Another ATHs Attempt For End Of Week

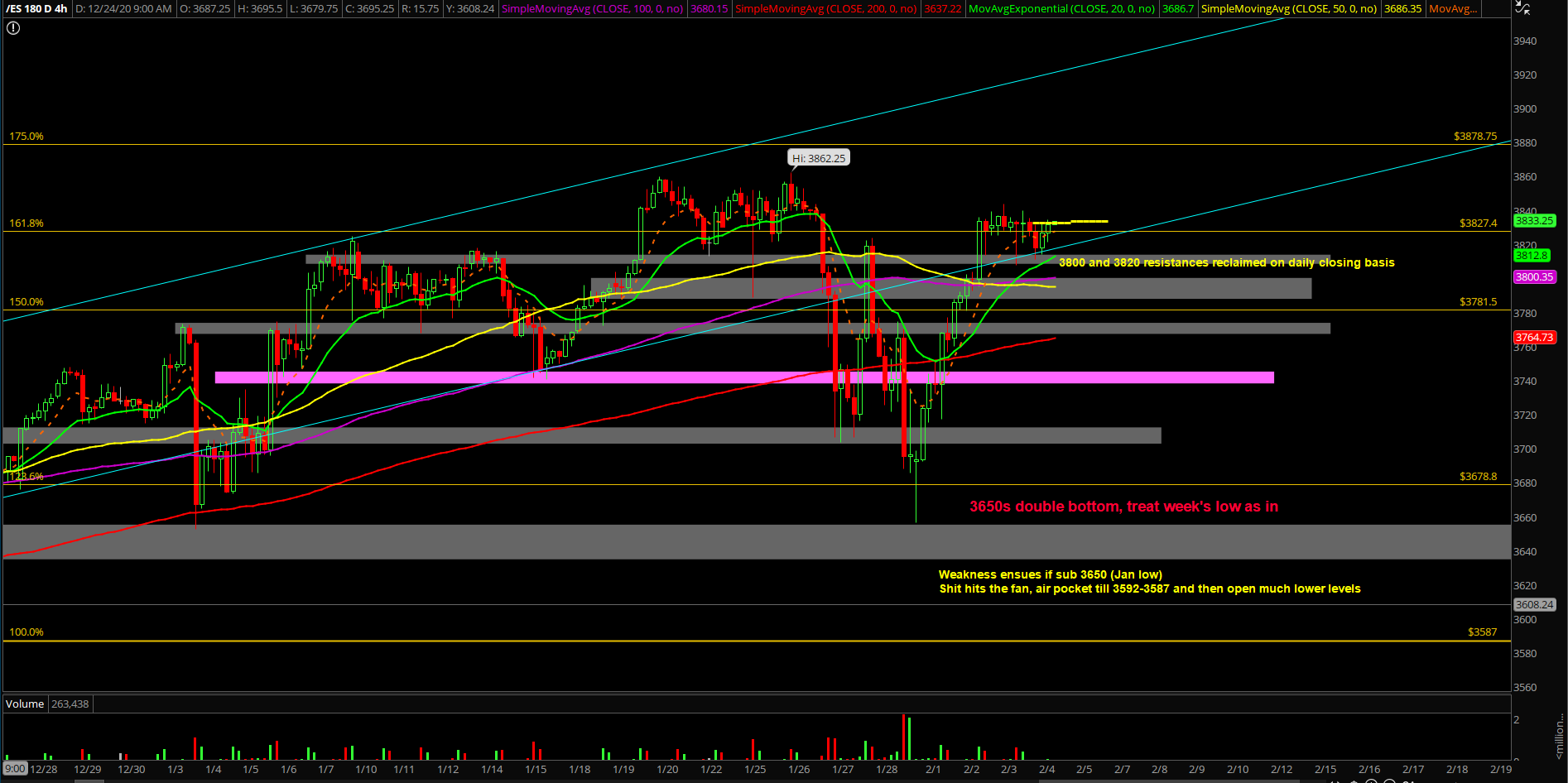

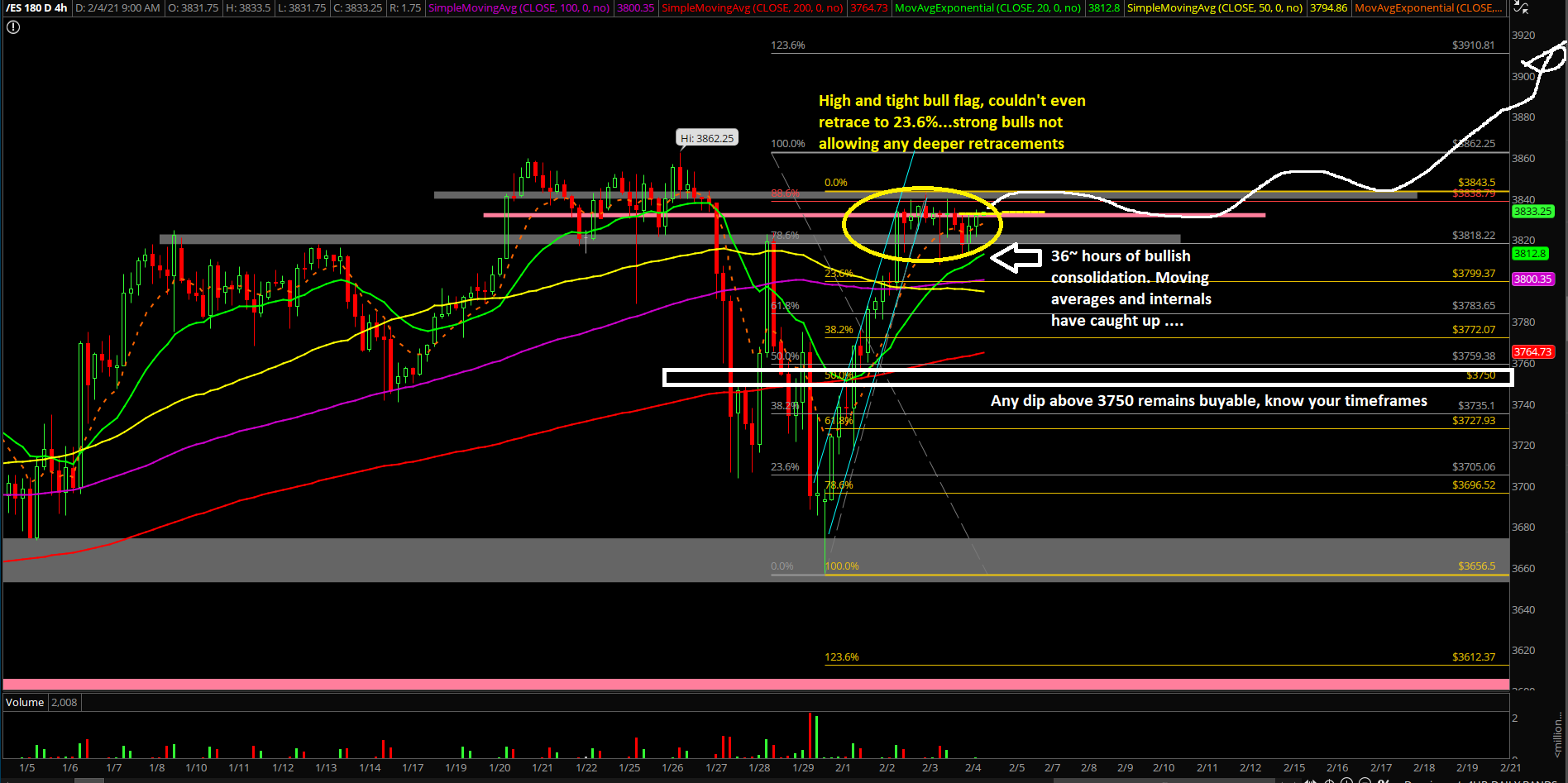

Wednesday’s session played out as a typical range day given that price action needed some healthy digestion. Price action remains ultra strong as bulls are not even allowing a 23.6% retracement of this week’s range (3840s-3650s). Price action bottomed out at 3807s on the Emini S&P 500 (ES) during Wednesday’s RTH.

