April Monthly Dead Highs. When’s the Curveball?

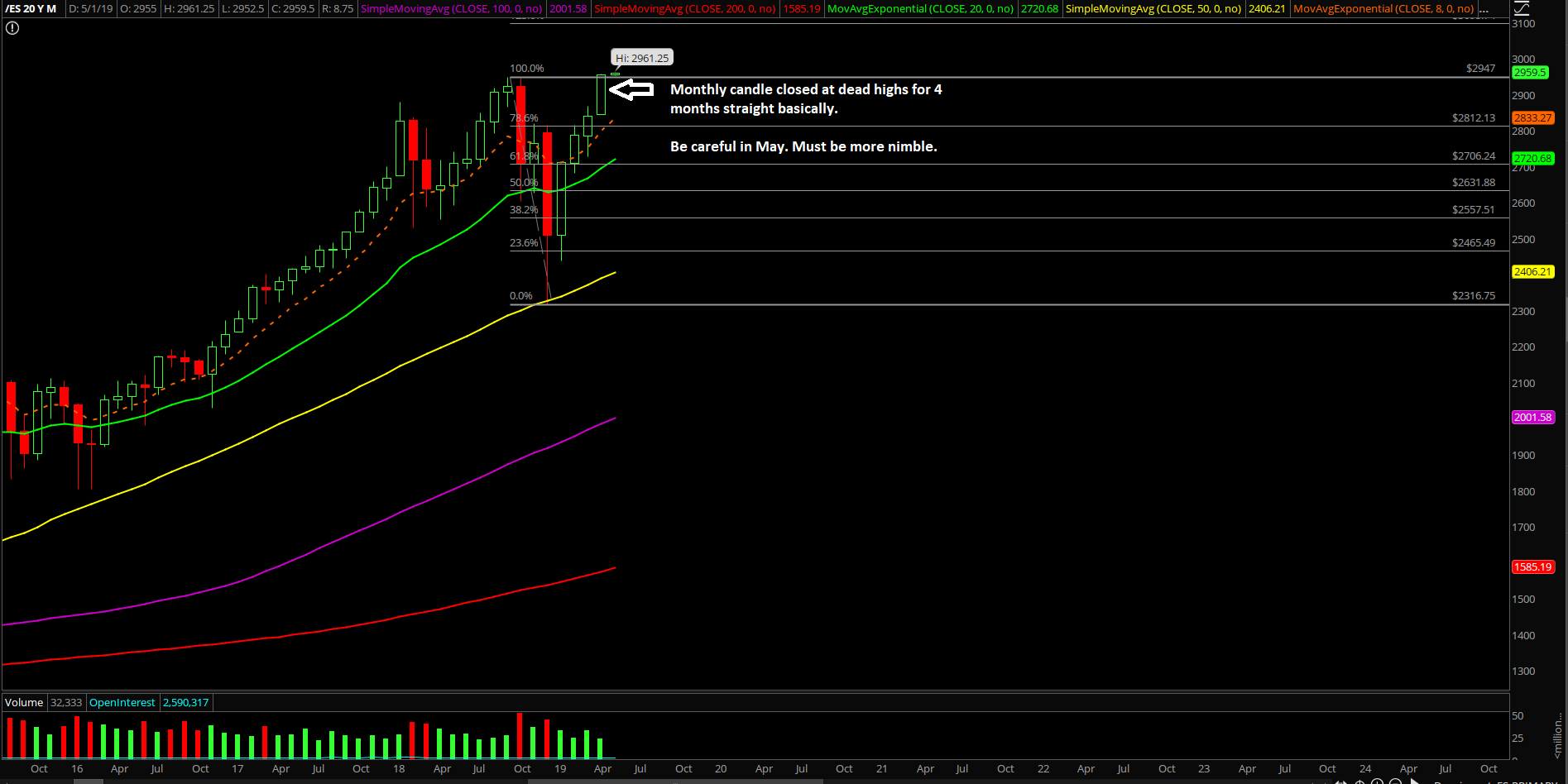

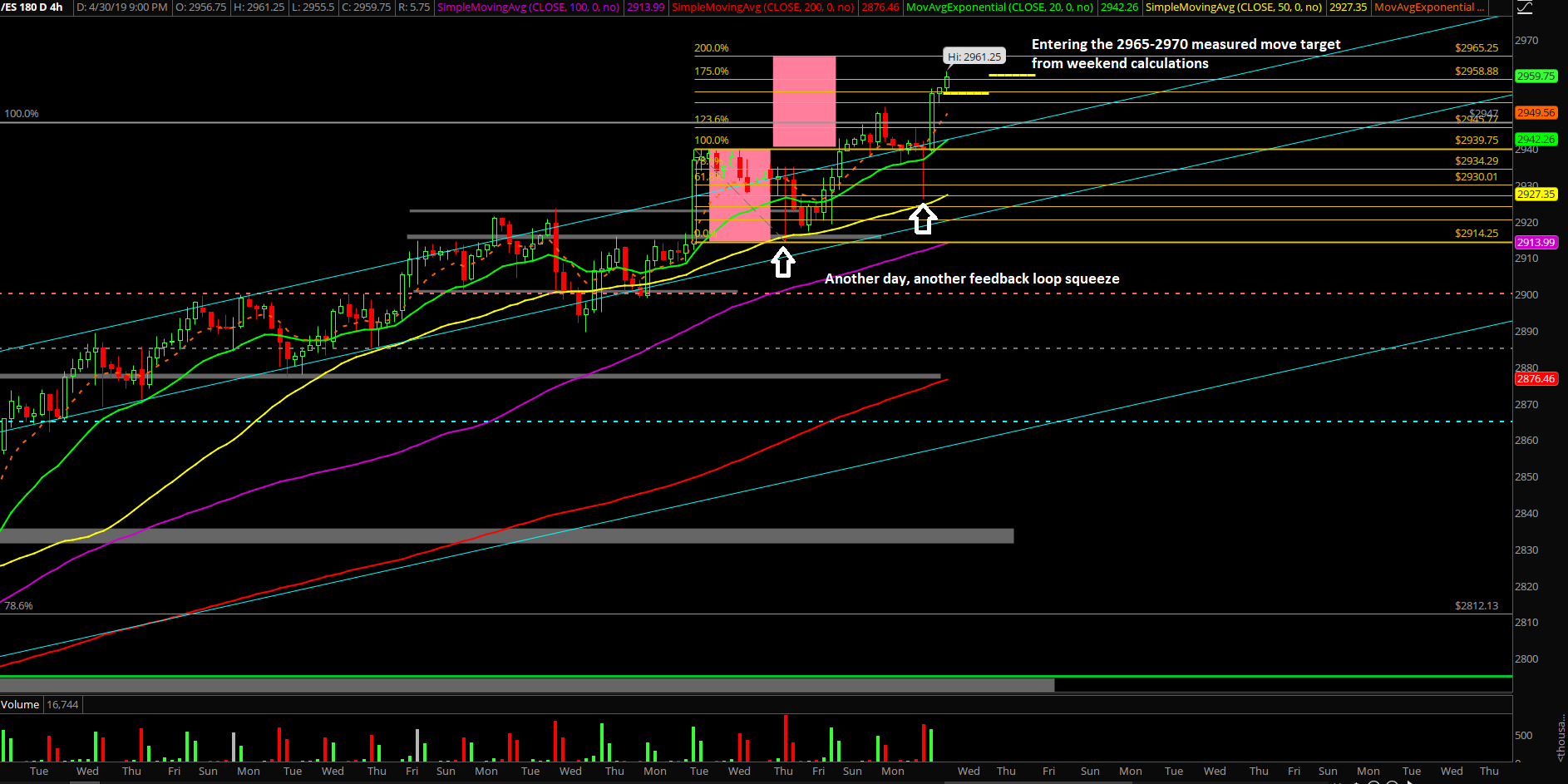

Tuesday’s session was fairly textbook and funny as it was just a repeat of Thursday’s game plan. The market shook out some weak hands in order to lighten up the train load before the acceleration into the pre-determined monthly dead highs closing print. The price action today gave everybody and their mother multiple chances to board or re-board the train even if they got forced out of the train or add more short-term alpha positions across the board.

