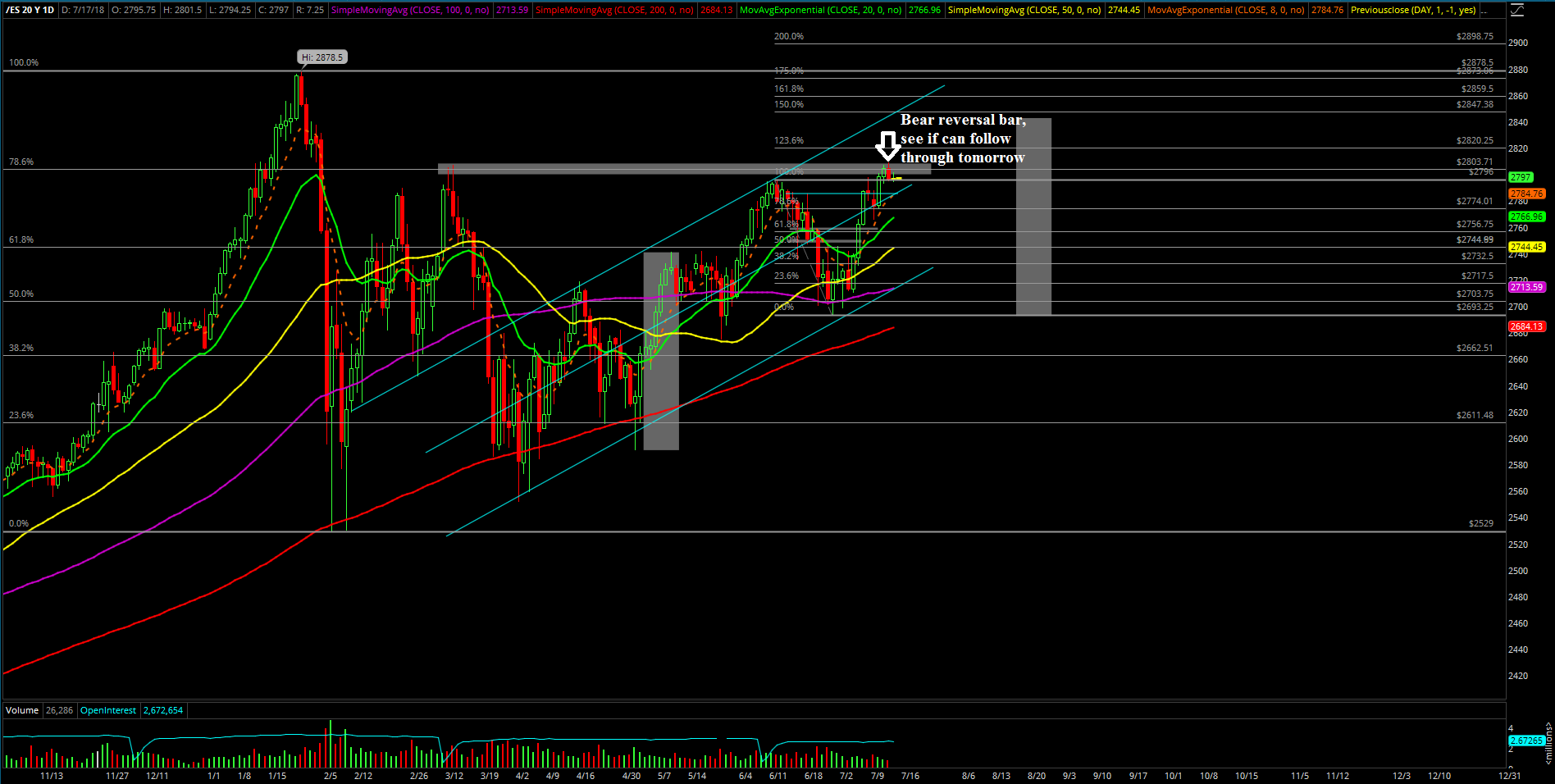

Backtest Likely Begun - Market Analysis for Jul 16th, 2018

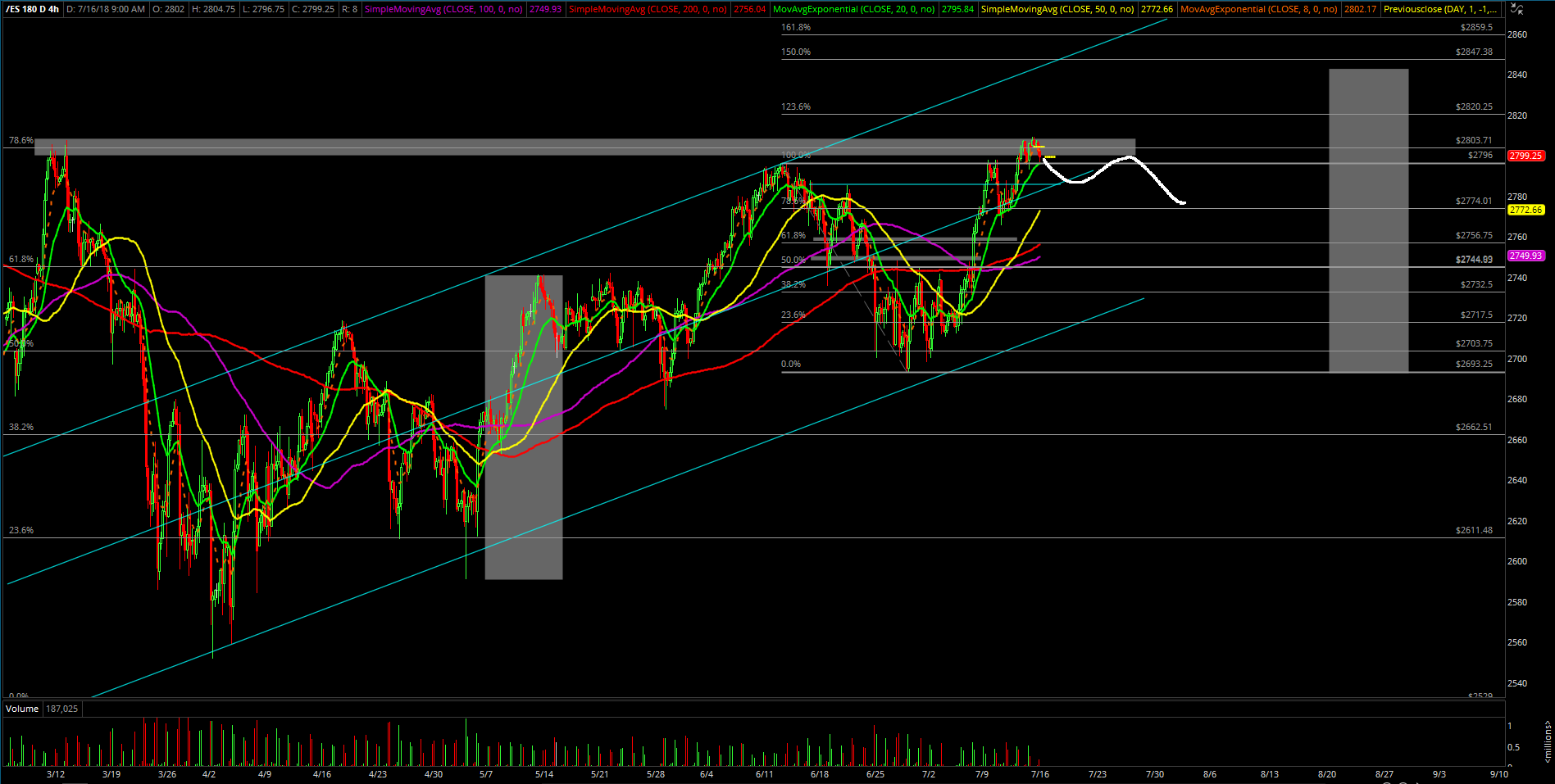

Monday was a typical tight consolidation day. The Emini S&P 500 (ES) overnight made a higher high at 2809 but couldn't sustain and needed to backtest against the initial 2792 trending support area after the open.

Our signals managed to anticipate that the morning high was in already, so the rest of the day played out accordingly as the market drifted slowly downwards with a bunch of intraday lower highs and lower lows.

