Awaiting Signal To Book Profits On Shorts

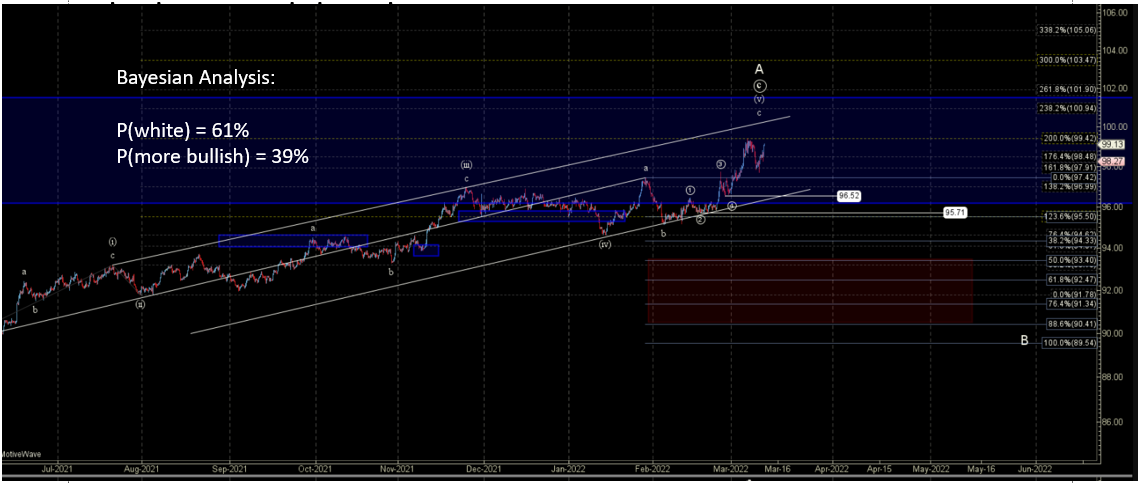

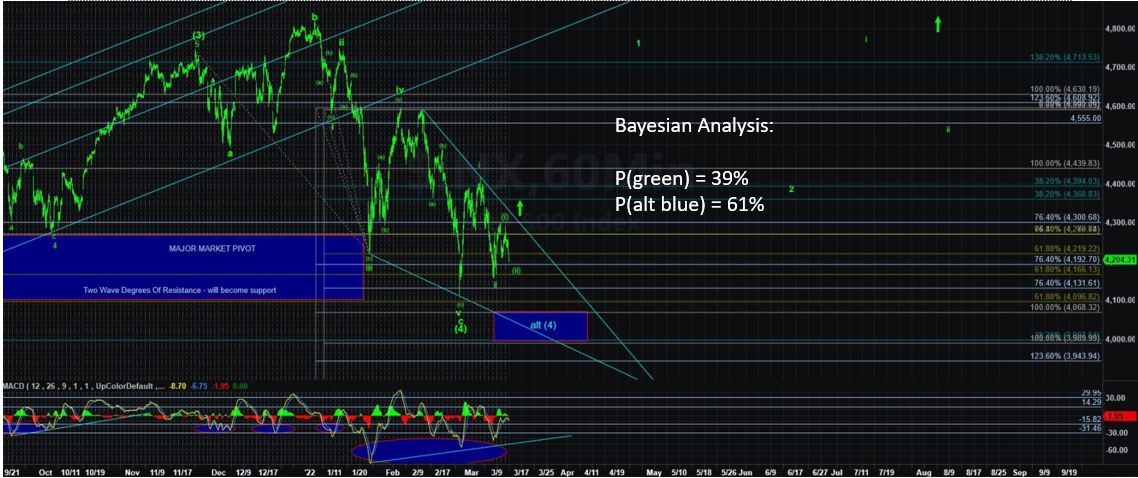

We have entered into the next vibration window, after correctly positioning short into the March 9 window. A Bayesian vibration window is a moment in time that serves as resistance or support in price – usually manifesting as a relative high or low in price. Now I want to combine this swing trade discussion with intermediate-term comments as the odds have subtly shifted in favor of the sine wave vs. waterfall scenario. Just something to be aware of, as it has implications for our swing trading portfolio.

In that light, the vibration window this week is leaning towards its usual relative-low setup. Thus, at the moment, odds support booking our short profits and then flipping long at the swing level. As I noted yesterday, for members reading my daily thoughts over the last several weeks, the BP path I laid out from late-February played out to a T. Basically, as discussed here-in, I said the move off of the Feb 24 low presented more as a bear market rally than it did as “the bottom” with a continued move higher. And that members should expect scalp type trades both short and long for several weeks before a vw relative high into Mar 8-10… and thus, that is exactly how we traded it and won with booked profits long/short and then shorting into the Mar 9 high. Even with the fake-out move premarket on Mar 11, I told members to sit tight, as my Bayesian models indicated a failure for bulls, of which happened into the close on Friday.

As such, not much else to add as we are positioned quite well and are riding short profits in “stocks.” We await a RTS to book profits vs. letting it ride a bit longer. Stay the course, my friends. Note: And I remind members of what I’ve posted dozens of times since the beginning of 2022 – given the nature of the market (a choppy, volatile mess), BTS trades are targeting several days to weeks in swing timeframe, but don’t be surprised if some of these signals end up being scalps. My job as an analyst is not to make the market, but to trade it. And if the market isn’t serving up multi-week swings, then we can’t force one on it.