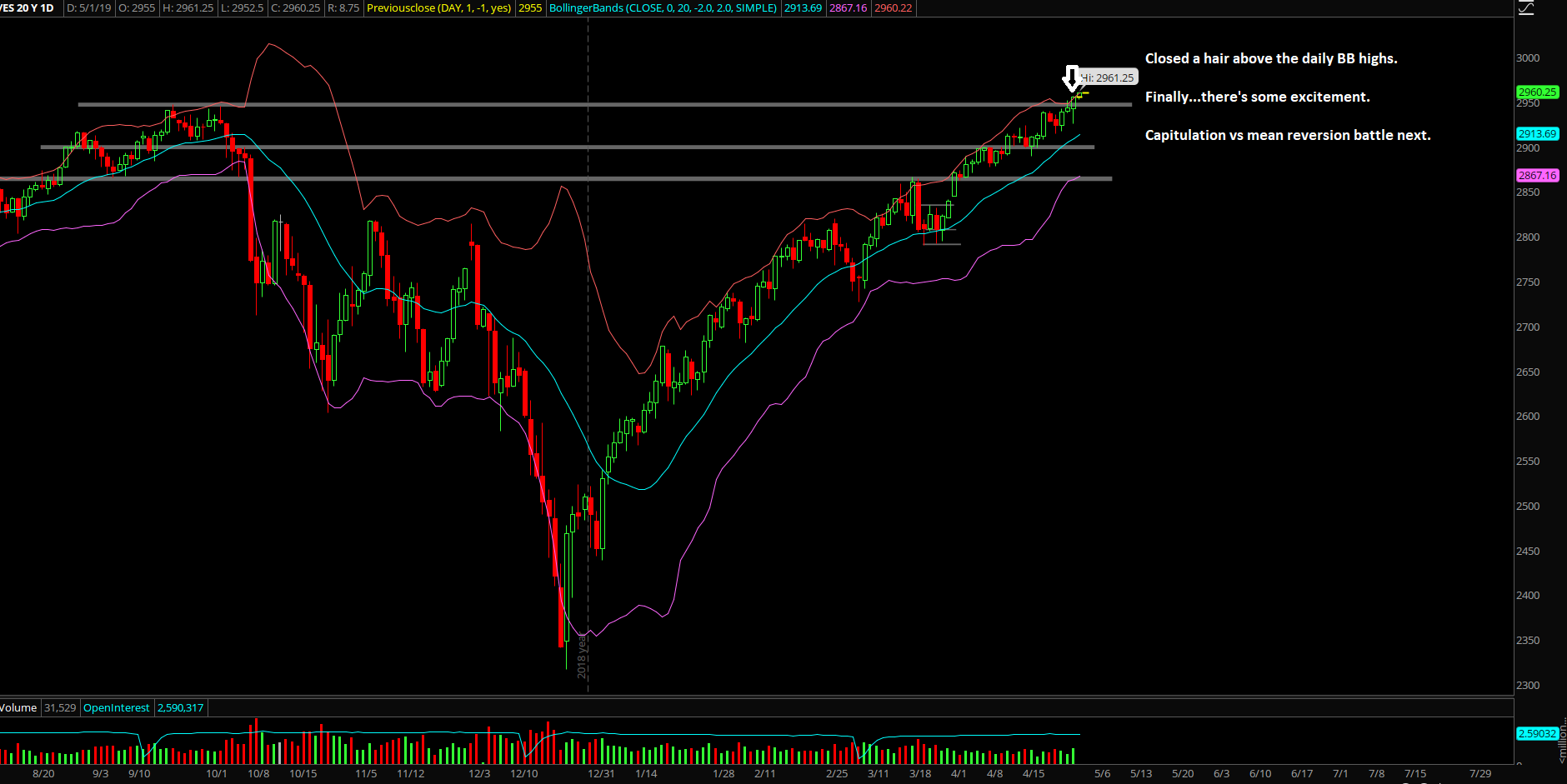

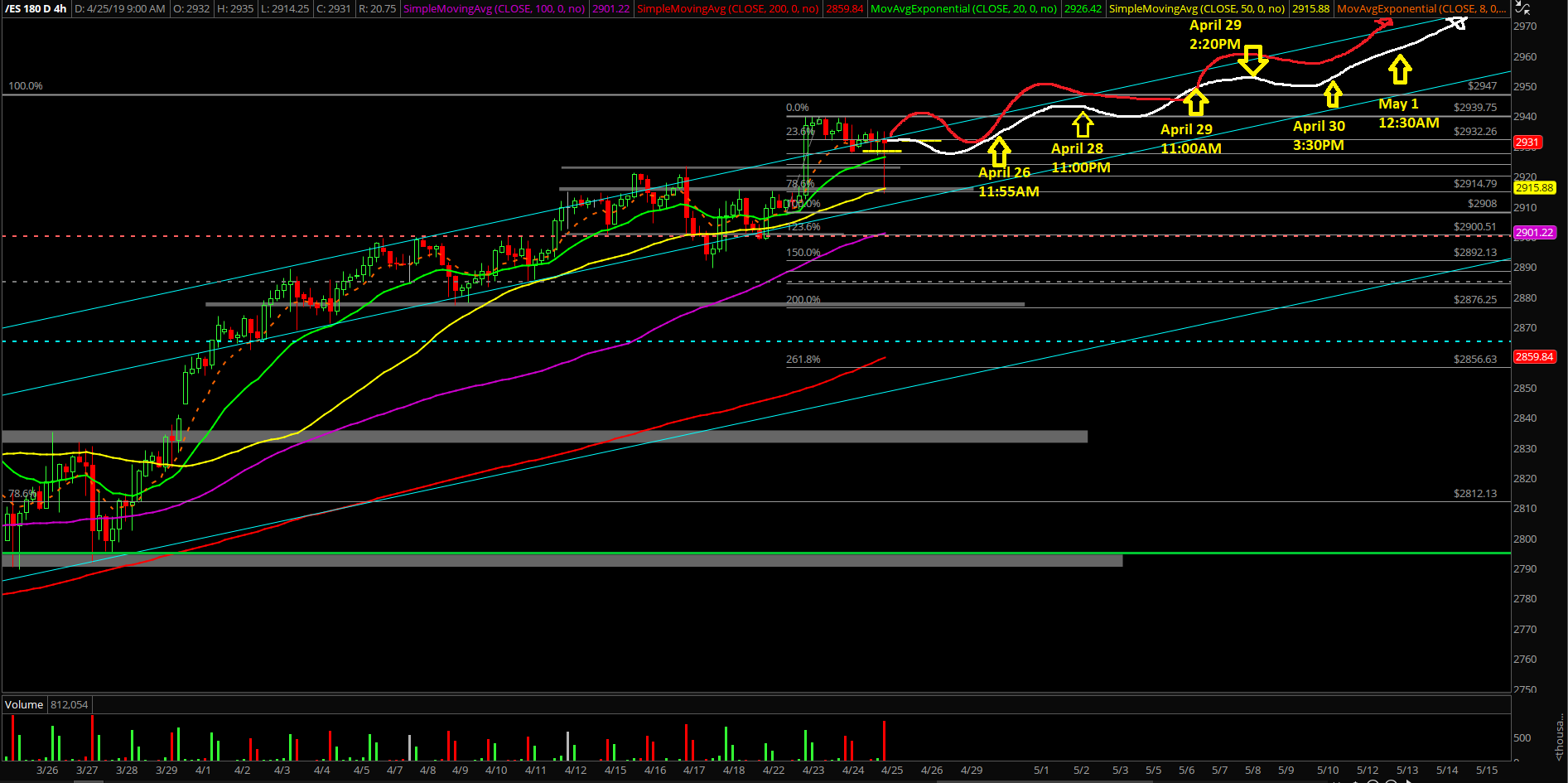

Basically, the market managed to kill some of the 2930~ stops on the Emini S&P 500 in the trending support area. Then, we loaded up the contracts at the LOD again as demonstrated. For reference, today’s low was 2926 and it was just a repeat of Thursday’s V-bottom. Overall, the bull train had a quite an impressive continuation month for April as the bulls were able to fulfill the goal of closing at the dead highs print for 4 months consecutively.

