Ambev: Fundamental Foundation In Place - Now, Will The Crowd Agree?

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

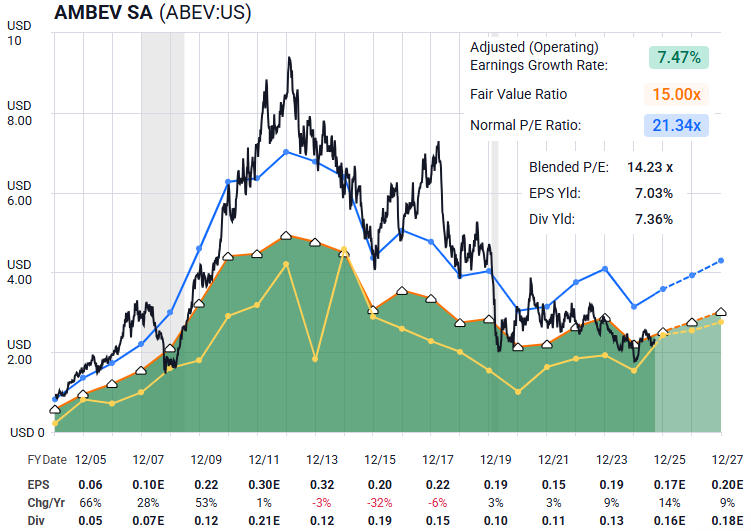

We have a foundation on which to build our scenario. But there is an all-important component that must participate for us to succeed in this thesis. First, here is the fundamental snapshot from Lyn Alden. Then, we’ll discuss the missing piece needed.

“ABEV looks solid fundamentally, especially on a total return basis with expected dividends included. The balance sheet is great, and while growth remains a challenge, it's already well-priced for that challenge.” - Lyn Alden

For many investors, a strong balance sheet provides confidence that downside risks are limited — but fundamentals alone rarely dictate price action.

This scenario sounds like something we want to investigate further. The key lies in crowd behavior. Without this component participating, the stock price won’t advance. Sentiment must turn and take the lead. Encouragingly, signs suggest it has already begun to do so. Let’s look at why this is likely and what is probable to happen next.

Note from this chart that our lead analyst, Zac Mannes, anticipated an important low to be struck at the beginning of this year. Garrett Patten also shared a chart near the same time that concurred with Zac’s. However, confirmation was needed. In our analysis, this confirmation ensures that what first appears to be a turning point is supported by structure, not just noise.

One of the key tenets of Elliott Wave theory is that five wave structures will typically indicate either a change or a continuation in trend. In this instance, with the key low appearing to have been struck back in January, note that there has now been what can be counted as five waves up.

What comes next? Corrective structures are formed in 3 waves. A few weeks ago, Zac projected an a-b-c to take the price of ABEV to the 2.00 - 2.10 region. Indeed, 2.11 was seen and price has now turned back up.

So what can we expect next? If we do indeed have a swing low in place at the 2.11 level, then the next lesser degree rally will take price to 2.57 - 2.64. A smaller pullback structure should hold higher than the 2.11 low and then see a higher high.

Ultimately, over the next several weeks to months, ABEV may see 3.00 or higher. If we view this from a percentage basis with 2.11 as our invalidation level for this current bullish setup and 3.00 as the potential target, the risk versus reward is easily calculated.

We have our fundamental foundation and we also can clearly identify our risk versus reward for this scenario - it’s up to the crowd now.