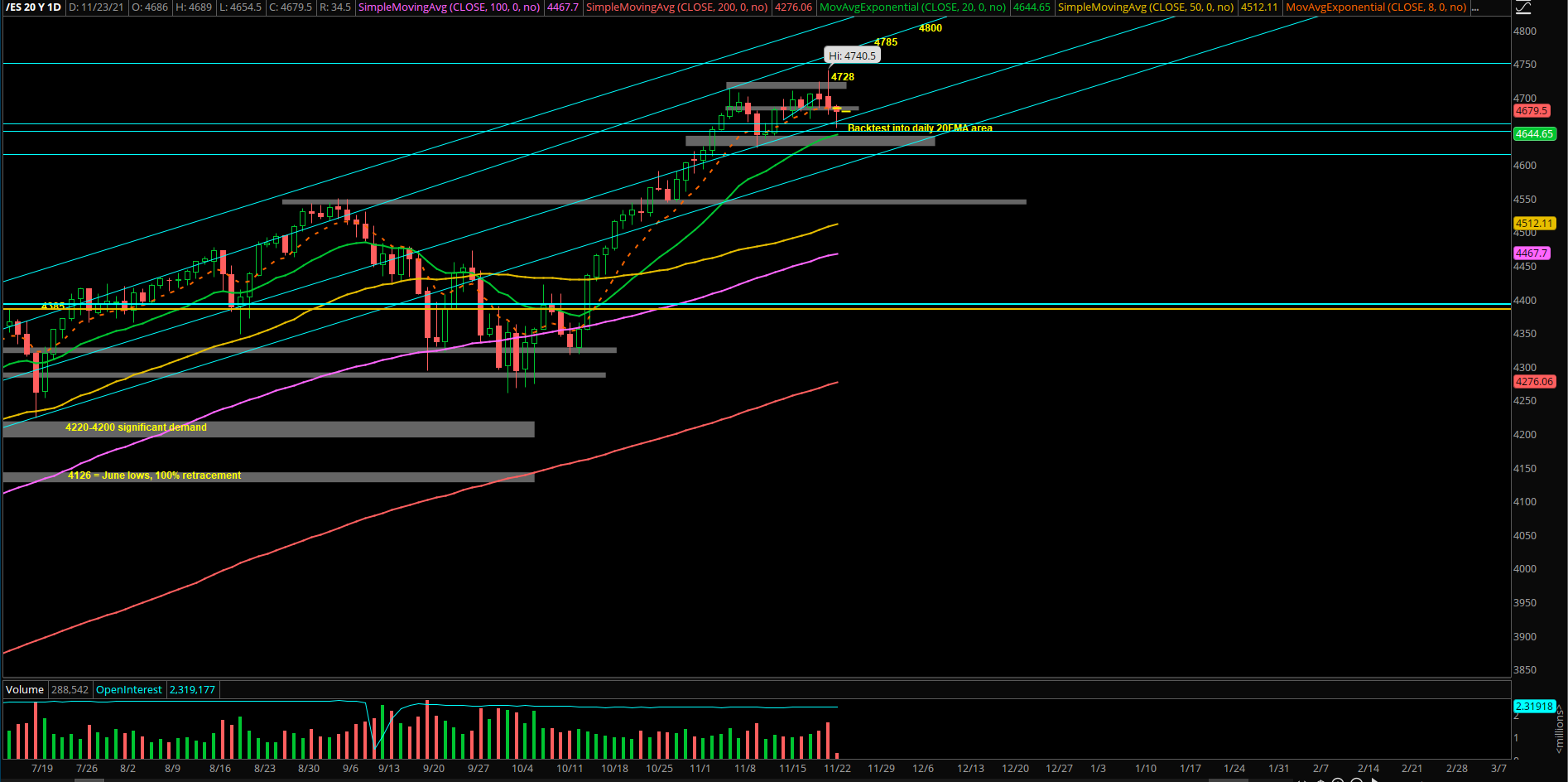

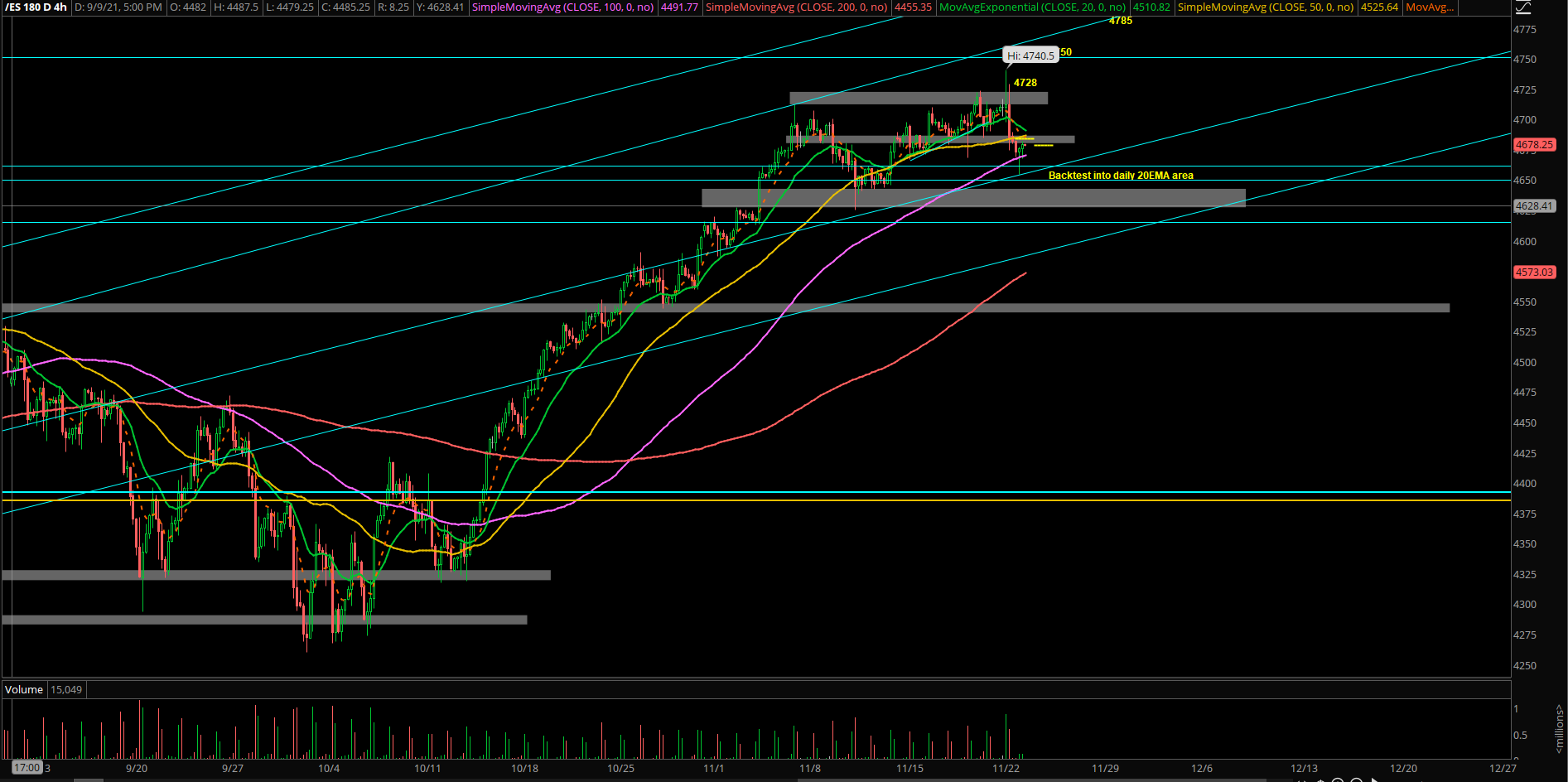

Backtest Before Resuming Trend Into EOY Highs

