A Flush Does a Crypto Right

We continued to roll into a deeper flush today. In both Bitcoin and Ether we finally invalidated the red count.

I know based on questions today that to many this was a different count. This is not the way I see it as that was only a more immediate, but unconfirmed path in my larger micro. Invalidation doesn't confirm the more bearish alts. But it does suggest that we need to setup again for C of circle 5.

Further, because of how we deep we are, and the divergences that showed, I want today's low to hold. Confirmation of my more bearish case comes with a break of $8K Bitcoin and $176 Ether, but breaking today's low warns those levels are likely to go. I gave the title above to this report because often the fearful action we saw in cryptos today is the start of a good reversal as long as we broke support. So I remain looking up with caveats listed here within.

Bitcoin

The lower (B) now adjusts the nominal target for (C) to $10,850 with a chance of seeing as high as $11,750.

Ethereum

The lower (B) now adjusts the nominal target for (C) to $236 with a chance of seeing as high as $255.

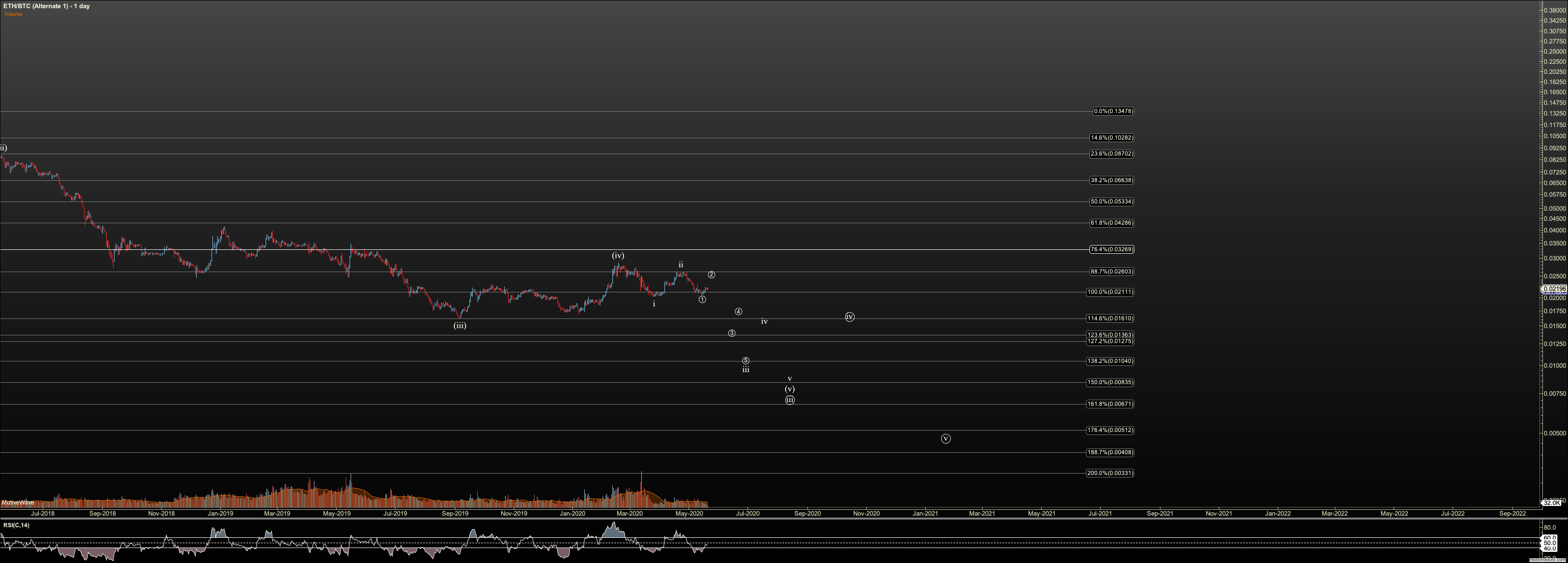

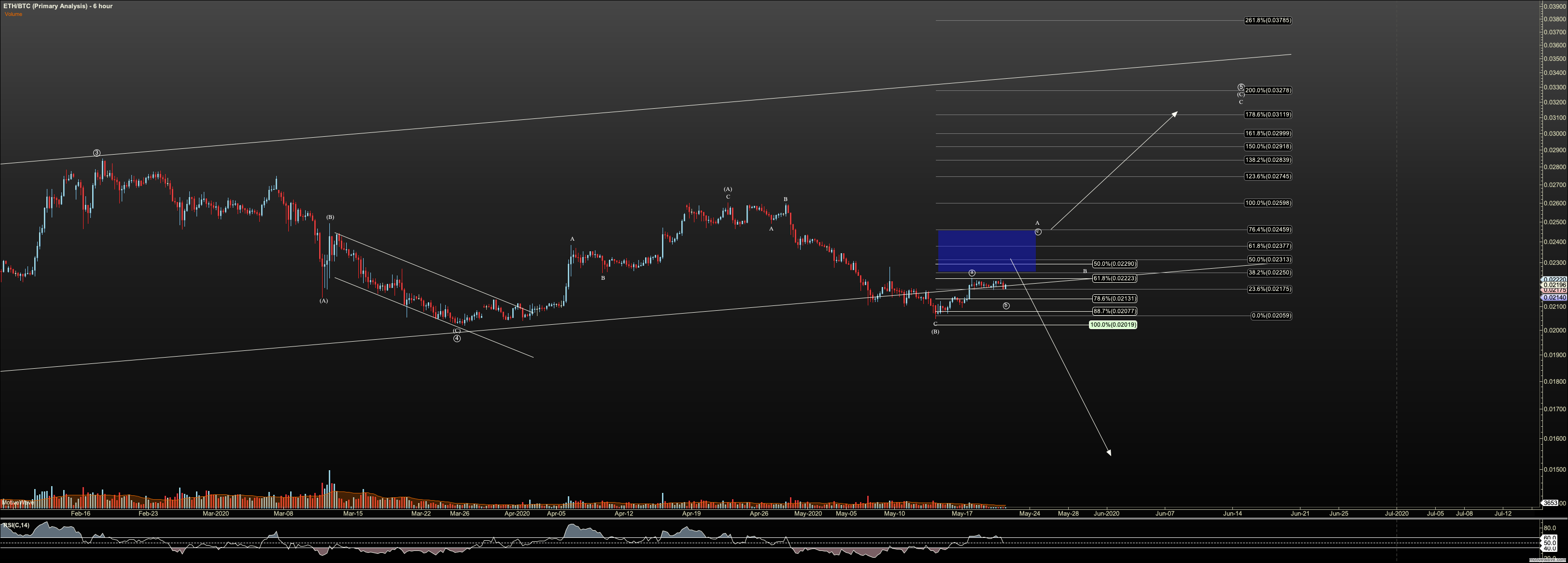

ETHBTC

No change today.

GBTC

GBTC continues to cut lower, but this is still valid as red b. It had a strong late session move off the low. I'd like to see $11.30 retaken ASAP. Note we are starting to split hairs between the white and red count. I am still counting it red, but regardless we've been in my scale in zone and I've been placing orders to rebuild the shares I took off higher.

ST Tactics:

I am adding short orders to hedge with a break of today's low in Bitcoin at $8790.

I added in GBTC with the push higher today as it gave a nod to red. Particularly, Bitcoin appears to be be bottoming in red 2. But I've left ammo to continue to add down into $9's if we take the white path. As mentioned, I left myself lightly positioned after last weeks peak and am ready to add back but I don't want to go too large in the murky middle.

Again, my basic strategy in Bitcoin is to hedge slowly and take core off, higher ideally.