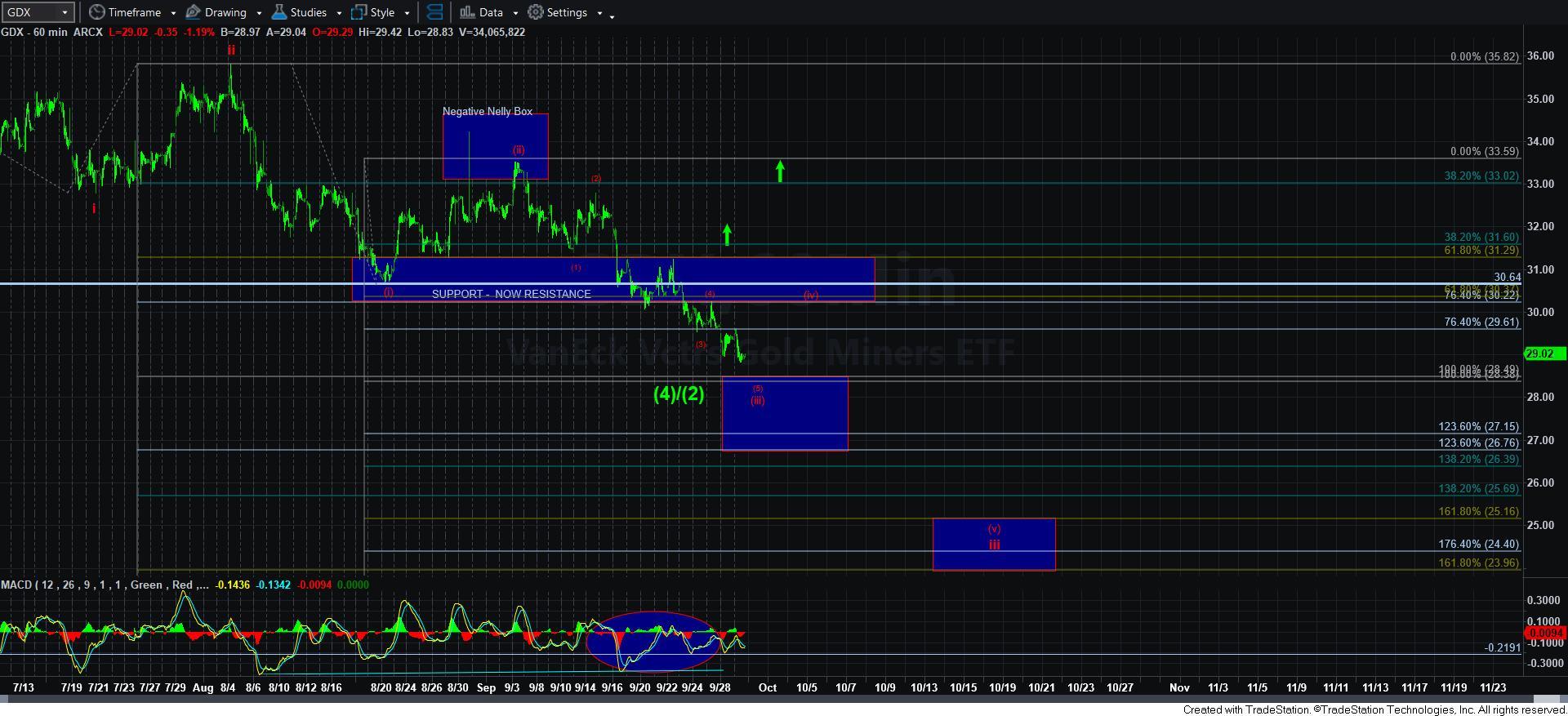

Approaching Next Support For GDX

As we approach the next support highlighted on my 60-minute chart for GDX, the one thing that is clear is that we still have no initial reversal signal. We have continued to maintain below resistance levels we have continually adjusted lower as the market has moved lower, and the market has not provided us any initial bullish indications during that time.

Moreover, the divergences on some charts are starting to fray, which is not good news for any immediate bullish resolution.