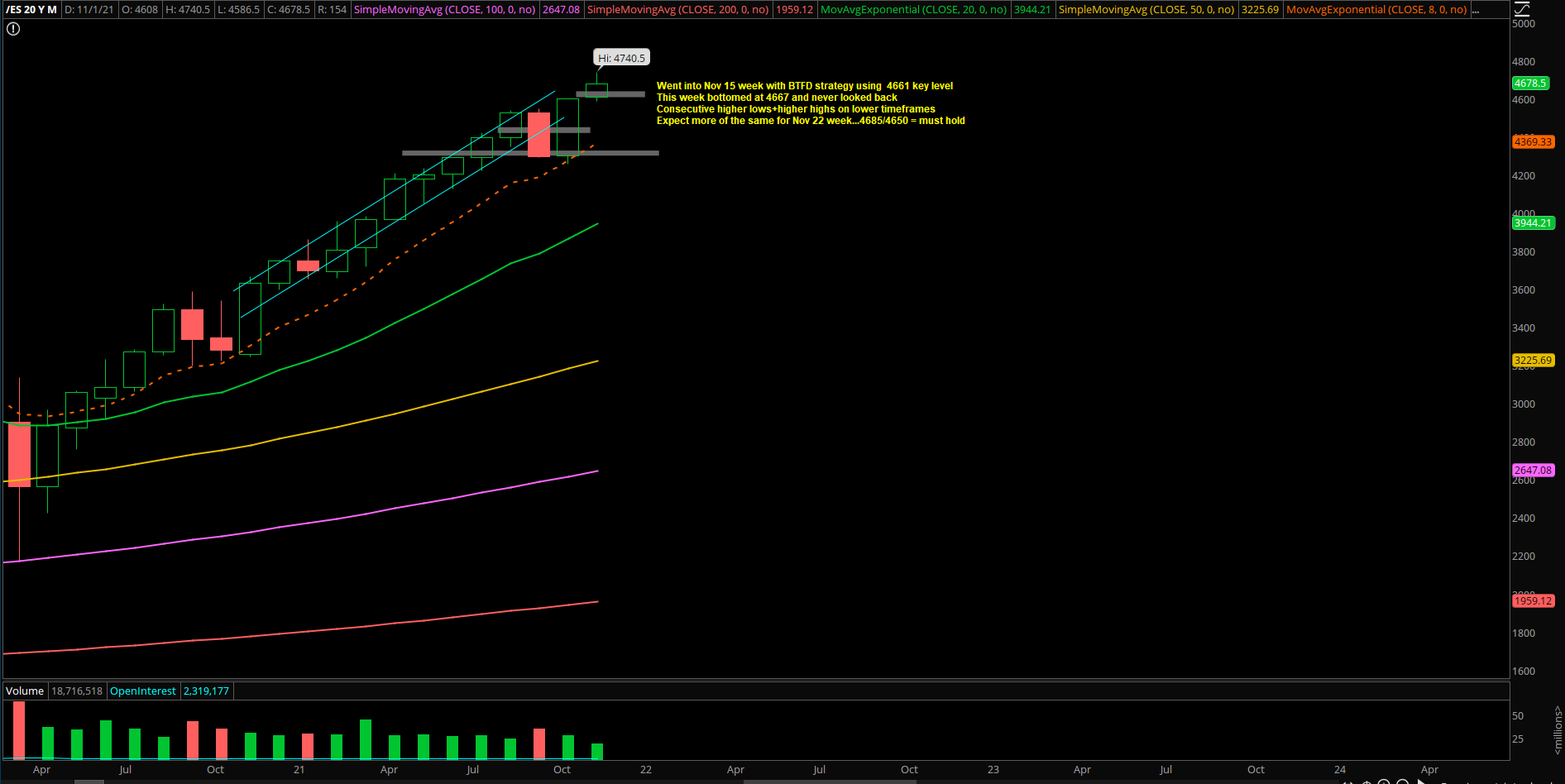

Context is important: October closed at the 4600s on the S&P 500 for the monthly closing, confirming the ongoing trend’s breakout into new all time highs (prior ATHs in Sept = 4540s).

