Another Push Higher So Long As 4410 Holds

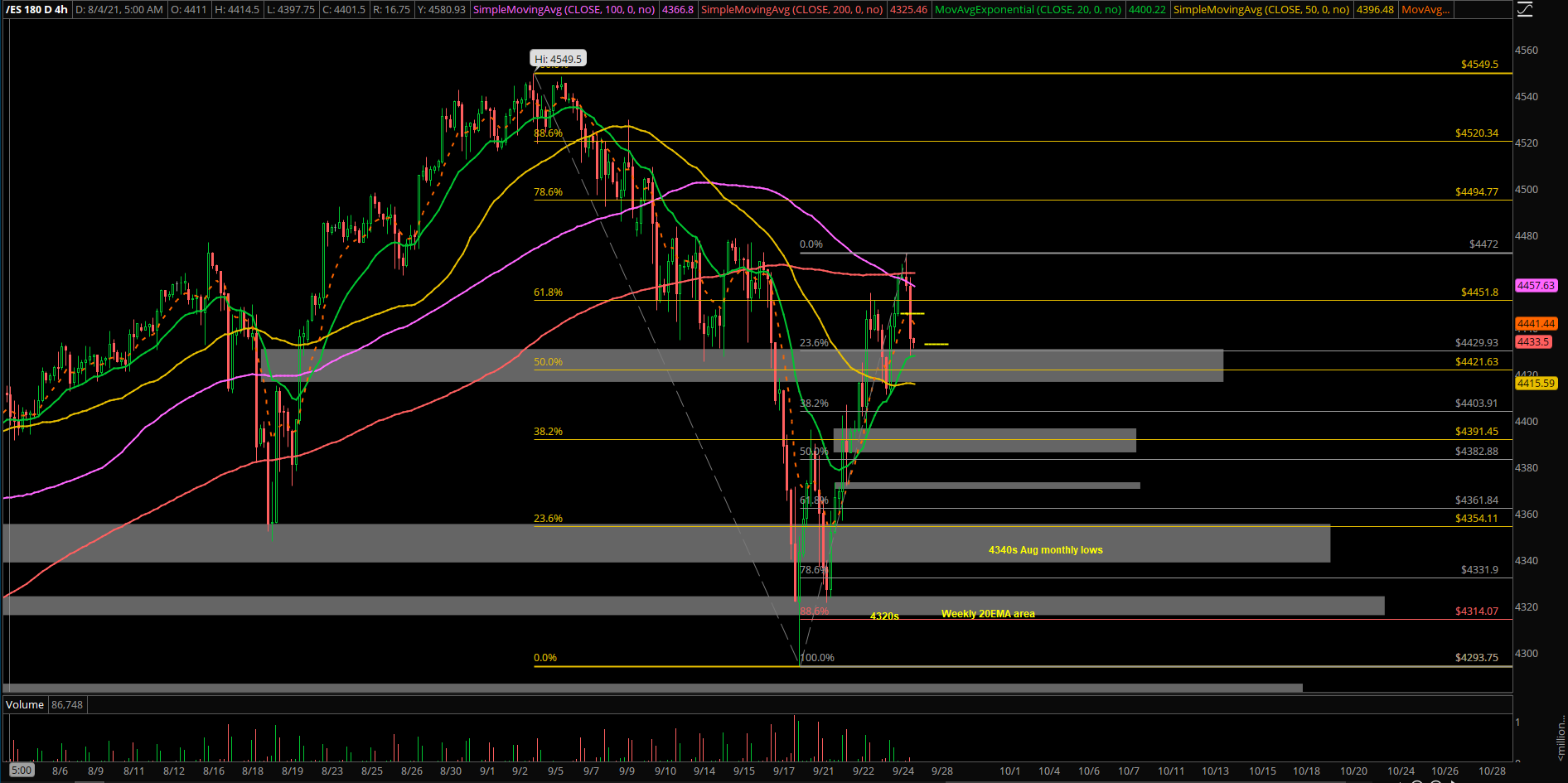

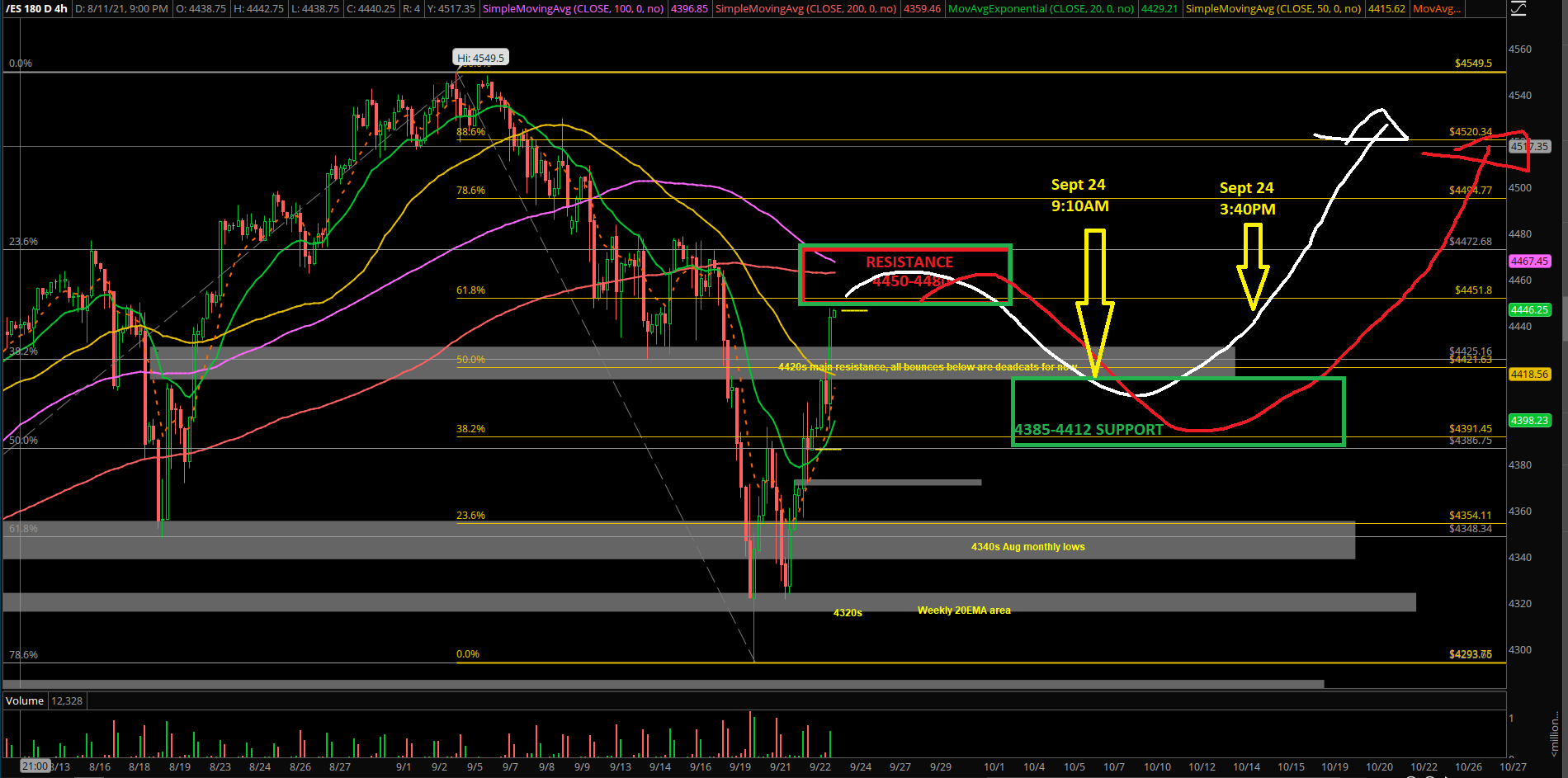

Price action got rejected and was unable to sustain Sunday night’s +20 run, meaning today (Monday) likely becomes a range day instead to digest a little bit.

