi Gilburt, The Market Pinball Wizard recently posted a public target for Gold on January 17, 2023, this aligns well with the increased profit potential for these two growing companies over the next few years.

Longer term, there is a very bullish view of metals in the coming years. But how should one take advantage of that opportunity?

In our Metals Miners & Agriculture service we provide similar Wave Setups to those in our Stock Waves services. Our team highlights high probability good Risk:Reward setups on charts displaying clean subwaves in good Elliott Wave patterns and specify Support, Invalidation, Resistance, and Target levels, and post these as charts are entering or turning up from actionable support zones.

We are looking to roll out a version of the Metals Miners & Ag service on the Seeking Alpha Market Place in late Q3/ early Q4, in the meantime you can still get MMA at a 50% discount when it is combined with Stock Waves.