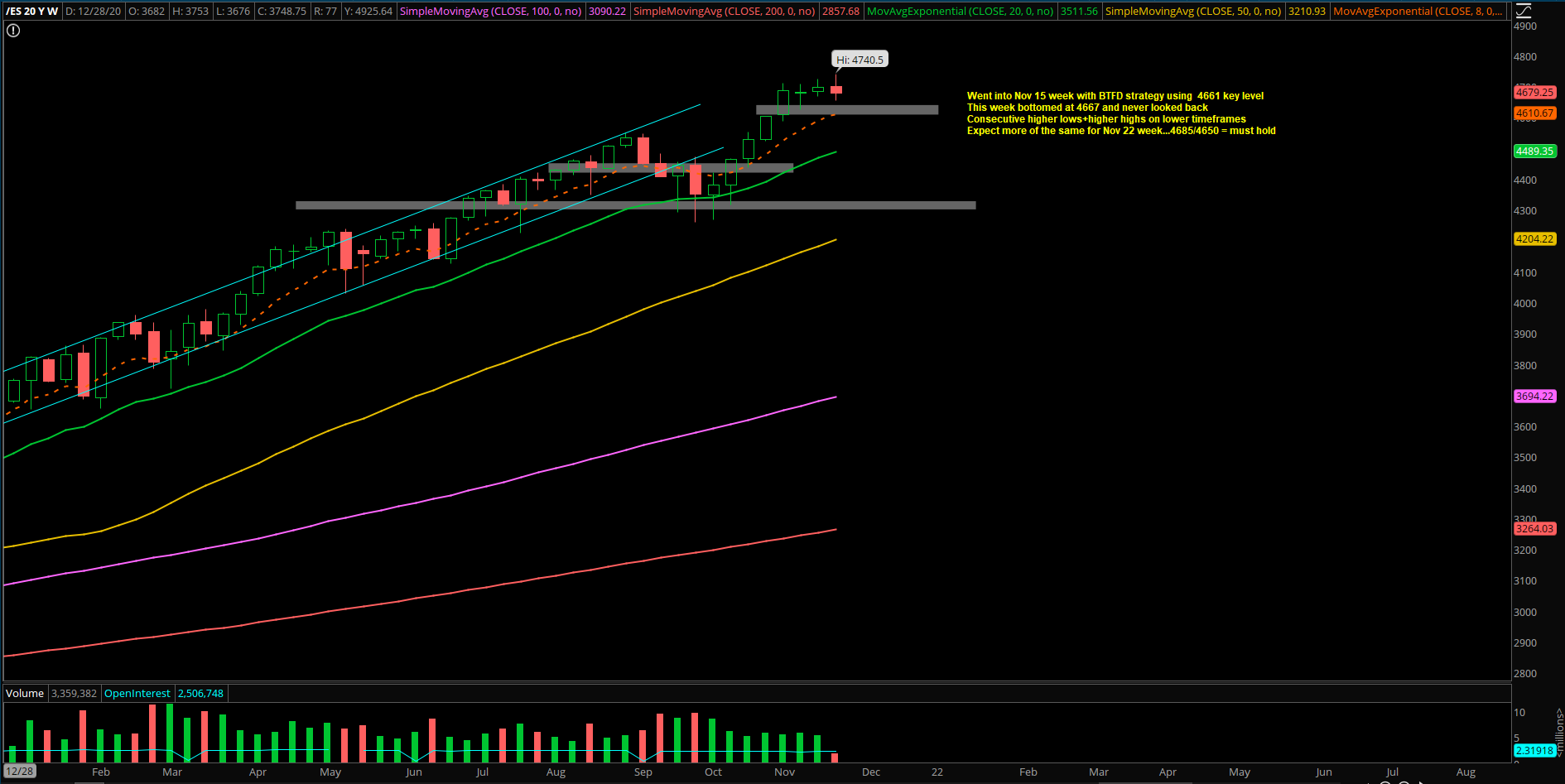

For the ongoing November price action, every week has made consecutive higher lows as price has slowly grinded higher (=4586/4625/4667) . Ongoing November vs October gains = +2.4%

If you recall, we went into the 3rd week of November (previous week) with a BTFD mentality when price action remains above 4661 and especially when above 4685. As demonstrated in real-time, our strategy worked well given the on-trend environment.

The most significant thing that occurred last week was the breakout above 4685 and staying above it on an EOD closing basis ever since. This means that immediate must-hold trending support moved up and just gives us a better location to calculate our max risk.