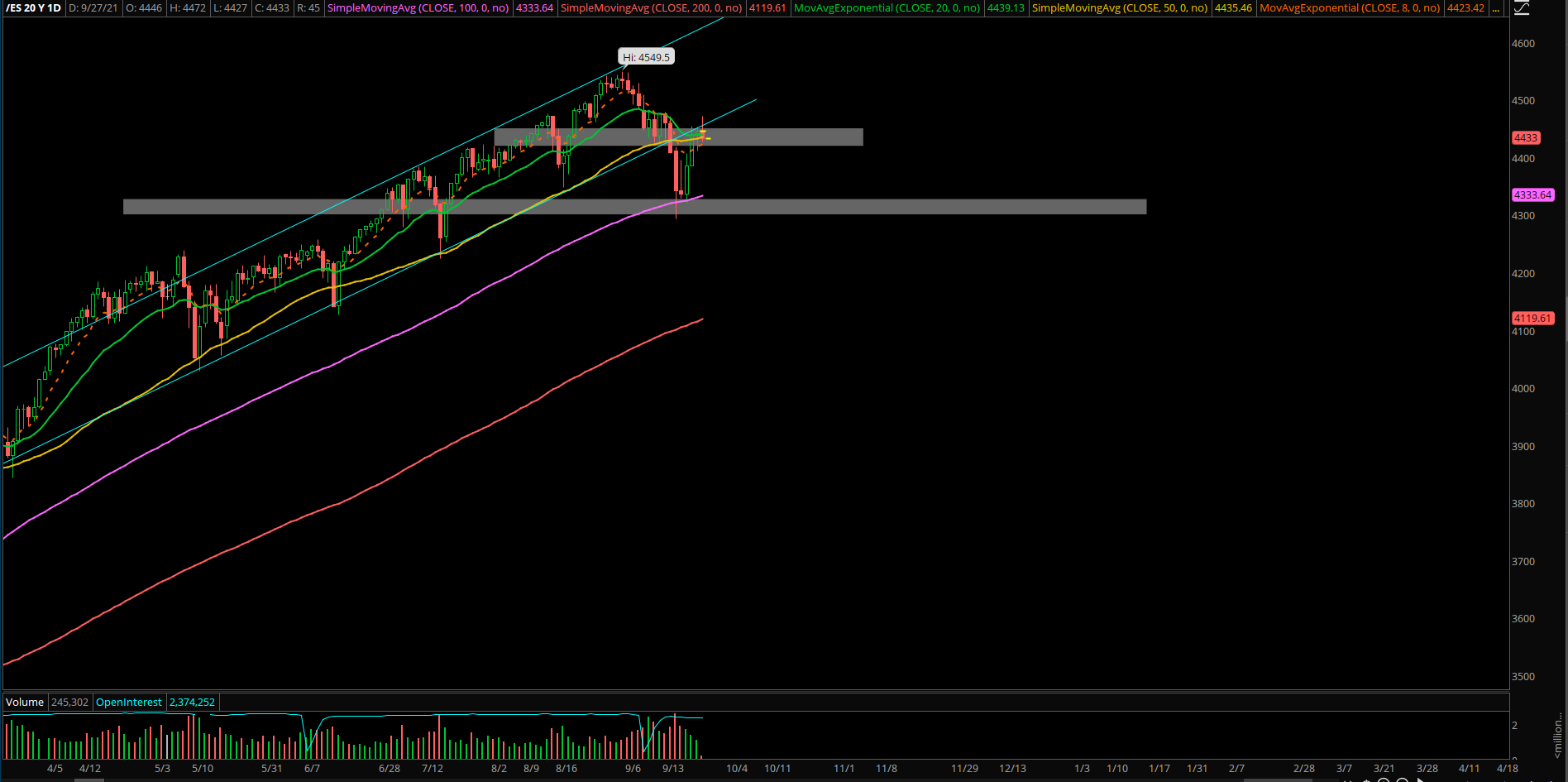

As of writing, price is hovering around the 4430s on the Emini S&P 500 (ES), meaning it’s going to be a small -15pts or -0.3% gap down versus Friday. We have to be aware of digestion/further weakness as price action trades back into last Thursday-Friday’s ranges.

Going into this today/this week, we’re expecting another push into 4500-4520 targets as long as 4410 holds. Failing to hold support, opens 4400/4385/4350 further backtest opportunities

For now, price action is still following last week’s 4hr white line projection building out higher lows and higher highs, so no changes until price proves otherwise.