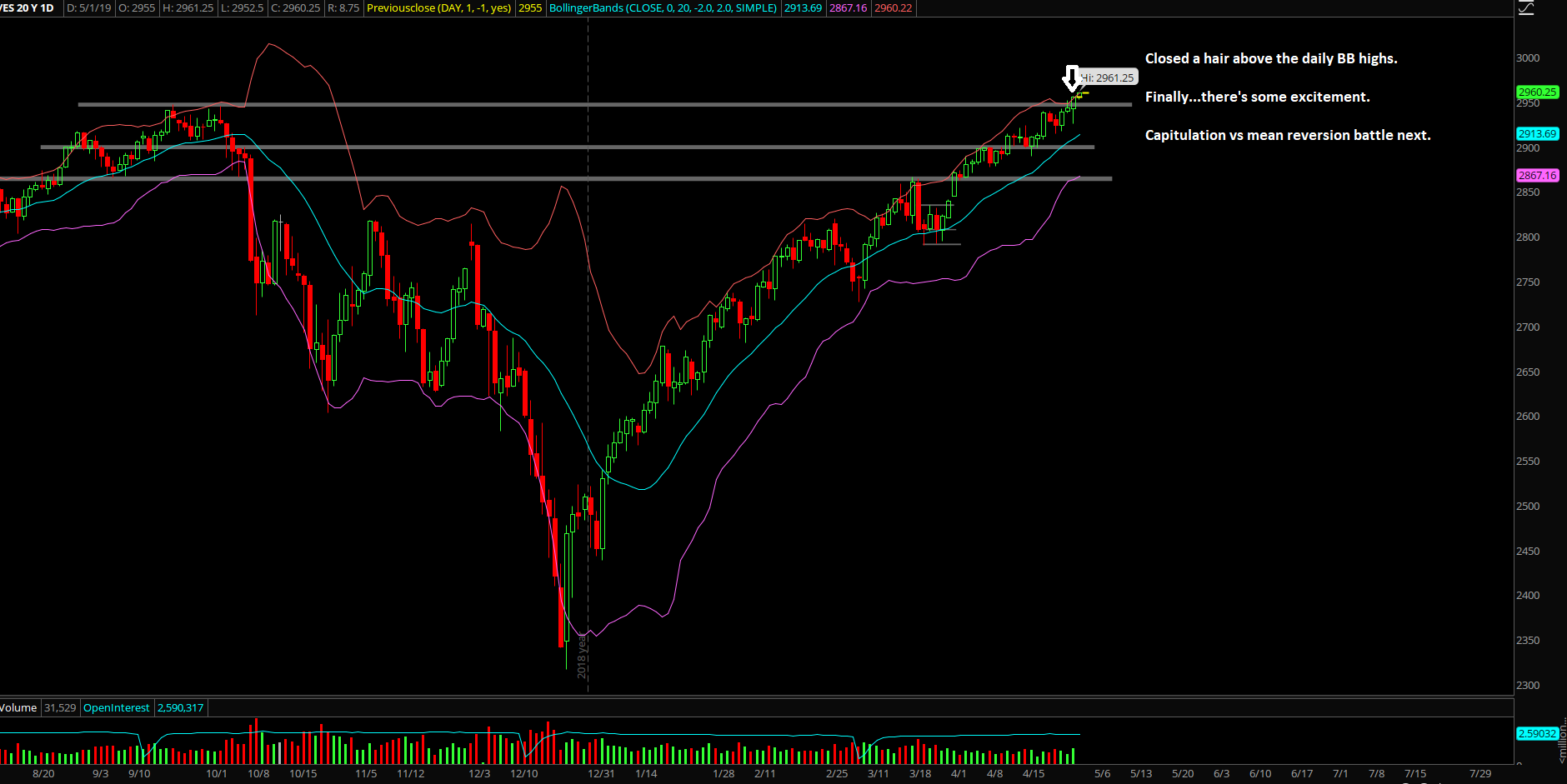

The main takeaway from this session is that it’s been two days in a row hovering around the daily BB and we have closed above it for the first time in about a month. This means two important battles at hand here: Either the bull train is in an acceleration mode within an acceleration mode going straight up northbound based off of today’s intraday feedback loop squeeze. Or price finally runs into some mean reversion risk as price action enters the 2965-2970 bullseye from last week’s projections. Either way, it doesn’t really matter because we’re going to be aggressively managing the ongoing risk exposure across the positions utilizing our textbook rules and level by level approach. Tomorrow = FOMC announcement at 2PM so perfect time for a timing catalyst to move the market even more. Be prepared.

What’s next?

Daily closed at 2955 as a bull engulf candle where the low of the day was coincidentally the daily 8EMA backtest once again just like the LOD prints for the past 10 sessions doing the same thing. It‘s a textbook bull train, we trade what is in front of us and take the easy money setups until the wheels fall off. If it ain’t broke, don’t fix it. Yada yada.

Current parameters/bias:

- 4hr white line projection remains king for now as the market opted to mimic it since last week

- Make sure you manage ongoing risk exposure properly as we head into the 2965-2970 bullseye target per weekend report notes

- When above 2930, bulls still have bears by the balls and opt try for the direct route towards 2970-3000 following the white line.

- If below 2930, treat as more consolidation for another bull flag/high level consolidation. Nothing is considered bearish until a minimum break of below 2914 which was last Thursday’s shakeout low. That’s when bears can resurrect themselves to play out the spring-summer battle

