BTC Intermediate Scenarios - Market Analysis for Mar 19th, 2020

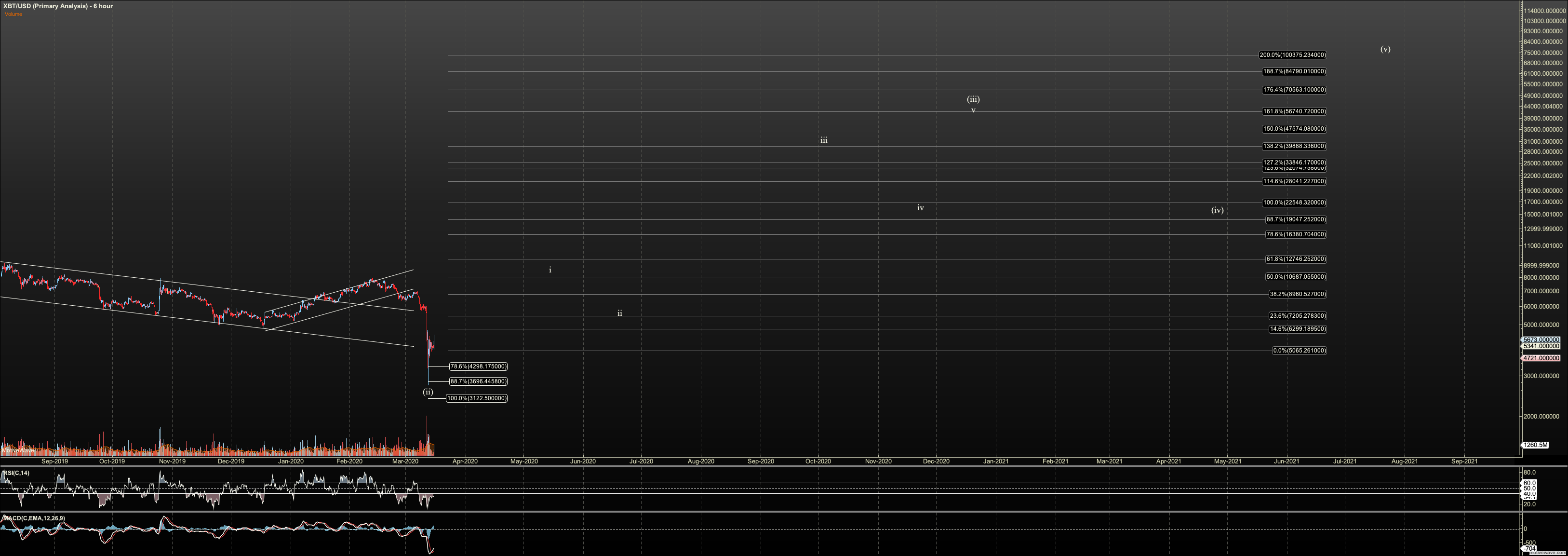

On March 12, we saw a broad Crypto crash. Not only did Bitcoin breach $7125, support for the potential wave 1 and 2 off the December 2019 low, but breached $4300, key support for the 2019 wave 1 and 2 of higher degree. While much of the character is like an ‘evil scenario’ I posted back in November where we have a high B wave like the one we saw at $10,500 and then decline to the $5-4K region before resuming the run to six figures, the breach of $4300 suggests it may be more than that.

While the 2019 wave 1 and 2 is not invalid according to Elliott Wave rules until the origin of wave 1 is breached ($3120 on Bitmex), we know from Avi Gilburt’s work that when the .764 is breached ($4300), often invalidation follows.

In light of this, and the strong reversal we saw from the nominal breach of $4300, I have to have one foot in the ‘bearish’ camp where the run to six figures-plus is delayed, and one in the bullish camp, with a reset of the 1-2 setup. The nominal targets for the bullish case took a haircut with a drop near a clean $100K. However, that certainly can be regained by extensions in the third wave.

