Another Set of Higher Lows Setting Up Bulls

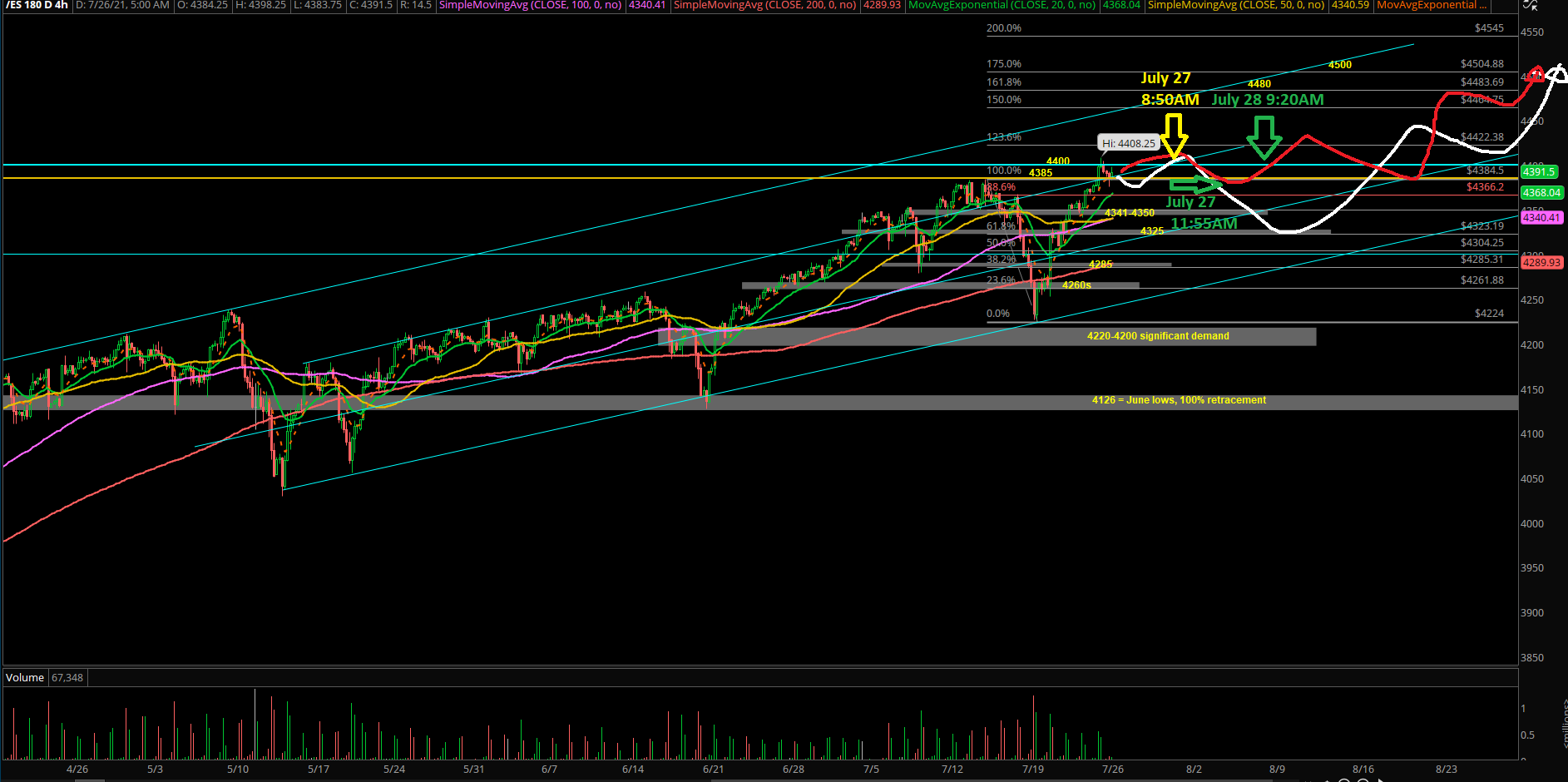

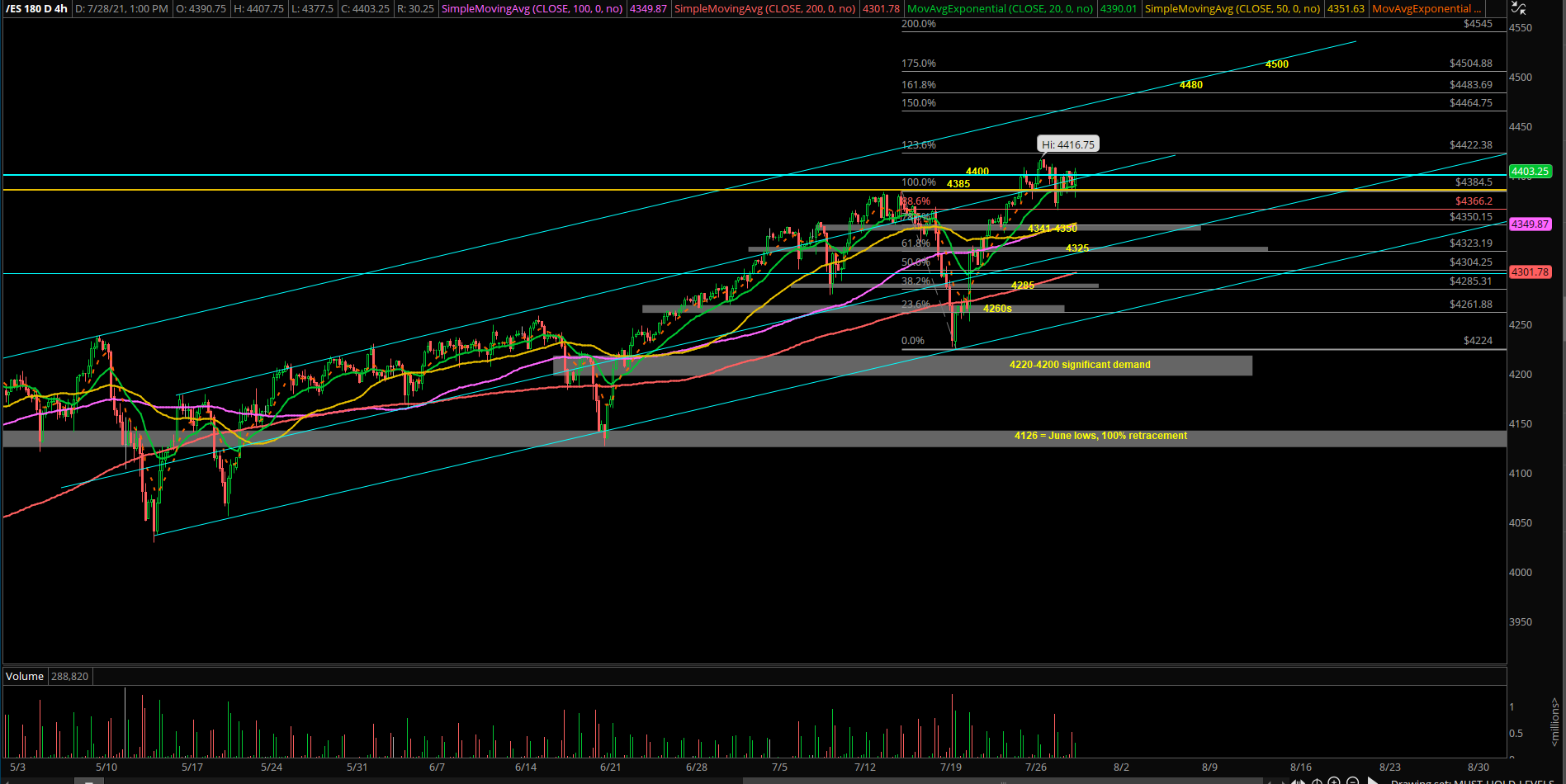

For now, the market price action continues to follow our red line projection since the beginning of the week.

Digestion inside this 4420s-4375s zone on the Emini S&P 500 (ES) was expected in order to ramp towards 4480-4450 at a later date.

Today formed another set of higher lows, so the bulls are setting up for the usual end-of-week highs attempt. We need to hold LOD at all times or else too weak for immediate breakout/acceleration

I'm sharing a bonus today: The Emini Russell 2000 (RTY) is breaking out on the daily chart. Eyes are on acceleration mode the next few sessions into 2300-2350 target. Now, 2230s. Must hold above 2185 at all times, otherwise too weak. This is the best risk vs reward equity index as of writing.