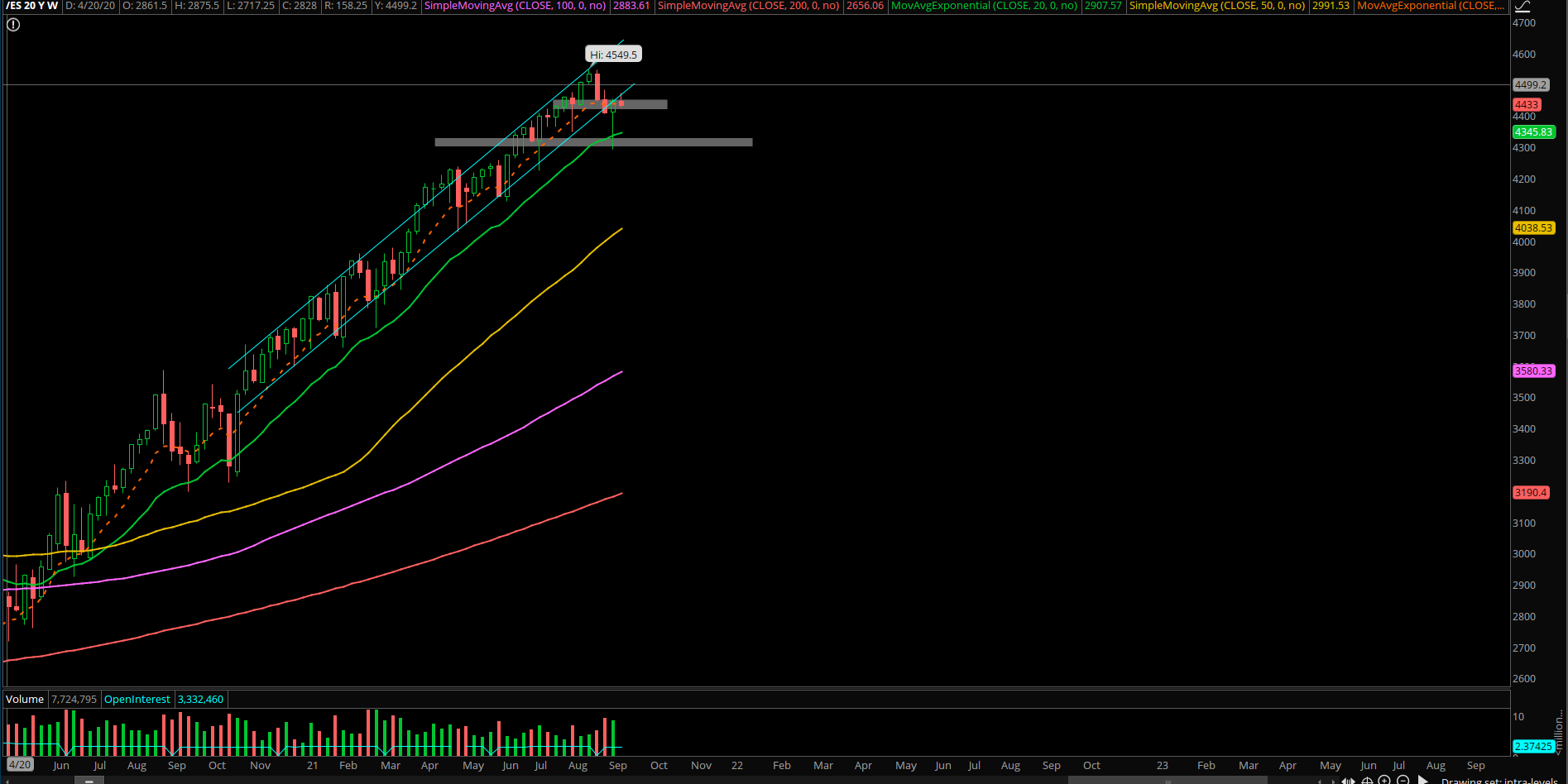

Lastly, end of month+quarter in a few days, given the overall bull trend+stats, expect an attempt into as high as possible to be made. If no attempt or failed attempt, then you know something has changed underneath the surface as we head into Q4