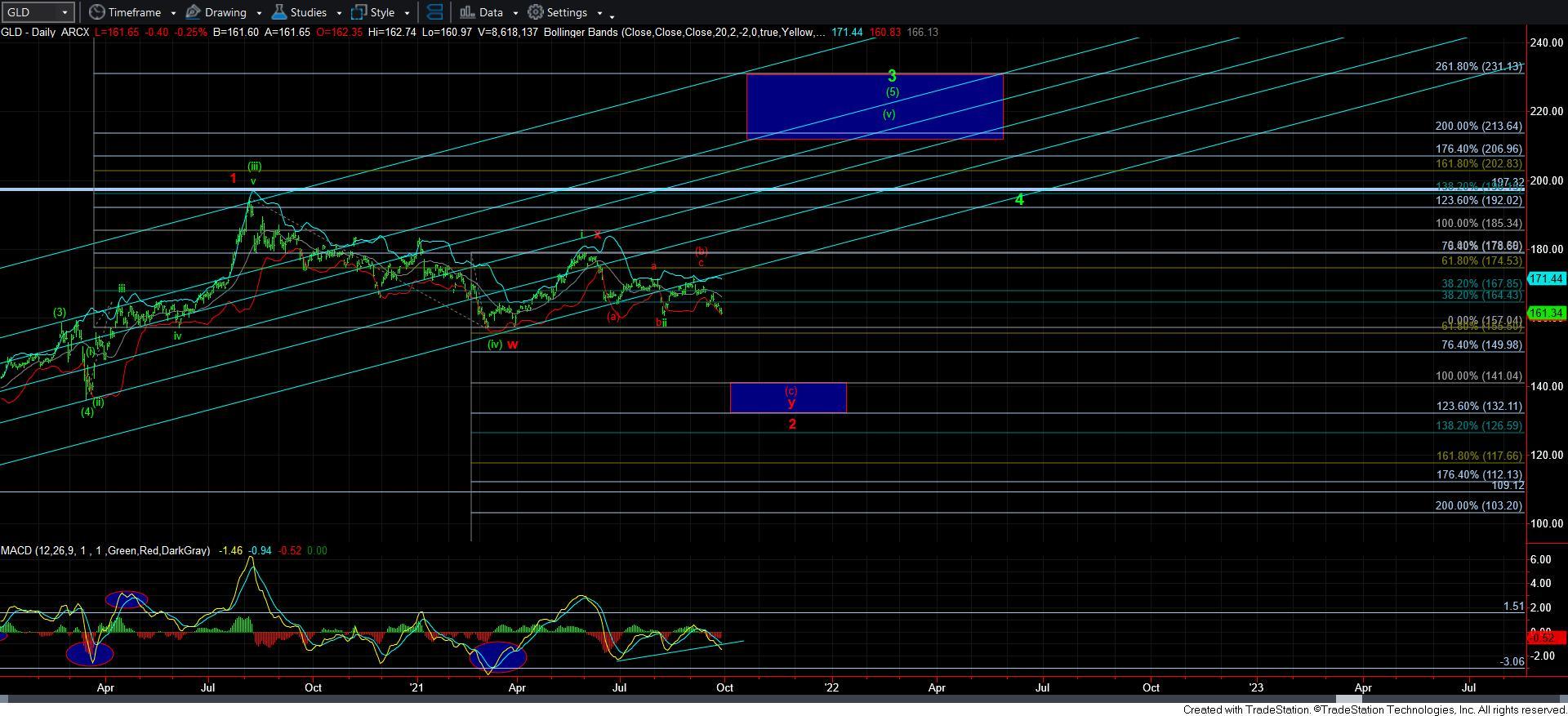

Yet, the downside structure in GC has more overlap than I would normally expect if we really are going to see the fullness of this decline. Moreover, silver still has maintained its divergences, but we will still need to see an initial 5-wave rally off a low very soon in order for us to be able to even consider a more bullish near-term resolution.

So, for now, the bears still remain well in control of the various charts we are tracking.

In order to maintain an impulsive decline structure, GDX is going to now have to maintain below the 30.20-50 region to keep pressure strongly down. Should the market fail to exceed that initial resistance on its next bounce, then our next lower target box resides in the 24-25 region.

At this point, the bulls are either going to step up big time, or we are going to see many charts begin to break their positive divergence set ups, which will much more strongly suggest we can see the fuller decline structures take hold in the coming weeks to months before the metals complex is able to find a lasting bottom.