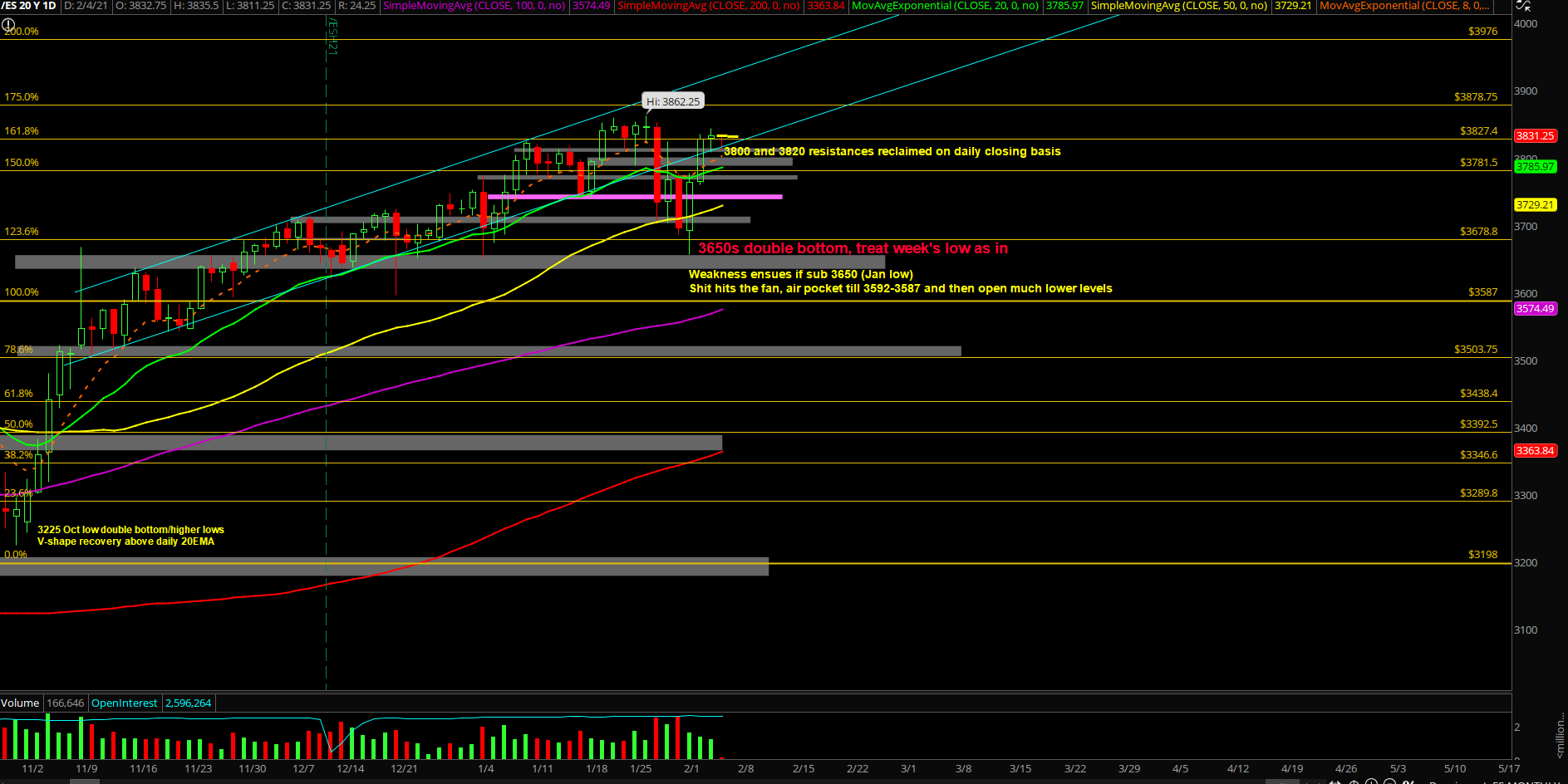

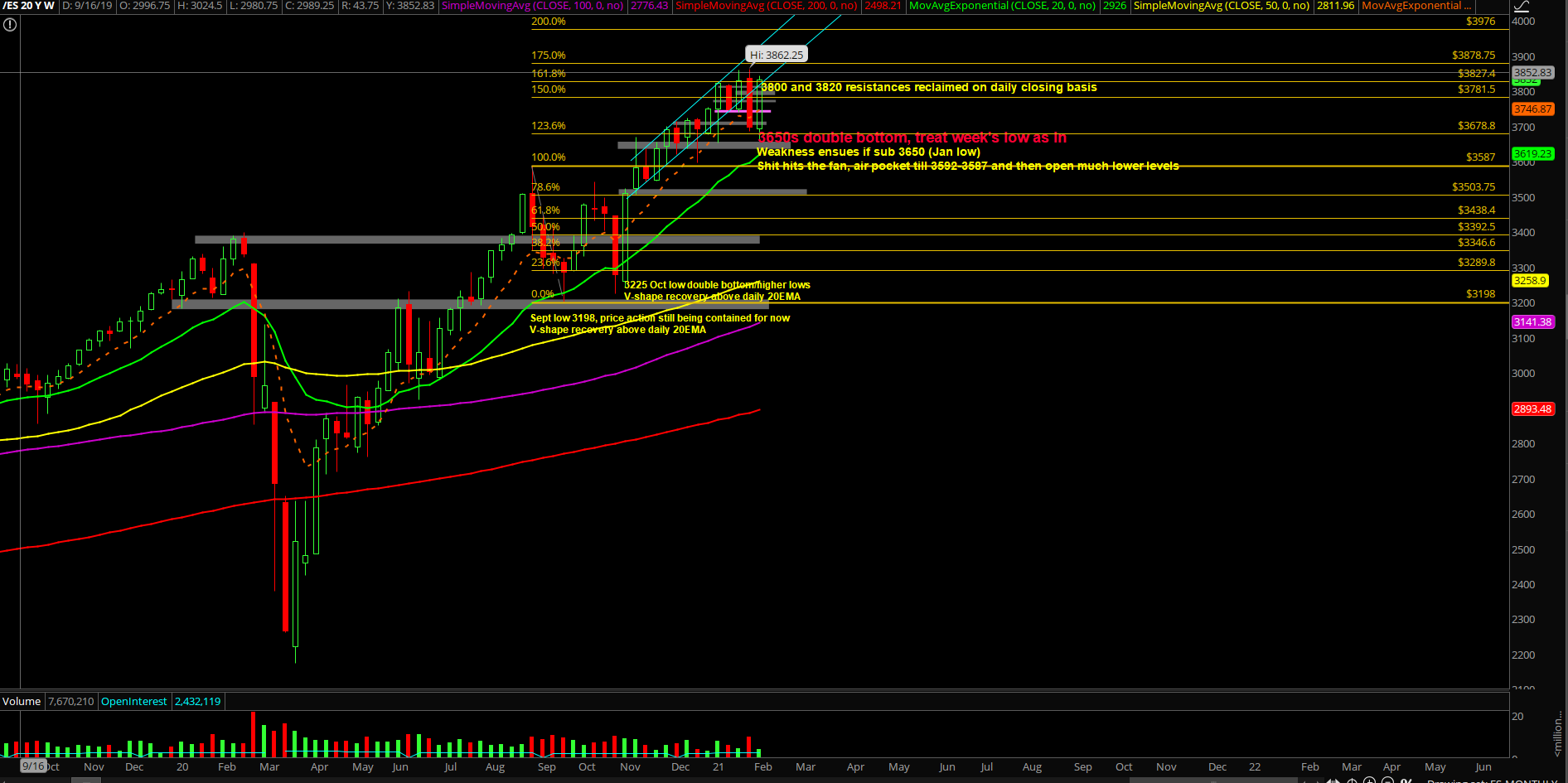

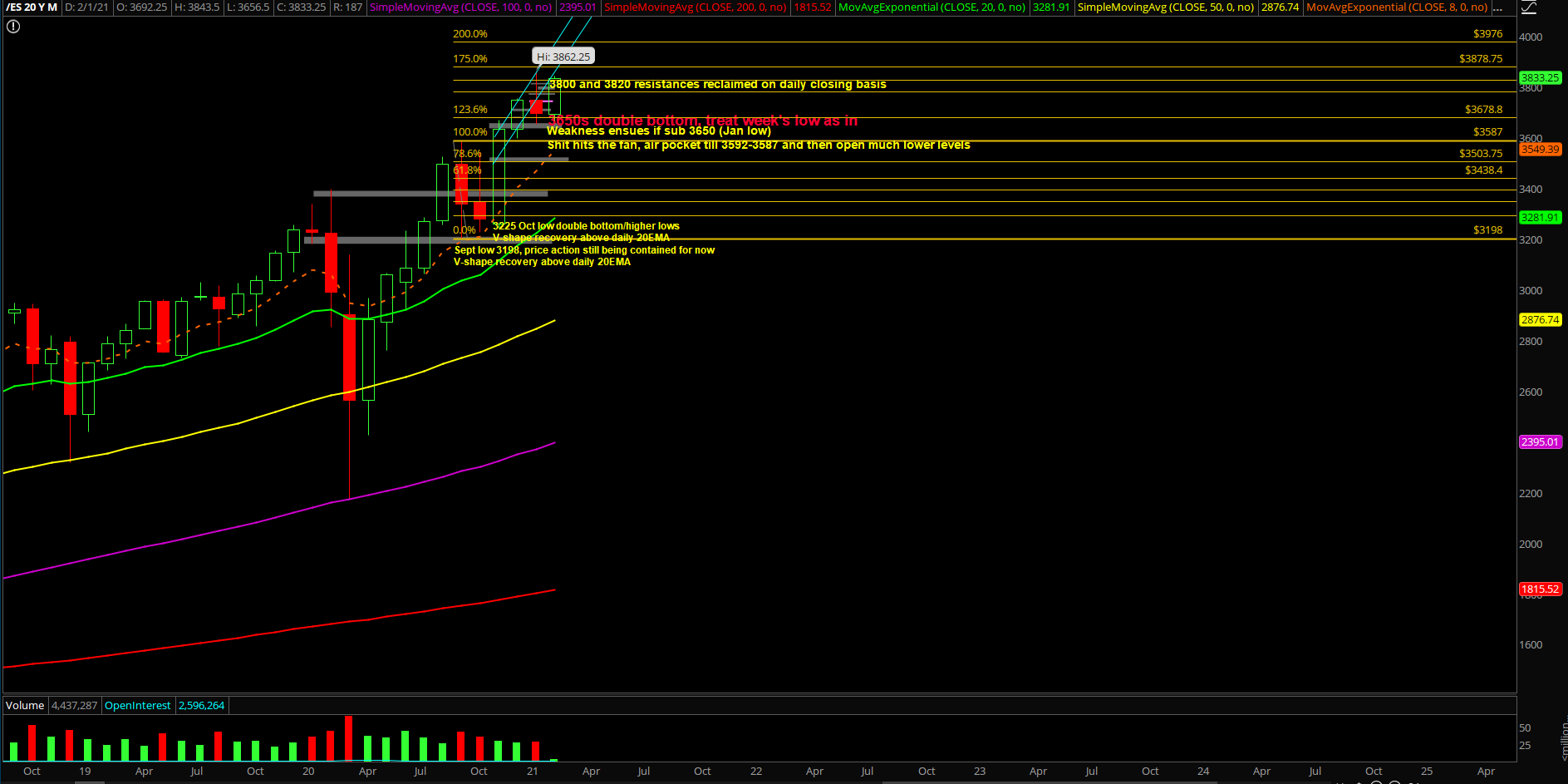

The main takeaway remains the same -- we’re treating this week’s low as in from the 3650s double bottom vs January monthly low and that the bull train is likely gearing towards 3976 measured move (derived from many months ago). In addition, NQ/tech is firmly leading the V-shape recovery and sporting the same daily 8/20EMA grind up posture as ES. Keep a close eye on this momentum follow through in the next few sessions. Given the high level consolidation/tight bull flag, the market is going to be attempting an acceleration breakout into new all time highs for all the US equity indices.

What’s next?

