Another Failure To Launch?

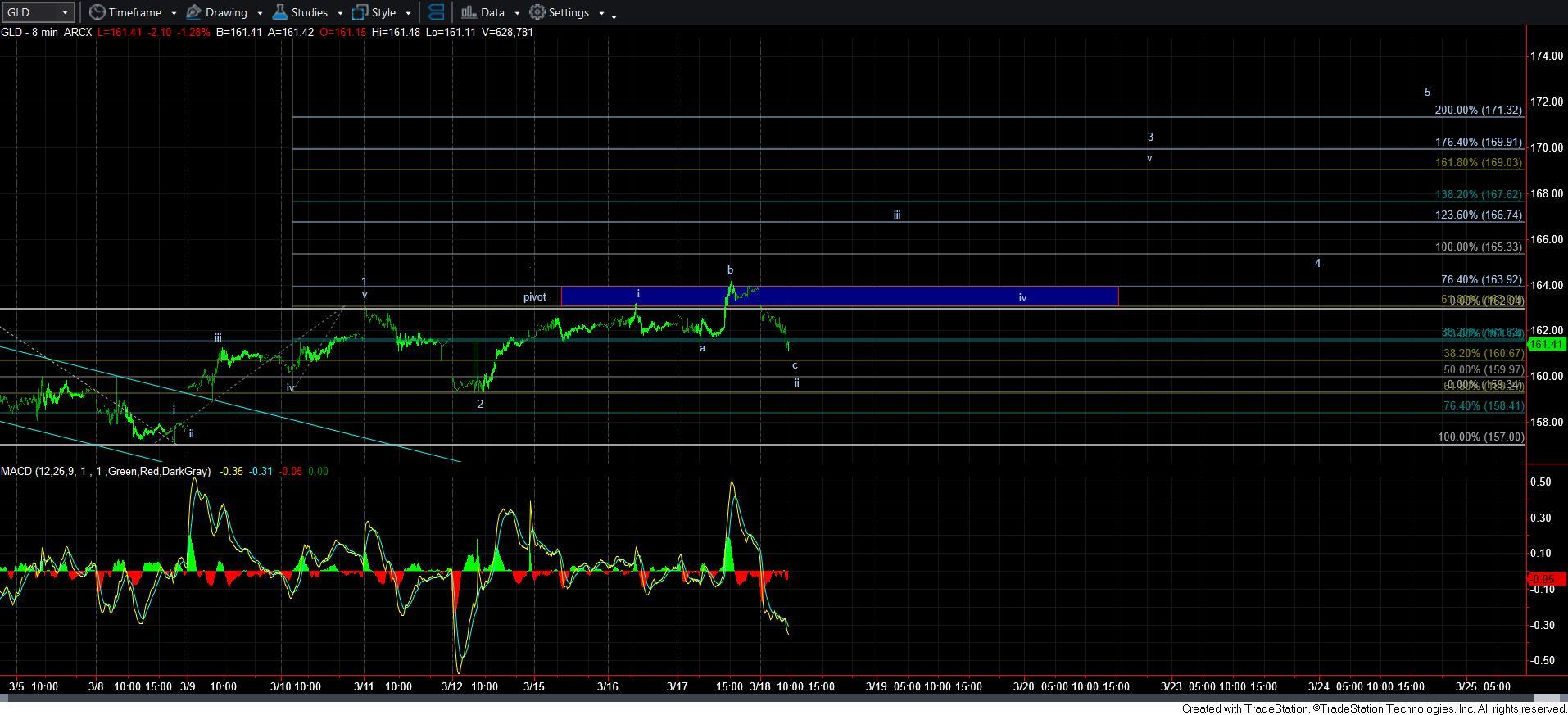

The GLD had an ideal set up in place to prove a bottom has been struck. With the overnight action turning south rather than continuation in a potential wave iii of 3, it has made a bottom in place much less likely. While it can always ressurect based upon the count I have on the 8-minute chart, I do not have high faith in that unless it takes out yesterday's high and breaks out through 165 strongly. For now, I think it may be more suggestive of a lower low.

But, if you look at the daily chart again, please see that a lower low will now even provide a positive divergence on the daily chart, which means that those that are aggressive can use a lower low as a buying opporutnity. Overall, my upside target remains the blue box on the daily chart.

As far as GDX is concerned, well, a break down below 33.50 is an issue from a Fib Pinball standpoint, and would have me looking for a lower low in the 30 region. And, this will remain probable until we break out over yesterday's high.

This has been a VERY complex structure in GDX, but, as in GLD, a lower low should finally complete the process, as it will also provide the needed lower lows to those individual mining charts that are missing it at this time.

As far as silver is concerned, it has left all potentials on the plate, as it has also not proven that it is ready to break out just yet.