Antero Resources: A Familiar Pattern Is Starting to Re-Emerge

Markets have a way of revisiting old behaviors long before investors are ready to recognize them. Not because the circumstances are identical, but because human participation tends to respond in repeatable ways when conditions line up. That is especially true in sectors where fundamentals can swing quickly and sentiment often does the heavy lifting.

Antero Resources may be moving back into one of those environments.

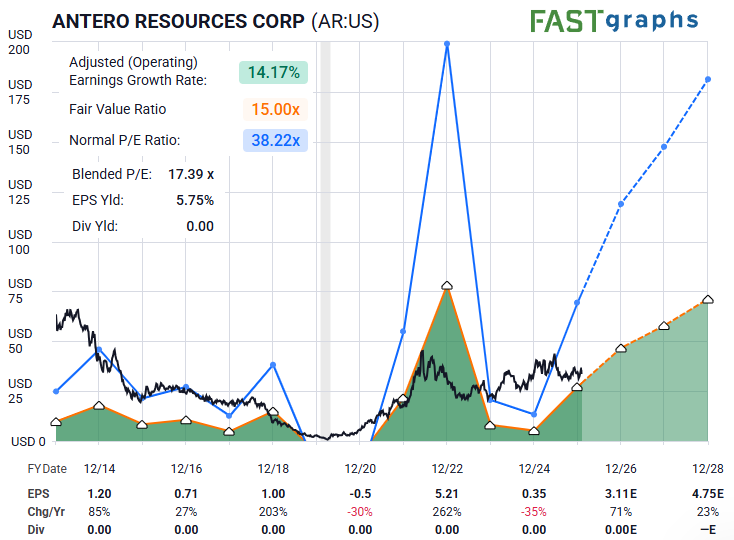

On the surface, the setup looks ordinary enough. Earnings expectations are improving, balance sheet concerns are present but manageable, and the business remains exposed to the inherent volatility of energy markets. By themselves, those factors rarely explain outsized moves. But they don’t have to. In Antero’s history, the most consequential advances did not begin when fundamentals were pristine — they began when expectations were reset low enough for sentiment to take the lead.

That dynamic has shown up here before.

In 2020, Antero Resources was priced as if its future were in question, trading below $1 per share amid concerns about viability and even dissolution. Fast forward to today, and while the energy space remains volatile by nature — with uncertainty and sharp swings in underlying variables never far away — the company now operates in a far more grounded environment. Sentiment has stabilized, fundamentals have improved, and the path forward, while still dynamic, is no longer purely speculative.

During that 2020–2022 window, forward earnings estimates began to inflect higher while the stock was still largely dismissed as risky and cyclical. What followed was not a gradual repricing anchored to valuation models, but a swift shift in participation. Once price began to move, sentiment accelerated the process. The stock didn’t simply improve — it overshot.

What makes the current backdrop compelling is not that conditions are identical, but that the sequence is beginning to rhyme. Earnings visibility is improving again. Volatility remains part of the equation. And the stock is starting to behave in ways that suggest positioning and expectations may once again be out of sync.

This perspective closely echoes how Lyn Alden has framed the setup.

As she recently noted:

“The fundamentals are supportive, but with a BBB- credit rating and volatile fundamentals, AR is the type of stock that I generally defer to technicals on.”

That observation captures the essence of the opportunity here: when the business backdrop is improving but still unstable, the market’s response tends to be governed less by valuation and more by participation.

This is where traditional analysis often runs out of explanatory power. When fundamentals are supportive but unstable, and balance sheet risk still exists, valuation alone rarely defines the path forward. In those moments, price behavior becomes the more reliable guide — not as a forecast, but as a record of shifting participation.

To determine whether this familiar pattern is truly re-emerging — or whether it stalls before gaining traction — we turn to sentiment as expressed through structure.

That is where the real signal tends to appear first.

Sentiment Speaks

When fundamentals are clean and stable, price often moves in a measured, explanatory way. When fundamentals are improving but still volatile, something different tends to take over. Participation — not valuation — becomes the primary driver.

That shift is especially relevant for Antero Resources.

AR is not a stock that typically advances through slow, incremental optimism. Historically, its most meaningful moves have occurred when price begins to travel ahead of broad confidence. In those phases, the market is not pricing certainty — it is responding to changing sentiment. And that transition tends to surface first in structure.

The recent price behavior suggests participation may be evolving again.

Rather than reacting violently to each fluctuation in energy prices, AR has started to move with greater organization. Pullbacks are being contained rather than extended. Advances are followed by consolidation instead of immediate rejection. These are often early signs that corrective pressure has largely run its course and that new positioning is forming beneath the surface.

This is not exuberance. It is alignment.

Crucially, this type of environment does not require widespread bullish sentiment to remain viable. In fact, it often benefits from lingering skepticism. As long as doubt remains present, advances tend to be driven by repositioning rather than crowding — a condition that has historically supported AR’s strongest upside phases.

Sentiment here is not about emotion. It is about behavior. It is about whether price can continue to make progress without needing a perfect backdrop. Thus far, AR is beginning to do exactly that.

The next step is to define whether this organization can persist. For that, we turn to structure — and the specific levels that will determine whether this developing shift continues… or gives way.

The Chart — A Study In Behavior

Please keep in mind that it is this structure of price unfolding onto the chart that communicates crowd behavior. So, what can we glean from this current setup?

Note that Zac Mannes is showing price to be initiating circle ‘c’ of wave 3 of a larger 5th wave higher. Inside this ‘c’ wave, there should be 5 waves — waves (i) and (ii) appear to have already taken shape. The subsequent advance should be wave (iii) of ‘c’ with a standard target overhead in the $45 zone.

Should price instead decline back below the January low struck at $31, it would communicate to us something else other than what is illustrated here — likely, a more protracted corrective move instead.

Conclusion

Antero Resources does not need ideal conditions to advance — it needs participation to continue organizing. With fundamentals supportive but still volatile, and balance sheet risk not fully erased, this is exactly the type of environment where price behavior carries the signal.

The current structure offers clear parameters: as long as it holds, probabilities favor continuation; if it fails, the message is just as clear. This is not about predicting a repeat of the past, but about recognizing when familiar dynamics begin to surface again. In stocks like AR, sentiment often moves first — and price tells us when it’s worth listening.