Wednesday closed at 3832.5 on the ES as a doji where it opened where it closed. It was a healthy digestion as internals and some key moving averages have caught up to speed given the swift V-shape recovery 3650s->3840s. The week’s trend is up and the overall context remains bullish so it’s not hard to put 2+2 together for end of week expectations when above support.

Our game plan summary:

- Price is back to bullish mode as short-term seller/bearish momentum disappeared after Jan 27-29th

- Given the price action clues from Monday Feb 1st, the market has stabilized from key level 3650s, it formed a double bottom into a V-shape recovery

- Market has retraced 88% of the 3860s-3650s range and now looking to reclaim 3860s all time highs in order to accelerate this train into the 3976 measured move target (calculated many months ago since the 3587 breakout setup)

- If you recall, Tuesday Feb 2nd, the market closed above 3800 and 3820 to double confirm bears are extinct as they could not stop the V-shape recovery. Déjà vu

- As discussed in the previous report, any pullback that is above 3750 is considered a buyable dip, we’re going to utilize key levels such as 3780/3800/3820

- Market is so strong that bulls only allowed a shallow pullback towards the 23.6.2% retracement (3799) of this week’s range and bottomed at 3807 on Wednesday

- Overnight confirmed a higher lows setup with the 3807 vs 3811 sticksave so the low of the day could be in already from overnight. Bulls are in full control of the train

- This gets double confirmed if price makes its way above 3840/3850 for an acceleration on the micro intraday charts that aligns with the higher timeframe charts such as daily+weekly. Also known as timeframe alignment from our most important lesson #1