All Eyes on Continuation or Bust

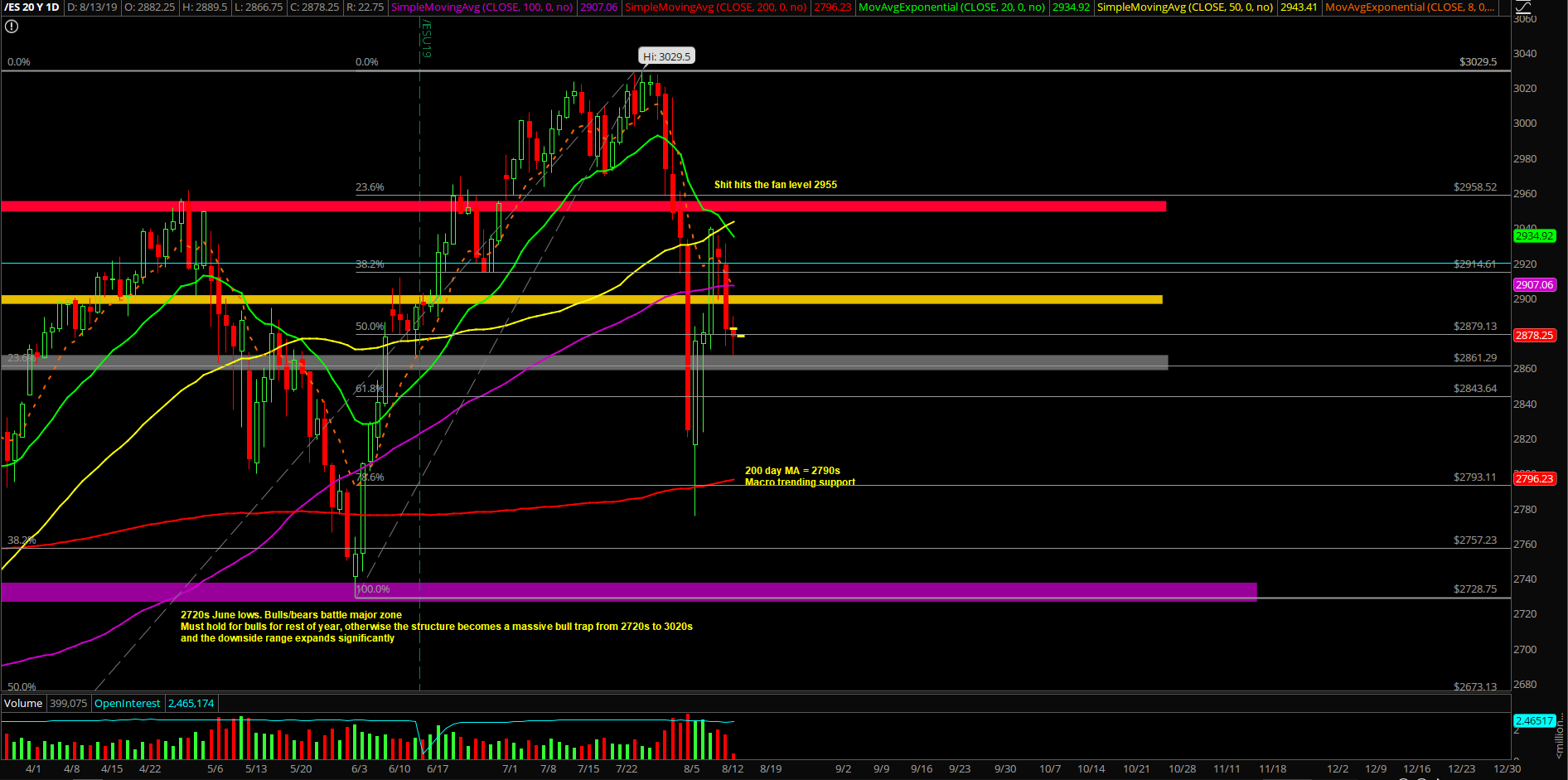

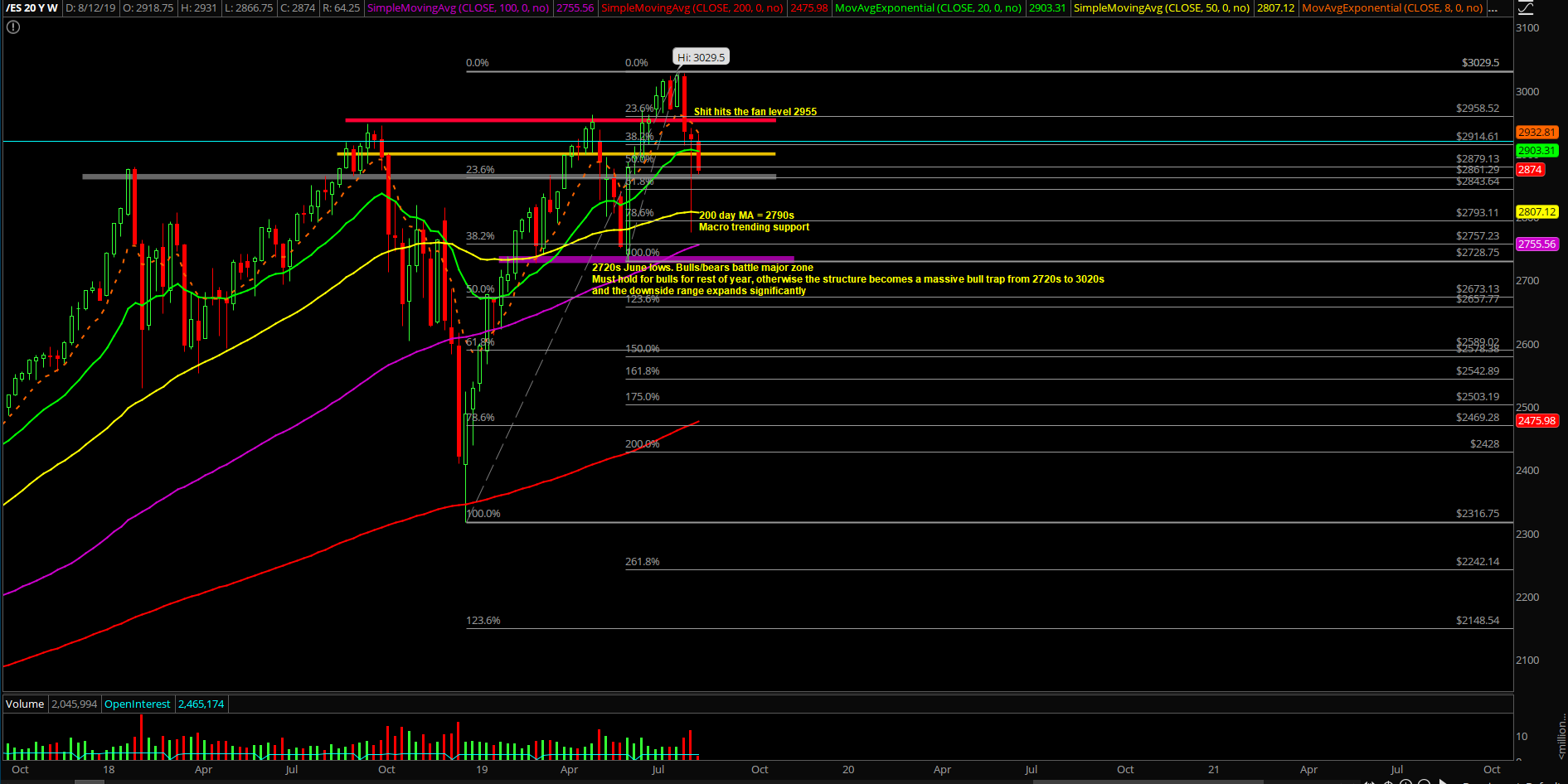

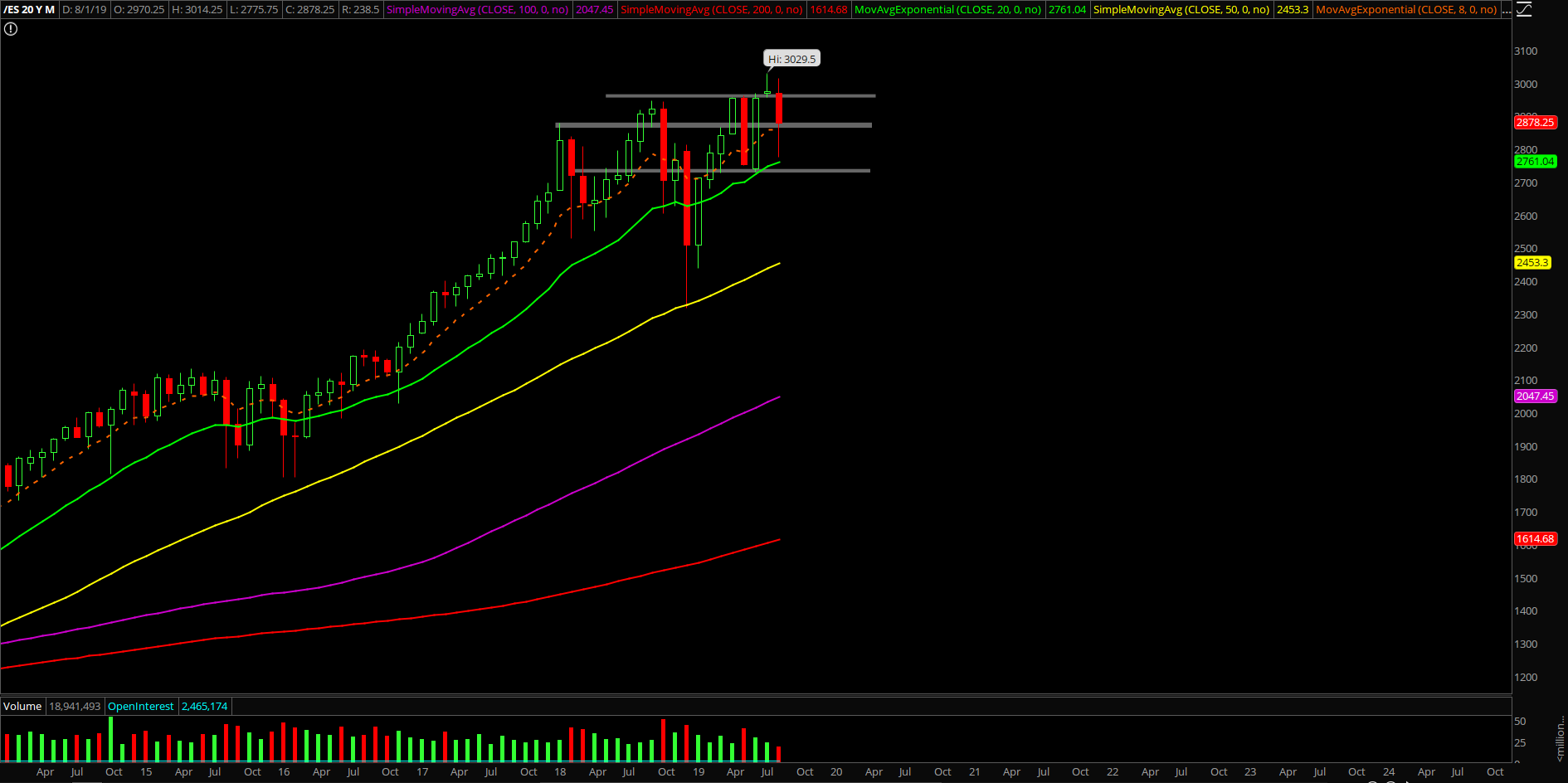

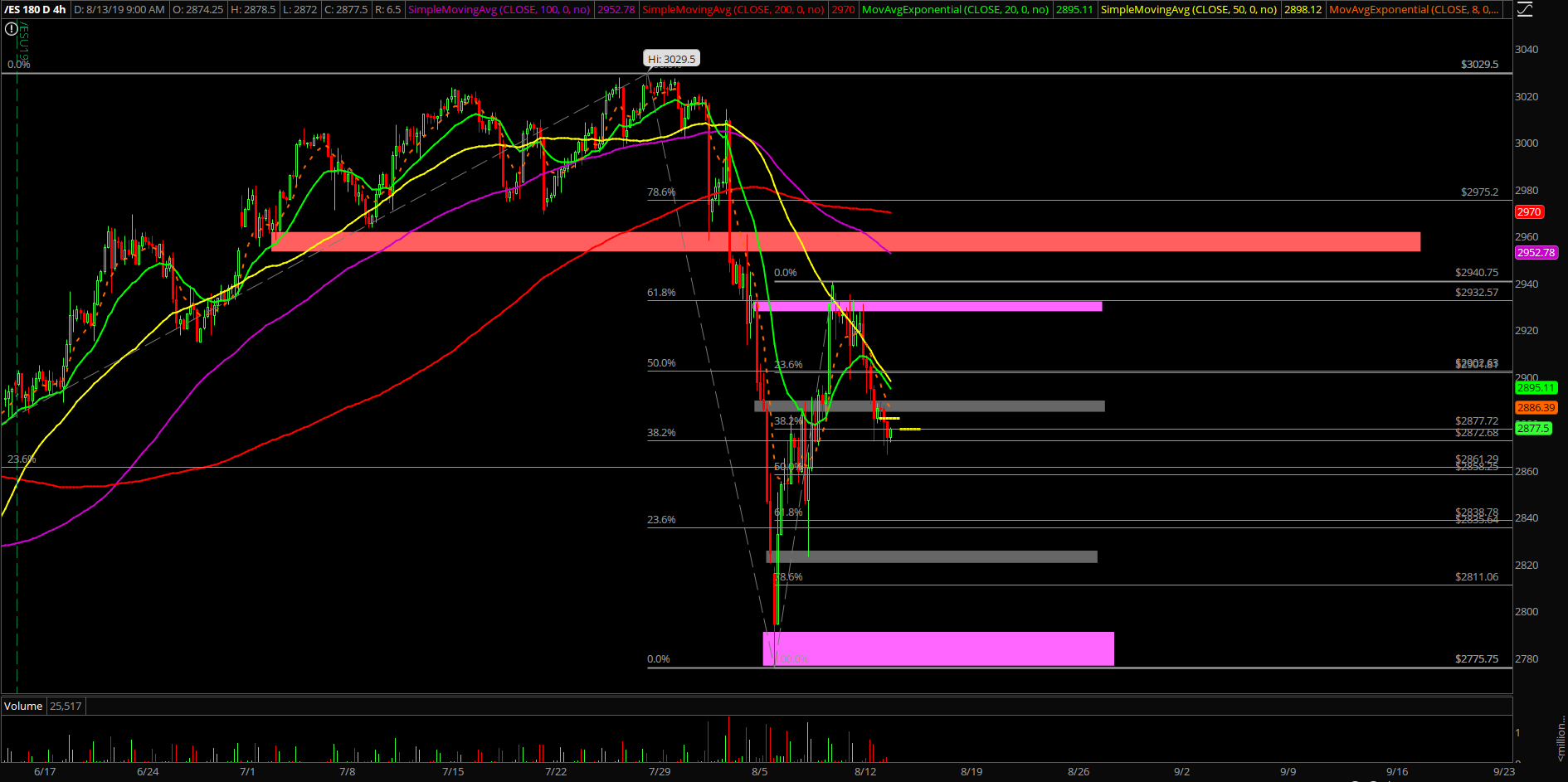

Monday was a "gap down and grind down"-type session from the bears as they were able to break below the 2900 and 2880 key levels. This whole shakefest so far is just meandering within the August 8 range, doing the inside/range day and chopping up traders. The market is still trying to make up its mind on what to do with the 3 different daily chart timeframe scenarios that we discussed during the prior report.

The main takeaway from this session is that the bears got what they wanted with the daily 20EMA rejection since last Friday, but they need to show strength by breaking below 2880 decisively as the 2865 is the line in sand for the next few sessions to give us more clues on which scenario the roadmap is taking place.

What’s next?

The Emini S&P 500 (ES) closed at 2882.25 around the low of the day and just hovering above the 2880 key support. Zooming into the micro/intraday only, we’re going to scalp both sides around these levels: intraday bear when below 2880 going towards 2865 and bull if reclaims 2880 gap fill going towards 2900. Need to be paired with a 15min/1hr chart because of too many false positives lately. Still treating today as an inside/range day within August 8 range of 2940-2870 until price proves otherwise and morphs into a trend day.

If you recall, we think the biggest hint we could take from the market are the daily closing prints, whether they are above/below 2865 in the next few sessions as the market makes up its mind on the higher timeframes.

The current perspective on price action is that all subsequent backtests are just going to be higher-low buying opportunities unless we see something change significantly with at least a decisive close below 2845 to entice sellers/bears to come back.