A New Look at the Big Picture

In this long diagonal that has been going on just about forever it seems, MMI has been severely handicapped not being able to calculate inversions or "flips" ahead of time in the usual manner. This often leads to only being able to clearly confirm or refute a potential inversion in hind sight which is not just annoying, but is extremely unhelpful in plotting a course to where things are likely going.

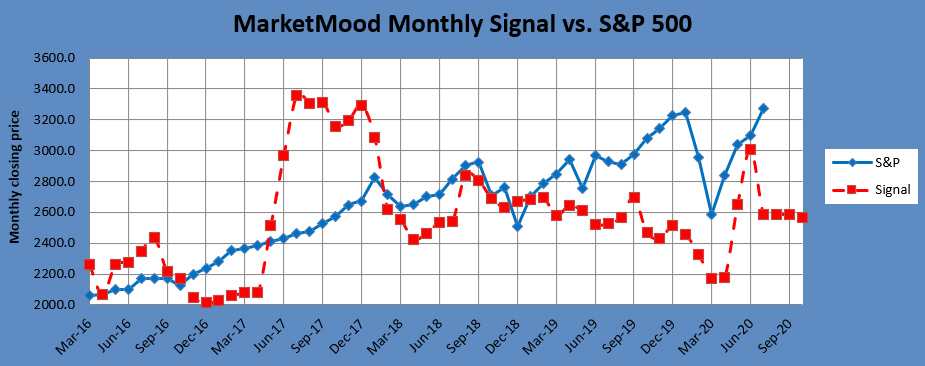

With 20/20 hindsight, I can now confidently say that there was no clear flip in July, and there was especially no clear flip from up to down. With that as fact, I must rework my big picture outlook. Below is the monthly chart I had been working with. It assumed a big about-face sometime in July followed by at best sideways action through September.

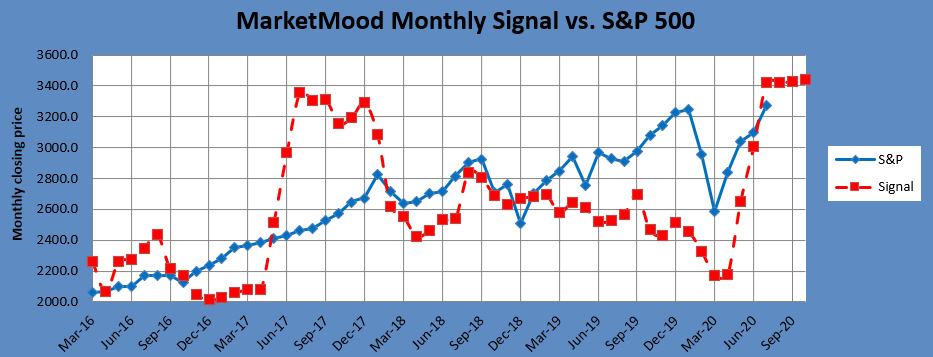

Without the July flip, the chart becomes the one below. It shows the market wanting to breakout past 3400 SPX if it can. This should be followed over the next few months with whipsaw and/or a reversal.

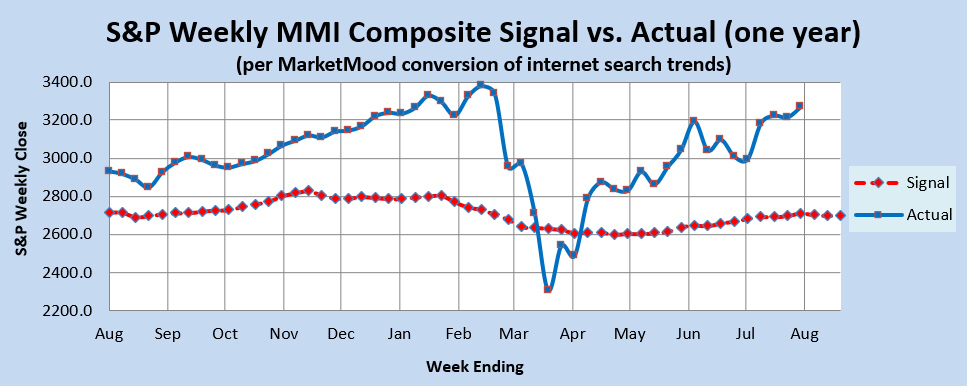

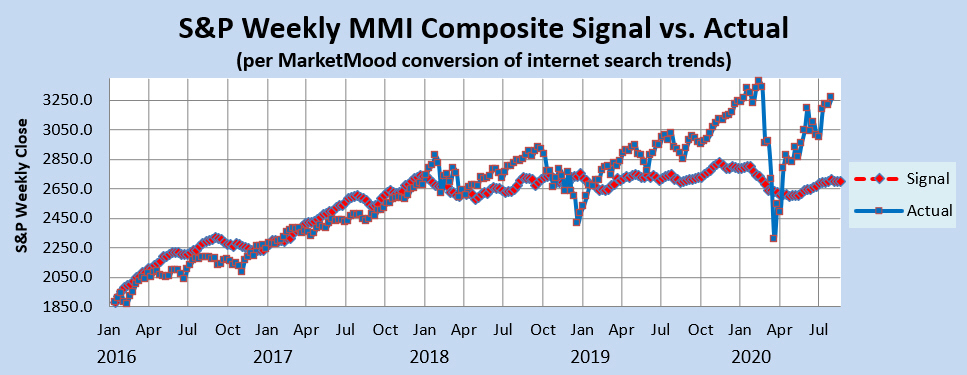

Before getting too immediately bullish, don't forget that there is the smaller picture to keep in mind as well. Let's look at the weekly data to see what it's telling us.