Clear and concise context for May:

The bull train rode the daily 8EMAtrain tracks for the past 22 sessions in a textbook acceleration pattern. And we have closed at the dead highs for April as expected so the momentum and follow through has been great. Now, the market is at a key juncture as a lot of levels are aligning around this 2970-3000 confluence zone. This just means two scenarios; straight up capitulation riding the daily BB up like Dec 2017~ or we finally get some mean reversion playbook. This also means managing risk exposure here is quite pivotal/important because of the expansion above all time highs already opening up ‘sky is the limit’ potential. Obviously, we must stay 4 steps ahead of everybody and lock in some short-term alpha as we hit our target levels and then aggressively manage our positions across the board whether it’s in higher beta sector or the rip in your face stocks that are just set and forget.

Try to condition yourself and don’t get too hyped up here because the real easy money has been made already in April (and Jan-March) as it was all about not messing up the buys vs. LOD/higher lows execution almost every day. For May, our proprietary extreme signals are currently telling us to be extra nimble again and not get complacent here as it should not be as easy. In simplest terms, we may have to utilize more of a guerilla warfare trading tactics while trading this ongoing train vs. the general more relaxed style that we had demonstrated for the past few weeks doing alpha scalps+buy and hold. This way we will protect ourselves even if the shit hits the fan with a quick mean reversion for the short-term; it really doesn’t matter to us given our level by level approach.