Approaching Targets - Market Analysis for Oct 2nd, 2019

There really is not much for me to update in the mid-week report on metals, so it will be rather general and short. As we have been primarily treating rallies as corrective in nature (until proven otherwise), we have been looking for the market to provide a pullback in the complex as a whole. And, thus far, that is exactly what we have gotten.

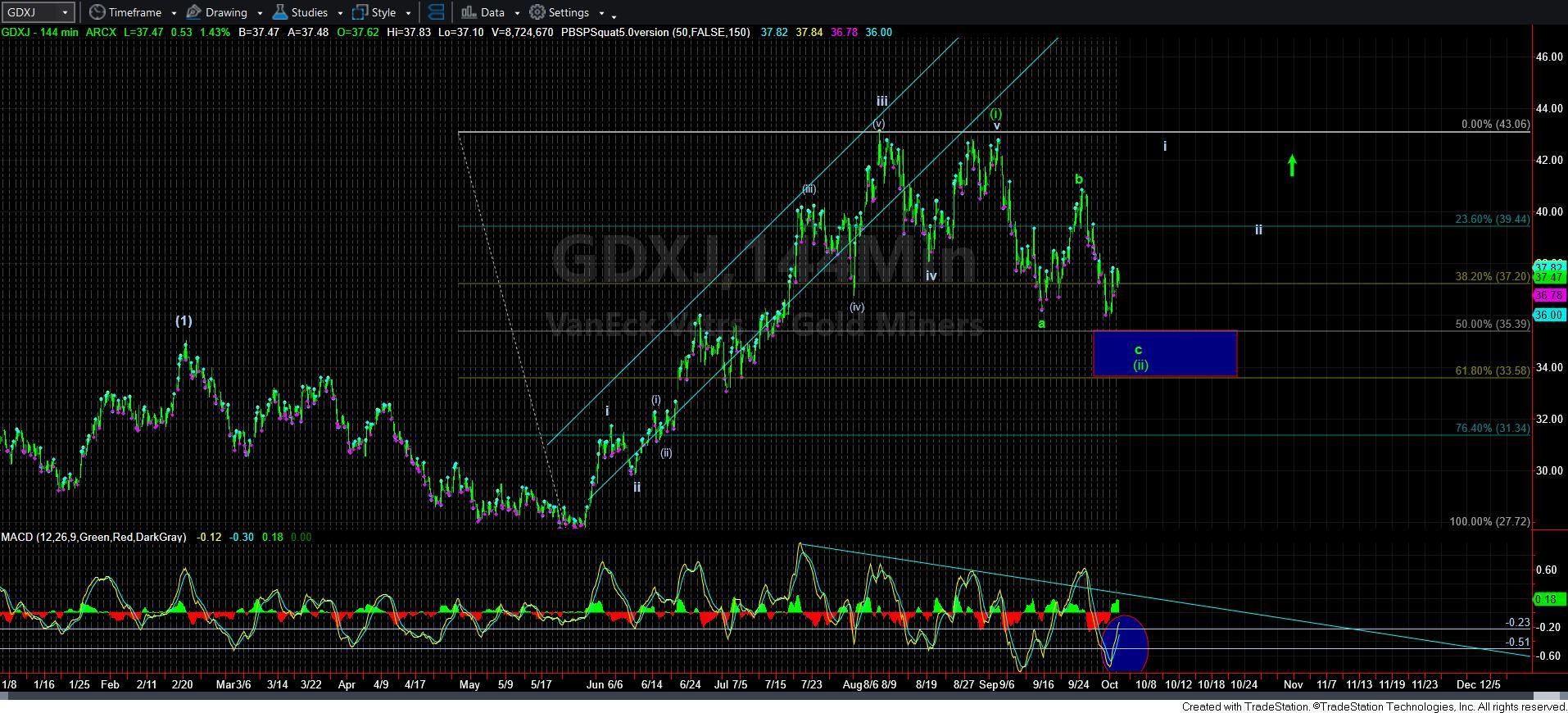

On the smaller degree expectations, I can count 3-waves down in this latest bout of weakness, with today’s rally potentially being the 4th wave of the c-wave down. That means that we will “likely” see one more bout of weakness to complete this pullback we have been tracking in the metals.

However, if the current rally begins to push for several more days, then it can suggest this c-wave came up short of its ideal targets. But, for now, my expectation is to see a 5th wave lower low to complete this c-wave in this a-b-c corrective pullback.

As I outlined today in both the GDXJ and silver, they are both set up for that lower low in a 5th wave, with the potential set up for a positive divergence in their respective MACD’s when price makes a lower low. Those present us with high confidence bottoming structures. And, should we see a rally off those bottoming structures, then we likely have completed this a-b-c pullback, and have begun the next bullish phase in the complex.

But, at the end of the day, I am still going to wait for the market to prove it has bottomed, and then allow it to form the next i-ii upside structure before I get ready to turn very bullish for the next break out phase. Until then, I am expecting bottoming action in the short term, which will thereafter set up that break out scenario. So, I am still going to be a bit more patient before I turn into a metals uber-bull again.