The weekly MMI sentiment vs price charts show an extremely and unsustainably overbought market.

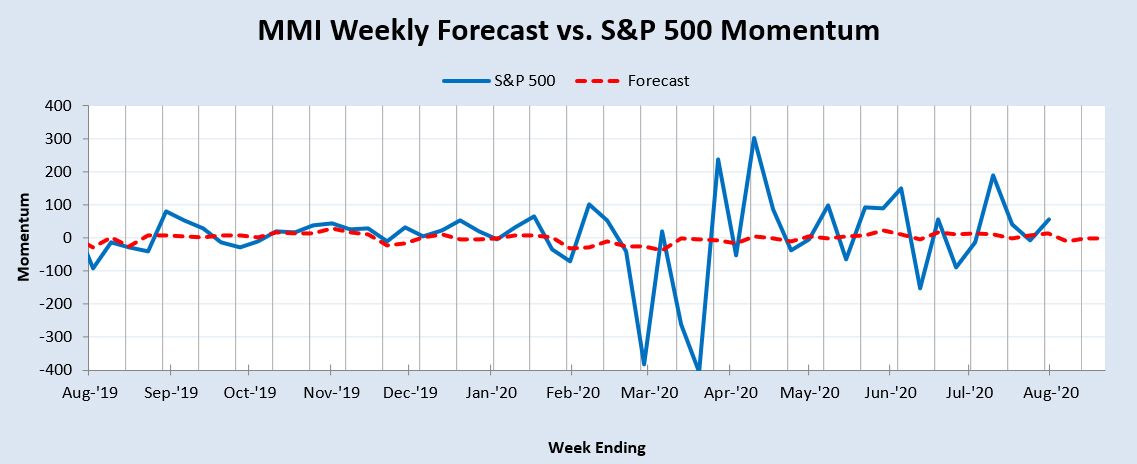

The weekly momentum chart hints of a slowing down and possible decline over the next few weeks.

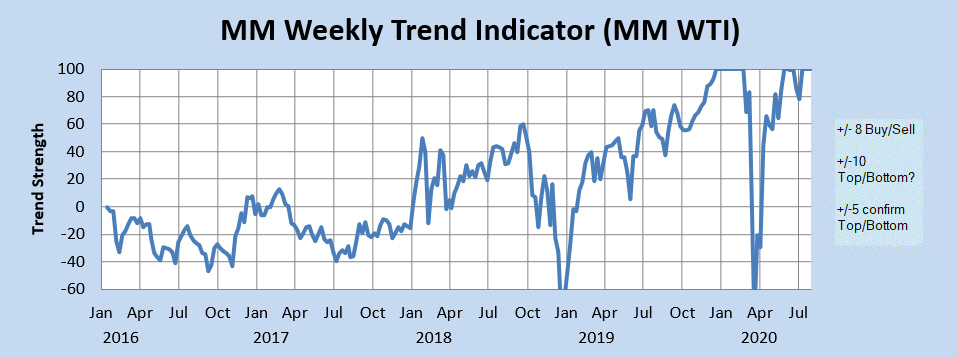

The weekly trend indicator shows an extremely strong, yet unsustainble bullish trend, only matched by the record extremity seen from December 2019 through mid February of this year. This was then followed by record extremity on the bearish side in March.

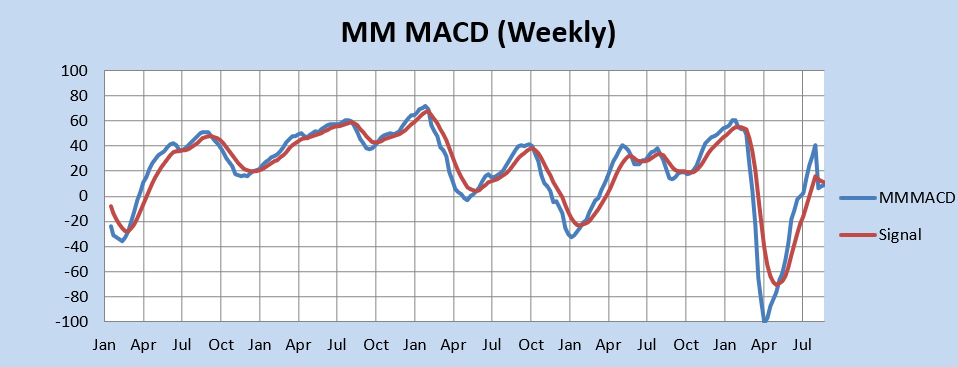

Finally, the weekly MM MACD is at a crossroads and giving mixed signals. It is wanting to turn bearish, but the trend is in bullish territory.

Taking all of this together, it appears that the overall context remains bullish and the market really wants to be above 3400 SPX, at least for a moment. However, the weekly data implies that there are near term headwinds the market will have to contend with. The weekly charts show a market that has no business being up as high as it is right now. Either sentiment will need to start finding some optimism to catch up with the market, or the market will soon enough give us the "snapped rubber-band" effect which can be quite alarming as was seen in February and March of this year. No matter how this plays out, with the bigger picture wanting to break up and out, and the nearer picture wanting to drop sharply, whipsaw and treacherous trading should continue for some time to come.