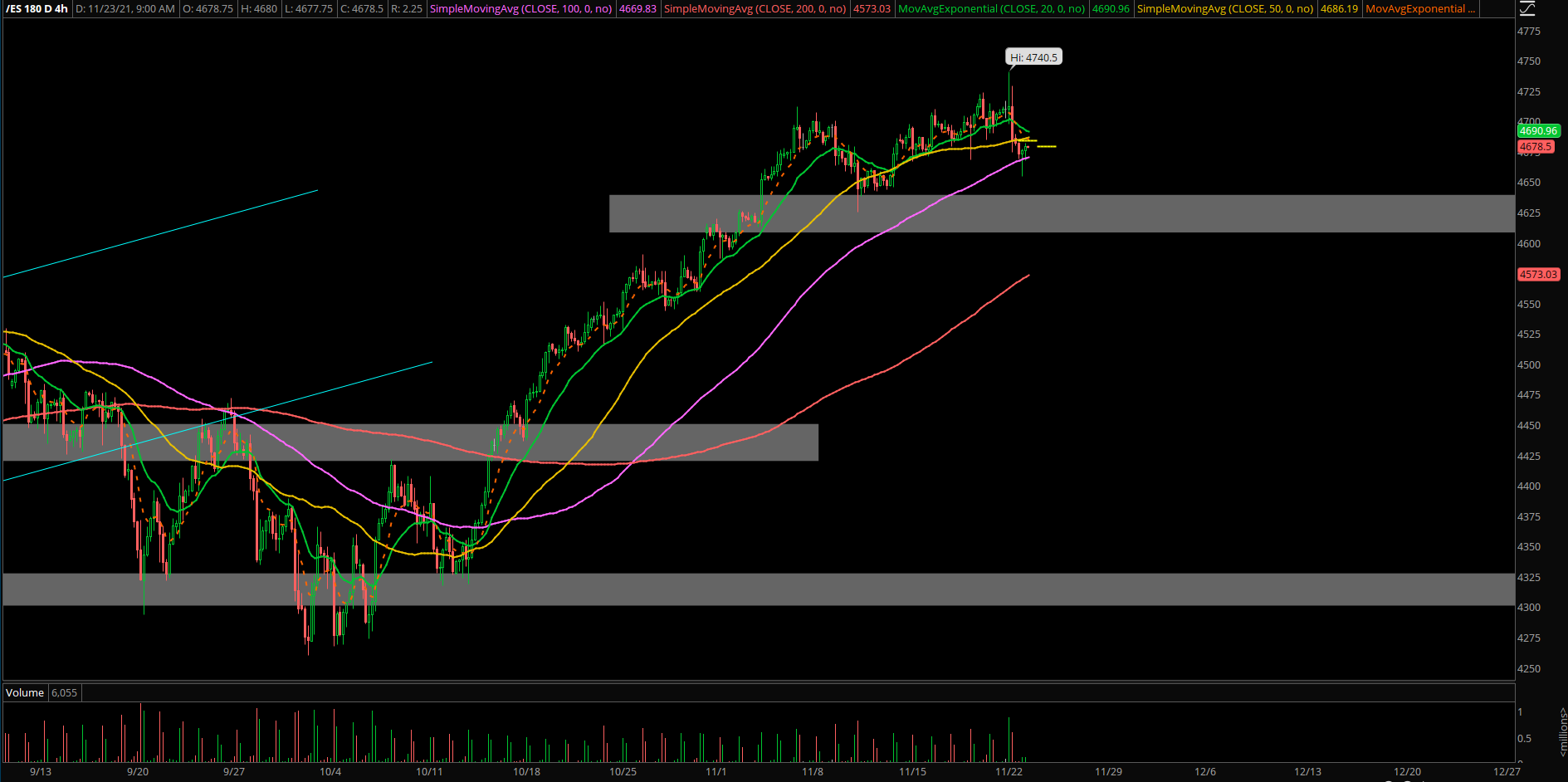

The most significant formation that occurred on Monday Nov 22nd is that the on-trend breakout turned into a breakdown formation during intraday. If you recall, the on-trend breakout targets were 4728/4750. Price hit a high of 4740.50, got rejected and then closed below 4685 on a daily closing basis (key trending support/must hold going into this week).

We need to see how price action reacts during RTH to give us the next edge:

1) Bulls need to reconquer 4700 followed by 4715 ASAP to confirm yesterday+overnight is just an overshoot of 4685 support because 4650s held. Then, eventually work its way back into new ATHs for rest of holiday week (eg. V-shape or W-shape bottom pattern).

2) Bears need to break below overnight low 4654.5 ASAP to confirm that the current temp bottom is not strong and next key support levels are 4640/4625/4615/4600.

Notes: The trending daily 20EMA = currently hovering 4644, so this is likely just a backtest into stronger support zone before resuming the trend into EOY highs. Real bears would need at minimum 1 daily close below it that sustains itself the very next day. Meaning…be aware of gummy bears failing their job.