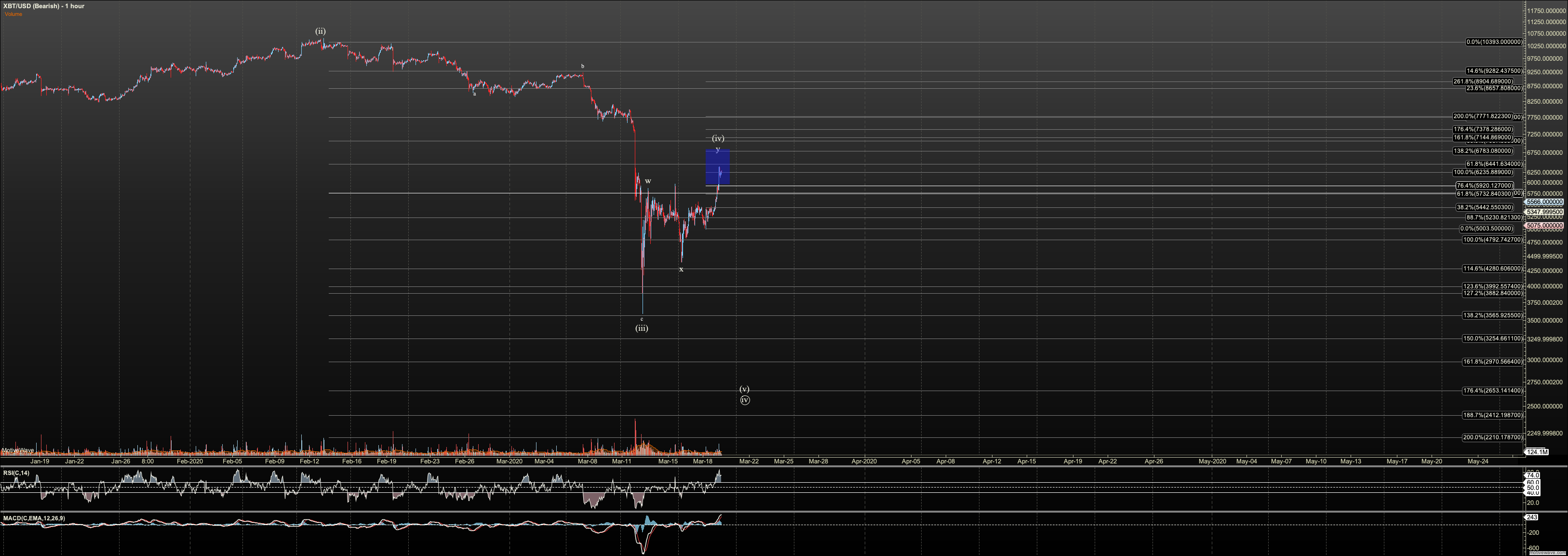

For the immediate bear case, I see a slide continuing to $2000, and if we can’t rally impulsively there, $1600 and $400 provide the next long term support. However, if our current reversal pattern reaches $8000, I’ll consider such a scenario unlikely.

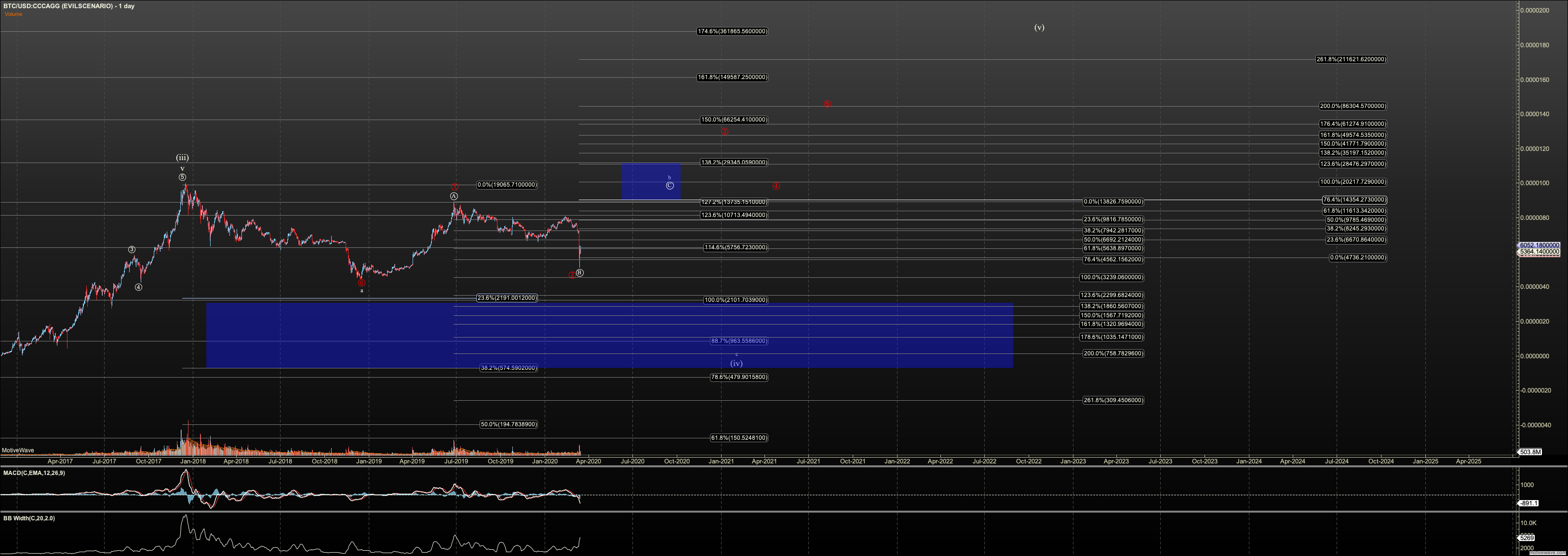

For the evil scenario, our rally in 2019 is still considered 5 waves, but the breach of support still warns that the bear market that started in December 2017 had not ended a year later at $3120. Rather, that five waves was an ‘a’ wave of a much larger B wave. The low on March 12th would be ‘b’ of said B wave, and we’ll see a ‘c’ wave rally within that large B. The ‘c’ has already started in this count.

The ideal target if the March 12th low holds is $17K, but can reach as high as $31K. Once complete, Bitcoin should begin a C wave down to $2K or slightly lower. This also confirms that the current bear market is the larger degree primary wave 4, an alt in that can be found in my Long Term Crypto Challenge write up. Because it is a primary wave 4, the wave 5 to come will more likely not culminate until north of $300K in a multi year incline.