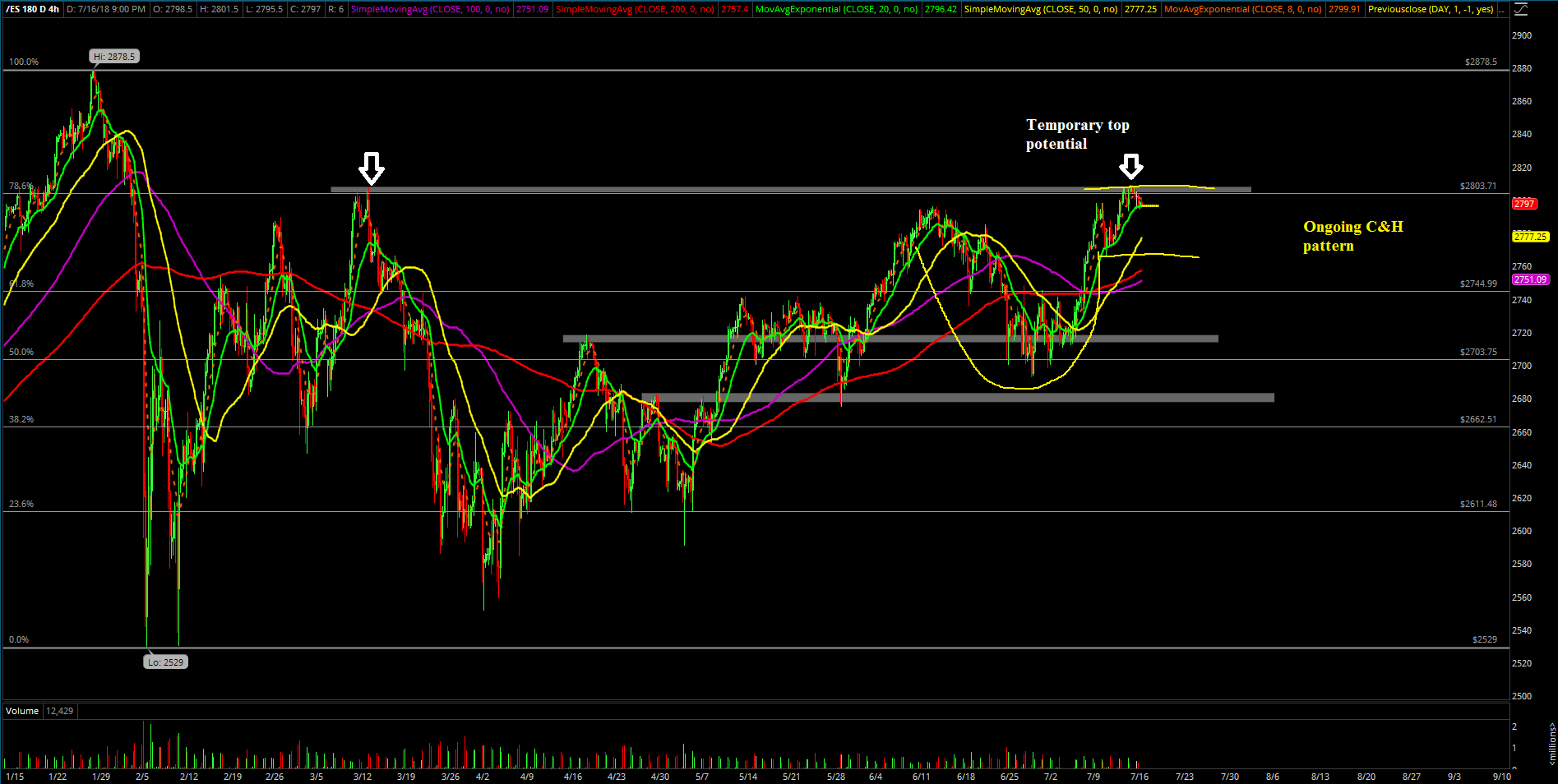

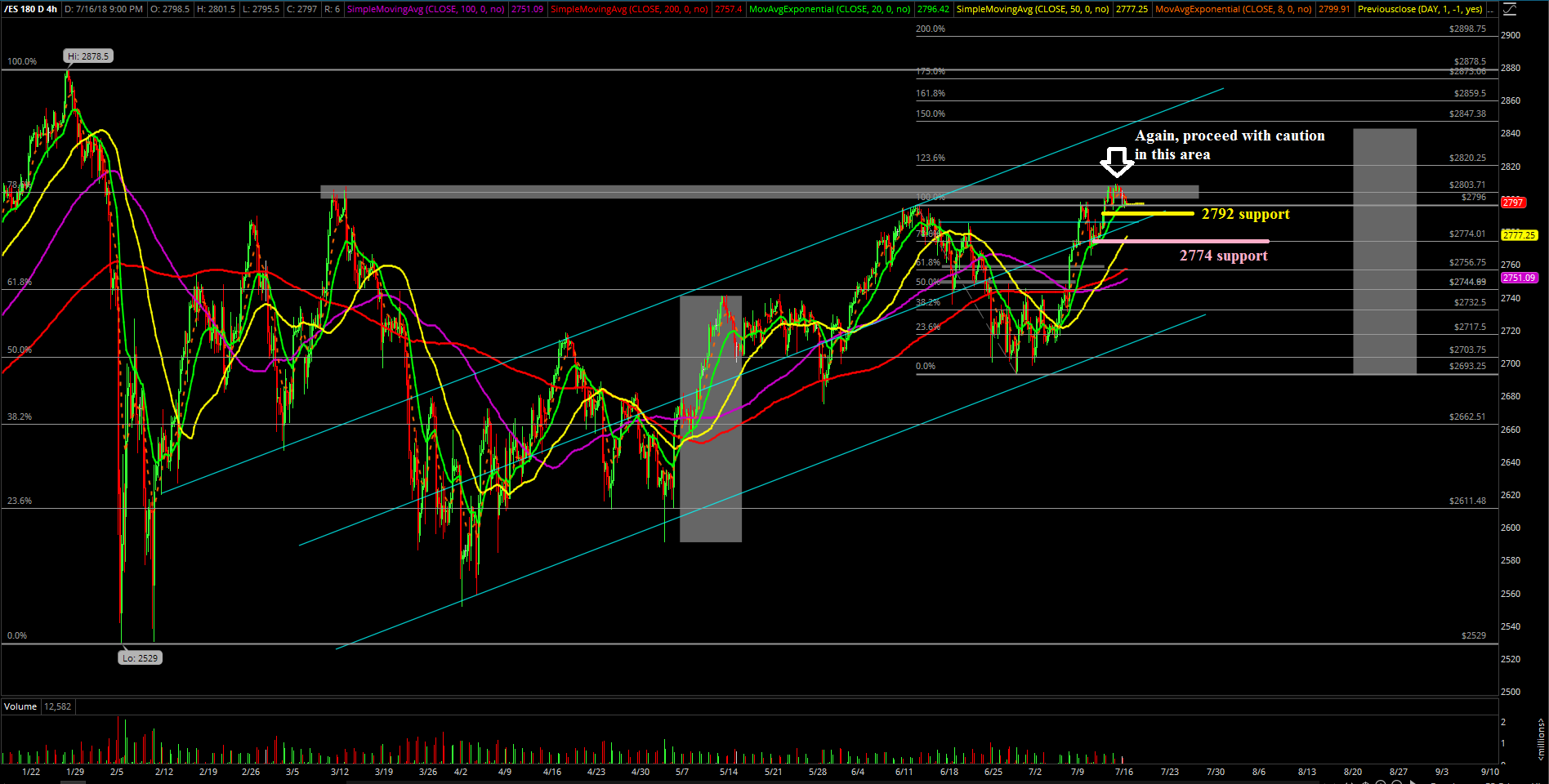

The main takeaway from this session is that the market is currently following the new 4-hour white line projection towards around 2774 on the ES in order to backtest the lower trending support. Tech stocks represented by NQ futures are giving us a decent hint by leading the downside pathway as expected given that the mega-cap tech stocks were the first ones to start the pullback Monday, so let’s see if we get some follow through Tuesday on the ES given the alignment.

What’s next?

The daily closed at 2796.5 as a bearish reversal bar so it’s pretty clear that the bears need a follow through Tuesday for the southbound train, otherwise something else is likely playing out (evolve into high level consolidation or immediately ramp back up).

In terms of our short-term perspective, as long as the market is below 2805, we’re looking for a backtest grind towards around 2774 for the gap fill to hit as the market continues to follow the new 4-hour white line projection chart. The market would need to go above 2805 to invalidate this thesis, and then it could potentially open back up the initial 2830-2840 ramp up potential or just consolidate in a high level manner first. As we discussed during the weekend report, easy money is considered over, so traders should remain nimble and cautious in this zone going for quick trades or decent skew opportunities like what we do in the ES trading room.